Mobile money and Mobile Banking are separate terms for a modernized cashless transaction. Mobile money and Mobile banking are maintained by the financial institution that provides the service for the users.

Key Takeaways

- Mobile money allows users to make transactions using their mobile devices, while mobile banking involves traditional banking services through mobile devices.

- Mobile money services are provided by mobile network operators or third-party providers, while banks provide mobile banking.

- Mobile money services are more prevalent in developing countries with limited banking infrastructure, while mobile banking is more common in developed countries with established banking systems.

Mobile Money vs Mobile Banking

The difference between Mobile money and Mobile banking is that mobile money enables only person-to-person (P2P) payments, and Mobile banking enables all kinds of transactions in addition to other services.

Through Mobile money, one can pay, receive and store money with the help of a mobile phone and the internet. On the other hand, Mobile banking is a service the bank provides customers for all kinds of transactions and other features using a phone or tablet and an internet connection.

Mobile money is a means of cashless transaction which helps pay bills or buy goods online with the help of a phone and Internet connection.

Mobile banking is also a means of cashless transactions with the help of a phone and an internet connection, but it provides more facilities to the users. The user can have all the banking services at the fingertip without visiting the bank or atm.

Comparison Table

| Parameter of Comparison | Mobile money | Mobile banking |

|---|---|---|

| Bank account | It does not need the user’s Bank account. | It does require the customer’s bank account. |

| Provider | The financial service provider company runs mobile money. | It is a bank product run by the bank. |

| Transactions | Transaction of Person to Person (P2P) payments takes place. | All kinds of transactions take place. |

| Services | It acts as a Mobile wallet | Acts as Net banking |

| Banking | It is agent banking. | It is a branch banking of the bank. |

What is Mobile Money?

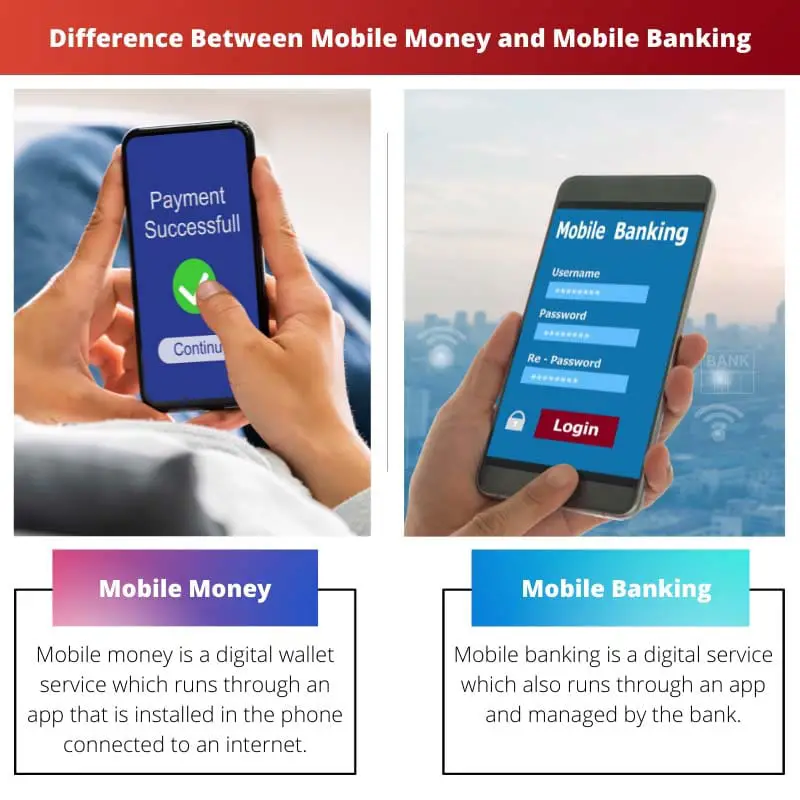

Mobile money is a digital wallet service that runs through an app installed in the phone, and it works when the phone is connected to an internet connection. It is a means of storing and managing money in an account linked to a phone number.

Mobile money enables its users to go cashless while making payments. The user can store cash, purchase items, pay bills and receive money using mobile money.

It mainly allows Person to Person, i.e. P2P payments, which are easy and safe.

It is modern technology, and its service is provided worldwide with increasing popularity in Africa, Asia, and Latin America. It is fast, easy to use, secure and can be used in remote areas with a mobile phone signal.

Some of the advantages of using Mobile money:

- Safe: Mobile money is a secure transaction between person to person, and no third party is involved.

- Fast: Mobile money is fast as it works through the internet; the money can be sent or received instantly, even in remote areas.

Cheap: Mobile money is cheap because it does not charge high taxes from the user whenever a payment is made.

What is Mobile Banking?

Mobile banking is a digital service that runs through an app and is managed by the bank. Mobile banking enables its customers to make all kinds of transactions, locate ATMs, pay loans and other services.

Mobile banking service is provided by the bank, which allows its users to conduct any transaction from any place remotely using a mobile phone or tablet with internet access. It makes the work of the user more accessible; one does not have to wait in long queues at the bank for any transaction or any other work.

The customer can maintain mobile cheque deposits through mobile banking apps using a smartphone camera. The customer can also generate e- passbook or change the phone number linked to the account with the help of mobile banking.

It is like having the bank in your hands.

Some of the advantages of Mobile banking:

- Accessibility: It is easy to access from anywhere and anytime. We can use a mobile banking app to check our account 24 hours and seven days a week.

- Convenience: It is a way to save time. Many mobile banking apps provide mobile cheques deposit; with this feature, users can deposit a cheque right from the home, office, or anywhere. One does not have to wait in long queues anymore.

- Good Security: Mobile banking apps provide good security by providing multi-factor authentication. But one should remember that they should never share the codes with others. Some phones and apps come with many security features, like scanning fingerprints or scanning faces. One can lock their phones and apps with such features.

Main Differences Between Mobile Money and Mobile Banking

- Mobile money allows the user to only pay, receive and store money, whereas Mobile banking allows all kinds of transactions with other bank services.

- Mobile money is a person-to-person payment service, whereas Mobile banking is not only a person-to-person payment service but also it does all kinds of transactions.

- Mobile money requires the user’s phone number, not the user’s bank account, whereas Mobile banking requires the user’s bank account.

- Mobile money is managed by the app companies, whereas The bank manages mobile banking.

- Mobile money acts like a mobile or digital wallet, but Mobile banking acts as net banking for the user.

This post provides a thorough insight into mobile money and mobile banking. The advantages and functionalities of each service are well-delineated, making the comparison immensely educational.

Absolutely. It’s quite a comprehensive guide for anyone looking to understand the difference between mobile money and mobile banking, and it manages to present the information in a clear and engaging manner.

I couldn’t agree more. The level of detail in the post is commendable, and the illustrations aid in conveying the nuances of mobile money and mobile banking effectively.

The advantages of mobile money and mobile banking are well-presented in the post, making it easier to comprehend the features and benefits that each option offers.

Absolutely right. The post provides a comprehensive overview of both mobile money and mobile banking, giving the readers a clear picture of what each service entails.

The article does a great job of highlighting the benefits of mobile money as well as mobile banking. The explanations are clear and precise, making it an informative read.

The post elaborates on the various aspects of mobile money and mobile banking comprehensively. The detailed descriptions provide readers with a well-rounded understanding of these cashless transaction methods.

Absolutely. The informative nature of the post is commendable, and it untangles the complexities of mobile money and mobile banking, providing readers with a wealth of valuable knowledge.

Indeed. The article delves into the intricacies of mobile money and mobile banking, offering valuable insights that enhance the reader’s grasp of these contemporary financial services.

The comparison table is a great visual representation of the differences between mobile money and mobile banking. It enhances the understanding of their varying features and functionalities.

I completely agree. The table simplifies the contrast between mobile money and mobile banking, making it convenient for readers to grasp the distinctions.

This is a very comprehensive comparison between mobile banking and mobile money. The advantages of each method are well explained, and it really helps to understand the key differences between the two.

I agree, the post provides a clear distinction between mobile money and mobile banking. The comparison table and key takeaways are really helpful, making it easier to comprehend the differences.

The post is a rich source of information, shedding light on multiple elements associated with mobile money and mobile banking. The content is well-researched and provides a compelling understanding of these transactional services.

I share your sentiment. The depth of analysis in the post is truly impressive, and it’s an invaluable resource for individuals looking to comprehend the intricacies of mobile money and mobile banking.

The post effectively differentiates mobile money from mobile banking, and the advantages associated with each service are articulated in a manner that’s both enlightening and engaging.

Absolutely. The author has done a remarkable job of presenting the details, and it’s certainly an informative piece for readers seeking to understand the key disparities between these services.

I find it interesting that mobile money is more prevalent in developing countries with limited banking infrastructure, while mobile banking is more common in developed countries. The post sheds light on this aspect very effectively.

I totally agree. It’s an aspect that many people might not be aware of, and the post gets into the details, giving a deeper understanding of these differences.

The geographical prevalence of mobile money and mobile banking is indeed intriguing. The article explains this disparity quite convincingly.

I wasn’t aware of the significant differences between mobile money and mobile banking until reading this post. It’s an eye-opener and provides valuable insights into the features and advantages of each option.