To many of us, both ‘public sector bank’ and ‘nationalized bank’ might not seem so different, but there are a few notable differences between them.

A bank is a financial institution that handles cash deposited by the public, safeguards them, and offers loans to the public.

Public sector and nationalized banks come under the category of commercial banks in India.

You would have visited a bank or done some bank-related work once or maybe many times. Nowadays, we need not visit a bank since there are alternatives like net banking.

Banks are of three types: private sector, public sector, and nationalised.

The terms public sector bank and the nationalized bank can be used interchangeably and sometimes refer to the same thing.

Key Takeaways

- Public Sector Banks are banks owned by the government and are responsible for providing financial services to the public.

- Nationalized banks were previously privately owned banks but were taken over by the government to become public sector banks.

- Public Sector Banks are run under the guidance of the Reserve Bank of India, while Nationalized Banks are governed by the Banking Companies (Acquisition and Transfer of Undertakings) Acts.

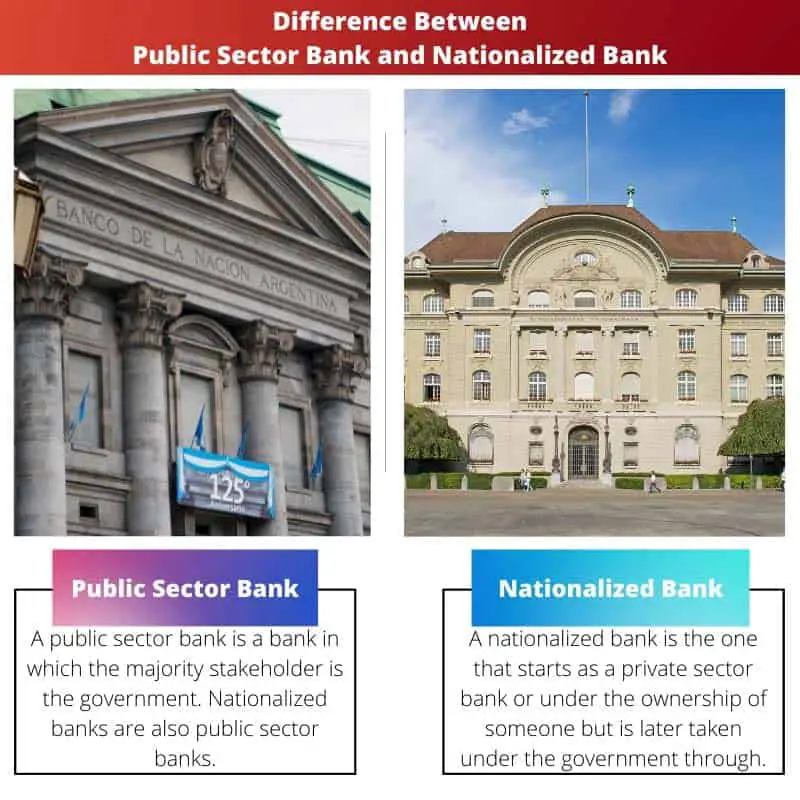

Public Sector Bank vs Nationalised Bank

The difference between a public sector bank and a nationalized bank is that a public sector bank is under the state or central government from the beginning. In contrast, a nationalized bank started as a private sector bank but was taken under by the government for the better good.

Public sector banks are under the government as the government is a significant stakeholder in these banks. There are 12 public sector banks in India. Public sector banks include nationalized banks because every nationalized bank is, or will become a public sector bank.

A nationalized bank started as a private sector bank but was later taken by the government for betterment. There were 20 nationalized banks earlier, but now there are 19, as two of them merged.

Comparison Table

| Parameters of Comparison | Public Sector Bank | Nationalized Bank |

|---|---|---|

| Definition | A public sector bank is a bank in which the majority stakeholder is the government. Nationalized banks are also public sector banks. | There were 20 nationalized banks earlier, but now there are 19 since two merged later. |

| Number of banks | There are 12 Public Sector Banks in India. | It is a narrower term compared to public sector banks, and a public sector bank need not be nationalized. |

| Broadness | Public sector banks include all the nationalized banks in them as it is a broader term. | It is a narrower term compared to public sector banks and a public sector bank need not be a nationalized bank. |

| Start as | These banks start as banks under the state government or the central government. | These banks start as private sector banks or under the ownership of someone. |

| Examples | Punjab National Bank, Bank of Baroda, Central Bank of India, State Bank Of India, etc. | UCO Bank, Union Bank of India, Dena Bank, etc. |

What is a Public Sector Bank?

A public sector bank is one in which the majority shareholder (more than 50%) is the government, and the government is responsible for all the activities that occur in it. The nationalized banks are also public sector banks.

There are currently 12 public sector banks in India. They are:

- Punjab National Bank

- Bank of Baroda

- Bank of India

- Central Bank of India

- Canara Bank

- Union Bank of India

- Indian Overseas Bank

- Punjab and Sind Bank

- Indian Bank

- UCO Bank

- Bank of Maharashtra

- State Bank Of India

What is a Nationalized Bank?

Nationalization is the process by which the government takes under any private company, body, or organization for the nation’s welfare.

Nationalized banks start as private sector banks but are taken by the government later.

The Government of India owns a nationalized bank. Private sector banks are nationalized to increase the overall economy of the country.

Earlier, before Independence, banks used to be private. Still, later on, i.e. after independence, the government started nationalizing the banks, and thus nationalized banks were established for the betterment of the public.

Currently, there are 19 nationalized banks in India. Their names, alongside their years of nationalization, are as follows:

- Andhra Bank- 1980

- Allahabad Bank- 1969

- Bank of Baroda- 1969

- Bank of India- 1969

- Bank of Maharashtra- 1969

- Canara Bank- 1969

- Central Bank of India- 1969

- Corporation Bank- 1980

- Dena Bank- 1969

- Indian Bank- 1969

- Indian Overseas Bank- 1969

- Oriental Bank of Commerce- 1980

- Punjab & Sind Bank- 1969

- Punjab National Bank- 1969

- Syndicate Bank- 1969

- UCO Bank- 1969

- Union Bank of India- 1969

- United Bank of India- 1969

- Vijaya Bank- 1969

Main Differences Between Public Sector Banks and Nationalized Banks

- Every nationalized bank is also said to be a public sector bank, while all public sector banks are not said to be nationalized banks.

- There are 19 nationalized banks and only 12 public sector banks in India.

- A nationalized bank starts as a private sector bank but is taken by the government, while a public sector bank starts as a bank under the government.

- Public sector bank is a broader term compared to a nationalized bank. Nationalized banks come under public sector banks.

- All nationalized banks are public sector banks, or they will become public sector banks, while a public sector bank can never become a nationalized bank.