Today’s world has many banks and different types of banking systems. Sometimes people get confused about some terms related to banking.

Banking is also needed when it comes to industries and public sector units. For them, there is a banking system called the Corporate banking system.

And for public and private banking, there is another system called the Investment banking system. Financial support is always needed when starting a new business or startup.

The Corporate banking system does this support. But when it comes to funding Investment banking system takes place.

Key Takeaways

- Corporate banking focuses on providing services to large clients, while investment banking focuses on raising capital and providing financial advice to corporations and governments.

- Corporate banking involves providing credit facilities, cash management services, and risk management, while investment banking involves underwriting securities and advising on mergers and acquisitions.

- Corporate banking generates revenue through interest income and fees, while investment banking generates revenue through underwriting and advisory fees.

Corporate Banking vs Investment Banking

Corporate banking focuses on providing financial solutions to businesses, including loans, credit facilities, and cash management services. This division helps companies manage their day-to-day financial operations and growth. Investment banking assists clients with more complex financial transactions, such as mergers and acquisitions, capital raising, and financial advisory services, enabling companies to achieve strategic objectives and expand their market presence.

The investment banking system does many services, like guaranteeing payment if any loss occurs and helping businesses set up by raising funds for them.

It has both the selling and buying side. The selling system includes promoting events like monetary gain, creating portfolios, etc.

And the buying system involves advisory services for investment-relating problems like where to invest or how to invest.

The corporate banking system provides services like setting up portfolios and making significant investments. They also offer assistance with the help of which large Multinational companies can lower their taxes.

In Corporate Banking, providers do deep research to avoid the risk of financial damage. They also provide their clients with full security service.

Investment banking and Corporate banking are good at providing security services and ensuring guaranteed payment if any financial loss occurs, but they involve high risk because of weak regulatory requirements.

The responsibility of a Corporate banking system is to increase the value of their client’s business or a corporate. And Investment banking system provides services to both private and public sectors.

Comparison Table

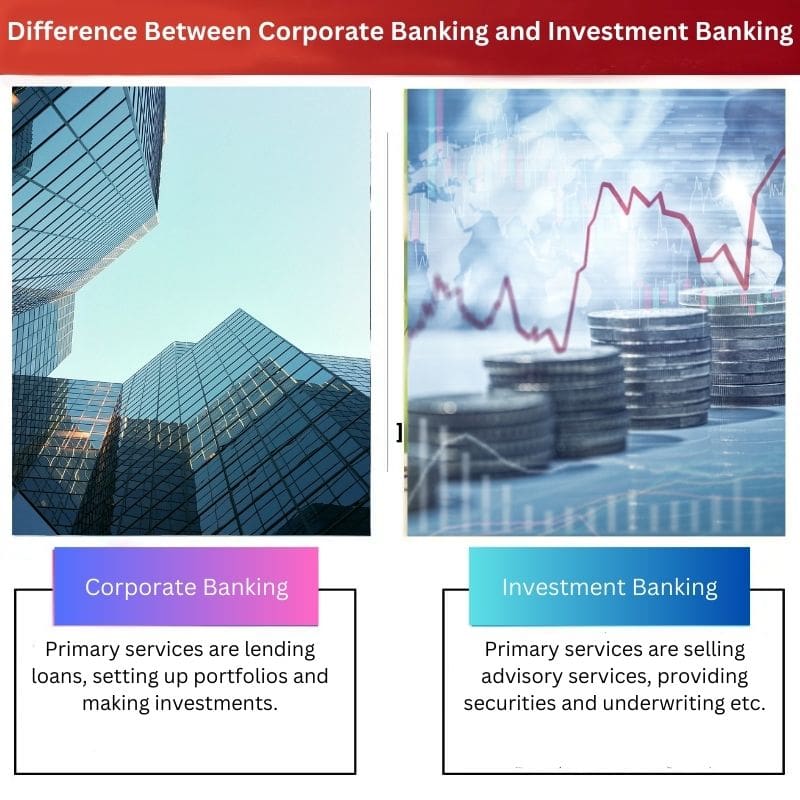

| Parameters of Comparison | Corporate Banking | Investment Banking |

|---|---|---|

| Primary services | Primary services are lending loans, setting up portfolios and making investments. | Primary services are selling advisory services, providing securities and underwriting etc. |

| Risk factor | In the Corporate banking system, the risk is low. | In the Investment banking system, the risk is high. |

| Customer base | The customer base is high. | The customer base is low. |

| Commission level | The commission level is low or moderate. | The commission level is high depending on the individual charge rate. |

| Examples | Examples are HDFC Bank and State Bank. | Examples are Goldman Sachs, RBS, UBS etc. |

What is Corporate Banking?

The corporate banking system deals with large corporates and Industry related investments. This banking system provides lots of services like providing required loans to their clients and setting up portfolios to increase their value in the corporate sector.

The risk involved here is low, and high financial security is provided to the customers.

Corporate banking does all the services that a corporate needs.

They also help large Multinational companies to lower their tax paying. Corporate banking also allows corporates to manage all changes related to foreign exchange rates, and by this, they provide surety to their clients that they get more profit.

Corporate banks earn money through the interest they get from their clients after providing them with loan services. They provide their clients with financial security by guaranteeing payment if any economic damage occurs.

What is Investment Banking?

The Investments banking system provides services to both the private and public sectors. They sell services like setting up portfolios and raising funds for large Corporates.

The investment banking system buys and sells services like the selling system, including promoting events like monetary gain and creating portfolios.

And the buying system involves advisory services for investment relating to problems like where to invest or how to invest.

The investment banking system does not have very high customer support because there is an increased risk in their banking system because of weak regulatory requirements.

As it deals with public and private sectors, it maintains security precisely by not disclosing any investment-related information.

Main Differences Between Corporate Banking and Investment Banking

- The corporate banking system is less risky than Investment banking as Investment banking has weak regulatory requirements.

- Corporate banking only deals with large Corporations, MNCs, and businesses, but Investment banking provides services to private and public sectors.

- Investment banks earn money through the charge they take after delivering advisory services. In contrast, Corporate banks make money through the interest they take from big Corporates after providing them with required loans.

- Compared to the Investment banking system, the corporate banking system has good customer support because it is more secure, and no pre-investment is needed.

- Investment banking involves a high commission rate depending on the client as they charge for their services. But in Corporate banking, a low or moderate commission is involved as there is no pre-investment.

The article provides a comprehensive understanding of the services offered by both corporate and investment banking. It’s a great resource for anyone seeking information on this topic.

I agree. The article is a valuable source of knowledge for those interested in banking systems.

I appreciate the practical examples given in this article. It helps in applying theoretical knowledge to real-world scenarios.

The examples of banks provided are quite relevant and recognizable.

Absolutely, the examples bring clarity to the concepts discussed.

I found the tone of the article to be somewhat biased towards corporate banking, overlooking the crucial role of investment banking. A more balanced perspective would be appreciated.

The emphasis on risk in investment banking could be further elaborated. I would like to learn more about this aspect.

I agree. Both corporate and investment banking play vital roles in the financial sector and should be equally represented in the article.

The article presents a relevant distinction between corporate and investment banking, however, there are many other aspects that could be explored further to provide a more comprehensive understanding.

I see what you mean. Perhaps an expansion on the regulatory environment or case studies could enhance the article.

This article raises awareness about the intricacies of banking systems. The comparison table is particularly useful to understand the nuances between the two systems.

The article could benefit from a more detailed discussion on the regulatory environment and compliance measures for both corporate and investment banking.

A deeper exploration of the regulatory framework would indeed enrich the content. It’s an important aspect to consider.

The comparison of the risk factors between corporate and investment banking is particularly interesting. It sheds light on the differing characteristics of the banking systems.

The risk factor comparison indeed highlights the unique challenges faced in each banking system.

This article gives a clear and concise overview of the difference between corporate banking and investment banking services. It is informative and an interesting read.

I agree. The article is well-structured and provides accurate information.

The comparison of the customer base and commission levels in the two banking systems provides insightful perspectives. It adds depth to the article’s analysis.

I agree. The article excels in presenting a well-rounded view of corporate and investment banking.

The article provides a logical breakdown of corporate and investment banking, making it accessible for readers from various backgrounds. The comparison table is particularly helpful.

I agree. The article is quite reader-friendly and serves as an excellent introductory guide to banking systems.