Taxation was implemented in Ancient Egypt from 3000 BC until 2800 BC. Indeed, it is specifically referenced in the Old Scripture section of Genesis.

The Persian Dynasty created a controlled tax regime in 500 BC, whereas Muslim conquerors in India implemented taxes in the 11th millennium, which was ultimately repealed.

Key Takeaways

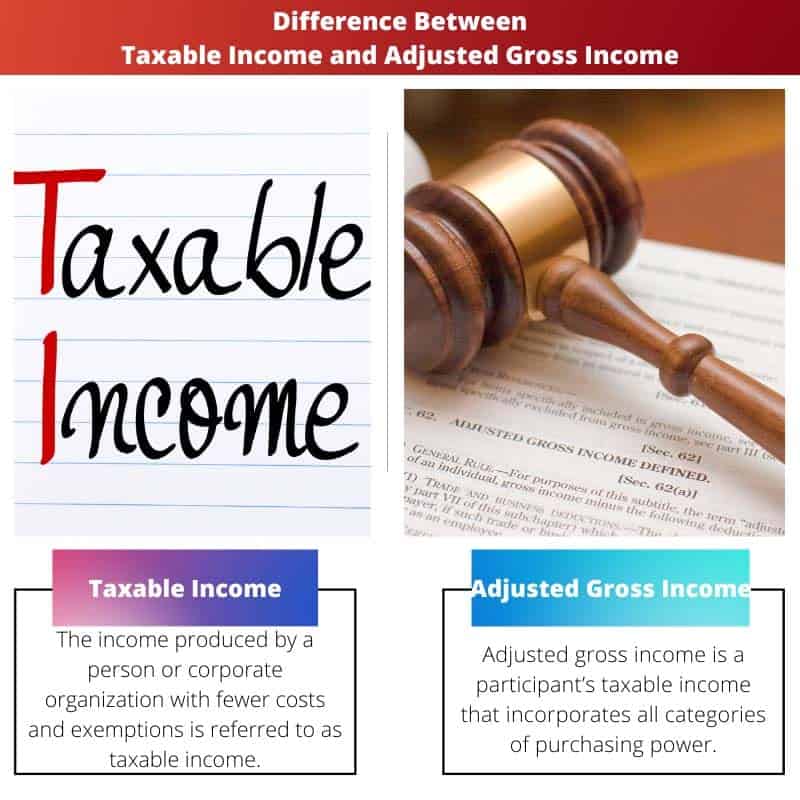

- Taxable income is the amount on which an individual or business owes taxes after all deductions, exemptions, and credits are applied.

- Adjusted Gross Income (AGI) is an individual’s total gross income minus specific deductions, such as contributions to retirement accounts and alimony payments.

- AGI is the basis for determining eligibility for various tax credits and deductions, ultimately affecting the final taxable income amount.

Taxable Income vs Adjusted Gross Income

The difference between taxable income and the adjusted gross income is that Gross income is any revenue that is not expressly excluded from taxes underneath the Internal Revenue Code (IRC). Whereas the part of your taxable income that seems to be susceptible to taxation is referred to as taxable revenue. Exemptions are removed against annual revenue to determine overall taxable income.

Taxable income is your AGI less than the normal exemption or the sum of itemized deductions, whichever is larger, as well as the qualifying corporate income deduction, if appropriate.

The marginal tax rate will be determined by your taxable income. Individual and reliant exemptions, which could have reduced individual taxable income, were repealed as part of the Tax Cut and Jobs Act between 2018 to 2025.

This encompasses all streams of revenue, including wealth, land, and the worth of labor obtained. Before payments are determined, gross income is lowered through modifications and deductions.

Wages, gratuities, interest, royalties, rentals, and retirement benefits are all illustrations of components of gross income. 401(k) contributions, medical spending account participation, and educational expenditures are prominent instances of exclusions that lower adjusted gross income.

Comparison Table

| Parameters of Comparison | Taxable Income | Adjusted Gross Income |

|---|---|---|

| Meaning | The income produced by a person or corporate organization with fewer costs and exemptions is referred to as taxable income. | Adjusted gross income is a participant’s taxable income that incorporates all categories of purchasing power. |

| Basis | Taxable income serves as the foundation for all duties levied on taxpayers. | Individual taxes are levied on the grounds of estimated gross earnings. |

| Allows | Taxable income provides for exclusions from a company’s or industry’s sales and operational expenditures. | Adjusted gross income takes into account solely an individual’s exclusions and exemptions. |

| Example | Humanitarian donations, health and surgical costs, house mortgage debt, earnings, sales, and special assessments are all examples of tax deductions. | Pensions and salary, investment income, term deposit interest, capital gains, company revenue, are all examples. |

| Calculation | A corporation’s or a person’s taxable income is calculated by subtracting gross income from company expenditures and additional exemptions. | The sum generated preceding any deductions except those specifically omitted by the IRC is referred to as gross income. |

What is Taxable Income?

In layman’s terms, taxable income is your AGI minus expenses itemized expenditures you’re eligible to collect or your mortgage interest deduction.

Your AGI is the consequence of several other “above-the-line” earning modifications, including distributions to an eligible individual retirement account (IRA), undergraduate loan repayments, and specific contributions to healthcare expenditure accounts.

To exceed these basic deduction limits, a taxpayer would require a considerable proportion of medical expenses, charitable donations, passive income, and other eligible itemized deductions.

Taxpayers can however claim the statutory deduction based on their registration status or itemize the chargeable costs they incurred throughout the year.

You cannot itemize your expenses and take the standard exemption at the same time. As a consequence, your taxable earnings are calculated.

Considering the TCJA almost quadrupled these exemptions from what they were previously in 2018, using the standard deduction frequently decreases a participant’s earned profit more than itemizing.

To establish your reporting category for a personal tax return, you must first identify your taxable income.

Provided you are unmarried, you must report your returns as a single earner or as a chief of residence if you cover more than half of the maintenance and accommodation expenditures for a qualified individual.

If you are married, you will most likely want to file as married filing together. However, there are some restricted circumstances in which filing as married filing individually may sound right.

What is Adjusted Gross Income?

The gross income wherein the Income Tax Department determines an individual’s tax due is the reference spot. It is your total revenue from all resources excluding any permissible deductions.

This comprises both generated cash from income, salary, bonuses, and conscience as well as inherited wealth from rewards and return on securities, royalties, and gaming wins. It is the difference between a corporation’s net sales and its costs of goods sold.

It comprises money, salaries and benefits, incentives, profits, mortgages, leases, copyrights, pensions, company income, income tax refunds, and corporate and collaboration shares.

It also takes into account capital earnings and depreciation. Some superannuation account disbursements, such as mandatory least distributions and incapacity coverage income, are reflected in the computation of gross income.

Gross business income isn’t just about gross revenue for self-employed persons, company entrepreneurs, and enterprises. Alternatively, the total money generated by the firm is less permissible for organization expenditures or gross profit.

Net business income is the term used to describe a corporation founder’s gross income. On the other hand, gross income can include a lot more; effectively, everything that isn’t specifically declared as tax-exempt by the IRS.

Child maintenance payouts, most divorce payments, punitive damages for bodily harm, veterans’ entitlements, assistance, workmen’s remuneration, and Additional Assistance Income are all examples of tax-exempt income.

Although they are not taxable, these kinds of profits are not reflected in your gross income.

Main Differences Between Taxable Income and Adjusted Gross Income

- Taxable income is the money generated by a business entity with lesser costs. Conversely adjusted gross income is a recipient’s taxable income that includes all buying capability categories.

- All charges imposed on taxpayers are based on their taxable income. Individual taxes, on the other hand, are charged based on expected gross earnings.

- Taxable income allows for deductions from an institution’s operating expenses. Adjusted gross income, on the other hand, needs to consider an entity’s deductions.

- Tax deductions include donations to charity, medical expenses, unsecured debt, and service charges. Employment, capital gain, fixed deposits interest, firm turnover, and so on are examples of AGI.

- An organization’s taxable income is computed by reducing gross income from corporate outlay in Taxable income. Whereas in AGI, the total created before any deductions save those expressly excluded by the IRC.

- https://apps.bea.gov/scb/pdf/2004/04April/0404PI&AG.pdf

- https://apps.bea.gov/scb/pdf/national/niparel/1996/0596gd.pdf

Last Updated : 13 July, 2023

Chara Yadav holds MBA in Finance. Her goal is to simplify finance-related topics. She has worked in finance for about 25 years. She has held multiple finance and banking classes for business schools and communities. Read more at her bio page.

I don’t think the information in this article is accurate. There are several contradictions and I am not convinced by the explanation of the differences between taxable income and adjusted gross income.

This is a great article to learn about the history of taxation in various ancient civilizations. It is very informative and provides a good basis of comparison for taxable income and adjusted gross income. The references are very helpful. Great job!

Yes, it is an excellent article. This information is very useful and I really liked the way it explains the main differences between taxable income and adjusted gross income!

The historical perspective provides a unique insight into the evolution of taxation. The comparison table is very helpful. I would have liked some more contemporary examples, however.

The article does an excellent job of explaining taxable income and adjusted gross income. The references add credibility and depth to the content. I really enjoyed reading this.

I agree, the historical context is very interesting. It’s good to know about the different civilizations’ tax systems. The explanation of Taxable Income and Adjusted Gross Income is also quite detailed.

This article is very thorough. The different examples and comparison table make it easier to understand the concept of taxable income and adjusted gross income

The article is riddled with inaccuracies and oversights. I can’t believe it was published with such obvious errors.