Many insurance providers are available. Car insurance is a must for driving a car on city roads.

The state form and Geico form are two different car forms. Both are U.S-based insurance provider companies.

Both provide many offers and discounts to their customers. Since they are, U.S based companies have many branches.

Key Takeaways

- GEICO has lower rates and is more affordable compared to State Farm.

- State Farm has more extensive coverage options and offers more personalized service.

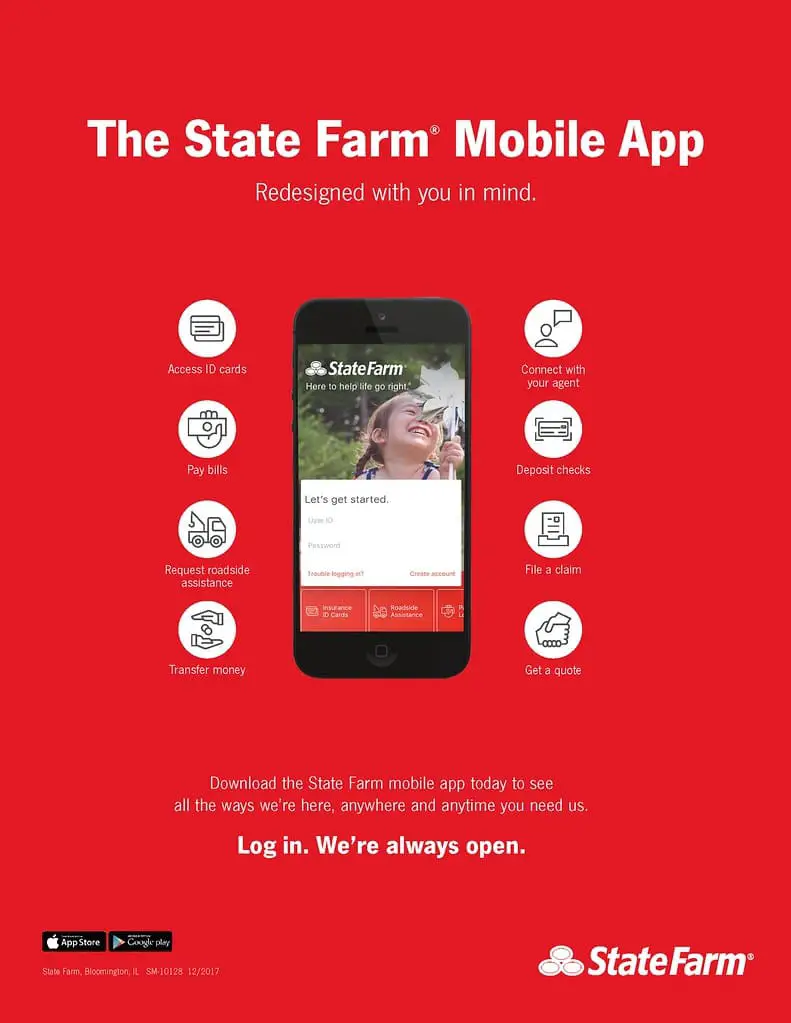

- GEICO’s user-friendly mobile app makes it easy to manage policies and file claims.

Geico Auto Insurance vs State Farm

The difference between Geico Auto Insurance and State Farm is their interests. The Geico insurance offers more discounts, and the state farm has fewer cuts. In claim satisfaction, Geico scores less, and state form scores more. Both companies have better customer ratings. Geico insurance was founded in 1936, and State Farm was founded in 1922. Both have similar discounts and offers. The Geico rated less for customer services when compared to State Farm company.

Geico is a popular insurance provider in the united states. Geico has a five-star rating for customer services and financial institutions.

It was established in 1936. The Geico company provides car insurance, homeowner insurance, and renters insurance.

Geico offers various discounts for Military, federal employees, and corporate people. Mechanical Breakdown Insurance(MBI0 is a unique feature in Geico insurance.

State Farm stands in the top five insurance provider companies. By the National Association of Insurance Commissioners (NAIC) in the United States, the State farm is the largest auto insurer.

In 1922 the state farm was founded. State farm provides car insurance, vehicle coverage, homeowner insurance, and renters insurance.

For students and young drivers, the state farm provides many offers. It also provides various discounts for the program delivering a safe and safe program.

Comparison Table

| Parameters of comparison | Geico Auto Insurance | State Farm |

|---|---|---|

| Founded year | Geico insurance was founded in 1936 | State farm was founded in 1922 |

| Availability | Geico insurance is available in 48 states | The state farm is available in 50 states. |

| Discount | Geico insurance has different discounts | State farm discounts of up to 30% |

| Mobile app Google play rating | Geico has 4.8 out of 5.0 | State Farm has 4.7 out of 5.0 |

| Cost range | Geico insurance has 8.5 | State Farm has 8.0 |

| Customer experience | Geico insurance has 9.0 | State Farm has 7.5 |

What is Geico Auto Insurance?

Geico stands for Government Employees Insurance Company. It is an American-based insurance provider company with five-star ratings from customers’ services.

The headquarters of Geico is located in Chevy Chase, Maryland. Geico is the second-largest company in the United States for providing insurance.

The subsidiary of Berkshire Hathway has completely owned the Geico company.

The Geico provides almost 24 million motor vehicle coverage and 15 million policies. By advertising, Geico gets more popular and entertains viewers.

Geico also provides property insurance and Umbrella coverage. It works as an insurance agent and sells the insurance to third-party vendors that are at risk.

But they have a separate handle team for every policy and discount they provide.

Leo Goodwin Sr. and Lillian Goodwin are the founders of Geico company. It is a subsidiary-based company.

Todd Combs is the chief executive officer of Geico. There are about 40,000 employees are working in this company.

Berkshire Hathaway is the parent company of Geico company. The official website of Geico company is www. geico.com.

It is popular for its unique policies for students and young workers. It attracts more people through those policies.

What is State Farm?

State Farm is a private insurance company with a large group of combined insurance companies. The headquarters is located in Bloomington, Illinois.

The state farm is the largest insurance provider company in the United States. It is ranked 36th company by Fortune 500.

They tied up with many exclusive agents for selling insurance. State farm insurance is sold only by state farm agents.

The agents are allowed only to sell State farm products.

State Farm has done many financial services and mutual funds. In 1999 the state form was first opened in the United States.

State Farm has many financial services like banking and mutual funds. It is a subsidiary company.

It does not have any separate branches. State farm companies have internet via transfers, savings accounts, and money market accounts.

It has a facility to connect through the phone for business. Robert H. Kent, an agent of State Farm, provides the auto loan idea.

George J Mecherle founded State Farm in 1922 as an insurance company. They have specialized offers and policies for farmers and also have some expanded services.

They provide life insurance and other banking services. It is the largest insurance sector in the United States.

State Farm has 70,000 employees and 19000 agents. It has more than 2 million active bank accounts.

The chairman and chief executive officer of State Farm are Michael Tipsord. They have a unique logo with red as the master colour.

Main Differences Between Geico Auto Insurance and State Farm

- Geico Insurance was founded in 1936, and the state farm was founded in 1922.

- Geico insurance is available in 48 states, and state farm is available in 50 states.

- Geico insurance has different discounts and state farm discounts of up to 30%

- The mobile app google play rating for Geico is 4.8 out of 5.0, and for the state, the farm is 4.7 out of 5.0

- The cost range of Geico insurance is 8.5, and the cost range of state farm is 8.0,