Unified Payment Interface (UPI) and Internet banking are two of the most commonly used banking tools which facilitate the user to perform several baking operations through the internet.

Key Takeaways

- UPI enables instant money transfers across banks, whereas Internet Banking allows for various transactions within a single bank.

- UPI relies on mobile phone numbers as unique identifiers, while Internet Banking requires usernames and passwords.

- UPI allows for 24/7 service availability, whereas Internet Banking may have limited hours for certain transactions.

UPI vs Internet Banking

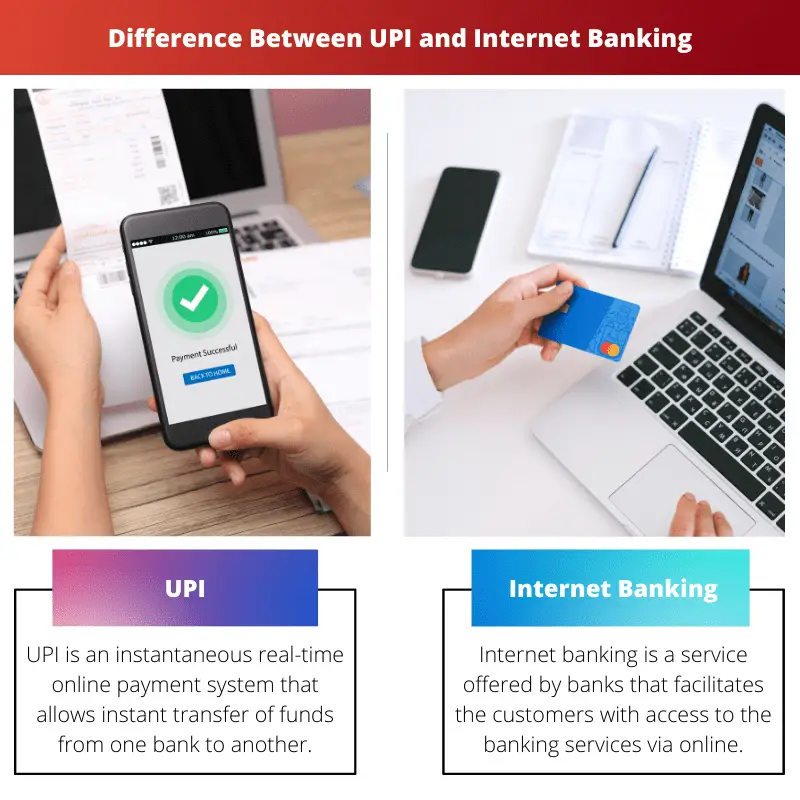

Unified Payments Interface (UPI) is a real-time payment system that allows instant fund transfers between bank accounts in India. Internet Banking, also known as online banking, refers to a banking service that allows customers to perform various financial transactions through the internet.

UPI and Internet banking are used as instant payment systems but require different input levels to complete the transaction. UPI only requires the beneficiary’s Virtual Payment Address (VPA), whereas Internet Banking requires the beneficiary’s bank account details.

Today, more and more people are opting for UPI over Internet Banking owing to its ease of access and lower chances of a transaction error. However, Internet Banking is necessary to perform certain banking operations where UPI is impuissant.

Comparison Table

| Parameter of Comparison | UPI | Internet Banking |

|---|---|---|

| Speed of transaction | The average number of touch inputs from the customer to complete a transaction is 6. | The average number of touch inputs from the customer to complete a transaction is 50. |

| Cost of fund transfer | No extra amount is charged. | A small fee is charged per transaction (Rs. 5 to Rs. 15). |

| Banks offering service | 29 banks. | Almost all banks. |

| Beneficiary addition | Only the Virtual Payment Address (VPA) of the beneficiary is required. | Pre-addition of beneficiary’s details (like bank account number and IFSC code) is required. |

What is UPI?

Unified Payment Interface (UPI) is an instantaneous real-time online payment system that transfers instant funds from one bank account to another. This system can handle transactions from different bank accounts through a single mobile application.

A VPA (Virtual Payment Address) needs to be created by the user to access the services offered by UPI. This VPA is linked to the user’s bank account and represents their financial address.

Hence, the user need not enter all their bank account details, like the account number or IFSC code, every time they wish to avail of one of UPI’s services once the VPA is linked to their bank account.

UPI incorporates a 2 Factor Authentication, which complies with the regulatory guidelines, making this service so secure.

Some of the key features of UPI include the following:

- UPI’s services can be accessed anytime as the platform is completely digital.

- Fund transfers are instant and hence way faster than conventional methods like NEFT.

- Different bank accounts can be accessed using a single mobile application.

- Uses MPIN (Mobile Banking Personal Identification Number) to confirm each transaction as a part of the 2 Factor Authentication.

- Transactions can be done using a scannable QR code with an enclosed VPA.

What is Internet Banking?

Internet banking (or e-banking) is a service offered by banks and financial institutions that facilitates customers’ access to banking services via an online platform. However, to avail of this provision, customers must register for internet banking at their respective banks.

To access the services offered by internet banking, the user must first enter their registered customer ID and password as a login procedure.

Since the e-banking account of a customer holds their vital financial information, security is of utmost importance. Hence, internet banking platforms use two security methods, PINs/TANs and signature-based online banking.

A PIN facilitates the login, and the TANs are one-time passwords that securely approve the transactions. Signature-based online banking refers to e-banking, where all transactions are signed and encrypted digitally.

Some of the key features of Internet Banking include the following:

- Payment for services like mobile or electricity bills (merchant payments) and fund transfers can easily be made.

- The user can open a fixed deposit account without going to the bank.

- Services like ordering a chequebook are incorporated.

- The user can download the account statements.

- Facilitates loan and credit card applications.

Main Differences Between UPI and Internet Banking

- UPI does not require the addition of any beneficiary to transfer the funds; only their Virtual Payment Address (VPA) is sufficient.

To perform a transaction using Internet Banking, the details of the beneficiary, including the bank account number and IFSC code, are required; however, this need not be repeated for every transaction once the beneficiary is added. - UPI can only be accessed through the mobile applications offering this service. Internet Banking can be accessed through a bank’s website or mobile application.

- Transactions made through UPI are currently free. However, banks are planning to induce minimal charges on each transaction.

On the other hand, Internet banking charges around Rs. 5 to Rs. 15 per transaction. - Internet banking offers many services like loan applications, credit card applications and opening a fixed deposit account.

Whereas UPI is used for finding transfer-related work. - UPI has a very high success rate, whereas Internet banking transactions register a 10% lower success rate than the former.

- https://www.igi-global.com/chapter/technological-advancements-in-payments/174877

- https://gujaratresearchsociety.in/index.php/JGRS/article/view/1662

The article’s comparison table effectively summarizes the key differences between UPI and Internet Banking, providing a great visual aid for readers.

I agree, the comparison table is a great addition, enhancing the article’s clarity and understanding.

The in-depth comparison table provides a systematic breakdown of the differences between UPI and Internet Banking, making it easier to understand the nuances of each system.

Absolutely, the article is a valuable resource for those looking to choose between UPI and Internet Banking.

I completely agree. The comparative analysis allows readers to make informed decisions based on their banking needs.

The article provides a comprehensive comparison between UPI and Internet Banking and highlights the key features of both. I found it very informative and useful.

I agree, the article provides a clear understanding of the differences and benefits of both UPI and Internet Banking.

The detailed insights into UPI and Internet Banking are excellent, and it’s great to see the key differences outlined so clearly.

The comprehensive explanation of UPI and Internet Banking features makes this article a must-read for anyone interested in digital banking innovations.

I couldn’t agree more. The detailed insights provided here are truly enlightening.

The comparison of UPI and Internet Banking is well-presented and allows for a clearer understanding of the distinctive advantages and limitations of each system.

Absolutely, the article effectively communicates the practical differences between UPI and Internet Banking.

I appreciated the objective analysis of UPI and Internet Banking, providing readers with valuable insights.

The article’s detailed breakdown of UPI and Internet Banking is both informative and engaging, offering a comprehensive analysis of these digital banking tools.

I couldn’t agree more. The article’s content is invaluable for anyone seeking clarity on UPI and Internet Banking.

While UPI seems to have the upper hand in speed and accessibility, Internet Banking offers a wider range of financial services. The article offers a balanced view of both platforms.

Indeed, the article comprehensively discusses the strengths and weaknesses of UPI and Internet Banking, helping readers make informed choices.

The detailed descriptions of UPI and Internet Banking functions are very enlightening, offering a nuanced understanding of each platform’s capabilities.

Absolutely, the article adeptly explores the intricacies of UPI and Internet Banking, making it a valuable resource for banking customers.

Although UPI is gaining popularity, Internet Banking still has its unique advantages. This article effectively articulates the pros and cons of both systems.

Absolutely, it’s crucial to consider both UPI and Internet Banking as complementary tools in the digital banking landscape.

The article effectively delineates the key characteristics of both UPI and Internet Banking, providing an insightful comparison.