Tax is a financial charge which is charged by the government so that it can put that money or spend it on public expenditure and welfare.

Tax is imposed on a person or a legal entity. A person who pays taxes is called a taxpayer.

One who fails to pay the tax is subjected to be punished by law. Tax can be of any type, be it a direct tax, indirect tax, wealth tax, property tax, Goods and services tax etc.

Real estate and Property Tax comes under the category of Property tax.

Key Takeaways

- The real estate tax is a levy on land and any structures permanently attached to it, whereas property tax covers both real estate and personal property.

- Real estate taxes fund local government services like schools, police, and infrastructure, while property taxes contribute to a broader range of local and state projects.

- The property’s assessed value determines both taxes, but tax rates and exemptions can vary depending on local and state regulations.

Real Estate Tax vs Property Tax

The real estate tax is a tax on the value of real property, which includes land and any buildings or improvements on the land. This tax is assessed by the government at the state or local level. Property tax is a broader term that includes taxes on real and personal property, such as vehicles and boats. Property tax is also assessed by the government at the state or local level and is used to fund public services.

Real Estate tax consists of building and land and everything which are a part of natural resources in a piece of land, whether it be plants, crops, water etc.

These things are not movable and are also attached to the land. Real Estate Tax is very different from property tax because here, assets can’t be moved.

Interest vested in the items is called real estate. Real estate Taxes are real property taxes, and it is charged by the municipalities of a locality.

Property Taxes are calculated on how much value is there on your property. It is also called a millage rate.

Property Tax is charged by the government depending on which area the property is located.

It can be charged by the central government, state government, municipal corporation etc. Property Tax is an umbrella term that includes real estate tax, rent tax, and land value tax as well.

Property tax can be charged once a year as its assets are movable.

Comparison Table

| Parameters of comparison | Real Estate Tax | Property Tax |

|---|---|---|

| Nature | Related with the land. | Related with the property. |

| Period | Monthly | Annually |

| Type | Real Property | Private Property |

| Categories | Apartment, Terraced house, Duplex, Villas, Haveli etc. | Land, personal property improvements to land, and intangible property. |

| Examples | Buildings, crops, houses, garages etc. | Cars, boats, jewellery, electronic devices, art etc. |

What is Real Estate Tax?

Real Estate Tax is permanent. It is also termed real property.

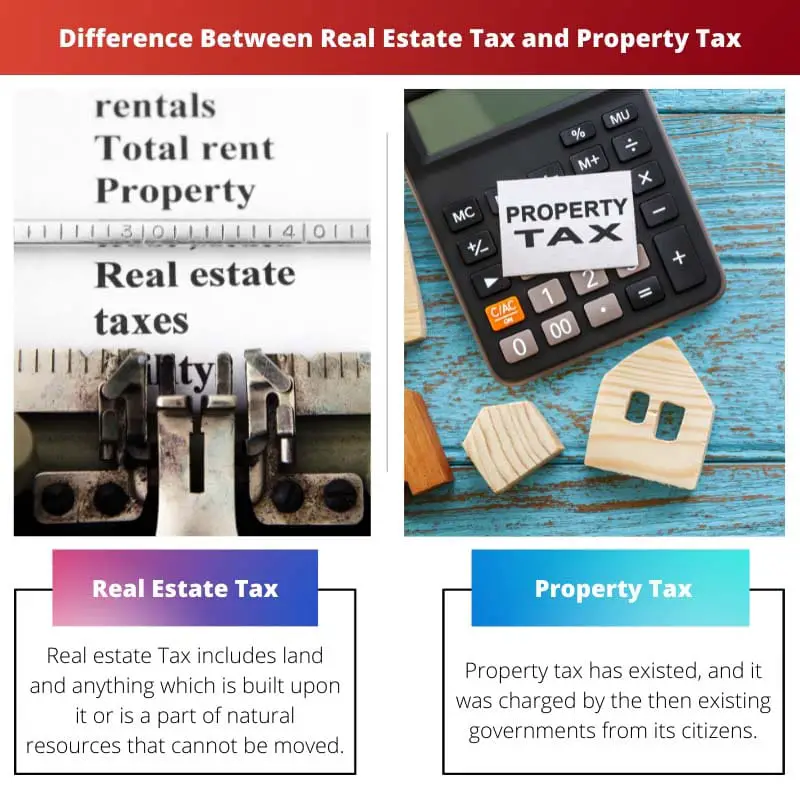

Real estate Tax includes land and anything which is built upon it or is a part of natural resources that cannot be moved.

Examples include houses, buildings, condos, industrial buildings, garages, as well as the ground beneath them. Most commonly, the real Estate tax is confused with property taxes.

People consider both as same, but they are not the same.

The real estate tax is a part of a type of Property tax only. This tax helps municipalities and government authorities to keep a record and check on real estate, and also it helps them to raise funds for their budgets.

Real estate taxes are charged on different types of buildings and houses because real estate property includes residential real estate as well.

Residential real estate consists of many types depending upon the residences as well as neighbouring land.

It includes apartments, condominiums, cooperatives, multi-family houses, detached houses, semi-detached houses etc. The real estate tax is mostly levied in America.

It is very popular there. In India, there is no such special tax for real estate.

Different types of Rewal estate Tax include Real Property Tax, Documentary Transfer Tax, Property Transfer Tax (for Charter Cities), Property-Related Fees and Parcel Tax.

What is Property Tax?

Since ancient times, Property tax has existed, and it was charged by the then-existing governments from its citizens. It was in different forms like in the form of crops or cattle, land oil etc.

A person who collected property tax in those times was called a tax assessor, and they were treated with respect.

In the Medieval period in England, it was very common for peasants to pay tax to the monarchy, which they rented from their owners. Records also suggest how taxes were imposed on the property.

From then to today’s time, different countries have different laws regarding property tax. There are few countries in the world where property tax doesn’t exist only.

These countries include Kuwait, Cook Island, Mauritania, Greenland, Palau etc. Often this country is termed a tax-heaven country because tax is exempted from here.

Property Tax is collected annually by the government. Sometimes, multiple governmental organizations can levy taxes at the same time.

There are four broad categories of property tax which include land, personal property, intangible property and improvements to the land.

Property tax is movable, and it is called ad valorem tax, i.e. tax is given depending upon the value of the property at the market price.

It is calculated in percentage as per mil, i.e. mill rate, and it is divided by 1000. In India, Property tax is also called house tax, and it is imposed on the custodian of the property.

Main Differences Between Real Estate Tax and Property Tax

- Real Estate Taxes are paid to anything which is attached or related to the land. Property Tax is the tax that is paid on the property which is owned privately and is not attached to the land.

- Real Estate Taxes are paid on a monthly basis to the tax assessors of your region locally. Property Taxes are paid annually to the government authorities depending upon the moving assets.

- Real Estate Tax includes real property. Property Tax includes private property.

- Real Estate Tax can be categorised depending on the types of buildings and houses, such as apartments, Terraced houses, duplexes, Villas, Haveli etc. Property Tax can be categorised into four types land, improvements to land, personal property and intangible property.

- Examples of Real estate Tax include Buildings, crops, houses, garages etc. Examples of property Tax include cars, boats, jewellery, electronic devices, art etc.

- https://link.springer.com/content/pdf/10.1007/BF00216188.pdf

- https://www.journals.uchicago.edu/doi/abs/10.17310/ntj.2003.1.03

Last Updated : 04 August, 2023

Chara Yadav holds MBA in Finance. Her goal is to simplify finance-related topics. She has worked in finance for about 25 years. She has held multiple finance and banking classes for business schools and communities. Read more at her bio page.

Understanding the nature of real estate tax and property tax is essential for property owners and local authorities. This knowledge helps in effective tax planning and resource allocation for local and state projects.

Precisely, the distinctions between real estate tax and property tax highlight the diverse sources of revenue for local and state governance, providing the necessary financial support for essential public services.

Absolutely, the comprehensive understanding of real estate tax and property tax contributes to informed decision-making and efficient utilization of tax revenues for public welfare.

Property tax holds historical significance and has evolved over time to adapt to the changing socio-economic landscape. Its long-standing presence emphasizes its importance in governance and revenue generation.

Absolutely, property tax has been a key component of taxation throughout history, reflecting the need for governments to fund public services and infrastructure.

The historical context of property tax provides valuable insights into its role in societal development and governance practices across different civilizations and eras.

The historical context of property tax and real estate tax sheds light on the evolution of taxation systems and their role in sustaining government services and public welfare across different societies and eras.

Indeed, understanding the evolution of tax systems and their adaptability to societal changes is vital for assessing the contemporary significance of property and real estate tax in governance and public revenue generation.

The distinction between real estate and property tax is essential for property owners and authorities alike. Understanding the nature and implications of each type of tax helps improve tax compliance and ensures adequate revenue for government public services.

Indeed, having a clear understanding of real estate tax and property tax helps to maintain transparency and equity in tax systems.

The comprehensive comparison table provides a clear insight into the key differences and similarities between real estate tax and property tax. It’s crucial for property owners to understand the distinctions to ensure compliance with relevant tax laws and regulations.

The detailed description of real estate tax and property tax helps in clarifying any misconceptions and highlights their distinct roles in tax systems. This understanding is essential for effective taxation policies and resource allocation for local and state projects.

Indeed, the in-depth explanation of real estate and property tax is essential for informed decision-making and efficient utilization of tax revenues for public welfare and infrastructure development.

Precisely, the distinct roles and implications of real estate and property tax underscore the need for accurate assessment and taxation policies to ensure equitable contributions to local and state projects.

The historical context of property tax and its historical significance across different civilizations underscores its enduring role in governance and public revenue allocation. Understanding its evolution is essential for assessing its contemporary relevance in modern tax systems.

Absolutely, the historical foundations of property tax provide valuable insights into its enduring role in funding government services and infrastructure, reflecting its importance across diverse historical contexts and societies.

The in-depth explanation of real estate tax and property tax helps to dispel common misconceptions and highlights the significance of both taxes in funding local government services and infrastructure development.

Absolutely, understanding the intricacies of real estate tax and property tax is crucial for informed financial planning and resource allocation for local and state projects.

The clear differentiation between real estate tax and property tax provides a holistic understanding of the diverse components of taxation. It underscores the need for accurate assessment and taxation of both real and personal property to ensure equitable contributions to public services.

Precisely, the insights into real estate and property tax facilitate informed decision-making and taxation policies that align with efficient resource allocation for public welfare and development projects.

Absolutely, the comprehensive understanding of real estate and property tax emphasizes the need for accurate valuation and taxation to maintain fairness and transparency in the tax system.

It’s important to understand that property tax and real estate tax are used interchangeably, but they can have different implications. While real estate tax refers to the tax on the value of land and buildings, property tax covers both real and personal property. Both are essential sources of revenue for the government.

Absolutely, understanding the differences between real estate and property tax is crucial to avoid misunderstandings when it comes to paying taxes and to understand what one’s obligations are.

This also highlights the importance of assessing the property’s value correctly, as it affects both the real estate and property tax rates and exemptions. Property owners need to stay informed about local and state regulations regarding property assessment and taxation.