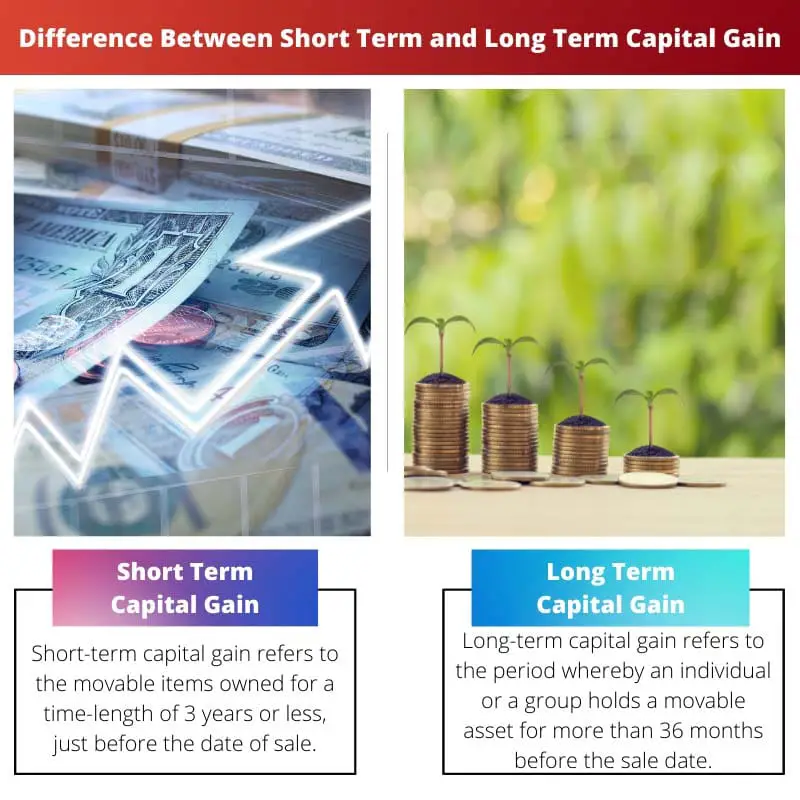

Lühiajaline kapitalikasum on kasum, mis on teenitud ühe aasta või vähem hoitavate varade müügist, mille suhtes kohaldatakse kõrgemaid maksumäärasid, mis põhinevad üksikisiku tavapärasel tulumaksuklassil. Seevastu pikaajaline kapitalikasum tekib üle ühe aasta hoitud varade müügist, mida maksustatakse sõltuvalt maksumaksja sissetulekutasemest madalamate määradega, stimuleerides pikaajalisi investeerimisstrateegiaid.

Võtme tagasivõtmine

- Hoidmisperiood on oluline:

- Peamine erinevus lühi- ja pikaajalise kapitalikasumi vahel on investeeringu või vara hoidmise kestus enne selle müümist.

- Lühiajalist kapitali kasvutulu kohaldatakse varade suhtes, mida hoitakse ühe aasta või vähem, samas kui pikaajalist kapitali kasvutulu kohaldatakse varade suhtes, mida hoitakse üle ühe aasta.

- Maksukohtlemine erineb:

- Lühiajalise kapitali kasvutulu suhtes kohaldatakse kõrgemat maksumäära, mis on võrdne teie tavalise tulumaksumääraga. See tähendab, et võite lühiajalise kasumi pealt maksta märkimisväärse summa makse.

- Pikaajalise kapitali kasvutulu suhtes kohaldatakse maksusoodustust ja madalamaid maksumäärasid. Mõnel juhul võib pikaajaline kasum olla isegi maksuvaba madalama sissetulekuga isikutele.

- Investeerimisstrateegia mõju:

- Investorid ja maksumaksjad peaksid vara müümise üle otsustades arvestama maksumõjuga. Varade pikaajaline hoidmine võib kaasa tuua väiksemad maksukohustused ja potentsiaalselt suurema maksujärgse tulu.

- Lühiajaline kauplemine ja varade sagedane käive võivad kaasa tuua kõrgemad maksud ja ei pruugi olla nii maksuefektiivsed kui pikaajaline osta ja hoia strateegia.

Lühiajaline vs pikaajaline kapitalikasum

Lühiajalist kapitali kasvutulu kohaldatakse varadele, mida hoitakse ühe aasta või vähem, ja sellele kohaldatakse kõrgemaid maksumäärasid. Võrdluseks, pikaajaline kapitalikasum on kasum varadest, mida hoitakse üle ühe aasta, millel on madalamad maksumäärad või võimalikud maksuvabastused, mis stimuleerivad pikaajalist investeerimist.

Näited: 1) Lühiajaline kasum: Müügilaud. 2) Pikaajaline kasu: kinnisvara laenutamine rendile.

Võrdlustabel

| tunnusjoon | Lühiajaline kapitalikasum | Pikaajaline kapitalikasum |

|---|---|---|

| Hoidmisperiood | Vähem kui 1 aasta (erineb riigiti ja vara tüübiti) | Rohkem kui 1 aasta (erineb riigiti ja vara tüübiti) |

| Maksustamine | Maksustatakse tavalise tulumaksumääraga | Üldiselt maksustatakse tavatuludest madalama määraga või isegi 0%, sõltuvalt sissetuleku tasemest ja konkreetsetest reeglitest |

| Investeerimisstrateegia | Sageli seotud aktiivse kauplemise ja lühiajaliste turuliikumisega | Sageli seostatakse ostu ja hoidmise strateegiate ja pikaajalise turukasvuga |

| Oht | Üldiselt peetakse seda kõrgemaks, kuna lühiajalised turu kõikumised võivad tekkida | Üldiselt peetakse madalamaks, kuna arvatakse, et turud kipuvad pikas perspektiivis tõusma |

| Potentsiaalne tootlus | Võimalik kõrgem tänu võimalusele ära kasutada lühiajalisi turuvõimalusi | Üldiselt madalam kui lühiajaline kasum, kuid seda peetakse järjekindlamaks ja usaldusväärsemaks |

| Teadmiste ja oskuste nõue | Võib nõuda tehnilise analüüsi ja turu ajastuse sügavamat mõistmist | Võib nõuda suuremat rõhku fundamentaalanalüüsile ja pikaajalistele majandustrendidele |

| Sobivus | Sobib inimestele, kellel on kõrge riskitaluvus, märkimisväärne ajakulu ja aktiivne juhtimiskalduvus | Sobib inimestele, kes otsivad vabamat lähenemist, on valmis leppima madalama riskiga väiksema potentsiaalse tuluga ja kellel on pikaajaline investeerimishorisont |

Mis on lühiajaline kapitalikasum?

Lühiajaline kapitalikasum viitab kasumile, mis saadakse ühe aasta või vähem hoitud varade müügist või vahetamisest. Need varad võivad hõlmata aktsiaid, võlakirju, kinnisvara ja muid investeeringuid. Omandi kestus on otsustava tähtsusega selle määramisel, kas kasum liigitatakse lühiajaliseks.

Maksustamine

Lühiajalise kapitali kasvutulu suhtes kohaldatakse kõrgemaid maksumäärasid võrreldes pikaajalise kapitali kasvutuluga. Lühiajalise kapitali kasvutulu maksumäär põhineb üksikisiku tavalisel tulumaksuklassil, mis võib USA-s alates 10. aastast ulatuda 37%-st 2022%-ni. See tähendab, et lühiajalist kapitali kasvutulu maksustatakse sama maksumääraga. kui üksikisiku regulaarne sissetulek.

Mõju investeerimisstrateegiale

Lühiajalise kapitalikasvu kõrgemad maksumäärad võivad investeerimisstrateegiaid märkimisväärselt mõjutada. Investoritel võib tekkida vajadus kaaluda varade lühiajalise ja pikema hoidmise maksutagajärgi. Järelikult võib see mõjutada otsuseid investeeringute ostmise ja müügi ajastamise kohta.

Mis on pikaajaline kapitalikasum?

Pikaajaline kapitalikasum viitab rohkem kui ühe aasta hoitud varade müügist või vahetamisest saadud kasumile. Need varad hõlmavad laia valikut investeeringuid, nagu aktsiad, võlakirjad, kinnisvara ja investeerimisfondid. Omandi kestus mängib otsustavat rolli selle kindlaksmääramisel, kas kasum on pikaajaline.

Maksustamine

Pikaajalise kapitali kasvutulu suhtes kohaldatakse soodsamaid maksumäärasid võrreldes lühiajalise kapitali kasvutuluga. Ameerika Ühendriikides on 2022. aasta seisuga pikaajalise kapitali kasvutulu maksumäärad vahemikus 0% kuni 20%, olenevalt maksumaksja sissetulekutasemest. Näiteks võivad madalamasse maksuklassi kuuluvad isikud saada 0% pikaajalist kapitali kasvutulu maksumäära, samas kui kõrgemates kategooriates olevatele isikutele võib kohaldada maksimaalset 20% maksumäära. Selline maksusoodustus ergutab pikaajalisi investeerimisstrateegiaid.

Mõju investeerimisstrateegiale

Pikaajalise kapitalikasvu soodne maksukohtlemine võib investeerimisstrateegiaid oluliselt mõjutada. Investorid võivad valida varade hoidmise pikema perioodi jooksul, et saada oma kasumilt madalamaid maksumäärasid. See lähenemine on kooskõlas "osta ja hoidke" investeerimise mõistega, kus investorid keskenduvad pigem pikaajalisele kasvule kui lühiajalistele kõikumistele. Ajastades varade müügi strateegiliselt, et kvalifitseeruda pikaajalisele kapitalikasumi käsitlemisele, saavad investorid potentsiaalselt optimeerida oma maksujärgset tulu.

Peamised erinevused lühiajalise ja pikaajalise kapitali juurdekasvu vahel

- Omandi kestus:

- Lühiajaline kapitalikasum tuleneb ühe aasta või vähem hoitud varade müügist.

- Pikaajaline kapitalikasum tekib üle ühe aasta hoitud varade müügist.

- Maksumäärad:

- Lühiajalist kapitali kasvutulu maksustatakse tavaliste tulumaksumääradega, mis võivad ulatuda 10% kuni 37%.

- Pikaajalise kapitali kasvutulu suhtes kohaldatakse soodusmaksumäärasid, mis jäävad vahemikku 0% kuni 20%, olenevalt maksumaksja sissetulekutasemest.

- Mõju investeerimisstrateegiale:

- Lühiajalised kapitali kasvutulu maksumäärad võivad ergutada sagedasemat kauplemist või lühemaid hoidmisperioode.

- Pikaajalised kapitali kasvutulu maksumäärad soodustavad "osta ja hoidke" strateegiat, edendades pikemaajalisi investeerimisperioode potentsiaalselt madalamate maksukohustuste jaoks.

- Maksu planeerimine:

- Lühiajalise kapitalikasumi maksuplaneerimine hõlmab kõrgemate maksumäärade mõju arvestamist üldisele investeeringutasuvusele.

- Pikaajalise kapitalikasumi maksuplaneerimine keskendub maksujärgse tulu optimeerimisele, ajastades varade müügi strateegiliselt, et kvalifitseeruda madalamate maksumääradega.

Viimati värskendatud: 03. märts 2024

Chara Yadavil on MBA rahanduses. Tema eesmärk on lihtsustada rahandusega seotud teemasid. Ta on rahanduses töötanud umbes 25 aastat. Ta on pidanud mitmeid finants- ja pangandustunde ärikoolidele ja kogukondadele. Loe temalt lähemalt bio-leht.

See artikkel kirjeldab tõhusalt lühi- ja pikaajalise kapitalikasvu maksumõju ja investeerimisstrateegiaga seotud kaalutlusi.

Kindlasti on pikaajalise investeerimisega seotud maksuefektiivsus investorite jaoks võtmetähtsusega.

Kuigi lühiajalise ja pikaajalise kapitali kasvutulu maksustamine on erinev, toob see artikkel tõhusalt esile pikaajalise investeerimise eelised.

Kahtlemata on pikaajaliste investeeringute potentsiaalne maksusääst maksujärgse tulu maksimeerimiseks ülioluline.

Lühiajalise ja pikaajalise kapitali kasvutulu maksumõju on investeerimisstrateegia väljatöötamisel otsustava tähtsusega. Selles artiklis hästi sõnastatud.

Pikaajalise kapitalikasumiga seotud maksusoodustused on üsna kaalukad. See artikkel rõhutab pikaajalise investeerimise eeliseid.

Tõepoolest, potentsiaalsed maksuvabastused ja erandid pikaajalise tulu saamiseks võivad olla kasulikud kannatlikele investoritele.

Ma leidsin, et lühiajalise ja pikaajalise kapitalikasumi võrdlus on silmiavav. See toob tõesti esile pikaajalise investeerimise eelised.

Hindan lühiajalise ja pikaajalise kapitali kasvu põhjalikku võrdlust. Investeerimisotsuste tegemisel on oluline arvesse võtta maksumõju.

Kindlasti on tulude optimeerimiseks ülioluline mõista maksukäsitluse ja investeerimisstrateegia mõjusid.

See artikkel annab selge ja kokkuvõtliku jaotuse lühi- ja pikaajalise kapitalikasumi kohta. See on hästi uuritud ja informatiivne.

Nõus, toodud näited aitasid mul mõistetest paremini aru saada.

Ma leidsin, et võrdlustabel oli eriti kasulik lühiajalise ja pikaajalise kapitali kasvu erinevuste mõistmisel.

Lühiajalise ja pikaajalise kapitalikasumi eristamine on hästi seletatav. Investoritel on oluline oma otsustusprotsessis maksukäsitlust arvesse võtta.

Kindlasti ei saa investeeringutasuvuse optimeerimisel tähelepanuta jätta maksumõju.

Artikkel annab põhjaliku ülevaate lühi- ja pikaajalise kapitalikasumiga seotud maksumõjudest. Hästi tehtud!

Nõustun, investeerimisstrateegia mõju on eriti kasulik investoritele, kes soovivad optimeerida oma maksutõhusust.

Võrdlustabel ja näited andsid mõistetest igakülgse ülevaate. See on kasulik nii algajatele kui ka kogenud investoritele.

Nõus, reaalse elu näited hõlbustavad lühi- ja pikaajalise kapitalikasvu mõju mõistmist.

Mulle tundusid eriti huvitavad maksuvabastused ja erandid. Pikaajalised investorid saavad sellest ülevaatest kasu.

Märkimisväärne on maksutõhusus ja investeerimisstrateegia mõju. See artikkel heidab valgust pikaajalise investeerimise olulisusele.

Kindlasti võivad maksutagajärjed aja jooksul oluliselt mõjutada investeeringutasuvust.

Leidsin, et näited ja võrdlustabel on väga kasulikud lühi- ja pikaajaliste tulude praktiliste rakenduste mõistmisel.