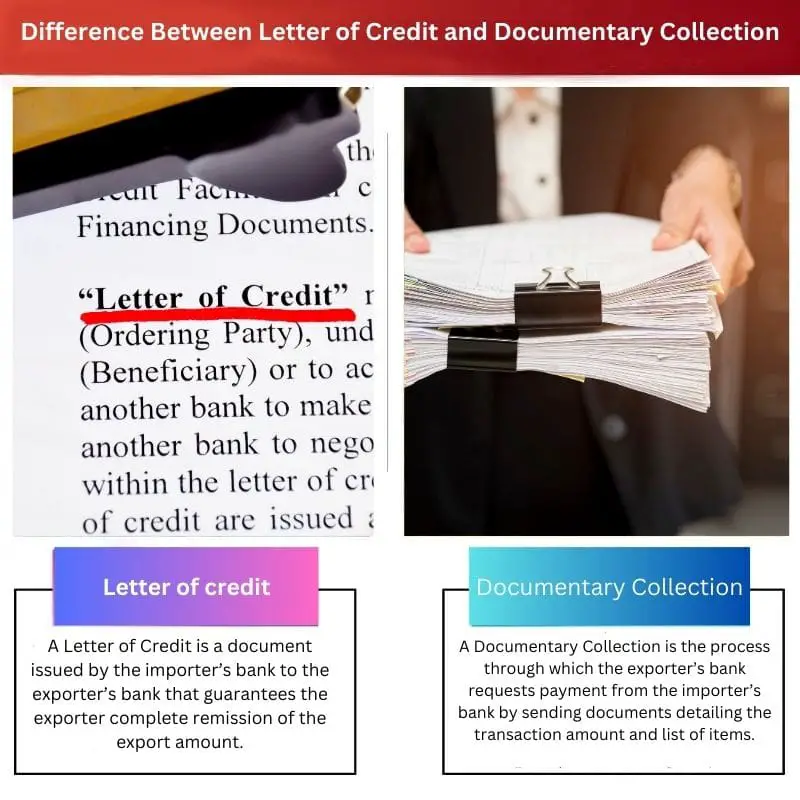

Letter of Credit (L/C): A financial instrument issued by a bank, ensuring payment to the seller upon fulfillment of specified conditions, providing a secure method for international trade transactions. Documentary Collection: A trade payment method where the exporter sends shipping documents to the importer’s bank, which releases them in exchange for payment, offering a less secure but cost-effective option compared to a Letter of Credit.

Key Takeaways

- A letter of credit is a bank-issued guarantee ensuring payment to a seller on behalf of a buyer if certain conditions are met, providing security for both parties.

- Documentary collection is a trade transaction in which the seller’s bank collects payment from the buyer’s bank in exchange for shipping documents, with no payment guarantee.

- Credit letters offer sellers more protection by guaranteeing payment, while the documentary collection is less secure but simpler and less costly.

Letter of Credit vs Documentary Collection

The difference between a Letter of Credit and a Documentary Collection is that in the former case, the bank has to remit the dues to the exporter. In the latter case, on the other hand, the bank holds no such responsibility.

It has the advantage that if the importer cannot remit for the imported goods, his bank has to bear the obligation to pay the exporter. A Letter of Credit is a widely used document in international trade.

A Documentary Collection is a document issued at the exporter’s request from his bank. The goods are delivered to the importer only when he clears the dues and fetches the consignment documents.

Comparison Table

| Feature | Letter of Credit (LC) | Documentary Collection (DC) |

|---|---|---|

| Definition | A financial guarantee issued by a bank on behalf of the buyer (importer) to assure payment to the seller (exporter) upon meeting agreed-upon terms and conditions. | A method for collecting payment for goods or services where a collection agent ( a bank) acts as an intermediary between the buyer and seller, ensuring proper documentation is presented before payment is released. |

| Payment Security | High – Bank guarantees payment once compliant documents are presented. | Lower – No bank guarantee, seller relies on buyer’s willingness to pay. |

| Cost | Higher – Banks charge fees for issuing and processing LCs. | Lower – Less bank involvement leads to lower fees. |

| Risk | Lower for seller – Payment guaranteed upon document compliance. | Higher for seller – Risk of buyer refusing payment or non-payment. |

| Flexibility | Less flexible – Strict adherence to LC terms is required for payment. | More flexible – Payment terms can be negotiated between buyer and seller. |

| Time | More time-consuming – Setting up LCs involves bank verification and document checks. | Faster – Less complex process compared to LCs. |

| Suitability | Ideal for high-value transactions or when parties are unfamiliar. | Suitable for lower-value transactions or when trust exists between buyer and seller. |

What is Letter of Credit?

Parties Involved

1. Applicant

The party initiating the LC, the buyer or importer, requests their bank to issue the letter in favor of the seller.

2. Beneficiary

The party to whom the LC is addressed, the seller or exporter, relies on the letter to receive payment upon meeting the agreed-upon criteria.

3. Issuing Bank

The bank that issues the LC on behalf of the applicant, committing to make the payment to the beneficiary once the terms are fulfilled.

4. Advising Bank

This bank, situated in the seller’s country, acts as an intermediary, advising the beneficiary of the LC’s authenticity and terms.

Types of Letter of Credit

1. Commercial LC

Used for the purchase and sale of goods, ensuring payment upon meeting specified conditions.

2. Standby LC

Primarily a backup payment method, activated if the buyer fails to fulfill the contractual obligations.

3. Revocable vs. Irrevocable LC

- Revocable: Can be modified or canceled by the issuing bank without prior notice to the beneficiary.

- Irrevocable: Cannot be altered or canceled without the consent of all parties involved.

LC Process

1. Initiation

The buyer and seller agree on using an LC for the transaction. The buyer applies for the LC from their bank.

2. Issuance

The issuing bank evaluates the buyer’s creditworthiness and issues the LC with specific terms and conditions.

3. Advising

The advising bank confirms the authenticity of the LC and notifies the seller, providing details of the issued LC.

4. Presentation of Documents

The seller ships the goods and presents the required documents to the advising bank to claim payment.

5. Examination

The advising bank reviews the documents to ensure compliance with the LC terms and forwards them to the issuing bank.

6. Payment

Upon approval of the documents, the issuing bank makes the payment to the seller, completing the transaction.

Advantages of Letter of Credit

1. Risk Mitigation

LCs reduce the risk for both parties by ensuring that payment is made upon fulfillment of specified conditions.

2. International Trade Facilitation

LCs facilitate international trade by providing a secure payment method, fostering trust between buyers and sellers.

3. Customization

The terms and conditions of an LC can be tailored to meet the specific requirements of the parties involved.

Challenges and Considerations

1. Costs

Both the buyer and seller may incur fees related to LC issuance, amendments, and discrepancies.

2. Documentary Compliance

Strict adherence to the specified documents is crucial, as any discrepancies may lead to payment delays or disputes.

3. Time-Consuming Process

The LC process, involving multiple banks and document verification, can be time-consuming.

What is Documentary Collection?

Parties Involved

- Exporter/Seller: The party selling goods or services and initiating the Documentary Collection process.

- Importer/Buyer: The party purchasing goods or services and making the payment.

Types of Documentary Collection

1. Documents Against Payment (D/P)

Under D/P terms, the exporter releases shipping documents to the importer only upon payment. The buyer must pay the agreed amount before obtaining control over the documents.

2. Documents Against Acceptance (D/A)

In D/A terms, the exporter sends shipping documents to the importer with a time draft. The importer accepts the draft and commits to paying at a later date, determined by the agreed credit terms.

Stages of Documentary Collection

1. Initiation of Collection

- The exporter and importer agree on the terms of the sale.

- The exporter ships the goods and prepares the necessary documents.

2. Submission of Documents

- The exporter presents the required documents (e.g., invoice, bill of lading) to their bank.

- The exporter’s bank forwards the documents to the importer’s bank.

3. Notification to the Importer

- The importer’s bank informs the buyer about the arrival of documents and any payment or acceptance requirements.

4. Payment or Acceptance

- In D/P, the importer pays the amount to their bank before receiving the documents.

- In D/A, the importer accepts the time draft, committing to pay at a later date.

5. Release of Documents

- Once payment is made or the draft is accepted, the importer’s bank releases the documents to the buyer.

Advantages of Documentary Collection

1. Simplicity and Cost-Effectiveness

- Compared to letters of credit, documentary collection is simpler and more cost-effective.

2. Flexibility

- Documentary collection offers flexibility in negotiating payment terms between the buyer and seller.

3. Reduced Risk

- While not risk-free, documentary collection provides a level of risk mitigation for both parties compared to open account transactions.

Challenges and Considerations

1. Risk of Non-Payment

- The exporter may face the risk of non-payment if the buyer fails to fulfill their payment obligations.

2. Discrepancies in Documents

- Any discrepancies in the presented documents can lead to delays or disputes in the payment process.

3. Limited Security

- Compared to letters of credit, documentary collection provides less security for the seller.

Main Differences Between Letter of Credit and Documentary Collections

- Nature of Payment:

- Letter of Credit (L/C): Involves a bank guaranteeing payment to the seller upon meeting specified conditions.

- Documentary Collections: Relies on the buyer’s payment to the bank, with the bank releasing documents to the buyer upon payment.

- Bank Involvement:

- Letter of Credit (L/C): The bank plays a more active role, providing a payment guarantee and ensuring compliance with the terms.

- Documentary Collections: The bank’s involvement is limited to facilitating document transfer and payment; it does not guarantee payment.

- Risk and Security:

- Letter of Credit (L/C): Provides a higher level of security for the seller, as the bank’s commitment ensures payment if the conditions are met.

- Documentary Collections: Involves more risk for the seller, as payment relies on the buyer’s willingness to pay upon document presentation.

- Control Over Goods and Documents:

- Letter of Credit (L/C): The bank controls the release of funds and documents, ensuring compliance with the agreed terms.

- Documentary Collections: The buyer has more control, as they can receive documents before making payment.

- Costs:

- Letter of Credit (L/C): Typically more expensive due to the bank’s active involvement and guarantee.

- Documentary Collections: Generally less expensive, as it involves fewer bank services and no payment guarantee.

- Flexibility:

- Letter of Credit (L/C): Less flexible, as any changes to the terms require the consent of all parties involved.

- Documentary Collections: More flexible, allowing for easier negotiation of terms between the buyer and seller.

- Usage in Trade Relationships:

- Letter of Credit (L/C): Commonly used in high-risk transactions or when trust between buyer and seller is limited.

- Documentary Collections: Often used in transactions where there is a higher level of trust between the parties.

- Dispute Resolution:

- Letter of Credit (L/C): Disputes are resolved through legal means, as the bank’s role is well-defined.

- Documentary Collections: Disputes may require negotiation between buyer and seller, with the bank playing a more limited role.

This is a fascinating breakdown of two critical components of international trade finance. The differences between a letter of credit and a documentary collection are made crystal clear in this article.

Yes, this article is incredibly valuable for anyone looking to understand the complexities of international trade finance. It’s a great resource.

Absolutely, the article makes it easy to understand the implications of choosing one method over the other in different trade scenarios.

This article provides a clear and comprehensive understanding of the differences between a letter of credit and a documentary collection. It’s a valuable resource for anyone in the international trade business.

Absolutely, the detailed comparison and explanation of these financial instruments makes this article a must-read for import-export professionals.

This article is both informative and engaging, providing a deep understanding of the complexities of international trade finance. It’s an excellent read.

Absolutely, this article is a valuable resource for anyone looking to gain insight into the intricacies of trade finance.

This is a very informative article, it clearly explains the key differences between a letter of credit and a documentary collection. It’s essential knowledge for anyone involved in international trade.

Absolutely, this information is invaluable for anyone in the business world. Understanding the nuances of these financial instruments is crucial for success in international trade.

The comparison table is extremely beneficial, making it easy to grasp the nuances of letter of credit and documentary collection. A very insightful article indeed.

Yes, the comparison table provides a very clear and concise summary of the key differences. It’s an excellent reference for anyone in the industry.

This article sheds light on the misunderstood differences between a letter of credit and a documentary collection. It’s a must-read for anyone in the import-export business.

While a documentary collection may be less secure, it’s interesting to learn about its use in situations where there is a strong and credible relationship between the exporter and importer. This article provides valuable insight into the choices available for international trade transactions.

Absolutely, this distinction is crucial and the article does a great job highlighting the nuanced decision-making process involved in international transactions.

I couldn’t agree more. This article really clarifies the considerations that need to be taken into account when deciding between a letter of credit and a documentary collection.

The article is very educational and provides great insights into the world of international trade finance and the nuances of letter of credit and documentary collection.

The comparison table provided here is excellent. It lays out all the key differences between a letter of credit and a documentary collection in a very clear and comprehensive way.

Definitely! The article does a great job of breaking down the complexities of international trade finance into easily digestible information.

I agree, the comparison table is incredibly helpful for understanding the nuances of these two financial instruments.

The article does a great job of clarifying the differences between a letter of credit and documentary collection. It’s a valuable resource for anyone involved in international trade finance.

Absolutely, the information presented in this article is essential for anyone working in the import-export business.