As the word suggests, Marine Insurance protects against damages caused during transit via the sea. It has various subtypes and provides for any losses incurred during the journey until the goods reach their destination.

Key Takeaways

- Marine insurance covers the risks associated with shipping goods by sea, while cargo insurance specifically covers the loss or damage of goods during transit.

- Marine insurance covers a wider range of risks, including damage to the ship or crew, while cargo insurance is more focused on the cargo itself.

- Marine insurance is required by law for ships and shipping companies, while cargo insurance is optional and can be purchased by the shipper or receiver of the goods.

Marine vs Cargo Insurance

The difference between Marine Insurance and Cargo Insurance is that marine insurance covers a lot of benefits, and the insured party gets an option to choose from the subtypes. In contrast, cargo insurance covers the losses that are caused due to timing delay of the ship or an accident as it is only a subtype of marine insurance.

On the other hand, Cargo insurance is also a subtype of Marine insurance. It also covers damages caused to goods in transportation via land and air.

It protects freight if any damages are caused to the products in transit.

Marine and cargo insurance are both essential for the protection of goods during international trade, but marine coverages also encompass many other aspects.

Comparison Table

| Parameter of Comparison | Marine Insurance | Cargo Insurance |

|---|---|---|

| Scope | Marine Insurance has a lesser extent. | Cargo insurance has a broader scope. |

| Subtypes | Its subtypes include Hull Insurance, Cargo Insurance, Freight Insurance and Marine Liability Insurance. | Its subtypes include land cargo and marine cargo insurance. These are further divided into categories based on duration. |

| Risk covered | It protects against damages caused due to perils of the sea based on the plans chosen. | It covers the risk of damage caused due to lightning, fire, explosion, storm, earthquakes, etc. |

| Type of Transportation | Marine Insurance only includes sea transits. | It provides for losses against damages caused during transit via land, sea or air. |

| Introduction | The first marine insurance company was Lloyd’s Coffee House. | It’s the first type of marine cargo insurance introduced by Edward Lloyd. |

| Customization | It is highly customizable. | It does not provide as many customization options as marine insurance. |

What is Marine Insurance?

Edward Lloyd introduced marine insurance in the 1680s. The overseas trade from London has made marine insurance a necessity.

Lloyd owned a coffee shop which the merchants and ship owners frequented. Thus, he started the first marine insurance company, Lloyd’s Coffee House.

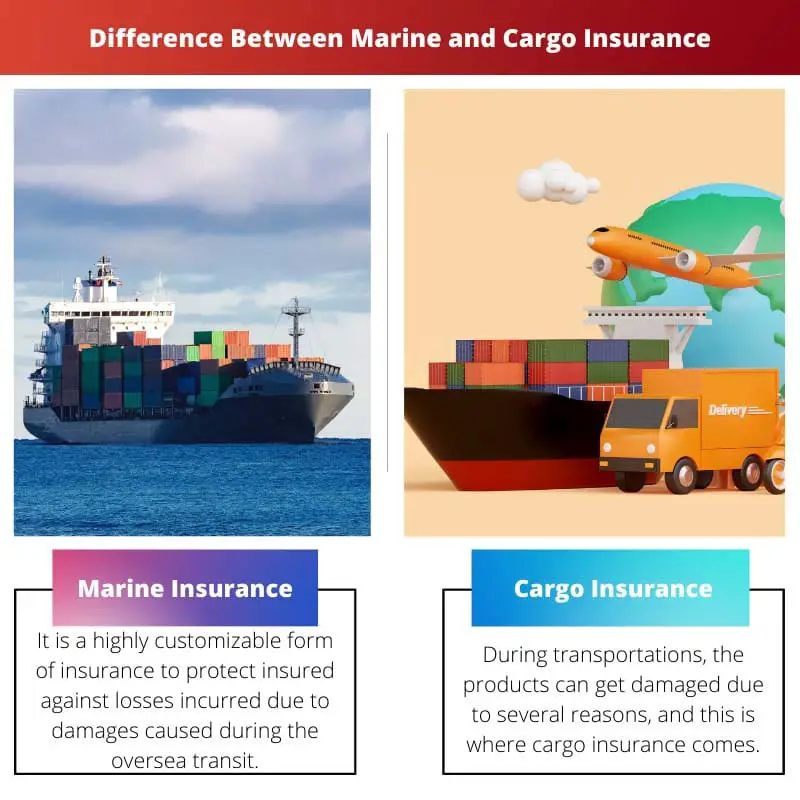

It is a highly customizable form of insurance to protect the insured against losses incurred due to damages caused during oversea transit. There are different types of Marine Insurance: Hull insurance, Cargo Insurance, Freight Insurance and Marine Liability Insurance.

Hull insurance provides for losses caused because of waterborne damages. Freight insurance protects the insured against freight losses caused by cargo loss or accident.

Marine Liability insurance is to provide for damages caused due to collisions or crashes.

What is Cargo Insurance?

Cargo refers to the goods that are being transported. During transportation, the products can get damaged for several reasons, which is where cargo insurance comes into play.

Any damage caused to the goods is covered by cargo insurance. This includes accidents caused during transit via air, sea or land.

This provides security to the insured until the time goods reach their destination.

Land cargo provides for losses caused by collisions, theft, etc. it is within the country’s boundaries. Marine Insurance covers losses for reasons like damages while loading/unloading, weather conditions, etc.

Other types of cargo insurance include open cover cargo, specific cargo, contingency cargo insurance, etc. Based on risk, cargo insurance can be categorized into all dangers, free of particular averages and shipment by shipment insurance.

In all risk coverage types of cargo insurance, the insured is even protected against damages caused due to improper packaging, abandonment, infestation, rejection, invasion, fire, riots, etc. The free of particular average insurance type covers losses caused due to collision, weather conditions, sinking, theft, earthquake etc.

The shipment by shipment insurance type provides for losses caused due to damages to the shipping vessel. Acts of war and God are excluded from the coverage.

Main Differences Between Marine and Cargo Insurance

- Marine Insurance is only for goods transported via sea through ships and other vessels. Cargo insurance provides for damages to products in transit via land, sea or air.

- Marine Insurance is divided into four categories: Hull, Cargo, Freight, and Marine Liability Insurance. Cargo insurance is divided into two groups, namely land cargo and marine cargo.

- Edward Lloyd introduced Marine Insurance, whereas Cargo insurance came into existence with its subtype, i.e., marine cargo, which was also a part of marine insurance.

- Marine Insurance is highly customizable, whereas Cargo insurance is not as customizable as compared to the former.

- Marine Insurance has a limited scope as it is restricted to travel via sea, whereas cargo insurance covers land, sea and air, thus, having a broader reach.

- https://heinonline.org/hol-cgi-bin/get_pdf.cgi?handle=hein.journals/tulr66§ion=19

- https://nsuworks.nova.edu/cgi/viewcontent.cgi?referer=https://scholar.google.com/&httpsredir=1&article=1118&context=ilsajournal/

The article does a good job comparing marine and cargo insurance, but it could benefit from a more detailed look at specific case studies where these types of insurance were beneficial or insufficient.

Agreed. Case studies would make the content more engaging.

I think that’s a valid critique. Going beyond the theoretical differences to real-world examples would add depth to the article.

The historical background surrounding the introduction of marine insurance by Edward Lloyd is fascinating. It enriches the content with a broader context.

The historical narrative provides a captivating backdrop to the discussion of marine insurance.

I found the historical context to be an engaging addition to the article.

The article doesn’t sufficiently address the potential drawbacks of cargo insurance. A more thorough examination of its limitations would enhance the overall presentation.

I share your view. A balanced discussion of the limitations would provide valuable insights.

It’s refreshing to see the article delve into the customizable aspects of marine insurance. The emphasis on customization adds subtlety to the discussion.

I found the focus on customization to be an enlightening aspect of the article.

The in-depth exploration of customization in marine insurance is certainly noteworthy.

The comparison table is a helpful summary of the key differences between marine and cargo insurance. It provides a quick reference for understanding the nuances of each type of insurance.

I found the table to be a great visual aid. It complements the written content effectively.

The coverage of different types of cargo insurance and their risk categories provides a comprehensive understanding of the subject. The article’s detail is commendable.

I concur with your sentiment. The comprehensive analysis of cargo insurance subtypes is indeed commendable.

The thorough explanation of the types of cargo insurance and their coverage is commendable. The article’s focus on detail is praiseworthy.

I concur with your appreciation of the detailed coverage of cargo insurance. It’s well-presented.

Absolutely, the comprehensive exploration of cargo insurance subtypes is praiseworthy.

This article lacks in-depth analysis of the potential drawbacks or limitations of marine and cargo insurance. A more balanced view would be beneficial.

A critical examination of the limitations of marine and cargo insurance is indeed warranted.

I share your sentiment. Exploring the downsides of these insurance types would offer a more comprehensive perspective.

It’s interesting to learn about the historical background of marine insurance and how it originated from Lloyd’s Coffee House. Contextualizing the information adds value to the topic.

I never knew that about the origin of marine insurance. It’s a fascinating historical tidbit.

I agree, the historical background provides a rich foundation for understanding the topic.

This article is an excellent overview of the differences between marine and cargo insurance. The explanation of the subtypes and coverage is very informative.

I agree with your positive take on this article. It’s clear and concise, making it easy to understand.