The forms we deal with to pay the tax may sound the same. But they are different in their ways. The contours will fill to pay the tax and for billing and many needs. Sometimes it depends on who fills up the documents.

The W2 and W4 are IRS(internal revenue service) forms. When you are employed, or you employ some people, then you must know about these forms.

Key Takeaways

- The W2 form reports an employee’s annual wages and taxes withheld, while the W4 form is used to adjust the amount of federal income tax withheld from an employee’s paycheck.

- Employers are required to provide W2 forms to employees, but employees fill out W4 forms themselves.

- Both forms are important for tax purposes and must be filed accurately and on time.

W2 Vs W4

The difference between W2 and W4 depends on who fills the form. W2 is the form that contains wages and tax deductions for that year. W4 is the form for employees to show the amount of withholding from the paycheck of the year. These forms are salient in tax payments. It helps to know about your salary and the tax you pay to the government yearly.

The W2 forms are for an employee to know about the wages and taxes filled out by the employers. It is called a wage and tax statement.

The employer sends the w2 form to the employee and the IRS(Internal Revenue Service).

The W2 form helps the IRS track the tax payments of individuals. An employer has to send the W2 form to the employees to who he gives his salary. The W4 form is for employees to check the withheld taxes in each paycheck every year. Employee withholding certificate is the other name of W4.

It is easy for people to do the same job over the years. But difficult for people who change their work yearly. By filling out the W4 form, employees inform the withhold and deductions to the employers. W4 forms are filled carefully; else results in difficulty while returning the files.

Comparison Table

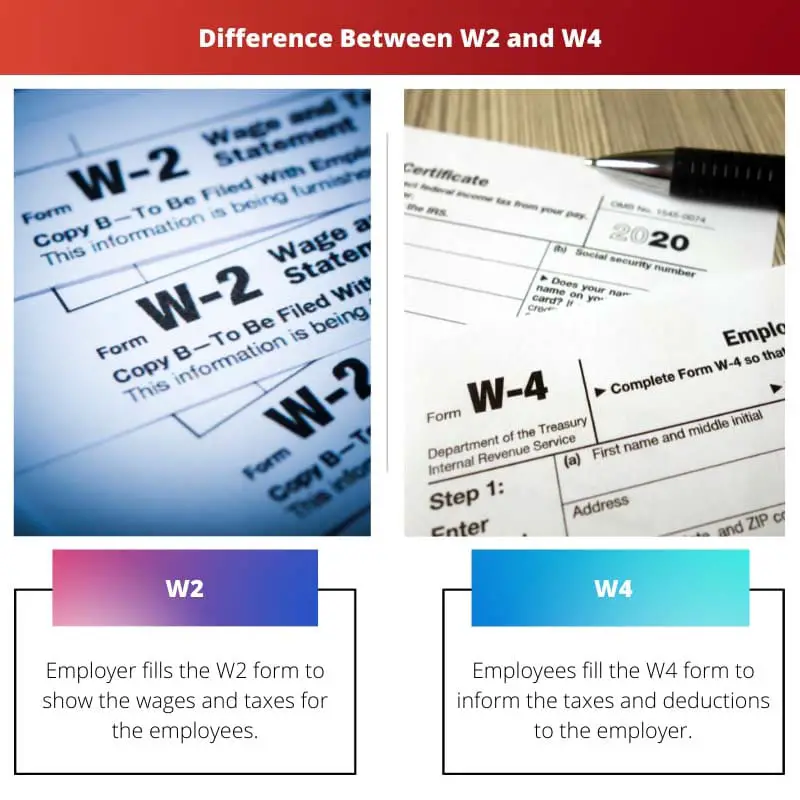

| Parameters on comparison | W2 | W4 |

|---|---|---|

| Definition | Employer fills the W2 form to show the wages and taxes for the employees. | Employees fill the W4 form to inform the taxes and deductions to the employer. |

| Submission time | At the end of every year( Jan 31) | Before beginning a new job |

| Fillers | Owners | Employers |

| Submission to IRS | Yes | No |

| Sections | 25 columns | Five sections |

What is W2?

The W2 form is to inform the wages and taxes of the employees by the employers. The employer is responsible for the W2 form. He is the one who sends this form to the employee and the IRS(internal revenue service).

The W2 form is also called the wages and tax statement. The IRS checks the tax payment history with the 1040 form. The W2 forms are to report to the FICA(Federal insurance contributions act). The W2 form is into two sections called state and federal to pay taxes on both levels.

It includes columns for personal information and professional pieces of information. After filling out the W2 form, the total paychecks of employees tax reduced. The w2 has a box of a-f and 1 to 15. Each box represents different pieces of information. The column from A to F denotes your personal information.

- Box 1 shows the income,

- Box 2 shows the withheld by the employer,

- Box 3 shows the earnings subject to social security,

- Box 4 represents the withheld by social security tax,

- Box 5 shows the Medicare tax,

- Box 6 shows the amount of withholding,

- Box 7 shows the tips,

- Box 8 represents the amount of withholding,

- Box 9 was left empty to show the deduction,

- Box 10 shows the amount received with benefits,

- Box 11 shows the money get from the non-qualified plan,

- Box 12 shows the reductions,

- Box 13 is for reports,

- Box 14 represents an additional tax

- Box 15-20 for state and federal tax.

What is the W4?

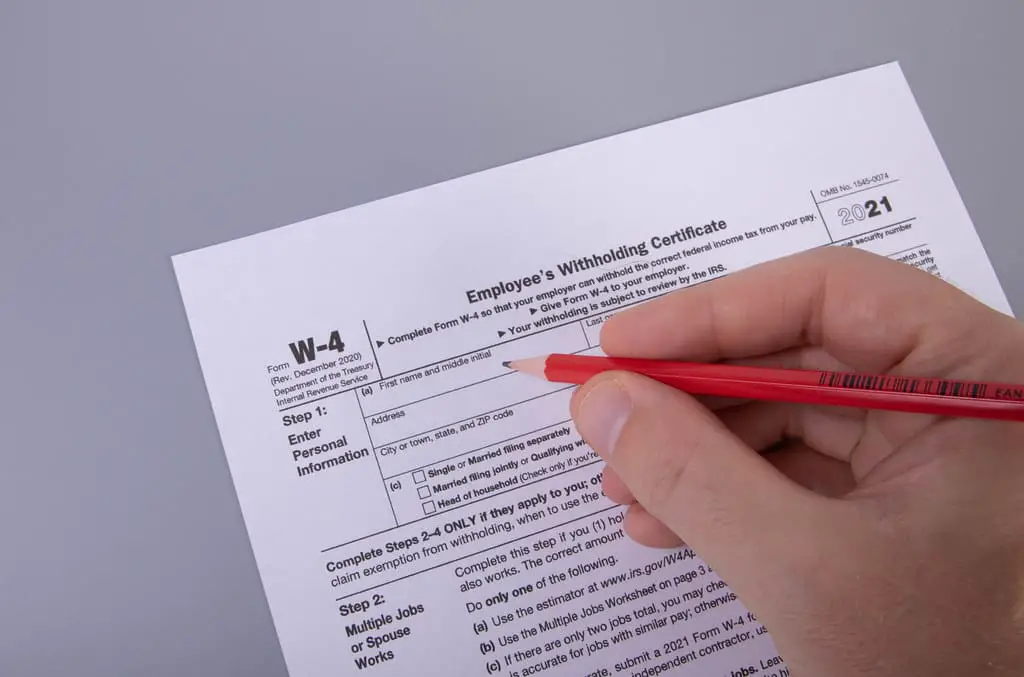

The W4 form is to inform the taxes and deductions to the employers. It is also called an employee withholding certificate. The IRS made many changes to the W4 form in 2020. So there is no need for the 1 or 0 allowances from 2020.

This results in an increased amount of money in the year’s paychecks. If you’re doing one job and don’t have any dependents, then the process is simple and easy, else you are doing some job that depends on the various income, and you need to fill many columns.

The w4 form shows the withholding, so every employee must fill out this form. If you are hiring new, then your employer gives you the W4 form.

It is vital to fill it out carefully.

It is the only way to make all your precious earnings legally with you. Else you can’t make income legal. Due to the tax cuts and the jobs act 2017, five changes happen in the w4 form. You go through the new changes before filling in.

There are five steps in W4 form filling. In step one, you provide the personal information. If you are single and doing one job, then fill first step and sign. In step two, you indicate the multiple jobs you are doing and your marital status.

In step three, you show the dependents and your child numbers. In step four, You fill other details and adjustments in your paychecks. In step five, sign the form with the date. It is easy to fill out the W4 form.

Main Differences Between W2 form and W4 form

- Employer fills the W2 form, and employee fills the W4 form.

- W2 shows the wages and taxes, and w4 shows the taxes and deductions.

- W2 is submitted every year, and w4 is consent before joining the new job.

- W2 needs to report to IRS, and W4 does not need to disclose to IRS.

- W2 has 25 distinct columns, and W4 has five sections.

- https://pubs.acs.org/doi/abs/10.1021/acs.jctc.5b00135

- https://ieeexplore.ieee.org/abstract/document/1068619/

Last Updated : 05 August, 2023

Chara Yadav holds MBA in Finance. Her goal is to simplify finance-related topics. She has worked in finance for about 25 years. She has held multiple finance and banking classes for business schools and communities. Read more at her bio page.

The forms W2 and W4 are of great importance. The W2 reports an employee’s annual wages and taxes withheld and W4 is used to adjust the amount of federal income tax withheld from an employee’s paycheck. Both forms are vital for tax purposes and must be filed accurately and on time.

Yes, you’re right. The W2 and W4 forms have a significant impact on the taxation process and it’s essential to understand the differences between them.

The detailed breakdown of the W2 and W4 forms provides valuable insight into their respective roles in tax-related matters. It’s crucial for individuals to familiarize themselves with these forms to ensure proper compliance with tax regulations.

Indeed, the accurate completion and understanding of W2 and W4 forms are essential for both employees and employers to fulfill their tax obligations effectively.

The comprehensive overview of W2 and W4 forms reinforces the importance of attention to detail in tax-related documentation, emphasizing the significance of accurate completion and submission of these forms.

The changes made to the W4 form in 2020 and the removal of 1 or 0 allowances has implications for employees and their paychecks. It’s essential for individuals to understand the impact of these changes and how it affects their income.

The alterations to the W4 form underscore the importance of staying informed about tax-related changes and their implications for individual taxpayers. It’s crucial for employees to stay updated and compliant with the revised form.

Indeed, the modifications to the W4 form bring about significant changes in how taxes are withheld from paychecks. Employees need to ensure they accurately fill out the revised form to reflect their specific financial circumstances.

The W2 and W4 forms are submitted by different entities, with W2 being filled by employers and W4 filled by employees. These forms have specific submission times and sections, making it crucial for tax purposes.

Indeed, understanding the submission times and key elements of W2 and W4 is essential for both employers and employees to carry out their tax-related responsibilities effectively.

The key differences between W2 and W4 forms are essential to comprehend for both employees and employers. Accurate completion of these forms is crucial for proper tax filing and compliance.

Absolutely. Developing a thorough understanding of W2 and W4 forms is vital for individuals involved in tax-related matters to ensure all requirements are met with precision and accuracy.

The detailed explanation of Box 1-20 in the W2 form provides a clear understanding of the information conveyed in each box. Employers must accurately fill out the W2 form to ensure proper tax reporting and payment.

The breakdown of information within the W2 form is crucial to ensuring compliance with tax regulations. Every box conveys specific details that contribute to accurate tax reporting.

Absolutely. The nuanced details within the W2 form are integral to the accurate reporting of an employee’s wages and taxes, and employers must handle this task diligently.

The W4 form plays a vital role in informing employers about the taxes and deductions to be withheld from an employee’s paycheck. It’s essential for employees to accurately complete this form to ensure proper tax withholding.

The W2 form is instrumental in tracking an employee’s tax payments, and it provides detailed information about wages, tax deductions, and other relevant financial details. Employers must ensure the accurate and timely submission of the W2 form.

The W2 form is a fundamental component of the taxation process, and both employers and employees must understand its significance in maintaining accurate financial records for tax purposes.

Absolutely. The W2 form serves as a comprehensive record of an employee’s income and tax withholdings, making it crucial for tax compliance and reporting.

The W4 form must be carefully filled out by employees to accurately inform employers about withholdings and deductions from their paychecks. This ensures that taxes are withheld correctly and avoids any potential issues during the tax return process.

Absolutely. Employees play a critical role in providing accurate and comprehensive information on the W4 form, contributing to the seamless processing of tax withholdings by employers.

The W2 and W4 forms serve different purposes. The W2 form contains wages and tax deductions for that year, whereas the W4 form is for employees to show the amount of withholding from the paycheck of the year. These forms are essential for employees and employers to handle tax payments properly.

The comparison table provided in the article effectively highlights the differences between W2 and W4 forms, making it easier to comprehend their unique roles in tax obligations.

Absolutely, understanding the distinction between W2 and W4 is crucial for both employees and employers to ensure accurate and compliant tax reporting.