Today so, many students pursue investment banking and investment management as their career options after finishing their master’s or their MBA. There is much scope in investment management and investment banking today.

Both play a very vital role in developing one’s business. This leads to economic growth and a rise in per capita income.

Key Takeaways

- Investment banking provides financial advisory services and helps companies raise capital through securities offerings and mergers and acquisitions.

- Investment management, on the other hand, involves managing investment portfolios for individuals and institutions to achieve specific financial goals.

- While investment bankers may work project-by-project, investment managers have ongoing relationships with their clients and provide ongoing investment advice and management.

Investment Banking vs Investment Management

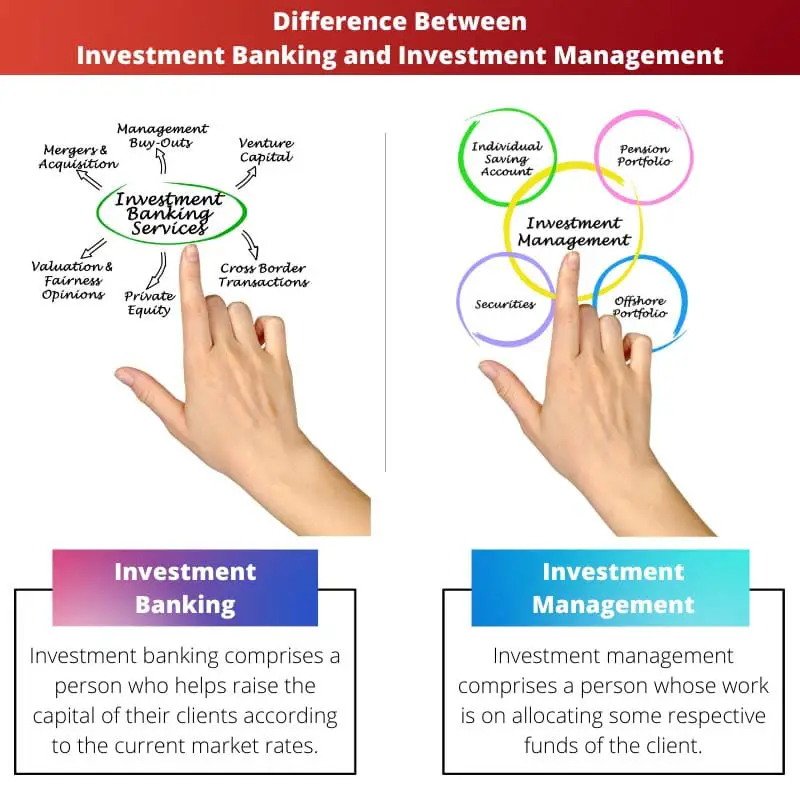

The difference between investment banking and investment management is that in investment banking, the banker helps raise the capital compared to the market rate of their clients. Whereas, in investment management, an investment manager helps the clients by giving advice and solutions in the most efficient way to manage a person’s money with equity research and analyzing the finance.

In investment banking, the person is said to be a deal maker. Their work is to give assistance as a consultant to their clients on a high level and act as an analyst to strategize on raising capital for a client’s company to raise profits.

Investment management is all about emphasizing the allocation of all kinds of assets and making decisions regarding them by an investment manager for the clients. The investment managers help develop sound strategies for investment and direct their clients to fund their properties.

Comparison Table

| Parameters of Comparison | Investment Banking | Investment Management |

|---|---|---|

| Basic feature | Assist and consult their clients for raising their capital. | Assist and help their clients to manage their money. |

| Skills required | Should have the ability to be a catchy eye, excellent ability skills, and good Strategic skills. | Should be able to work in a fast-based environment having skills in strategies and funds. |

| Mostly used by | Common people | People have a high net worth. |

| Another name | They are also called Dealmakers. | They are also called wealth management. |

| Work includes | Provide strategies, mathematical proficiency, initial public offering, etc. | Research on equity, analyzing finance, etc. |

What is Investment Banking?

Investment banking comprises a person who helps raise their clients’ capital according to the current market rates. They are titled to be known as dealmakers.

The work of an investment banker is assisting in having high-level profits and giving them strategies to raise their capital, leading them to raise business profits.

Investment banking includes performing functions like research of equity, Security research, buying and selling, and holding their respective recommendation. Every investment banker starts their career as a financial analyst first usually.

They help in Co-operating with a client’s financial needs. Investment banking is institutions that engage themselves in underwriting a financial institution.

Consequently, to sum up everything, investment banking comes to its rescue whenever a client needs corporation some financing. Getting into this field is not so easy as it has a lot of competition these days as this involves professional-level finance management.

In investment banking, a person should have analytic abilities for having eye-catching detail. They should be an expert in mathematical calculations and proficient in communicating with clients.

What is Investment Management?

Investment management comprises a person whose work is on allocating some respective funds of the client. Decisions regarding how an Investment should be made and what time it is to be made are all features an investment manager provides his clients.

Central authorities like the Government and many top-grade companies help them facilitate mergers for clients efficiently. They provide services and guide their clients regarding pension plans by standardized equity bonding.

The Main work of investment managers is that they help manage their client’s money so that the client would earn some profits. They assist an individual in investing and where to invest, which helps the clients achieve their business goals.

Usually, people who seek information from an investment manager are the ones who hold a high net worth of individuals.

A person working as an investment manager needs to possess some skills, such as having Absolute and complete knowledge of instruments related to investments. They should be an expert in mathematics and make complex lines into a simplified solutions for their clients.

An investment manager helps with long-term objectives in finance.

Main Differences Between Investment Banking and Investment Management

- Investment banking is where a client gets assistance from a professional to guide a company to raise capital and meet their financial needs. On the other hand, investment management is where clowns get advice from a professional on how to invest and manage money.

- Investment management is a service given more to people with high net worth investment banking can have benefits for more of the common public.

- Investment banking needs a catchy eye, excellent ability, and good Strategic skills. In contrast, in investment management, the skills required are good knowledge of mathematics and outside market rates and the ability to make easy solutions.

- The Main work of investment banking is to raise a client’s capital, whereas an investment manager has the crucial role of guiding his client in managing their money.

- Investment management is considered more of a Blissful career choice which is not the case in investment banking.