El sistema de impuestos se practica en casi todos los países del mundo. La razón más común es generar ingresos para los gastos del gobierno.

Los impuestos pueden recaudarse a nivel federal, local y estatal. Es esencial entender la diferencia entre varios tipos de impuestos para entender la infraestructura de nuestro país.

Puntos clave

- El IVA es un impuesto sobre el valor agregado en cada etapa de producción, mientras que el impuesto especial es un impuesto sobre bienes o servicios específicos, en la producción o en la importación.

- El IVA se cobra como un porcentaje del precio final de un producto o servicio, mientras que el impuesto especial se cobra como una cantidad fija por unidad de bienes o servicios.

- El IVA es un impuesto más general que se aplica a una amplia gama de bienes y servicios, mientras que los impuestos especiales se aplican a productos específicos como el alcohol, el tabaco y el combustible.

IVA frente a impuestos especiales

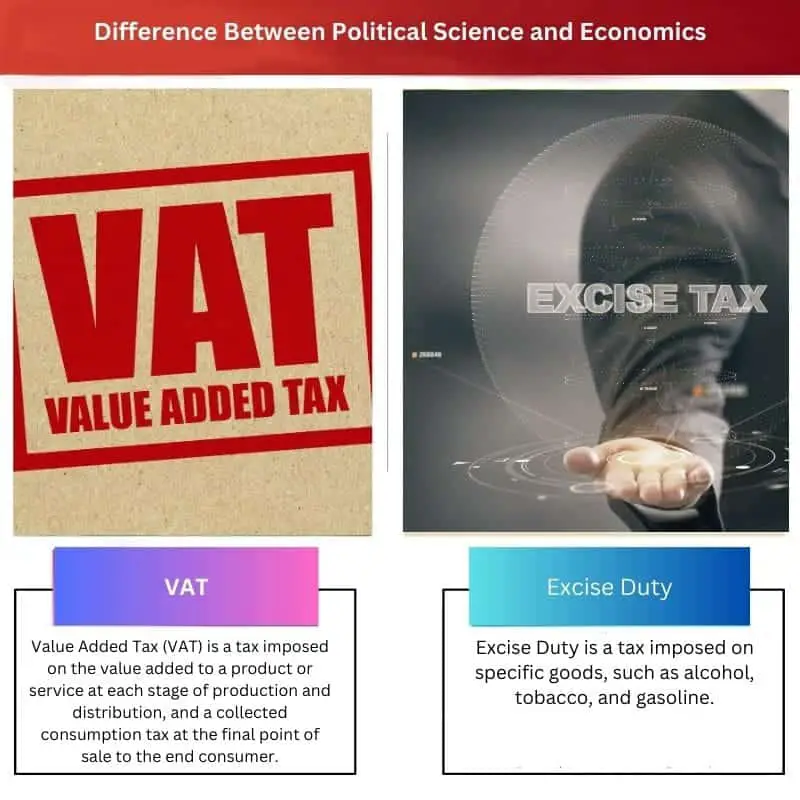

El Impuesto al Valor Agregado (IVA) es un impuesto que grava el valor agregado a un producto o servicio en cada etapa de producción y distribución, y un impuesto al consumo recaudado en el punto final de Venta al consumidor final. El impuesto especial es un impuesto que grava bienes específicos, como alcohol, tabaco y gasolina.

El impuesto especial es el impuesto añadido a la fabricación de bienes. Se impone en el momento de la fabricación y no en el momento de la venta, a diferencia del IVA. Su diferencia se entiende mejor con este ejemplo aquí.

Cuando la empresa está fabricando jabón, luego de hacerlo, tiene que pagar impuestos especiales incluso antes de vender el jabón. La siguiente tabla de comparación muestra las otras características que diferencian entre el IVA y los impuestos especiales.

Tabla de comparación

| Parámetro de comparación | IVA | Impuesto especial |

|---|---|---|

| Definición | El impuesto se agrega a los bienes a medida que viajan desde el punto de producción hasta el final de la venta. | Impuesto añadido sobre la fabricación de existencias. |

| Impuesto | Después de que el producto ha entrado en la etapa final de venta. | Después de que el producto ha sido fabricado. |

| Pagado por | Clientes que compran el producto. | La empresa que fabrica el producto. |

| Implementación | Método de recolección y momento de la recolección. | Ad valorem y específico. |

| Ejemplos | Galletas, dulces, jabón, pasta de dientes, zapatos. | Tabaco, alcohol, combustible. |

¿Qué es el IVA?

IVA significa impuesto al valor agregado. Es la cantidad de costo agregado al producto después de que ha llegado a la etapa final de comercialización. El sistema del IVA se ejerce en más de 160 países de todo el mundo.

El cliente solo debe pagar el IVA del producto final, no las materias primas necesarias para fabricar el producto.

La estado decide la tasa impositiva como un porcentaje del producto final. Se implementa de dos maneras:

- Método de recolección

- Momento de la recogida

En el método de cobro, el vendedor envía al comprador una factura con el monto del impuesto en ella. La otra forma es que no se genera y calcula ninguna factura específica en base al valor agregado al producto.

¿Qué es el impuesto especial?

Impuesto especial es el monto del impuesto agregado en el momento de la fabricación de los bienes. Es posible que los clientes no vean este monto directamente, ya que la empresa debe pagarlos a los departamentos de impuestos especiales de acuerdo con la infraestructura del gobierno.

Como resultado, los fabricantes aumentan el precio de los productos finales para adaptarse a ese costo. Es un impuesto empresarial que las empresas deben pagar aparte de otros impuestos como el impuesto sobre la renta.

Se implementa de una de dos maneras:

- ad valorem

- Ciertas

En ad valorem, hay un porcentaje fijo de ciertos tipos de bienes. El monto específico se aplica a compras con altos costos sociales, como boletos de avión, cigarrillos y alcohol.

Principales diferencias entre el IVA y los impuestos especiales

Algunas de las características que diferencian entre el IVA y los impuestos especiales son las siguientes:

- La implementación del IVA se lleva a cabo por el método de recaudación y el momento de la recaudación. El método ad valorem y el método específico llevan a cabo la aplicación del derecho de ejercicio.

- Los bienes con IVA incluyen galletas, dulces, jabón y pasta de dientes, y zapatos, mientras que los bienes con impuestos especiales incluyen tabaco, alcohol, boletos de avión y combustible para motores.

- https://pdfs.semanticscholar.org/f474/c44a44902007cca8fe0759b81ba2a5ab44e7.pdf

- https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1468-5965.1988.tb00335.x

Última actualización: 13 julio, 2023

Emma Smith tiene una maestría en inglés de Irvine Valley College. Ha sido periodista desde 2002, escribiendo artículos sobre el idioma inglés, deportes y derecho. Lee más sobre mí en ella página de biografía.

En el artículo se presenta una evaluación exhaustiva del IVA y los impuestos especiales, adecuada para personas que buscan una comprensión profunda de los sistemas tributarios.

El artículo proporciona un excelente análisis en profundidad de los sistemas impositivos del IVA y los impuestos especiales, proporcionando una comprensión clara de las conclusiones clave.

No podría estar más de acuerdo, Griffiths. La tabla comparativa del IVA y los impuestos especiales es especialmente informativa.

El contraste detallado del artículo entre el IVA y los impuestos especiales sirve como una guía reveladora para comprender las estructuras tributarias, lo que lo hace ventajoso para los lectores.

Estoy completamente de acuerdo, Nthomas. La cobertura integral del artículo fomenta una comprensión más profunda de estos asuntos tributarios esenciales.

El artículo no aborda las implicaciones prácticas de estos sistemas tributarios, que son igualmente importantes para comprender su impacto.

Tienes un punto válido, Ruby. Si bien los aspectos teóricos están bien cubiertos, el conocimiento de las aplicaciones prácticas mejoraría aún más el contenido.

Considero que el artículo está demasiado sesgado hacia el IVA, restando importancia a la importancia y el impacto de los impuestos especiales.

Comparto el mismo sentimiento, Rachel. Una visión más equilibrada de ambos sistemas tributarios podría mejorar la credibilidad general del contenido.

La falta de objetividad es realmente evidente, Rachel. Un enfoque equilibrado daría más autoridad al análisis.

El artículo proporciona una comprensión integral de los principios tributarios y sus diferencias, y sirve como un excelente recurso educativo.

Absolutamente, Yjames. Las explicaciones detalladas sobre el IVA y los impuestos especiales facilitan una comprensión clara de estos sistemas fiscales.

La exploración detallada del artículo sobre el IVA y los impuestos especiales aumenta la comprensión de los lectores sobre los sistemas tributarios complejos, ofreciendo un valor educativo significativo.

Comparto tu punto de vista, Scott. La profundidad analítica del artículo mejora la claridad a la hora de comprender estas intrincadas estructuras tributarias.

Bien dicho, Scott. El mérito educativo del contenido es realmente encomiable, ya que proporciona información valiosa sobre el IVA y los impuestos especiales.

El artículo ilumina las distinciones entre IVA e impuestos especiales con meticuloso detalle, lo que permite a los lectores comprender conceptos tributarios complejos de manera efectiva.

Bien dicho, Richardson. La profundidad intelectual del contenido lo distingue como un material informativo excepcional sobre impuestos.

No podría estar más de acuerdo, Richardson. La claridad de las explicaciones facilita a los lectores la comprensión de estos sistemas tributarios.

El artículo ofrece un discurso intelectual sobre el IVA y los impuestos especiales, proporcionando una experiencia de aprendizaje enriquecedora para los lectores.

Absolutamente, Frank. La naturaleza reveladora del contenido contribuye a una comprensión más profunda de las dimensiones tributarias.

El artículo transmite eficazmente los detalles del IVA y los impuestos especiales, esenciales para que cualquiera comprenda la infraestructura tributaria del país.

Absolutamente, Blanco. Estos conceptos son cruciales para que cualquiera pueda obtener una comprensión integral de los sistemas tributarios.

De hecho, es una pieza bien estructurada e informativa. Felicitaciones al autor por esta explicación detallada.