Internet Banking and Debit card are two different methods of conducting monetary transactions.

Key Takeaways

- Access: Internet banking requires online access to a user’s bank account, while debit cards are physical cards connected to a user’s bank account.

- Transactions: Internet banking allows users to perform various banking transactions online, while debit cards enable users to make payments and withdraw cash from ATMs.

- Security: Internet banking employs login credentials and multi-factor authentication, while debit cards use a personal identification number (PIN) and card verification value (CVV) for security.

Internet Banking vs Debit Card

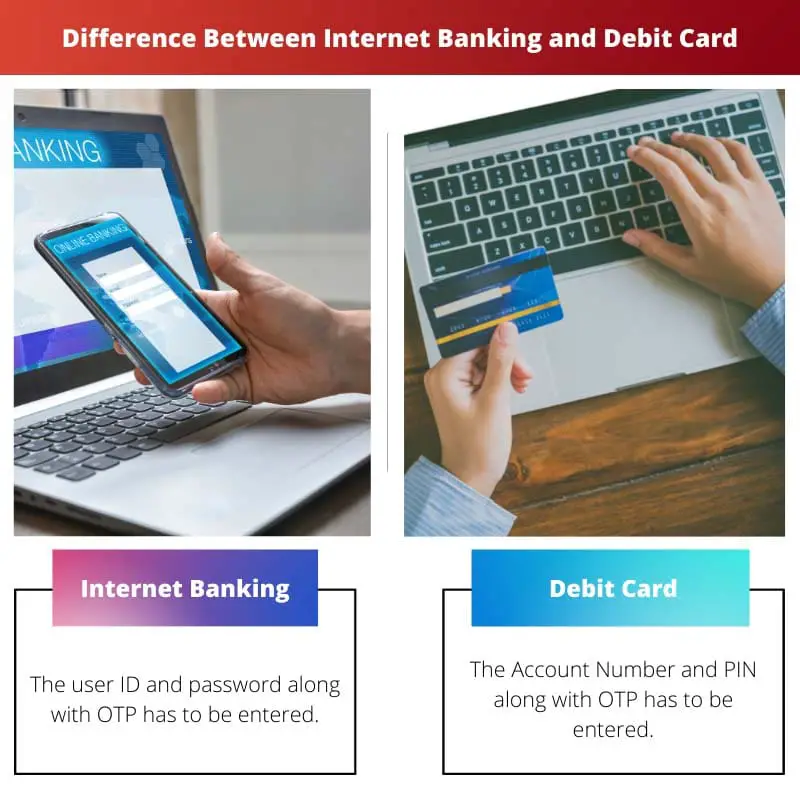

The difference between Internet banking and debit card is that while using Internet Banking, the customer is supposed to have an online account on their bank’s official website, and the user ID and password are used for the transaction. On the other hand, in the case of the Debit Card, the customer has to enter their account number and PIN to carry out the transaction online.

Internet banking is carried out through the bank’s official website, whereas the account number must be entered to use a Debit Card. The Debit Card is also used to withdraw cash from the ATM.

Internet Banking is a system that facilitates the online transfer of funds from account to account through the customer’s net banking account.

A debit Card is a card(plastic) used during transactions to avoid using cash.

Comparison Table

| Parameter of Comparison | Internet Banking | Debit Card |

|---|---|---|

| Method of transaction | The user ID, password, and OTP must be entered. | The Account Number, PIN, and OTP must be entered. |

| Safety | No credentials are saved with Merchant’s website, thus safe. | Banking details are saved with the website, thus unsafe. |

| Authentication Steps | OTP/IVR verification steps are taken. | 3D Secure Verification steps taken. |

| Process | Transactions are routed through banks. | Transactions are routed through card issuers like VISA and MasterCard. |

| Offers and Loyalty Points | It does not provide cashback, recommendations, or loyalty points. | Provides up to 1-2% cashback, loyalty points, and multiple offers on Debit Card. |

What is Internet Banking?

Internet banking is an arrangement that offers the ability of a customer to carry out monetary transactions from their banking account. Using the bank’s official website, the user can transfer funds to other versions of the same bank or a different bank from their account.

The intermediate that facilitates this technology is the Internet. It acts as the medium.

To carry out internet banking, electronic devices are needed. Generally, a mobile phone, computer or laptop is used.

Internet banking is made available to customers through and by the banks. To avail of this facility, the customer must have an account in any bank.

When you pay through internet banking, then as you select the payment through internet banking option you are directed to the bank’s login site. There you enter your id and password.

Then you confirm your payment by accepting the terms and receive an OTP (one-time-password), after which the transaction is complete.

The benefits of net banking are:

- It doesn’t need you to enter the card number, CVV number, etc., every time you make a payment.

- Internet banking transactions are routed through the bank.

- Internet banking has another ladder of authentication provided by OTP on your mobile phone, making transactions more secure.

- The cost of internet banking transactions to banks is cheaper than that of a debit card transaction.

- Internet banking also provides various functions like the creation of RD, the result of FD, account statements, and the best functionality of paying off bills.

What is Debit Card?

It is a card for payment that subtracts money straight from the customer’s savings account to carry out a transaction. Debit cards eradicate the use of cash or cheques and cut the money directly from your savings.

Debit cards are distributed by processors such as Mastercard or Visa.

When you choose payment through a debit card, then on the service provider’s or merchant’s website, you have to enter your debit card number, which is a 16-digit or, in some cases 19, digit number, which gets saved on these websites. After saving these numbers, you are directed to the bank’s website, where you must give your card PIN to complete the transactions.

In the case of Debit cards, the transaction has to be routed through an Acquiring Bank (not the same as the Debit card issuing bank, in most cases) that, in turn, communicates with an integrated gateway and Switch of that bank.

The transaction then, via a card Network (Mastercard/Visa, etc.), get routed to the Debit card issuing bank, where it gets authorized after checking for funds in the cardholder’s account by the CBS of the (issuing) bank. The approved/declined message is returned to the Merchant and the customer through the same route.

Main Differences Between Internet Banking and Debit Card

- The main difference between Internet Banking and Debit Cards is that the transaction happens in the customer’s bank domain in net banking. The customer is routed to his bank domain. While A debit or credit card transaction happens in the acquirer domain, i.e. card number is captured by the payment processor/acquirer.

- In Internet Banking, no credentials are saved on the website where the transaction is being carried out, whereas, while using the Debit Card, account details are saved with the Merchant’s website.

- In Internet Banking, OTP(one-time-password) or IVR( interactive voice response) system. is set into place for authentication, while a Debit Card uses the 3D secure System.

- The primary difference between paying through Internet banking and a Debit card is that you will get an 8-digit OTP for Net banking and 6 digit OTP for Debit cards.

- It is not possible to withdraw cash through Internet Banking. Whereas through a Debit Card, cash withdrawal can be made by using an ATM and entering the PIN.

- http://acadjournal.com/2007/V20/part6/p2/

- https://www.sciencedirect.com/science/article/pii/S0148296316301904

The cost comparison and functionality of internet banking in handling various financial tasks are highlighted well. This article serves as a valuable resource for users.

Absolutely, the enhanced functionality of internet banking is worth considering for one’s financial management.

Yes, the cost-effectiveness of internet banking opens new perspectives for considering this method over traditional debit card transactions.

I appreciate the in-depth explanation about the safety and authentication steps involved in both internet banking and debit card transactions. This was very enlightening.

Yes, it’s crucial to place a high value on security when it comes to handling financial transactions. This article does a great job in emphasizing that.

The article effectively outlines the benefits and functionalities of internet banking and debit cards, giving users a thorough understanding of both mechanisms.

Absolutely, the features and security aspects of both methods are presented comprehensively for users to make informed decisions.

This article provides a comprehensive comparison between internet banking and debit cards, which is really helpful for users to understand the distinction between these methods of monetary transactions.

Definitely! Understanding the differences and safety measures associated with each method is crucial for financial security.

It’s fascinating to see the detailed breakdown of how internet banking and debit card transactions occur, as well as the safety measures implemented. This is very insightful.

Indeed, the article is a valuable educational resource for understanding the nuances of financial transactions through different methods.

This comparison table provides a concise view of the differences between internet banking and debit cards, making it easier to discern which method suits individual needs best.

Agreed, the table helps to clearly understand the varying aspects of these monetary transaction methods.

I find the explanation of internet banking and debit cards to be thorough and informative, especially in terms of how each transaction is carried out and the safety measures involved.

Indeed, the article helps in weighing the pros and cons of both methods to make more informed financial decisions.

Absolutely, this allows users to make informed choices based on their preferences and security concerns.

It’s quite interesting to note the differences in offers and loyalty points between internet banking and debit card transactions. The additional benefits of each method are clearly outlined.

Yes, it’s intriguing to see how these methods differentiate in terms of providing incentives to users.

Absolutely, the breakdown of offers and loyalty points helps in assessing the overall value of each transaction method.

The article’s comparison between internet banking and debit cards offers a comprehensive view of their functionalities and security, providing valuable insights for users.

Yes, the breakdown of features and security measures assists in making more informed decisions about monetary transactions.

Absolutely, the detailed comparison helps users to weigh the advantages and disadvantages of both methods effectively.

While both methods offer convenience, it’s apparent that the safety and authentication measures in internet banking provide an added layer of security compared to debit cards. Good to know.

Absolutely, and the cost-effectiveness of internet banking for banks is an interesting point to consider as well.