Capital funding is critical for any trade and plays a vital role in every division. It is awarded by certain companies and financial institutions based on the demand from the business. Few systems offer clients the money to meet the end objectives of their particular business.

Many of us know these terms at the primary level. Still, a deeper understanding of such words and expressions they work will allow us to understand the operational policies and practices.

Key Takeaways

- Public finance deals with the financial management and activities of government institutions, while private finance focuses on the financial activities of individuals, households, and businesses.

- Public finance involves revenue generation through taxation, expenditure on public projects, and fiscal policy, whereas private finance includes personal savings, investments, and financial planning.

- Public finance aims to ensure the efficient allocation of resources, economic stability, and social welfare, while private finance focuses on wealth creation and financial security for individuals and organizations.

Public vs Private Finance

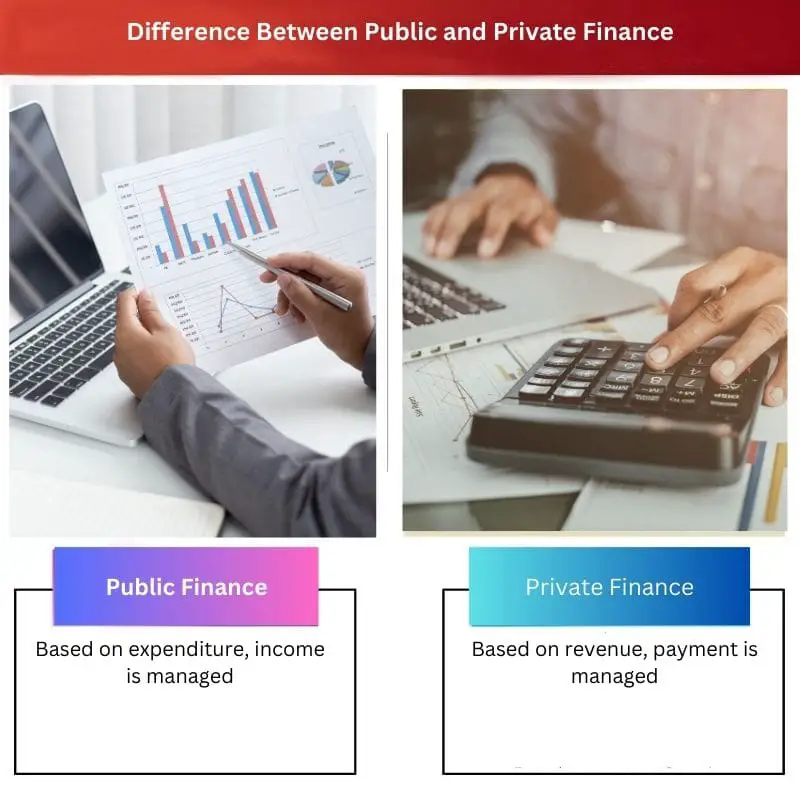

The difference between public finance and private finance is that public finance deliberately alters and adjusts income based on expenses. In contrast, personal finance manipulates costs based on future income.

Public finance divisions have government offices and all the agencies that are part of a team, and it is managed in the government buildings and state offices.

On the contrary, personal and business finance are the two essential aspects of private finance.

Comparison Table

| Parameter of Comparison | Public Finance | Private Finance |

|---|---|---|

| Income and Expenditure ratio | Based on expenditure, income is managed | Based on revenue, payment is managed |

| Cash Flow | Both internal and external factors borrow cash | External borrowing is allowed. |

| Ownership | The whole control of the cash flow procedure | Has no control over the cash flow procedure |

| Objective | To serve people is the motto | To make profits out of business is the motto |

| Transparency | The process is transparent | The process is not transparent |

What is Public Finance?

Public finance is an economic sector that allocates funds to various public entities based on a fixed budget and timelines. Public Finance is a sector that deals primarily with taxation and expenditure thereof.

It deals with income raised through revenue using taxes and policies. It is utilized to spend on community activities.

In simple words, public finance is the topic of the study of government revenue and expenditure.

Public finance is part of the study of revenue collection and spending in the public interest for the government’s welfare.

Scope of Public Finance

Public Finance can support the government and the people of a nation in various ways. The spectrum of support offered by public financing can be summarized as follows:

- Government Wealth: The government’s treasury is balanced and kept healthy to avoid and manage an economic disaster.

- Public Loss: Any loss of public lives or properties due to natural calamities are supported by public finance.

Greater Observations:

- Public finance systematically analyses the reality and values of government revenue and expenditure.

- Scientific approaches stand to research public finances.

We can say that the subject of public finance is not static but a dynamic one that continually expands with the change in the state concept and the government’s power.

As the economic and social responsibilities of the state are regularly increasing, the methods and techniques of raising tax income and public expenditure are also evolving.

What is Private Finance?

Private finance is money management by an individual or a private entity. It is, indeed, fund optimization over revenue generation and expenditure.

Private finance is, on the whole, the entire life’s financial planning. It includes debt management, pension plans, future investments and so on.

One of the categories of the private sector is business finance. It is the allocation of optimum funds to run a business successfully.

It involves the acquisition of assets and the proper allocation of funds to maximise the achievement of the objectives set.

The revenue generated based on investments is considered profit if the income generated is more than the expenses incurred.

Private financing is also about availing loans and repayment as well. It works both on the personal as well as corporate front.

Individuals can obtain Personal Finance to fulfil their needs, making their life comfortable.

Main Differences Between Public and Private Finance

- The main difference between Public finance and Private Finance is that the public sector comprises all government agencies, corporations, and local offices. The private sector is made up of companies, individuals, and companies.

- The primary goal of the public sector is to build social gains, while the private sector is to make money.