Starting a business as a single partner can be tough. This can be solved easily if we start the business by involving us in partnerships.

There are many partnerships, and two such common partnerships used in business are general partnerships and the other one is a limited partnerships.

They have some differences in the partners as well as in the operations so that we can choose them according to our business.

Key Takeaways

- A general partnership involves two or more individuals who share equal responsibility and unlimited liability. In contrast, a limited partnership involves at least one general partner with unlimited liability and one or more limited partners with limited liability.

- A general partnership requires all partners to actively participate in the management and decision-making process, while limited partners have limited involvement in management and decision-making.

- General partnership profits and losses are shared equally among partners, while limited partnership profits and losses are shared based on the percentage of ownership.

General vs Limited Partnership

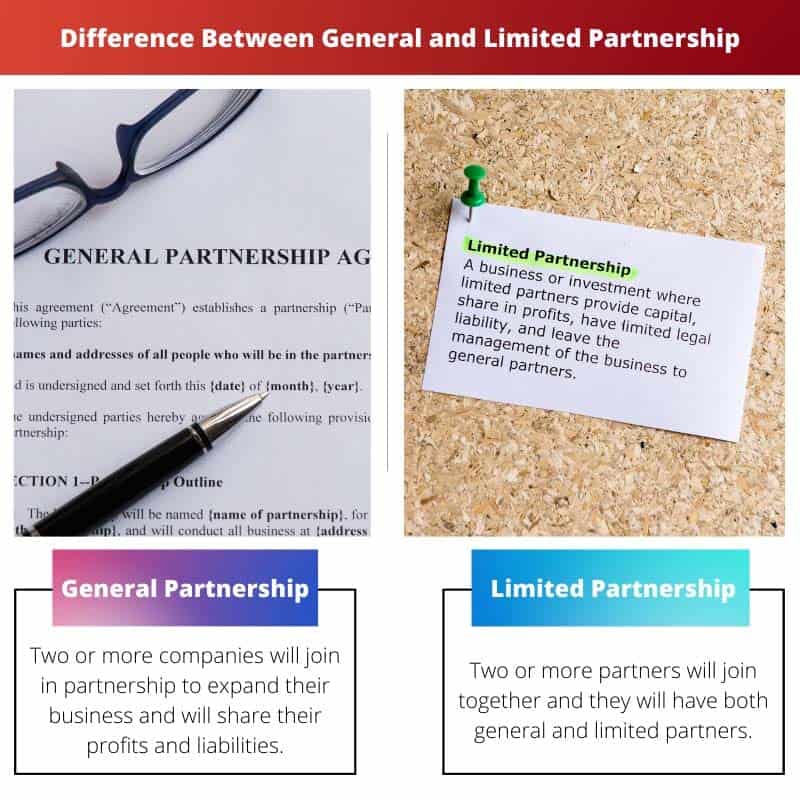

A general partnership is a type of partnership in which all partners are equally responsible for the management of the business, as well as its profits and losses. A limited partnership is a type of partnership that includes both general partners and limited partners. The general partners are responsible for managing the business.

A general partnership is taken by companies to increase their growth.

This kind of partnership is carried by many companies because the cost involved in making the partnership is very less when compared to other partnerships in the market.

There are also some features available in the general partnership. Using general partnerships will help the companies to gain some benefits.

A limited partnership is a partnership where the partners will have limited control over the liability. This is the only partnership where you can find both the general and as well as limited partners in one place.

However, they are not responsible for the mistake caused by the general partners or others who are involved in the partnership.

Comparison Table

| Parameters of Comparison | General Partnership | Limited Partnership |

|---|---|---|

| Definition | Two or more companies will join in partnership to expand their business and will share their profits and liabilities. | Two or more partners will join together and they will have both general and limited partners. |

| Rate | Less | High |

| Expense reason | They will agree with each other and stick to the rules. | Since they have both general and limited at one place the price will be higher. |

| Operations management | They are responsible for maintaining operations. | They are not responsible for maintaining operations. |

| Advantages | The paperwork will be less. | You will be able to find unlimited shareholders. |

What is General Partnership?

A general partnership is used when two or more companies plan to do their business together. In that case, they will join with the other company and do their business.

In this process, they will share their financial ability, shares, and profits in a jointly owned business. In this partnership, there is not any limitation, and it is unlimited.

They agree to unlimited liability. If any debt occurs, the other business partner will get sued.

In this partnership, they are responsible for paying their taxes and everything that is included in the business. When the income tax department comes to check anything, the other partner is not responsible for others’ mistakes.

This kind of partnership will give the partners to take a closer look at the business, and they can manage their operations efficiently. There are some criteria to be met to make this kind of partnership work.

There should be a minimum of two participants included in the partnership. In this partnership, the partners should occur to all the liabilities that will occur during their partnership.

Their agreement should be formally written with the help of a lawyer, and then the same should be given in an oral statement as well.

Since this kind of partnership is very less expensive and many companies and startups will plan to take them for their benefit.

What is Limited Partnership?

A limited partnership is taken down by two or more partners. But the thing here is the limited partner is sometimes liable to the investment that is made by them.

This type of partnership will have both general partners and limited partners. So in this type, the general partners who are involved in the partnership will tend to have more liability.

The limited partners will have less involvement and more involvement in some cases. So, their liability will also be limited.

Before beginning this partnership, the partners should agree to each other’s terms and conditions so that there won’t be any problems in the future that might affect their business.

These terms and conditions should be written in both the papers and as well as in oral statements.

This partnership is a type of investment partnership. In this partnership, all partners will only have limited liability.

They can’t exceed the liability of what they have been given. But they have some other perks as well.

If any discrepancies occur in the business, they will not be held responsible for the mistake made by other partners.

This type of partnership is mostly found and used in law and accounting companies. Their work is not associated with the company’s everyday operations.

Main Differences Between General and Limited Partnership

- A general partnership involves two to more companies, and it will contain only general partners. On the other hand, a limited partnership will have two or more companies with both general and limited partners.

- A general partnership is less expensive when compared with a general partnership. But the general partnership is very expensive because of having both general and limited partners.

- The advantage of having a general partnership is that the investment will be cheaper, and you will have less paperwork. On the other hand, the advantage of having a limited partnership is you will be able to have unlimited shareholders.

- The disadvantage of a general partnership is that the partners have to take care of the responsibilities of liabilities no matter who did that. On the other hand, the disadvantage of limited partnerships is that they have to carry the burden of business obligations.

- In a general partnership, they are responsible for maintaining operations. But the limited partnership does not hold responsible for maintaining operations.