The dividend is the percentage of the company’s annual profits given to the stockholders or shareholders by the board members. The dividends are declared in the percentage format using the share’s par value or market value.

The dividend yield and percentage are calculated using different share values to evaluate the financial condition and attract investors.

Key Takeaways

- The dividend yield is the return on investment based on the dividend paid, divided by the stock price, expressed as a percentage. The dividend percentage is the portion of a company’s profits paid out as dividends, expressed as a percentage.

- Dividend yield considers the stock price, while dividend percentage does not.

- The dividend yield is a forward-looking measure that changes with the stock price, while the dividend percentage is a historical measure fixed at the time of payment.

Dividend Yield vs Dividend Percentage

The difference between the dividend yield and dividend percentage is that dividend yield is measured using the par value of the share, and the dividend yield is calculated using the current market value of the claims. The dividend percentage is declared either quarterly or half-yearly, whereas the dividend yield is distributed once a year.

The dividend yield measures the current market price of the company’s shares given to the shareholders. It is represented in percentages to help investors analyze the company’s risk.

The dividend yield is calculated on the paid dividends in a year against the market price.

On the other hand, the dividend percentage is also termed as rate or dividend, or simply dividend is paid either quarterly or half-yearly, or annually to the shareholders by dividing the dividend per share value by the company’s earnings.

The company commonly uses the dividend percentage to divide the shares of shareholders from the profits.

Comparison Table

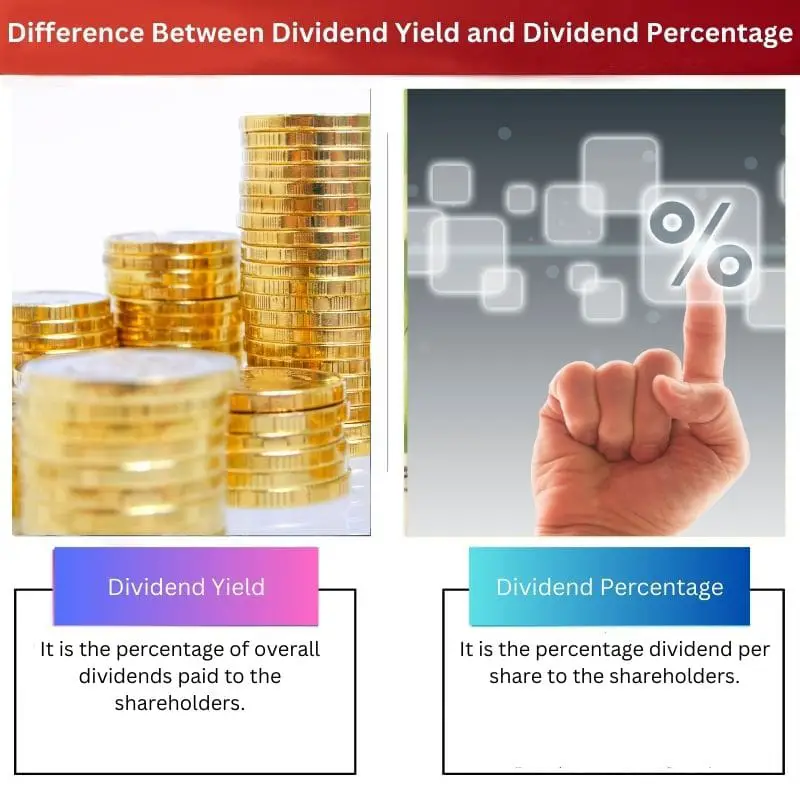

| Parameters of Comparison | Dividend Yield | Dividend Percentage |

|---|---|---|

| Definition | It is the percentage of overall dividends paid to the shareholders. | It is the percentage dividend per share to the shareholders. |

| Share value | Dividend yield uses the current price of the company’s share in the market. | The dividend percentage uses the nominal or face value of the company’s share. |

| Results | It gives the expected rate of return on the shares. | It gives the amount paid on each share to the shareholder. |

| Payment time | It is paid annually to the shareholders. | It is paid quarterly, half-yearly, or annually. |

| Factors Affecting | The dividend rate and the current market price affect the dividend yield. | The company’s face value and net profit affect the dividend percentage. |

What is Dividend Yield?

Some organizations raise capital by selling their stocks to public investors. They raise funds to start a new project or invest in current business operations. In return for the investment, the company gives an amount of profit earned to the shareholders or investors.

The dividend yield is the percentage of the net profit a shareholder gains from the company after investing capital.

Dividend yield shows the organisation’s financial condition and helps investors understand the risks and profits of investing in a company. The dividend yield shows the expected return on investments to the investors in a year.

It is similar to the interest rate on the capital given to the investor for taking risks in investing in a particular company.

The company’s board members calculate the dividend yield by dividing the paid dividends in a year by the current market price of the company’s stocks to attract new investors.

Usually, investors invest in the company with higher dividend yields as higher dividends give more profit returns. However, the dividend yield does not guarantee the security of the investments. A company with a higher dividend yield results in to change in dividends.

The dividend yield influences the volatility of the stock prices.

What is Dividend Percentage?

The dividend percentage, or simply a dividend, is the fraction of the amount from the net profit shared among the company’s shareholders. The dividend is expressed per share using the face value of the claim.

It is distributed among the shareholder either quarterly or annually based on the compliances of countries and profits earned by the company.

The dividend percentage is estimated by dividing the dividend per share by the current face value of the claim. The dividends get influenced by factors like liquidity, availability of funds, profitability, company growth, industry type, market condition, ownership, and tax effect.

The dividends are paid to the shareholders to retain them for a long time and attract new investors to raise capital in the company.

The dividend percentage helps the financial manager to make effective dividend decisions. The increase in dividend percentage will increase the wealth of the shareholders and also the market value.

The dividend percentage depends on the earnings, and if the company fails to earn the dividends, its market performance goes down.

Main Differences Between Dividend Yield and Dividend Percentage

- The dividend yield is the overall annual percentage of returns on investments paid to shareholders. In contrast, the shareholders pay the dividend percentage quarterly or half-yearly.

- The prevailing market price of the share is used in dividend yield prediction, and the face value of the company’s share is used in dividend percentage calculation.

- The percentage of dividend yield depends on the dividend rate. That is, the dividend yield increases with an increase in dividend rate and vice versa.

- The dividend yield shows the expected return on shares, and the dividend percentage shows the desired amount on every investor’s share.

- The dividend yield is calculated on overall dividends shared with the investors, and the dividend percentage gives the investor percentage profits on each share.

- https://www.researchgate.net/publication/323392193_A_Study_on_the_Investment_Performance_of_High_Dividend_Yield_Stocks_With_Reference_To_Nifty

- https://www.researchgate.net/profile/Md-Zahangir-Alam/publication/314573369_Dividend_Policy_A_Comparative_Study_of_UK_and_Bangladesh_Based_Companies/links/5a994d430f7e9ba429780677/Dividend-Policy-A-Comparative-Study-of-UK-and-Bangladesh-Based-Companies.pdf