As a buyer or seller, both persons are engaged in commerce. It was originally exchanged goods and services directly between two people or by barter.

It was sometimes called trade. Money was then coined as an auction, and credits were then bought.

This resulted in the complication of trading and the introduction of accounting processes that allow individuals and companies to handle their costs correctly and, in the case of credit users, payable or liabilities.

The management of these accounts includes a strong knowledge of accounting principles and the economics of the company. These accounts can be used in an organization to help the firm build a more coherent cash balance while also encouraging stock to be sold for short-term profits.

Key Takeaways

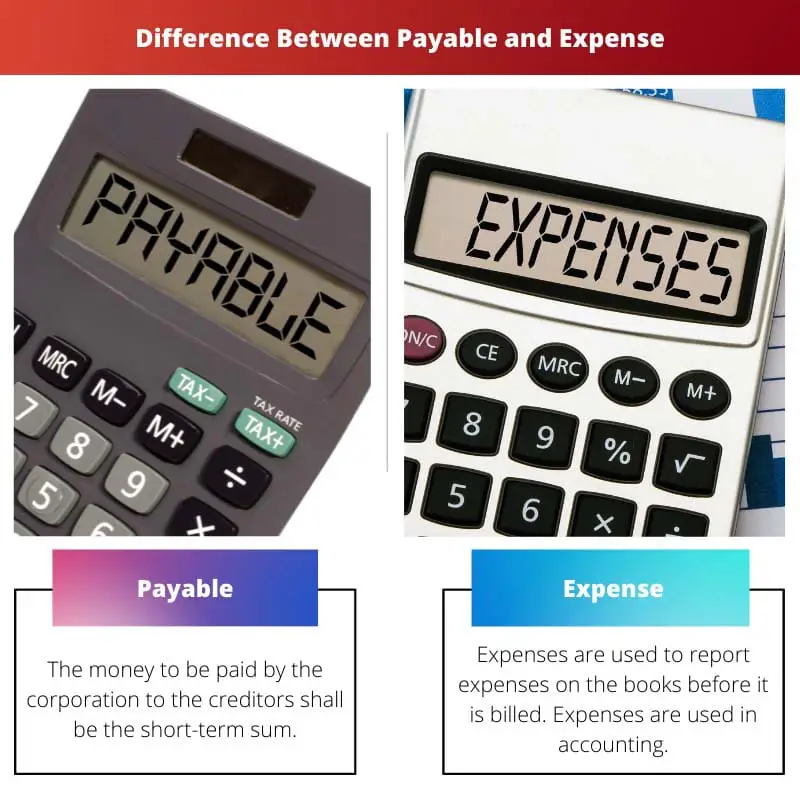

- Payable refers to an amount a person or organization owes to another party. In contrast, the expense is incurred by a person or organization while doing business.

- Payable is recorded as a liability on the balance sheet, while expense is registered as an expense on the income statement.

- Payable is paid later, while expense is paid at the time of purchase.

Payable vs Expense

Payable is the amount of money the firm or corporation must pay the creditors. When a company borrows a loan to buy goods or services, it is also added as payable to the balance sheet. The term ‘expense’ can be used to define the expenditures. Rent or income are examples of expenditures. A Bank loan is also considered as an expense.

A payable means an existing obligation or loan to be settled on the terms and conditions negotiated by all parties. Examples include electrical costs, cable bills, and phone bills, which already require users to use the service and are granted later payment of a fee.

The spectrum of payable payments in the industry is wider and more complex. Invoices and checks are used, and newspapers are held in which all payables are specified.

Expenses are the payment of money for goods and services to another individual. You are charged when you pay for the rent or buy food, drugs, automobiles, or clothing.

In business and accounting, a charge refers to the cost of generating income charged to another person or business company in cash or value. It triggers a decrease in the value of a company and a liability acquisition.

Comparison Table

| Parameters of Comparison | Payable | Expense |

|---|---|---|

| Meaning | The money to be paid by the corporation to the creditors shall be the short-term sum. | Expenses are used to report expenses on the books before it is billed. Expenses are used in accounting. |

| Occurrence | Payable only occurs when credit is purchased. | Expenses are used in both organizations. |

| Example | Only documents owed to creditors are payable. | Rent, income, interest on bank loans. |

| Balance Sheet | These payments are an integral part of the daily routine and are seen on the balance sheet as payable. | Expenditure is intermittent and is classified as Expenditure as the existing debt in the balance sheet. |

| Counter- party | The costs will be paid to staff and banks. | These expenses are reported only when creditors are paid. |

What is Payable?

The payable shall include all costs arising out of credit transactions by suppliers/sellers of products or services. Present obligations are payable and are due within 12 months of the transaction date.

In balances, the most commonly incurred non-financial costs include benefits, wages, interest, and royalties.

Both costs incurred by purchasing credit for products or services from suppliers shall be included in accounts payable. Present obligations that are to be accrued in the near term are accounts payable.

This concept is used to describe the short-term debt of a corporation which has to be taken out to prevent default within a certain period.

In the case of balance sheets, non-financial costs also used in the grouping include pay, compensation, interest, and royalties. The accounts payable are reported on a balance sheet when the company purchases goods or services on loan.

Only documents owed to borrowers are used in accounts payable.

What is Expense?

The word is used to build up. If an enterprise costs, this means that there is a growing proportion of outstanding bills.

The Accrual accounting principle says that all inflows and outflows should be registered. If real cash is paid or not, this is done.

That is the most recognized in the accounts before the invoice.

Examples are services used for a whole month but obtained at the end of the month. Workers work for the whole time but pay the staff at the end.

Consumption of services and merchandise, but no submitted invoice. At the close of the financial period and the adjustment of entries necessary to represent current costs, the accrued expenses are reported on the balance sheet.

This is because these expenditures must always be measured and updated to account for the full sum after receipt of bills. There are mostly costs such as rent, bank loans, and salaries where every month payments are made.

Accumulated costs, or accumulated liabilities, are accumulated over the course of time. The portion of outstanding bills increases as a company collects costs.

Main Differences Between Payable and Expense

- Expenses are an accounting term in which the expenses are reported in the ledger before they are charged, whereas payables are the money to be paid by the corporation and are short-term payable to the creditors.

- Expense is intermittent and is classified as an expense as the existing debt in the balance sheet, whereas payable as an existing obligation on the balance sheet is part of the daily operation.

- Expenses are used in both organizations, whereas payable only occurs when credit is purchased.

- Expenses are items you owe, but there are no invoices for a time, whereas the invoices issued from the company are payable.

- By the end of the financial year, expenses are realized on the balance sheet and remembered by the adjustment of journal entries, whereas payables recorded on the balance sheet are the business purchases of goods or services in cash.

The post provides a comprehensive explanation of payable and expense, elucidating their importance in financial transactions and accounting principles.

Absolutely, the post serves as an informative resource for clarifying the concepts of payable and expense.

Indeed, the post is insightful for understanding the financial implications of payable and expense.

The post provides a comprehensive overview of payable and expense, emphasizing their significance in business and financial management.

The post effectively elaborates on the meaning of payable and expense, emphasizing on their use in accounting and financial management.

The comparison table is quite insightful in highlighting the differences between the two concepts.

The in-depth explanation of what constitutes an expense and a payable is beneficial for students and professionals alike.

I agree. The post not only defines the terms but also explains their significance in accounting practices.

Absolutely, the post offers valuable knowledge for anyone looking to understand financial management.

The post effectively explains the intricacies of payable and expense, shedding light on their importance in business operations and financial reporting.

Indeed, the comparison of payable and expense provides a comprehensive understanding of their roles in financial management.

Absolutely, the post articulates the significance of these financial terms in organizations.

The detailed explanation of payable and expense is insightful, offering valuable knowledge for individuals interested in accounting and economics.

I agree. The article effectively outlines the significance of payable and expense in accounting practices.

The article provides a comprehensive explanation of the concepts of payable and expense, as well as their importance in business and accounting.

Indeed, it’s very informative and useful for those interested in accounting and economics.

It’s true, the post can be a good resource for students or professionals who want to have a deeper understanding of these financial concepts.

The differentiation between payable and expense is well-illustrated, providing clarity on their occurrence and reporting in accounting.

Indeed, the post is a valuable reference for understanding the complexities of financial accounts and their implications.

The post does a great job of comparing payable and expense, providing clear insights into their distinctions and relevance.

The comparison table is particularly useful in understanding the features of payable and expense.

The concept of payable and expenses are clearly explained in the post, which is helpful for people who want to improve their knowledge in this area.

Absolutely, the post provides clarity on the important differences between payable and expense.

The key takeaways at the end of the post summarize the main points effectively.