A charge card typically requires full payment of the balance each month, often with no pre-set spending limit, while a credit card allows users to carry a balance with interest charges. Charge cards often offer perks like rewards and no interest, but require responsible budgeting.

Key Takeaways

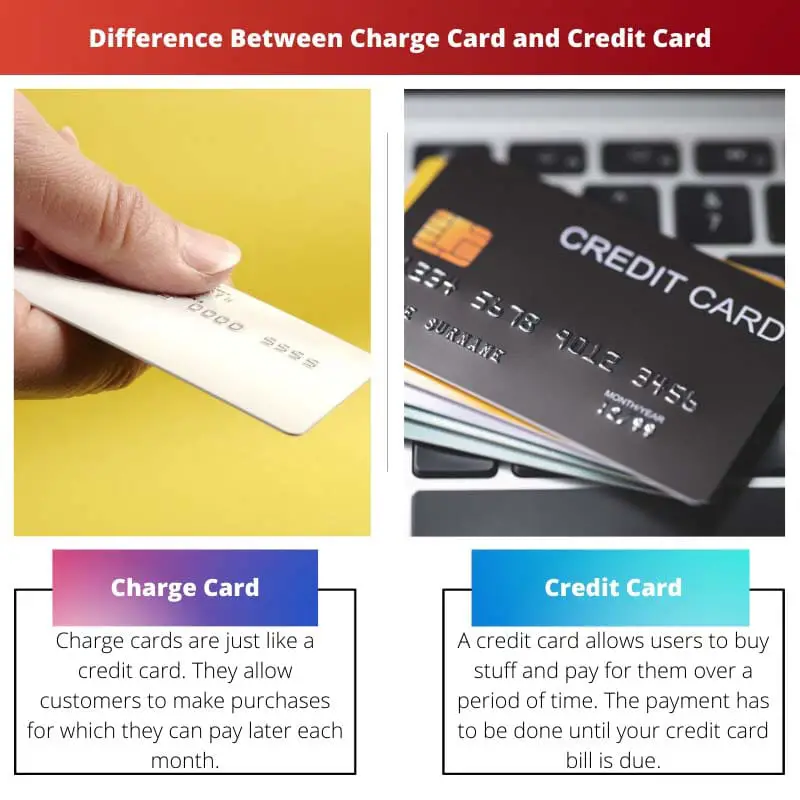

- Charge cards and credit cards are both payment cards that allow consumers to make purchases without using cash.

- Charge cards require payment of the total balance each month, while credit cards allow the option to carry a balance over time.

- Charge cards come with higher fees and stricter requirements than credit cards.

Charge Card vs Credit Card

A charge card requires the balance to be paid off in full at the end of each billing cycle, while a credit card allows the balance to be carried over with interest. Charge cards have higher credit limits and exclusive perks. Credit cards may have rewards programs and can help build credit history.

A charge card looks similar to a credit card. They play the same role as a credit card does, which is to help you make purchases.

However, the one thing which is different is that you have to pay the balance immediately.

Comparison Table

| Feature | Charge Card | Credit Card |

|---|---|---|

| Payment | Must be paid in full at the end of each billing cycle | Offers a minimum payment option and allows you to carry a balance |

| Spending Limit | Typically no preset spending limit, but issuer may decline large purchases | Has a preset spending limit based on your creditworthiness |

| Interest | No interest charged | Interest charged on any outstanding balance after the grace period |

| Fees | Typically have annual fees | May or may not have annual fees, but often have other fees like balance transfer fees and cash advance fees |

| Credit Reporting | May report payment history to credit bureaus, but not required | Reports payment history to credit bureaus, which can impact your credit score |

| Issuers | Typically issued by high-end card companies and invitation-only | Widely available from various banks and credit unions |

| Target Audience | Individuals with good credit history and strong financial management skills | Individuals with varying credit history, seeking flexibility in repayment options |

| Examples | American Express Black Card, J.P. Morgan Reserve Card | Visa, Mastercard, Discover |

What is Charge Card?

A charge card is a financial tool that allows users to make purchases with a promise to pay the balance in full at the end of each billing cycle. Unlike credit cards, charge cards typically do not have a pre-set spending limit. Instead, the issuer assesses the cardholder’s spending habits and financial situation to determine the appropriate spending limit for each transaction.

How Charge Cards Work

- Full Payment Requirement: One of the key features of a charge card is that the cardholder is required to pay off the entire balance by the due date each month. Failure to do so may result in penalties, including late fees and a negative impact on the cardholder’s credit score.

- No Revolving Credit: Unlike credit cards, which allow cardholders to carry a balance from month to month with interest charges, charge cards do not offer a revolving credit option. This means that users cannot carry a balance beyond the current billing cycle without incurring penalties.

- No Pre-set Spending Limit: While charge cards do not have a pre-set spending limit, this does not mean unlimited spending. Instead, the issuer evaluates the cardholder’s spending patterns, income, and credit history to determine the maximum amount that can be charged on the card at any given time.

Benefits and Drawbacks

Benefits:

- No Interest Charges: Since charge card users are required to pay off the balance in full each month, they do not incur interest charges on carried balances.

- Rewards and Perks: Many charge cards offer rewards programs, such as cashback, travel rewards, or points that can be redeemed for merchandise or services.

- Builds Credit History: Responsible use of a charge card can help individuals build a positive credit history, as payment history and credit utilization are reported to credit bureaus.

Drawbacks:

- Strict Payment Requirements: The requirement to pay the balance in full each month may be challenging for some cardholders to manage, leading to potential penalties for missed payments.

- Annual Fees: Some charge cards may come with annual fees, which can offset the benefits of rewards and perks if not used frequently enough.

- Limited Acceptance: Charge cards may not be as widely accepted as credit cards, particularly in regions or establishments that do not typically deal with charge card issuers.

What is Credit Card?

A credit card is a financial instrument that allows cardholders to borrow funds from a financial institution up to a certain limit to make purchases, pay for services, or withdraw cash. Unlike charge cards, credit cards offer users the flexibility to carry a balance from month to month, with the option to pay off the balance over time, albeit with interest charges.

How Credit Cards Work

- Credit Limit: Each credit card has a predetermined credit limit, which represents the maximum amount of money that the cardholder can borrow from the issuer. This limit is based on factors such as the cardholder’s creditworthiness, income, and credit history.

- Revolving Credit: One of the distinguishing features of credit cards is the ability to carry a balance from one billing cycle to the next. Cardholders can choose to pay off the entire balance or make minimum payments, with the remaining balance subject to interest charges. The flexibility of revolving credit allows users to manage their finances more effectively, but it also carries the risk of accumulating debt if not used responsibly.

- Interest Charges: When cardholders carry a balance on their credit cards, they are typically charged interest on the outstanding amount. The interest rate, also known as the annual percentage rate (APR), can vary depending on factors such as the card issuer, the cardholder’s credit score, and prevailing market conditions.

Benefits and Drawbacks

Benefits:

- Convenience: Credit cards offer a convenient way to make purchases online, in-store, or over the phone without the need for cash. They also provide a secure payment method, with built-in fraud protection features.

- Rewards and Perks: Many credit cards offer rewards programs, such as cashback, travel rewards, or points that can be redeemed for merchandise or services. Cardholders can earn rewards based on their spending habits and redeem them for various benefits.

- Builds Credit History: Responsible use of a credit card can help individuals establish and build a positive credit history. Payment history, credit utilization, and other factors are reported to credit bureaus, which can impact the cardholder’s credit score.

Drawbacks:

- Interest Charges: Carrying a balance on a credit card can result in accruing interest charges, which can add up quickly if not paid off in full each month. High-interest rates can significantly increase the cost of borrowing and lead to debt accumulation.

- Annual Fees: Some credit cards come with annual fees, which can offset the benefits of rewards and perks, especially if the cardholder does not use the card frequently enough to justify the fee.

- Potential for Debt: The flexibility of revolving credit can tempt cardholders to overspend beyond their means, leading to the accumulation of debt. Failure to manage credit card debt effectively can have long-term financial consequences and impact creditworthiness.

Main Differences Between Charge Cards and Credit Cards

- Payment Requirement:

- Charge Card: Requires the cardholder to pay off the entire balance each month.

- Credit Card: Allows the cardholder to carry a balance from month to month, with the option to make minimum payments.

- Spending Limit:

- Charge Card: Typically does not have a pre-set spending limit but evaluates the cardholder’s spending habits and financial situation for each transaction.

- Credit Card: Has a predetermined credit limit, representing the maximum amount the cardholder can borrow from the issuer.

- Interest Charges:

- Charge Card: Generally does not accrue interest charges since the balance must be paid in full each month.

- Credit Card: Accumulates interest charges on carried balances, based on the card’s annual percentage rate (APR).

- Revolving Credit:

- Charge Card: Does not offer revolving credit; the balance must be paid in full each billing cycle.

- Credit Card: Provides revolving credit, allowing the cardholder to carry a balance over time with interest charges.

- Penalties and Fees:

- Charge Card: May incur penalties for late payments or failure to pay the balance in full, potentially leading to negative impacts on credit score.

- Credit Card: May incur penalties for late payments, as well as annual fees and interest charges on carried balances.

- https://repository.law.umich.edu/cgi/viewcontent.cgi?article=4617&context=mlr

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2248804

- https://www.degruyter.com/view/journals/rne/2/2/article-rne.2003.2.2.1018.xml.xml

I appreciate the detailed comparison table. It makes it easy to understand the distinctions between charge cards and credit cards.

Yes, it’s always helpful to have the features and terms laid out side-by-side for comparison. Great article!

The detailed breakdown of the features and characteristics of charge cards is impressive. It’s a valuable resource for anyone considering these financial products.

I couldn’t agree more, Scott. This article could serve as a go-to guide for individuals navigating the world of charge cards.

I found the information about the target audience and qualification for charge cards particularly useful. It’s definitely aimed at a specific group of consumers.

Absolutely, Stewart! The eligibility criteria for charge cards is quite stringent.

The language used is very straightforward and accessible. It makes complex financial concepts easier to comprehend.

I second that, Mary. The author’s ability to present technical information in an approachable way is impressive.

I agree, Mary. The clarity of the writing is commendable.

The section on annual fees and rewards provided valuable insights into the trade-offs associated with charge cards. It’s a comprehensive analysis.

Absolutely, Samantha. The pros and cons were well-delineated.

It’s always beneficial to have a clear understanding of the costs and benefits of these financial products.

The discussion on spending flexibility was enlightening. It’s interesting to see the different approaches to credit limits between charge cards and credit cards.

I completely agree, Robertson. The comparison on spending flexibility was an eye-opener.

Yes, it’s a crucial aspect to consider when choosing between the two.

I would have liked to see more real-world examples or case studies included to illustrate the points made in the article. It would further enhance the readers’ understanding.

I agree, Mike. Case studies always provide a more tangible context for the theoretical concepts.

That’s an excellent suggestion, Mike. Practical examples would certainly add depth to the discussion.

I wish the article had delved more into the potential risks involved with charge cards. It seems to only highlight the positives.

I agree, Ethomas. A more balanced discussion of the pros and cons would be beneficial.

The comparison between charge cards and credit cards was illuminating. This post has clarified many misconceptions I had about these payment methods.

I’m glad to hear that, Sabrina. It’s crucial to have accurate information when making financial decisions.

This post does an excellent job of explaining the key differences between charge cards and credit cards. Very informative!

I completely agree with you, Jayden. This is a very well-researched and thorough article.