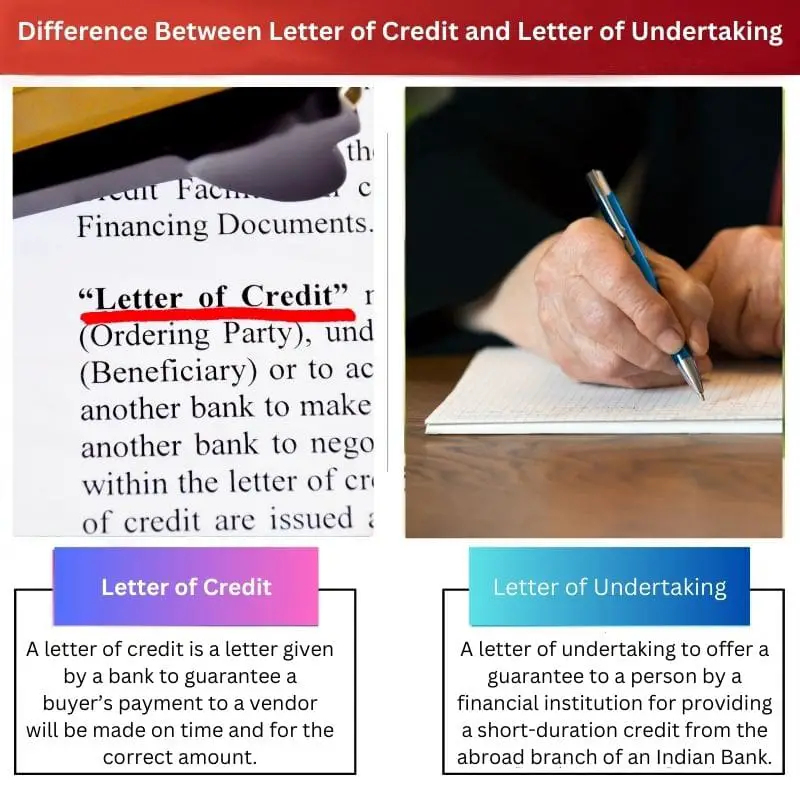

A Letter of Credit is a financial document issued by a bank guaranteeing a buyer’s payment to a seller if certain criteria are met. On the other hand, a Letter of Undertaking is a promise from one party to another, usually a bank, to fulfill a commitment or obligation, often used in trade transactions as a form of guarantee or security.

Key Takeaways

- A letter of credit is a financial instrument issued by a bank or financial institution that guarantees the payment of a specified amount to a beneficiary, provided that the beneficiary meets certain terms and conditions; a letter of undertaking is a formal, legally binding document in which a party commits to fulfill specific obligations or responsibilities.

- Letters of credit are primarily used in international trade transactions to ensure payment between buyers and sellers. In contrast, letters of undertaking can be used in various contexts, including financial transactions, contractual agreements, and legal disputes.

- Both letters of credit and letters of undertaking serve as assurances, but letters of credit focus on guaranteeing payment, while letters of undertaking involve broader commitments and obligations.

Letter of Credit vs. Letter of Undertaking

The difference between a Letter of Credit and a Letter of Undertaking is that though both are useful in international trade, a letter of credit is more reliable and safer. Still, a letter of undertaking carries chances for fraudulence.

A letter of credit and a letter of undertaking are two methods to smoothen the transaction process between parties from two countries. A letter of credit can be understood as a means to provide a guarantee by a bank to the seller against a correct payment made in due time.

A letter of undertaking is produced to offer assurance against payment of the previously agreed amount to the destination party, but there won’t be any formal contract.

Comparison Table

| Feature | Letter of Credit (LC) | Letter of Undertaking (LOU) |

|---|---|---|

| Definition | A document issued by a bank guaranteeing payment to a seller if the buyer fails to fulfill their obligations in a transaction. | A document issued by a company promising to fulfill a certain obligation to another party, but not involving a bank guarantee. |

| Issuing party | Bank | Company (either buyer or seller) |

| Guarantee | Provides a strong guarantee of payment due to the bank’s involvement. | Offers a weaker guarantee as it solely relies on the issuing company’s promise. |

| Benefits for seller | Reduces risk of non-payment and provides a reliable source of payment. | May offer some assurance of fulfillment, but the seller carries higher risk compared to an LC. |

| Benefits for buyer | Provides flexibility and potentially lower costs compared to an LC. | Can be used in situations where an LC is not required or unavailable. |

| Cost | Generally more expensive due to bank involvement and risk assessment. | Typically less expensive than an LC. |

| Use cases | International trade: Used to ensure payment for goods and services across borders. | Domestic transactions: Used in various situations, such as guaranteeing rent payments, performance bonds, or fulfillment of contracts. |

| Legal enforceability | Highly enforceable due to the involvement of a bank and established trade finance regulations. | Less enforceable as it relies solely on the issuing company’s ability and willingness to fulfill its promises. |

What is Letter of Credit?

Structure and Parties Involved

- Issuing Bank: The bank that issues the Letter of Credit upon the request of the buyer, undertaking the obligation to make payment to the seller upon presentation of compliant documents.

- Beneficiary/Seller: The party to whom the Letter of Credit is addressed, usually the exporter or seller of goods or services. The beneficiary receives payment upon complying with the terms and conditions outlined in the LC.

- Applicant/Buyer: The party who requests the issuance of the Letter of Credit from the issuing bank. The applicant is usually the importer or buyer of goods or services and assumes the responsibility for reimbursing the issuing bank for the payment made to the beneficiary.

Types of Letters of Credit

- Revocable LC: Can be modified or canceled by the issuing bank without prior notice to the beneficiary. This type of LC is rarely used in international trade due to the risk it poses to the seller.

- Irrevocable LC: Provides more security to the beneficiary as it cannot be amended or canceled without the consent of all parties involved, including the beneficiary.

- Confirmed LC: Involves a second bank, usually in the beneficiary’s country, providing an additional guarantee of payment. This type of LC offers increased security to the seller, especially in cases where the issuing bank’s creditworthiness is in question.

Process of Letter of Credit

- Issuance: The buyer and seller agree on the terms of the transaction, including the type and conditions of the LC. The buyer requests the issuing bank to issue the LC in favor of the seller, detailing the terms and conditions of the sale.

- Presentation of Documents: The seller ships the goods or provides the services as per the terms of the LC and submits the required documents (such as invoices, bill of lading, inspection certificates) to the issuing bank through their own bank (if necessary).

- Payment: Upon verification that the presented documents comply with the terms of the LC, the issuing bank makes payment to the beneficiary or honors the LC. If discrepancies are found, the documents may be rejected, and the seller may need to correct them before payment can be made.

What is Letter of Undertaking?

Purpose and Scope

- Guarantee of Performance: An LoU serves as a guarantee from the issuing party to the recipient that certain obligations will be fulfilled as agreed upon in the underlying contract or arrangement.

- Risk Mitigation: It helps mitigate risks associated with non-performance or default by providing a formal commitment to fulfill responsibilities, thereby fostering trust and confidence between parties involved in the transaction.

Parties Involved and Structure

- Issuing Party: The entity issuing the LoU, which could be a bank, corporation, or individual, undertakes the obligation outlined in the document. This party assumes the responsibility for honoring the commitment stated in the LoU.

- Recipient: The party to whom the LoU is addressed, often the beneficiary of the undertaking. The recipient relies on the LoU as a form of assurance that certain obligations will be fulfilled as specified.

Types of Letter of Undertaking

- Financial Undertaking: In the banking sector, an LoU may involve a financial institution providing an assurance or undertaking to another bank or entity regarding financial transactions or obligations. For example, a bank may issue an LoU to facilitate a loan or credit arrangement for a customer.

- Performance Guarantee: In contractual agreements, an LoU may serve as a performance guarantee, ensuring that a party will meet its contractual obligations, such as completing a project within a specified timeline or delivering goods/services as per the agreed terms.

Process of Letter of Undertaking

- Issuance: The issuing party drafts the LoU outlining the specific obligations or commitments it intends to undertake and delivers it to the recipient.

- Acceptance: Upon receipt, the recipient reviews the LoU to ensure that it aligns with the terms of the agreement or arrangement. Once satisfied, the recipient accepts the LoU as a formal commitment from the issuing party.

- Execution and Enforcement: The obligations outlined in the LoU are executed as per the agreed terms. In the event of non-compliance or default, the recipient may seek enforcement of the LoU through legal means or pursue appropriate remedies as stipulated in the document.

Main Differences Between Letter of Credit and Letter of Undertaking

- Nature of Instrument:

- LC: LC is a financial document issued by a bank, guaranteeing payment to a seller upon fulfillment of certain conditions in a trade transaction.

- LoU: LoU is a formal commitment issued by one party to another, often a financial institution, guaranteeing performance or fulfillment of obligations in various contexts beyond trade.

- Purpose:

- LC: Primarily used in international trade to ensure payment security for both buyer and seller.

- LoU: Used in a broader range of contexts such as banking, contracts, and legal agreements to provide assurance of performance or fulfillment of obligations.

- Involvement of Parties:

- LC: Involves three parties – issuing bank, beneficiary (seller), and applicant (buyer).

- LoU: Involves two parties – the issuing party and the recipient, and can be utilized in transactions involving various entities beyond buyer-seller relationships.

- Risk Mitigation:

- LC: Mitigates risks related to non-payment or default in international trade transactions by providing a financial guarantee.

- LoU: Mitigates risks associated with non-performance or default in various contexts by offering a formal commitment to fulfill obligations, thereby fostering trust between parties.

- Legal Framework:

- LC: Governed by international trade laws and banking regulations, with standardized practices such as UCP 600 (Uniform Customs and Practice for Documentary Credits).

- LoU: Governed by contract law and may vary based on the terms agreed upon between the parties involved, often tailored to specific agreements or transactions.

- Flexibility:

- LC: More rigid in terms of conditions and procedures, with strict adherence to documentary requirements for payment.

- LoU: Offers more flexibility in terms of scope and usage, as it can be tailored to suit the specific needs of parties in various types of transactions beyond trade.

- https://repository.law.umich.edu/cgi/viewcontent.cgi?article=2776&context=mlr

- https://digital.sandiego.edu/cgi/viewcontent.cgi?article=1244&context=ilj

The explanation of a letter of credit as a reliable payment mechanism in international trade highlighted its significance and implications for trade transactions.

The article provided a well-rounded understanding of letters of credit and letters of undertaking, along with their relevance and benefits in international trade.

The explanation of the difference between a letter of credit and a letter of undertaking was very well-written and allowed for a comprehensive understanding of each concept.

The article was very informative and shed light on the importance of a letter of credit in international trade transactions.

The detailed comparison between letters of credit and letters of undertaking was absolutely informative and eye-opening.

The letter of credit and letter of undertaking comparison table provided a clear and concise summary of the two payment mechanisms.

The article brilliantly describes the importance of international trade and provides a comprehensive overview of letters of credit and letters of undertaking.

The explanation of various types of letters of credit was insightful and carefully detailed.

The discussion on letters of credit was quite insightful as it addressed the use of this financial instrument in different contexts.

The potential for fraudulence and safety concerns mentioned when comparing letters of credit and letters of undertaking was a little disheartening.