Mobile banking and Internet banking are two different but online modes of banking introduced by the banks only that enable their customers to make transactions whenever and wherever.

Both forms of banking require intense access and have their own uses. Both banking systems have made transactions and other bank-related issues so much easier that all we need today is a few clicks.

Mobile banking is the internet-based banking system by the banks that allows customers to execute their bank-related transactions via their cellular devices. Internet banking is much related to mobile banking only as it enables people to make transactions electronically, with the help of the Internet.

Key Takeaways

- Mobile banking allows you to conduct banking activities through a mobile device, while internet banking can be accessed via a web browser on a computer or mobile device.

- Mobile banking is more convenient for on-the-go banking transactions, such as checking account balances or transferring money. In contrast, internet banking is better for more complex banking transactions, such as applying for loans or managing investments.

- Mobile banking may have limitations on transaction amounts, while internet banking has higher transaction limits.

Mobile Banking vs Internet Banking

Mobile banking is an online transaction that is done using mobile phones or mobile computers. Mobile banking provides limited functions. In Internet banking, an Internet connection is required to make a transaction. In Internet banking, transactions can be done through an electronic device. Internet banking provides a lot of functions.

Mobile banking is an online banking mode by the banks that allows customers to perform transactions via cellular devices like smartphones or the tab.

Mobile banking allows you to make any financial transaction anytime and anywhere because you only need your smartphone. With the introduction of mobile banking, transactions are now at your fingertips within a few clicks.

On the other hand, Internet banking is also a form of online banking that allows customers to perform any financial transaction using the Internet on any electronic device.

Internet banking has contributed a lot to evolving the banking system as with the Internet form of banking, and you do not need to visit the exact branch of your bank for any small or big transaction.

Comparison Table

| Parameters of Comparison | Mobile Banking | Internet Banking |

|---|---|---|

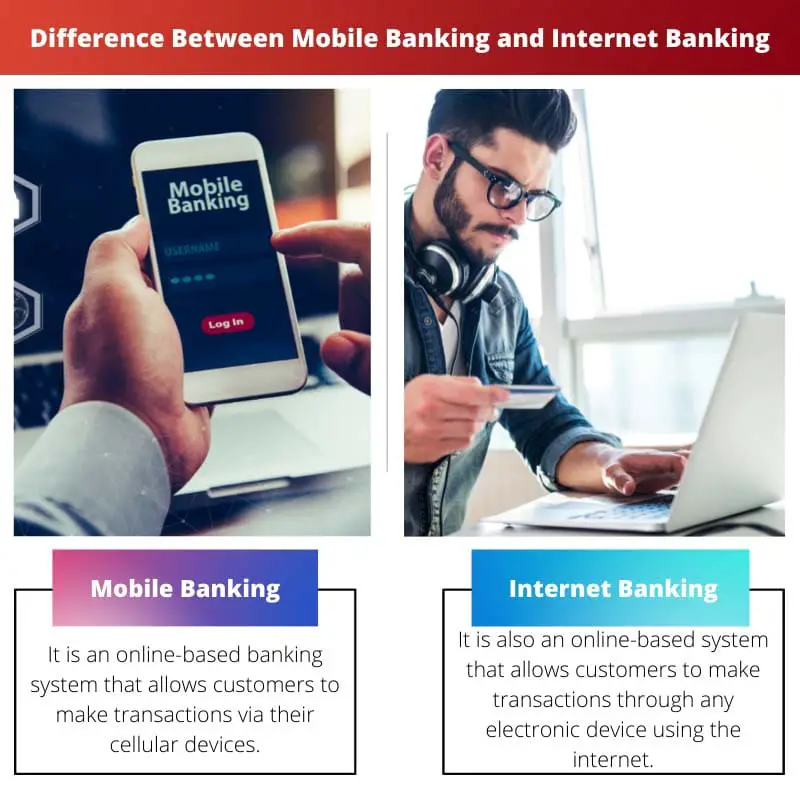

| Meaning | It is an online-based banking system that allows customers to make transactions via their cellular devices. | It is also an online-based system that allows customers to make transactions through any electronic device using the internet. |

| Devices used | Mobile, tab, basically any smartphone. | Desktop |

| Functions | Mobile banking has some limitations in its functioning as it is quite complicated. | Internet banking has comparatively much more functions than mobile banking. |

| Transfer of Funds | Funds are transferred through NEFT or RTGS. | Funds are transferred through NEFT, TRGS, or IMPS. |

| Uses | Mobile banking is used for any short message service or immediate funds transfers. | Internet banking is more used by banks and their websites. |

What is Mobile Banking?

Mobile banking is a banking model that allows you to make transactions via your smartphone. Through mobile banking, you can make transactions anytime and from anywhere.

Many transactions occur from mobile banking, including bill payments, immediate funds transfers, monitoring the balance, booking tickets, etc.

Not just transferring the funds immediately, but the mobile banking system has made online banking much more secure as you can check your balance within a few clicks, get security alerts for any activity in your account, and much more.

In this digital age, mobile banking is the most convenient and easiest way for any bank-related transactions. The fact that it has made the ability to pay or get a check, transfer funds to anyone, and pay bills immediately is the reason why mobile banking has taken up the pace so fast.

What is Internet Banking?

On the other hand, Internet banking is also a form of online banking that allows customers to perform any financial transaction using the Internet on any electronic device.

Internet banking has contributed a lot to evolving the banking system as with the Internet form of banking, and you do not need to visit the exact branch of your bank for any small or big transaction.

In simpler words, internet banking is a system that has enabled people to make financial transactions much more conveniently from anywhere and anytime without any risk to their bank accounts. This can be done within a few clicks by using the bank’s website, and you are all set to go.

Online banking is so used and famous among almost every bank account holder and has made Internet banking a major part of every bank these days.

Main Differences Between Mobile Banking and Internet Banking

- The main difference between mobile banking and internet banking is that in mobile banking, you can make any bank transaction via your cellular device, but in internet banking, you need a desktop, and the transaction will take place at the bank’s website.

- The device needed for mobile banking is just your smartphone or a tab, while in internet banking, you need your laptop or computer.

- Mobile banking has some limitations in its functioning as it is quite complicated, while Internet banking has comparatively much more functions than mobile banking.

- Funds are transferred through NEFT or RTGS, while in Internet banking, funds are transferred through NEFT, TRGS, or IMPS.

- Mobile banking is used for any short message service or immediate funds transfers, while Internet banking is used more by banks and their websites.

- https://www.inderscienceonline.com/doi/abs/10.1504/IJMC.2003.003494

- https://aisel.aisnet.org/cgi/viewcontent.cgi?article=1188&context=jais

Mobile banking and internet banking are truly changing the way we interact with banks and manage our finances. Mobile banking seems more convenient for quick transactions, while internet banking offers more functions for in-depth financial management.

The convenience of mobile and internet banking can’t be overstated. These platforms have made banking accessible to a much wider audience.

I agree, both modes of banking offer different but essential functions and advantages. They have revolutionized the way we handle money and access to financial services.

Understanding the differences between mobile and internet banking helps users make informed decisions about which platform is best suited for their needs.

Absolutely, it’s essential for consumers to be aware of the capabilities and limitations of each type of banking. Both options provide valuable financial management tools.

Agreed, the convenience of mobile and internet banking empowers individuals to take charge of their financial transactions and monitoring.

The evolution of banking services through mobile and internet platforms has enabled customers to engage in banking activities with a level of convenience and immediacy that was previously unavailable.

The rise of mobile and internet banking has fundamentally reshaped consumer interactions with financial institutions, providing a new level of convenience and accessibility.

Absolutely, the digital transformation of banking has been instrumental in streamlining financial processes and enhancing customer experience.

The ease of access and flexibility offered by mobile and internet banking have made banking more seamless and convenient for users.

Absolutely, the ability to manage finances on-the-go and from remote locations has simplified our daily banking activities.

The realm of financial management has been revolutionized by the advent of mobile and internet banking, providing consumers with unprecedented levels of accessibility and control over their accounts.

The integration of technology into banking services has enhanced consumer empowerment, making financial transactions more efficient and user-friendly.

Mobile banking and internet banking complement each other, offering users different levels of access and functionality. Both play a crucial role in our financial lives.

Indeed, the banking landscape has been significantly transformed by these digital platforms. Customers now have unparalleled control and convenience over their finances.

The distinction between the two systems is certainly important. Mobile banking is great for simplicity and speed, but internet banking provides more comprehensive services.

The distinction between mobile and internet banking services is vital for users to leverage the most suitable banking platform for their needs.

Absolutely, being aware of the capabilities of these systems allows people to make better use of banking technology.

Understanding the nuances of mobile and internet banking enables individuals to make informed financial decisions and utilize the right tools for their transactions.

The emergence of mobile and internet banking has truly brought banking services directly into the hands of consumers. It’s a game-changer in the finance industry.

The expansion of mobile banking and internet banking has brought banking services to new heights in terms of accessibility and efficiency.

Indeed, technology has reshaped the banking experience, giving customers much greater control and flexibility in managing their finances.

Mobile and internet banking have redefined the way we approach financial transactions. The benefits of these platforms extend beyond mere convenience, offering users unprecedented flexibility and control over their accounts.

Absolutely, the digitization of financial services has empowered consumers to manage their banking activities with unparalleled ease and efficiency.