A balance sheet provides a snapshot of a company’s financial position at a specific time, showing its assets, liabilities, and equity. At the same time, a cash flow statement tracks the inflow and outflow of cash over a period, providing insights into a company’s liquidity and cash management.

Key Takeaways

- A balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a specific point in time.

- A cash flow statement is a financial statement that shows the inflows and outflows of cash and cash equivalents during a specific period.

- A balance sheet provides a snapshot of a company’s financial position, while a cash flow statement shows the movement of cash in and out of the company.

Balance Sheet vs Cash Flow Statement

Balance Sheet discloses the company’s financial position, and the Cash Flow Statement helps in budgeting and forecasting. Balance sheet is prepared for a specific day, after completion of the financial year, whereas the Cash Flow Statement is made for a particular period.

Long-term investors wishing to load some money on an organization and remain quiet for years consider the former to evaluate the firm’s business dealings. Mutual fund investors who buy and sell frequently evaluate Cash Flow Statements before investing their funds in a company.

So before choosing the financial tool, work on a few factors that are apt for you. Some of them are the period of investment(short-term or long-term), the readiness of cash, i.e., whether you need the cash to be readily available or as an asset, etc.

Let us look at their differences and uses them in detail below.

Comparison Table

| Feature | Balance Sheet | Cash Flow Statement |

|---|---|---|

| Purpose | Provides a snapshot of a company’s financial health at a specific point in time. | Shows the inflow and outflow of cash during a specific period. |

| Timeframe | Represents a specific date, the end of a quarter or fiscal year. | Covers a period of time, a quarter or fiscal year. |

| Focus | Assets, liabilities, and shareholders’ equity | Sources and uses of cash |

| Format | Two columns: assets and liabilities & equity; assets should equal liabilities & equity. | Three sections: operating, investing, and financing activities |

| Key information | Current assets, fixed assets, intangible assets, current liabilities, long-term liabilities, shareholders’ equity | Net income, depreciation and amortization, changes in working capital, capital expenditures, dividends paid, issuance of debt or equity |

| Provides insight into | A company’s financial stability, liquidity, and solvency | A company’s ability to generate cash and manage its cash flow |

| Used by | Investors, creditors, and analysts to assess a company’s financial health and performance. | Management, investors, and analysts to understand a company’s cash generation and spending habits. |

What is Balance Sheet?

A balance sheet is a financial statement that provides a snapshot of a company’s financial health at a specific time. It summarizes the company’s assets, liabilities, and shareholders’ equity, offering valuable insights into its financial position and solvency.

Key components of a balance sheet:

- Assets: These are the resources owned by the company, such as cash, inventory, accounts receivable, property, plant, and equipment, intangible assets (like patents and trademarks), and investments.

- Liabilities: These are the company’s debts and obligations, including accounts payable, accrued expenses, taxes payable, long-term debt, and other financial obligations.

- Shareholders’ equity: This represents the ownership interest of the company’s shareholders and is calculated by subtracting liabilities from assets.

Essential information provided by a balance sheet:

- Financial stability: Indicates the balance between the company’s assets and liabilities, providing insight into its ability to meet financial obligations and withstand potential challenges.

- Liquidity: Shows the company’s ability to quickly convert its assets into cash to meet short-term obligations.

- Solvency: Assesses the company’s long-term financial health and ability to pay off its debts over time.

- Capital structure: Provides information about the company’s funding sources, including debt and equity financing.

Benefits of using a balance sheet:

- Informed decision-making: Helps investors, creditors, and management make informed decisions about investing in the company, extending credit, or allocating resources.

- Performance evaluation: Enables comparison of the company’s financial health over time to assess its progress and identify trends.

- Risk assessment: Provides information about potential risks associated with the company’s financial position.

- Compliance with regulations: Companies are required to prepare and disclose their balance sheets to comply with accounting standards and regulations.

What is Cash Flow Statement?

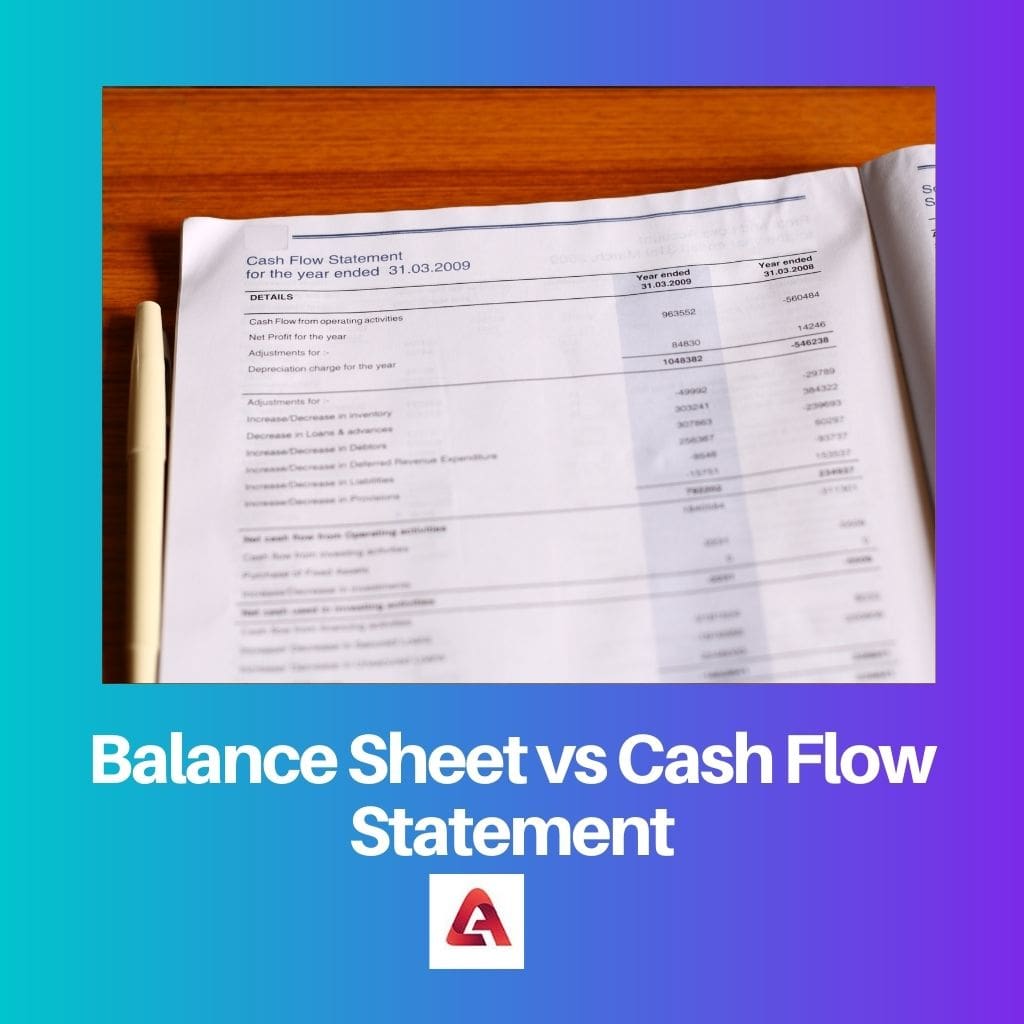

A cash flow statement is a financial statement that provides a detailed breakdown of a company’s cash inflows and outflows over a specific period, a quarter or fiscal year. It offers valuable insights into the company’s ability to generate and manage cash, which is essential for its survival and growth.

Key components of a cash flow statement:

- Operating activities: This section shows the cash generated from the company’s core business operations, including net income, depreciation and amortization, changes in working capital, and other operating cash flows.

- Investing activities: This section shows the cash used for purchasing or selling assets, such as property, plant, and equipment, investments in other companies, and acquisitions and divestitures.

- Financing activities: This section shows the cash raised or paid through debt and equity financing, including issuance of debt or equity, repayment of debt, and dividends paid to shareholders.

Essential information provided by a cash flow statement:

- Cash generation: Indicates the company’s ability to generate positive cash flow from its operations, which is crucial for its long-term financial sustainability.

- Cash management: Shows how the company uses its cash inflows to fund its operating activities, investments, and financing needs.

- Capital expenditures: Provides information about the company’s investments in its business and its growth potential.

- Dividend payments: Shows how much cash the company returns to its shareholders.

Benefits of using a cash flow statement:

- Improved financial analysis: Provides valuable information beyond the income statement, offering a more comprehensive understanding of the company’s financial health.

- Investment decisions: Helps investors assess the company’s ability to generate sustainable cash flows and make informed investment decisions.

- Credit analysis: Enables creditors to evaluate the company’s risk profile and ability to repay its debts.

- Strategic planning: Provides management with insights to make informed decisions about allocating resources and investing in growth initiatives.

Main Differences Between the Balance Sheet and Cash Flow Statement

- Purpose:

- Balance Sheet: The balance sheet provides a static snapshot of a company’s financial position at a specific time, detailing its assets, liabilities, and shareholders’ equity.

- Cash Flow Statement: The cash flow statement provides a dynamic view of a company’s cash inflows and outflows over a specific period, helping to assess its liquidity and cash management.

- Content:

- Balance Sheet: The balance sheet includes information on assets (both current and non-current), liabilities (both current and non-current), and shareholders’ equity. It shows what a company owns and owes at a particular moment.

- Cash Flow Statement: The cash flow statement focuses solely on cash transactions, categorizing them into three main sections: operating activities, investing activities, and financing activities.

- Time Frame:

- Balance Sheet: The balance sheet is a static report representing a company’s financial position at a specific date, at the end of a reporting period (e.g., a fiscal quarter or year).

- Cash Flow Statement: The cash flow statement covers a specific period, a fiscal quarter or year, showing how cash has flowed into and out of the company.

- Information:

- Balance Sheet: The balance sheet provides information on a company’s assets and liabilities that have not necessarily resulted in cash transactions. It includes items like accounts receivable, inventory, and long-term investments.

- Cash Flow Statement: The cash flow statement focuses on actual cash transactions and provides insights into where cash has been generated or used. It includes cash from operating activities, cash from investing activities, and cash from financing activities.

- Analysis:

- Balance Sheet: The balance sheet helps assess a company’s overall financial health, solvency, and ability to meet its long-term obligations by comparing assets to liabilities.

- Cash Flow Statement: The cash flow statement helps analyze a company’s liquidity and short-term cash flow, indicating whether it has enough cash to cover its immediate obligations and investments.

- Relation:

- Balance Sheet: Changes in the balance sheet, such as fluctuations in assets and liabilities, do not necessarily correlate directly with cash movements and may involve non-cash transactions.

- Cash Flow Statement: The cash flow statement provides a more direct link to actual cash movements, showing how changes in cash balances relate to specific activities.