Letter of Credit (LC): A financial instrument issued by a bank on behalf of a buyer, assuring the seller that payment will be made upon the fulfillment of specified conditions, typically related to the shipment of goods. Buyers Credit: A credit facility extended by a financial institution to a buyer, allowing them to make a purchase and defer the payment, often used in international trade to provide financing flexibility beyond the traditional Letter of Credit arrangements.

Key Takeaways

- A letter of credit is a guarantee from a bank that ensures payment to a seller on behalf of a buyer, provided specific conditions are met.

- A buyer’s credit is a short-term loan facility provided by a bank or financial institution to an importer, enabling them to finance the purchase of goods or services from an overseas supplier.

- Both instruments facilitate international trade; however, a letter of credit primarily reduces transaction risk, while buyer’s credit provides financing for importers.

Letter of Credit vs Buyers Credit

The difference between a Letter of credit and a Buyers credit is that a letter of credit can be used for any ordinary individual for one of the most significant business transactions. On the other hand, Buyers’ credit is known primarily for high-end purchases or massive import/export deals costing millions of dollars.

A letter of credit is a document that ensures the payment will be settled to the seller on behalf of the buyer. It is issued by a bank and is dated and timed to pay the total amount to the seller.

Buyers’ credit can be described as a credit facility for those related to import and export business. The buyer will receive credits from an offshore bank of the country he is importing to pay off the exporter.

Comparison Table

| Feature | Letter of Credit (LC) | Buyer’s Credit |

|---|---|---|

| Type | Payment Guarantee | Loan Mechanism |

| Who Benefits | Seller (Exporter) | Buyer (Importer) |

| Source of Funds | Buyer’s Bank (initially) | Overseas Lender |

| Risk Mitigation | Protects seller from buyer default | Protects buyer from upfront payment and potentially lower interest rates |

| Payment Timing | Seller receives payment upon presentation of compliant documents | Buyer pays loan back over time with interest |

| Cost | Fees charged by issuing bank | Interest on loan + potential fees |

| Regulation | Governed by Uniform Customs and Practice (UCP 600) | Standard loan agreements |

| Parties Involved | Buyer, Seller, Issuing Bank, (Confirming Bank optional) | Buyer, Buyer’s Bank, Overseas Lender |

| Suitability | Short-term transactions, Focus on security for seller | Large purchases, Financing needs for buyer |

What is Letter of Credit?

Types of Letters of Credit

1. Commercial Letter of Credit

- Purpose: Facilitates trade transactions by ensuring payment to the seller upon presentation of compliant documents.

- Key Components: Issued based on commercial agreements between buyer and seller.

2. Standby Letter of Credit (SBLC)

- Purpose: Acts as a secondary payment mechanism if the buyer fails to fulfill their payment obligations.

- Key Components: Often used as a financial safety net or performance guarantee.

Parties Involved

1. Issuer

- Role: The bank that issues the LC, undertaking the responsibility to make payments on behalf of the buyer.

2. Applicant (Buyer)

- Role: The party requesting the LC, typically the buyer in the transaction.

3. Beneficiary (Seller)

- Role: The party to whom the LC is addressed, usually the seller.

LC Process

1. Issuance

- The buyer applies for an LC from their bank, providing necessary documentation and details.

2. Issuing Bank’s Responsibility

- The issuing bank reviews the application and, if satisfied, issues the LC to the beneficiary.

3. Presentation of Documents

- The seller ships the goods and presents compliant documents to the issuing bank.

4. Payment or Acceptance

- If documents are in order, the issuing bank makes payment to the seller or accepts a time draft.

Advantages of Using LC

1. Risk Mitigation

- Provides assurance of payment, reducing the risk for both the buyer and seller.

2. International Trade Facilitation

- Smoothens cross-border transactions by establishing a secure payment mechanism.

3. Flexibility

- Various types of LCs cater to different needs, offering flexibility in trade agreements.

Challenges and Considerations

1. Document Compliance

- Strict adherence to documentation requirements is essential for successful transactions.

2. Costs Involved

- LCs may incur fees for issuance and amendments, affecting the overall cost of the transaction.

3. Discrepancies

- Any discrepancies in presented documents can lead to delays or non-payment.

What is Buyers Credit?

Key Parties Involved

1. Importer/Buyer:

The party that requires financing to purchase goods or services from an overseas supplier.

2. Exporter/Supplier:

The entity selling goods or services to the importer, typically located in a different country.

3. Financial Institution:

The bank or financial institution that facilitates the credit by providing funds to the importer. This institution plays a crucial role in ensuring the smooth flow of funds in international transactions.

Mechanism

1. Request for Buyers Credit:

- The importer initiates the process by requesting buyers credit from the financial institution.

- This request includes details such as the amount needed, terms of the credit, and supporting documentation related to the transaction.

2. Due Diligence:

- The financial institution conducts due diligence on the importer, exporter, and the proposed transaction.

- This step ensures the legitimacy of the trade and assesses the creditworthiness of the parties involved.

3. Issuance of Buyers Credit:

- Upon approval, the financial institution issues a buyers credit in favor of the exporter.

- The credit may take the form of a letter of credit or a similar financial instrument.

4. Supplier Shipment and Documentation:

- The exporter ships the goods or provides the agreed-upon services to the importer.

- The exporter submits the required documentation to the financial institution to claim the payment.

5. Repayment by Importer:

- The importer is obligated to repay the buyers credit according to the agreed-upon terms.

- Repayment terms may include interest, and the importer needs to settle the outstanding amount within the specified period.

Advantages

1. Improved Cash Flow:

- Buyers credit allows importers to defer payment, easing their cash flow and providing flexibility in managing finances.

2. Negotiating Power:

- Importers may negotiate better terms with suppliers by having access to buyers credit, potentially securing discounts or more favorable pricing.

3. Risk Mitigation:

- The involvement of a financial institution helps mitigate risks for both the importer and exporter, ensuring a secure and trustworthy transaction.

Challenges

1. Costs Involved:

- Buyers credit may come with associated costs, such as interest rates and fees, impacting the overall cost of the transaction.

2. Documentation Complexity:

- The process often involves extensive documentation, and any discrepancies can lead to delays or complications.

3. Currency Risks:

- Fluctuations in exchange rates can expose both parties to currency risks, affecting the overall cost of the transaction.

Main Differences Between Letter of Credit and Buyers Credit

- Nature of Transaction:

- Letter of Credit (LC): It is a financial document issued by a bank, ensuring that the seller will receive payment upon fulfilling the terms and conditions specified in the letter.

- Buyer’s Credit: It involves a credit facility extended by a financial institution to the buyer to finance the purchase of goods or services.

- Parties Involved:

- LC: Involves the buyer, seller, and two banks – issuing bank and advising/negotiating bank.

- Buyer’s Credit: Involves the buyer, seller, and a financial institution providing the credit.

- Financing Aspect:

- LC: Primarily a payment mechanism, with the issuing bank guaranteeing the payment to the seller upon complying with the terms.

- Buyer’s Credit: Provides financing to the buyer, allowing them to defer payment for the purchased goods or services.

- Purpose:

- LC: Ensures that the seller will be paid for the shipped goods as per the agreed terms and conditions.

- Buyer’s Credit: Helps the buyer manage their cash flow by providing a credit facility for the purchase.

- Risk and Security:

- LC: Focuses on mitigating the risk for the seller, ensuring they receive payment for the goods shipped.

- Buyer’s Credit: Aims to ease the financial burden on the buyer, allowing them to defer payment and manage their working capital.

- Documentation:

- LC: Involves a set of documents (e.g., invoices, bills of lading) that the seller must present to receive payment.

- Buyer’s Credit: Requires documentation related to the credit facility, and less emphasis on the shipment-related documents.

- Applicability:

- LC: Commonly used in international trade to facilitate secure transactions between buyers and sellers across borders.

- Buyer’s Credit: More focused on providing financial assistance to the buyer, often in the form of medium to long-term credit.

- Control Over Goods:

- LC: The focus is on the documentation, and control over the goods may not be as direct.

- Buyer’s Credit: The buyer has more control over the goods as they receive financing to make the purchase.

- Timeframe:

- LC: Typically used for short-term transactions with a focus on immediate payment.

- Buyer’s Credit: More suitable for medium to long-term financing, allowing the buyer flexibility in payment timelines.

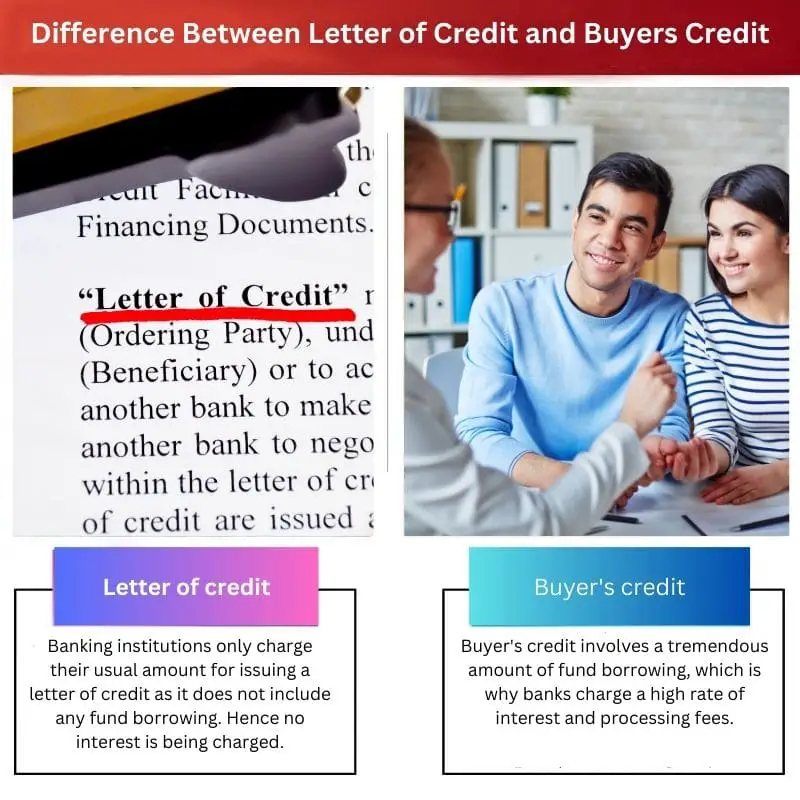

- Interest Rates:

- LC: Generally, interest rates are not directly associated with an LC since it is more about payment assurance.

- Buyer’s Credit: Involves interest rates, as the financial institution providing the credit expects compensation for the financing service.

- https://heinonline.org/hol-cgi-bin/get_pdf.cgi?handle=hein.journals/blj102§ion=22

- https://chicagounbound.uchicago.edu/cgi/viewcontent.cgi?article=4400&context=uclrev

- https://www.nber.org/papers/w17146.pdf

- https://onlinelibrary.wiley.com/doi/abs/10.1111/1468-5957.00434

I found the article quite dry and lacking in engaging content. It could be more captivating in its presentation.

I see your point, Karlie. A more engaging approach to present the information could indeed enhance the article’s appeal.

This article provides an insightful analysis of the nuances and obligations associated with both letter of credit and buyer’s credit.

The article undoubtedly presents a detailed understanding of the obligations and nuances of these credits.

I found this article very confusing. It seems to present the information in a disorganized manner.

I understand your perspective, Heather. Perhaps a reorganization of the content would improve its clarity.

It took me a while to fully grasp the concept of these credits. The article could be clearer in presenting the information.

The explanations for both types of credits are precise and exact. The article is well-written and informative.

I couldn’t agree more, Olivia. The article provides very precise explanations of these complex credits.

I found the article to be very well-written, and the explanations provided a clear understanding of the credits.

The author could have provided more real-world examples to illustrate the application of these credits.

I agree with you, Quentin. Real-world examples would have added practical context to the article.

The clear distinction between the objective and scope of letter of credit and buyer’s credit as provided in the article is quite impressive. It helps in understanding their unique purposes.

The article certainly does an excellent job in highlighting the divergent objectives of these credits.

I found the article very educational and the distinction between the two credits was well-articulated.

This is a very informative article, it provides a great explanation of both a letter of credit and a buyer’s credit and their differences.

I believe the author did a great job in explaining the differences and characteristics of each credit. It is indeed insightful.

I appreciate the detailed comparison table provided in the article. It helps understand the key differences between letter of credit and buyer’s credit.

The comparison table was certainly beneficial in distinguishing the characteristics of each type of credit.

The comparison table really helped in clearly understanding the nuances of each credit. It was a great addition to the article.

The article does an excellent job in capturing the nuances of both types of credits. It is well-researched and provides valuable knowledge.

I agree, Charles. The depth of information provided is commendable.

The article presents the information in a way that captures the attention of the reader and ensures a clear understanding of letter of credit and buyer’s credit.

Absolutely, the article does a great job in engaging the reader and presenting the concepts clearly.

I concur, the engaging style of the article ensures that the information is comprehensible to the reader.