Every country and nation has its growth calculator. It helps them to look for all the purchases and other important matters regarding the market. The economy of a country is always dependent on its market value.

The economy can fall or it can rise. In a particular region if the economy is declined then it represents the recession of that particular region.

The term recession and depression in the economy is a microeconomy term.

The economic cycle always runs smoothly, and the economy must not stop, whether it is falling or rising above. The economy of a particular region is connected to the other areas.

The world is connected through economic activity. If a region’s economy is declined,, it will affect that region’s economy and others as well. The economy can be in recession or depression.

Key Takeaways

- A recession is a period of economic decline characterized by a fall in GDP for two consecutive quarters, while depression is a prolonged and severe recession.

- Depressions have a more significant impact on unemployment rates and business closures than recessions.

- Monetary and fiscal policies can alleviate the effects of a recession, but depressions require more extensive intervention.

Recession vs Depression

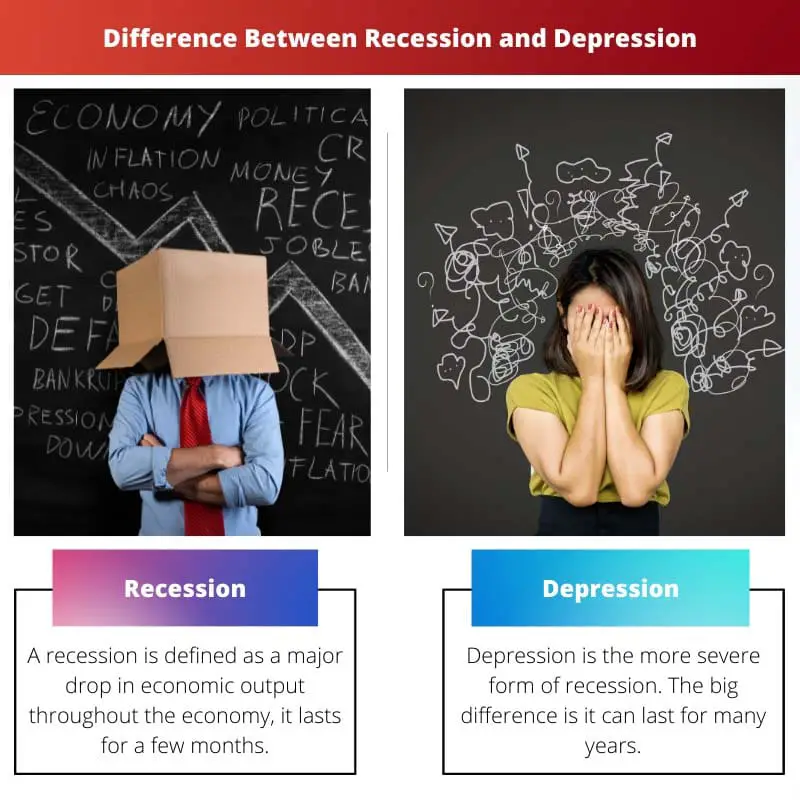

A recession is a significant decline in economic activity that lasts for at least six months, and is characterized by a decrease in gross domestic product (GDP), employment, and income. Depression is a severe and prolonged economic downturn that is more severe than a recession.

Recession means low economic activities in a particular region at a meager rate. When there is an overall decrease in spending, a recession occurs as an adverse demand shock.

A recession can happen because of many reasons. The main reason for the downturn is the financial cause. The recession can cause a massive difference in the market. The market can face a substantial economic downfall.

Depression lasts for a more extended period. It can last for years and happens when the economy falls very down, and the market rate goes low.

The demand is very high, but the supply is meager to provide goods and services to the customers. Depression in the economy has been in recent years for several regions worldwide.

Comparison Table

| Parameters of Comparison | Recession | Depression |

|---|---|---|

| Definition | High-interest rates can cause people to lose their confidence. Inflation causes an increase in the money supply in the market. | Depression is the more severe form of recession. The big difference is it can last for many years. |

| Causes | Effects the monetary, and fiscal changes, the credit availability also gets harder, the interests rate also falls, high rate of inflation. | Crashing the market causes a decrease in the trade of goods. Decreasing orders, control of prices, and wages also change. |

| Effects | Fall of the economy, political changes, social changes, and unemployment increases. During political changes, the aspects of political change. | The GDP and the manufacturing fall due to a low economy and then it indicates recession. |

| Indicators | Producer price index, unemployment also increases as people do not find jobs, the trade balance also gets disturbed. | The significant recession period was December 2007- June 2009. This was the only recession period that occurred in early 2000. |

| Period | The significant depression period was from 1929-1939, it caused a drastic change in society. The world remembers. | The significant depression period was from 1929-1939; it caused a drastic change in society. The world remembers. |

What is the Recession?

A recession is a financial phrase that denotes a considerable drop in overall economic growth in a specific area.

It was previously defined as two-quarters of economic contraction, as measured by GDP and monthly signs such as an increase in unemployment.

Earlier, the NBER declared recession as low economic growth in a quarter of sessions. But now the NBER says with a decline in economic growth that remarks for several months.

The months which undergo the recession experience a high inflation rate, and temporary unemployment. Organizations start laying off people to decrease costs and halt losses, resulting in rising unemployment rates.

When industrial development decreases, inflation rises, and a region’s GDP falls, reflecting or indicating recession.

After the industrial revolution, things started to change, resulting in short-term recessions. There were long-term and short-term economic fall downs after the industrial revolution.

The market goes down as demand increases with supply decreases, the industry loses manufacturing goods, the supply falls, and the region faces a decline in economic growth, which means recession.

If a recession occurs in a region, that region will suddenly lose its GDP level. Employment will decrease, the supply will decrease, and the share markets will start to experience low profits.

A recession does not hold for many years; it lasts for a few months, which doesn’t cost much compared to a depression.

What is Depression?

The depression is a lengthy and severe drop in economic activity.

Within economics, depression can be described as a prolonged period of economic contraction that lasts three years or longer and results in a GDP Growth fall of at minimum 11%.

Depression does not happen every time; it can occur in a gap of years. It does not occur like a recession in the middle of the financial year.

Decreasing output at the economic levels are indicator of declining economic activity. Depression is used when an economy has been in depression for two or maybe more quarters.

The main thing in depression that a region can experience is decreased investments of people and companies. People lose confidence, and people won’t be able to get short-term interest at a low rate.

Every region is connected globally, and every market is connected globally. During the depression, the market falls and also reflected the global connections. Trade is also affected.

It is a much more severe financial slump than a setback, a regular business cycle slowdown in business activity.

In the business sector, the depression can hit very hard, as it is connected with different aspects of the world. The way the economy changes, the business also tends to change in its way.

Main Differences Between Recession and Depression

- The main difference that you will find between a Recession and a depression is the time gap. A recession occurs mainly within months or lasts for a few months until it has reached better economic growth. But in a depression, the economic fall can last for several years.

- Both the terms differ in the severity of their cause. Both the terms have different consequences, as a recession lasts only months. The interest rate starts to fall. Consumers don’t find any interest. Depression can have a huge impact, and it can cause many changes in society and even in the market. It can ease up the industry works, and trade will be low.

- Recession can happen anytime, as it is still happening in many regions. And Recessions can cause a little problem that can be changed and dealt with. But, depression can cause a severe problem that can not be changed quickly. It changes the political view, social matters, the markets, etc.

- The recession does not have a sharp decline in GDP. But depression has a sharp GDP decline. The GDP falls so quickly in depression that it is difficult to catch up. While during the recession, the GDP can be brought back with an instant increase in supply and service in the market.

- The early recession of 2000 caused an 11% decline in the GDP. The greatest depression of all time caused a panic situation for the whole world. And it caused a -28% decline in the GDP.