A limited company can be differentiated from a private limited company based on its ownership and the way they are traded. When a new company is formed, there are comparatively much fewer employees and a very small executive team. These companies are recognized as private limited companies, but eventually, when they grow into a large multinational conglomerate, they can get listed on the stock exchange and become limited companies.

Key Takeaways

- Limited and private companies are separate legal entities with limited liability for their shareholders, but private limited companies have restrictions on share transfers. They cannot offer shares to the public.

- Limited companies can be publicly traded on stock exchanges, while private limited companies cannot.

- Private limited companies must have at least two shareholders, while limited companies can have only one.

Limited company vs Private Limited company

A limited company is a business structure that legally separates the company’s assets and income from its owners and shareholders, limiting their liability to their investment. A private limited company is a type of limited company, not publicly traded, whose shares are held privately, by a small group of individuals.

A limited company is also known as a public company, and there can be several shareholders of the same. The shares of the company are traded in public, and anyone can buy and sell these shares. A private company is a legal entity of its own which means that if the company is sued, the shareholders don’t have to pay from their pockets.

On the other hand, a private limited company has limited ownership which means a fewer number of shareholders. The shares of these companies are not open to the common public for trading, and they are also not listed on the stock exchange. Under adverse situations, the shareholders of the company are liable to sell the assets which they own in the company.

Comparison Table

| Parameters of Comparison | Limited Company | Private Limited Company |

|---|---|---|

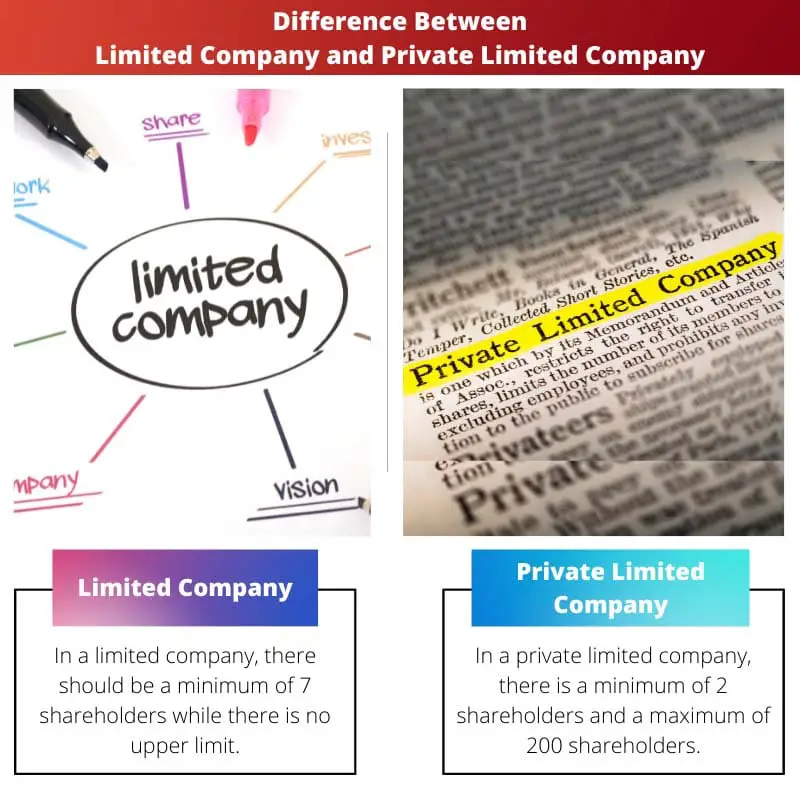

| Shareholders | In a limited company, there should be a minimum of 7 shareholders while there is no upper limit. | In a private limited company, there is a minimum of 2 shareholders and a maximum of 200 shareholders. |

| Ownership | A limited company which is also known as a public limited company is owned by multiple shareholders. | Only a limited group of promoters own a private limited company. |

| Shares | In a limited company, freely trading the shares is allowed. | In a private limited company, all shareholders have to approve for trading the shares. |

| Stock exchange | A limited company files an IPO and gets listed on the stock exchange. | t doesn’t get listed in the stock exchange as public trading is not allowed. I |

| Transparency | Working of a limited company is much more transparent and the common public is allowed to view the records. | A private limited company doesn’t show transparency as a limited company and details of transactions are not disclosed to the public. |

What is a Limited Company?

A limited company is a specific legal entity/ business structure that can go into contracts and suffer legal charges without the shareholders getting affected. The individual shareholders don’t need to spend money from their pockets or sell off the assets of the company if someone sues it. But, if the shareholder is found guilty and involved in fraud or related activities, the charges will be pressed.

Public limited companies are allowed to sell shares to the common people to raise capital. But to trade publicly, a company first files an IPO and when it gets listed on the stock exchange, it can trade. There is a fixed price for a single share, and it can vary every day according to the stock market. Generally, small companies don’t go public until and unless they become a more pronounced business.

A limited company has to register for corporation tax within three months of its establishment. Apart from the mandatory corporation tax, limited companies can also be eligible for other taxes like VAT, Capital Gains Tax, etc.

What is a Private Limited Company?

A private limited company doesn’t trade its business publicly, and they are not listed on the stock exchange for selling its shares. Generally, small companies are privately held with a minimum of 2 members to 200 maximum. This is per the provisions of the Companies Act 2013.

In a private limited company, each shareholder or member has limited liability. It means if the company faces any loss, the shareholders have to sell their assets of the company to pay the payment. A private limited company also has two directors, and there is no need of indexing the employees, unlike limited companies.

A private limited company is not bound to disclose its financial information to the common public. Other sensitive information on an executive level is also kept secret in private companies. And when it comes to decision-making, all the shareholders should approve for it to pass.

Main Differences Between Limited Company and Private Limited Company

- In a limited company, there should be a minimum of 7 shareholders while there is no upper limit, whereas, in a private limited company, there is a minimum of 2 shareholders and a maximum of 200 shareholders.

- A limited company which is also known as a public limited company is owned by multiple shareholders, whereas only a limited group of promoters own a private limited company.

- In a limited company, freely trading the shares is allowed whereas, in a private limited company, all shareholders have to approve for trading the shares.

- A limited company files an IPO and gets listed on the stock exchange, whereas a private limited company doesn’t get listed on the stock exchange, as public trading is not allowed.

- Working in a limited company is much more transparent, and the common public is allowed to view the records. On the other hand, transactions and details of other activities are not revealed to the commoners in a private limited company.

- https://onlinelibrary.wiley.com/doi/abs/10.1111/1468-2230.00267

- https://www.iasplus.com/en/binary/resource/0804restatements1997-2006.pdf

This detailed breakdown of the differences between limited companies and private limited companies provides a wealth of information for individuals seeking to establish their own businesses. It offers valuable insights into the legal, financial, and operational variances between the two types of companies.

It would be interesting to delve deeper into the tax implications and filing requirements of limited companies and private limited companies. Understanding these financial aspects is crucial for business planning and compliance.

The article effectively explains the concept of a limited company and a private limited company, shedding light on their characteristics, ownership, and financial transparency. This is valuable information for anyone interested in business structures.

The article offers great insight into the differences between limited companies and private limited companies. Their ownership, trading restrictions, and number of shareholders are key points in understanding their distinctions.

I agree with Ulloyd. Including case studies would provide practical insights into the operating differences between limited companies and private limited companies, further enhancing the article’s value.

Although the comparison is thorough, it would be beneficial to include more examples or case studies to illustrate the practical application of these differences in real business scenarios.

The article’s detailed explanation of the legal features and ownership structures of limited companies and private limited companies is essential for understanding the different business entities. It provides a comprehensive analysis of the distinction between the two.

The article effectively outlines the legal and operational disparities between a limited company and a private limited company. This comprehensive analysis clarifies their unique features and provides valuable knowledge for prospective business owners.

An addition of case studies or real-world examples would be beneficial, as it can help readers understand how the differences between limited and private limited companies can impact business operations and decision-making.

The article does a commendable job of explaining the complex concepts behind limited companies and private limited companies in an accessible manner. The clear comparison table and insightful descriptions contribute to a thorough understanding of the topic.

The comparison table is a useful tool for anyone looking to understand the differences between a limited company and a private limited company. It provides a clear and concise overview of the key parameters of comparison.