Money is very important for living. Different countries have their own currencies, which are sequence divided and arranged in order. When people work for someone, they earn money to buy goods, clothes, etc.

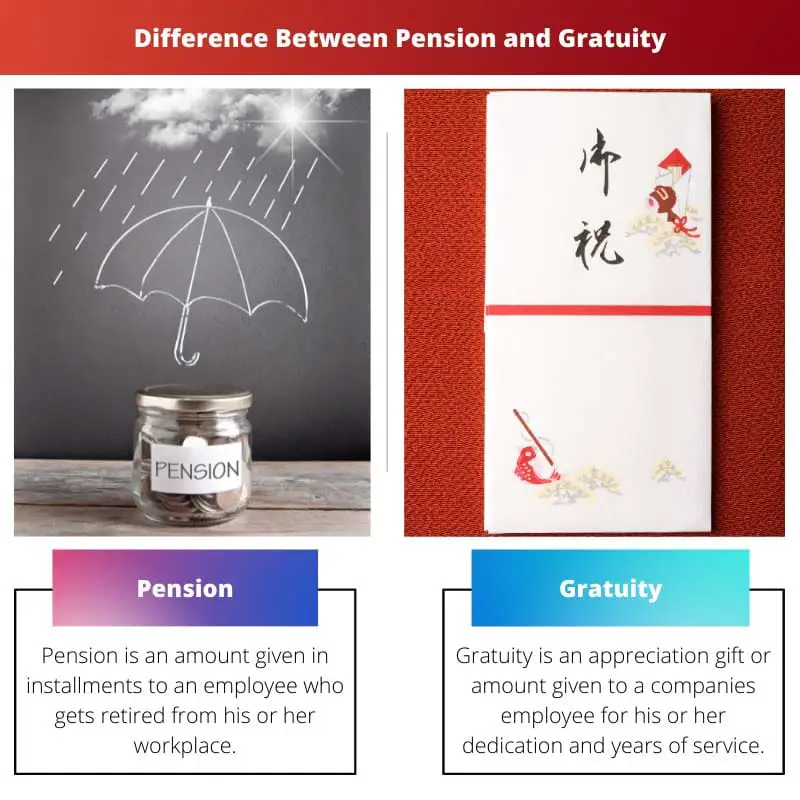

This is called salary or pay. But after a certain age, a person gets retired from work or office. Pension and Gratuity are amounts that are given to an employee when they get retire from their work.

Both of these amounts are very much different as Pension is given monthly to a person who gets retired from their office, and the amount given is little in quantity while Gratuity is a lump sum amount paid to the employee after completing five or more years in the same workplace.

Key Takeaways

- Pensions provide a regular income after retirement, whereas gratuity is a one-time lump-sum payment.

- Gratuity is given as a reward for long-term service, while pensions are based on salary and years of employment.

- Both employee and employer contributions fund pensions, while gratuity is employer-funded.

Pension vs Gratuity

A pension is a type of retirement plan that provides employees with a regular income after they retire. The employer funds pensions, although some plans may require employees to contribute as well. Gratuity, also known as a “tip,” is a one-time payment that is made to an employee as a reward for their service. Gratuity is given at the end of an employee’s service.

Pension is given to a government employee or a person who used to work in a government-operated company or office. This pension scheme is for those employees who get retired after a specific period of time. The amount given is scheduled from month to month.

Gratuity is an appreciation gift given to employees who have devoted more than 4 years of faithfulness towards their company. The Gratuity amount depends on the working years of an employee.

And the amount given is provided altogether, not from month to month. In addition to this amount, so many more advantages are provided.

Comparison Table

| Parameters of Comparison | Pension | Gratuity |

|---|---|---|

| Definition | Pension is an amount given in installments to an employee who gets retired from his or her workplace. It is a monthly installment scheme decided by the government for people of a specific age group. | Gratuity is an appreciation gift or amount given to a companies employee for his or her dedication and years of service. |

| Amount | The amount is given from month to month or in installments to a person. | The amount given is a lump sum depending on the years of service provided by the employee. |

| Scheme | It is given according to employees pension scheme launched by the government in 2017. | It is given according to the payment of gratuity act that was framed in 1972. |

| Minimum service | The minimum work service of an employee should be more or equal to ten years. | For Gratuity, the minimum work service should be five years or more. |

| Consideration | The term Pension can also be considered as a retirement plan or a departing plan. | The term Gratuity is also considered a gift or an appreciation amount. |

What is Pension?

The government launched a pension scheme to enhance their employee’s financial security after his or her retirement. In this scheme, a retired employee is benefited from the fixed amount of money that the government provides from month to month or in instalments.

Pension is only given to an employee who has served more than ten years of their life as a government employee. This scheme is not for non-government employees.

In some places, this scheme is based on the age system in which a specific retirement age is defined, and according to that, a pension is provided.

People can go for the Pension scheme by registering themselves on websites launched by the government. And if they pass all the criteria, they get benefits with the Pension.

What is Gratuity?

The Gratuity Act was launched in 1972, according to which some lumpsum amount of the money is provided by the company to its employees who have worked for four or more years for their company. This Gratuity scheme works both for government and non-government employees.

Gratuity can also be considered an appreciation gift by the company. The Gratuity amount is decided according to an employee’s salary.

Nowadays, in some government jobs, a Gratuity scheme is used instead of a Pension which is a lumpsum amount of money provided instead of an instalment scheme.

People can also nominate heirs to collect their Gratuity money in case they are dead or have an accident. They can nominate their heirs by filing when joining a company.

Main Differences Between Pension and Gratuity

- Pension is an amount given in instalments to an employee who gets retired from his or her workplace. It is a monthly instalments scheme decided by the government for people of a specific age group. On the other hand, Gratuity is an appreciation gift or amount given by the company to those employees who have served their company for years.

- The term Pension is also referred to as a retirement plan or departing plan. In contrast, the term Gratuity can also be referred to as a gift or appreciation amount.

- To be eligible for the Pension scheme, a person should have served a minimum of ten years of service. Whereas to be eligible for Gratuity, an employee should have served equal or more than five years of service.

- The guidelines followed in Gratuity are taken from the Payment of gratuity act that was framed in 1972. While providing a Pension, the employees’ pension scheme is taken into account.

- The gratuity amount is given as a lump sum amount to an employee after he or she gets eligible for that. Whereas in Pension, the amount given is scheduled from month to month or in instalments.

The details about how the gratuity amount is decided based on an employee’s salary are quite insightful.

Indeed, understanding the considerations for determining gratuity is crucial for employees.

The description of how one can enroll in the pension scheme and registration process is quite informative.

The explanation of the Gratuity Act and its application in both government and non-government sectors is enlightening.

I agree, it’s helpful to know the process for availing these benefits.

The comparison table provides a clear distinction between pension and gratuity. It helps in understanding how these benefits differ.

Thank you for outlining the key parameters, it makes the distinction between the two quite clear.

Absolutely, the direct comparison is beneficial when understanding complex financial concepts like these.

Thank you for elucidating the distinction between pension and gratuity.

The provision of the comparison table is very useful in understanding the specific details of each benefit.

I find the comparison table to be an excellent visual aid for grasping the differences.

The alternative use of Gratuity in some government jobs instead of Pension is an interesting shift.

I find the use of Gratuity as an alternative retirement benefit to be an intriguing policy choice.

The distinction between a regular pension and a Gratuity lump sum is quite clear now.

The explanation of who is eligible for pension and gratuity based on their service tenure is an important factor in understanding these concepts.

Absolutely, the minimum service duration for each benefit is a crucial distinction.

Thank you for breaking down the pension and gratuity schemes in such detail.

It is interesting to learn about the differences between pension and gratuity. The pension and gratuity act dates are very important information.

Yes, it is important to have clarity between the two terms as they are crucial for employee benefits.

The historical context of the Pension and Gratuity schemes is quite intriguing.

The comparison between Pension and Gratuity as retirement plans or gifts provides clarity.

I agree, learning about the origins of these benefits adds depth to the understanding.