The forms we deal with to pay the tax may sound the same. But they are different in their ways. The contours will fill to pay the tax and for billing and many needs. Sometimes it depends on who fills up the documents.

The W2 and W4 are IRS(internal revenue service) forms. When you are employed, or you employ some people, then you must know about these forms.

Key Takeaways

- The W2 form reports an employee’s annual wages and taxes withheld, while the W4 form is used to adjust the amount of federal income tax withheld from an employee’s paycheck.

- Employers are required to provide W2 forms to employees, but employees fill out W4 forms themselves.

- Both forms are important for tax purposes and must be filed accurately and on time.

W2 Vs W4

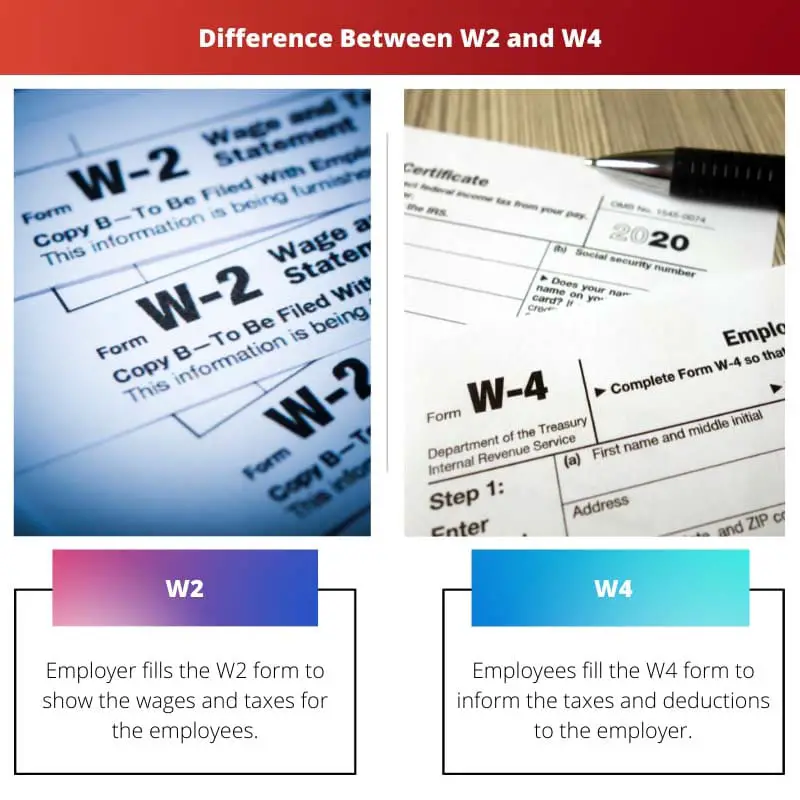

The difference between W2 and W4 depends on who fills the form. W2 is the form that contains wages and tax deductions for that year. W4 is the form for employees to show the amount of withholding from the paycheck of the year. These forms are salient in tax payments. It helps to know about your salary and the tax you pay to the government yearly.

The W2 forms are for an employee to know about the wages and taxes filled out by the employers. It is called a wage and tax statement.

The employer sends the w2 form to the employee and the IRS(Internal Revenue Service).

The W2 form helps the IRS track the tax payments of individuals. An employer has to send the W2 form to the employees to who he gives his salary. The W4 form is for employees to check the withheld taxes in each paycheck every year. Employee withholding certificate is the other name of W4.

It is easy for people to do the same job over the years. But difficult for people who change their work yearly. By filling out the W4 form, employees inform the withhold and deductions to the employers. W4 forms are filled carefully; else results in difficulty while returning the files.

Comparison Table

| Parameters on comparison | W2 | W4 |

|---|---|---|

| Definition | Employer fills the W2 form to show the wages and taxes for the employees. | Employees fill the W4 form to inform the taxes and deductions to the employer. |

| Submission time | At the end of every year( Jan 31) | Before beginning a new job |

| Fillers | Owners | Employers |

| Submission to IRS | Yes | No |

| Sections | 25 columns | Five sections |

What is W2?

The W2 form is to inform the wages and taxes of the employees by the employers. The employer is responsible for the W2 form. He is the one who sends this form to the employee and the IRS(internal revenue service).

The W2 form is also called the wages and tax statement. The IRS checks the tax payment history with the 1040 form. The W2 forms are to report to the FICA(Federal insurance contributions act). The W2 form is into two sections called state and federal to pay taxes on both levels.

It includes columns for personal information and professional pieces of information. After filling out the W2 form, the total paychecks of employees tax reduced. The w2 has a box of a-f and 1 to 15. Each box represents different pieces of information. The column from A to F denotes your personal information.

- Box 1 shows the income,

- Box 2 shows the withheld by the employer,

- Box 3 shows the earnings subject to social security,

- Box 4 represents the withheld by social security tax,

- Box 5 shows the Medicare tax,

- Box 6 shows the amount of withholding,

- Box 7 shows the tips,

- Box 8 represents the amount of withholding,

- Box 9 was left empty to show the deduction,

- Box 10 shows the amount received with benefits,

- Box 11 shows the money get from the non-qualified plan,

- Box 12 shows the reductions,

- Box 13 is for reports,

- Box 14 represents an additional tax

- Box 15-20 for state and federal tax.

What is the W4?

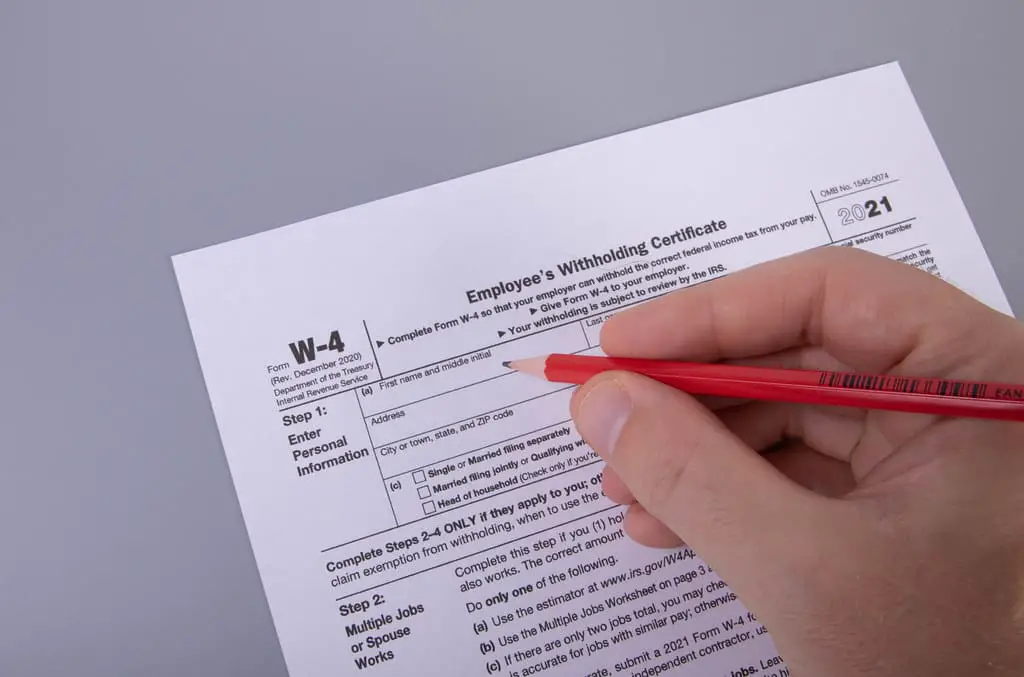

The W4 form is to inform the taxes and deductions to the employers. It is also called an employee withholding certificate. The IRS made many changes to the W4 form in 2020. So there is no need for the 1 or 0 allowances from 2020.

This results in an increased amount of money in the year’s paychecks. If you’re doing one job and don’t have any dependents, then the process is simple and easy, else you are doing some job that depends on the various income, and you need to fill many columns.

The w4 form shows the withholding, so every employee must fill out this form. If you are hiring new, then your employer gives you the W4 form.

It is vital to fill it out carefully.

It is the only way to make all your precious earnings legally with you. Else you can’t make income legal. Due to the tax cuts and the jobs act 2017, five changes happen in the w4 form. You go through the new changes before filling in.

There are five steps in W4 form filling. In step one, you provide the personal information. If you are single and doing one job, then fill first step and sign. In step two, you indicate the multiple jobs you are doing and your marital status.

In step three, you show the dependents and your child numbers. In step four, You fill other details and adjustments in your paychecks. In step five, sign the form with the date. It is easy to fill out the W4 form.

Main Differences Between W2 form and W4 form

- Employer fills the W2 form, and employee fills the W4 form.

- W2 shows the wages and taxes, and w4 shows the taxes and deductions.

- W2 is submitted every year, and w4 is consent before joining the new job.

- W2 needs to report to IRS, and W4 does not need to disclose to IRS.

- W2 has 25 distinct columns, and W4 has five sections.