Loan and Debt both link to the term money. Basically, for an ordinary man, both are liabilities that need to be paid off. Most people use these words synchronously but have slightly different perspectives.

Key Takeaways

- A loan is a specific type of debt where a borrower receives a sum from a lender, agreeing to repay the principal amount and interest over a specified period.

- Debt is a broader term that encompasses any amount of money owed by one party to another, including loans, bonds, and credit card balances.

- Both loans and debts represent financial obligations, but loans are a more specific form of debt with agreed-upon terms and conditions for repayment.

Loan vs Debt

The difference between a loan and Debt is that money borrowed from a lender and the bank is called a loan, and money borrowed through debentures and bonds is called Debt. Loans are readily available through some typical paperwork, and there are various loan types according to your fit with their plans.

But then, you have a specific rate of interest that you need to pay monthly or might be penalized.

Debts are more easily obtainable, and you can get any amount you want, irrespective of your background. Some obligations might not require monthly interest to pay.

Comparison Table

| Parameter of Comparison | Loan | Debt |

|---|---|---|

| Character | When a person wants to flourish his business, build his own home, or want to study abroad, he applies for a loan from a bank or any other financial institution. | Finally, when the man is hard-pressed by the loan amounts, he asks for a debt from any individual to pay off his loan. |

| Scheme | Some principal amount is to be paid monthly along with the rate required. | Here the top rate is paid at the maturity level with some interest at regular intervals or no rate at all. |

| Lender | The lender is primarily a Bank or other financial institution. | The lender can be any individual, like your friend or a nonprofit organization. |

| Flexibility | The lenders have set up some rules which you have to abide by, or you shall be penalized. | You have the flexibility to pay whenever you are ready. |

| Security | They are safe and have options to reschedule your payments. | You can be threatened for not paying. |

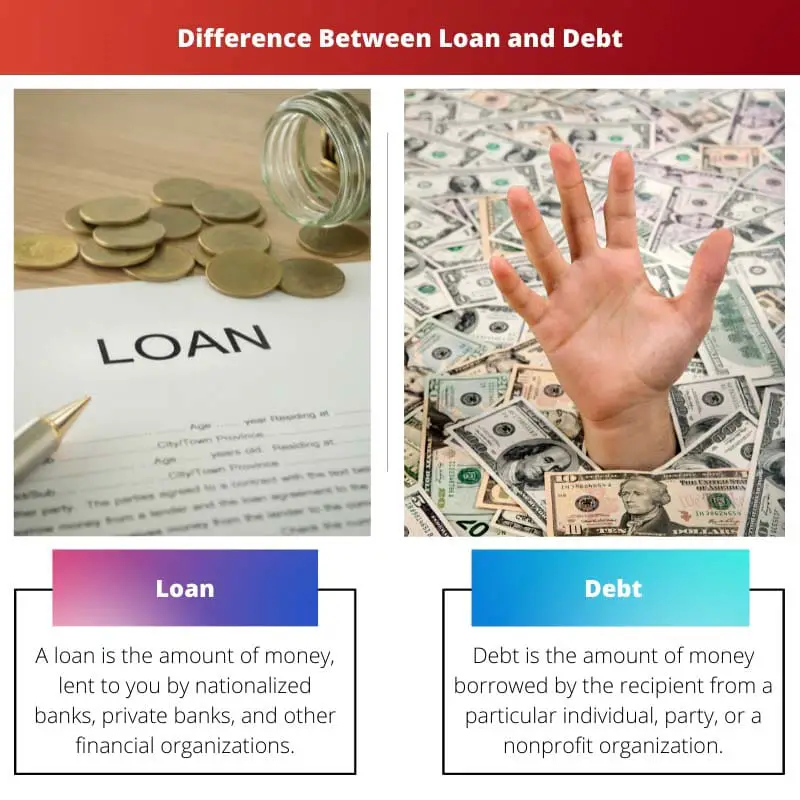

What is Loan?

A loan is the amount of money lent to you by nationalized banks, private banks, and other financial organizations and expected to be paid back with timely interest.

The exact amount of loan you can get depends on your job type, your income, tax information, Debt in the market, credits, and other factors.

Loans are safe and secured. Moreover, they have a pledge of an asset like – a home, car, vehicle, and others. If you are unable to pay back, they take possession of your purchase.

There are different types of loans –

- Student loans

- Mortgage loans

- Business loans

- Home loans

- Car loans

- Gold loans and others.

Advantages of loan:

Low-interest rates: Banks mainly provide manageable interests that are more comfortable to pay than the frequently incoming debt threats.

Tax benefit: When you use your loan for business, the interest that you pay is a deducible tax expenditure. Moreover, you do not require to share your profit with the lender.

Disadvantages of loan:

Collateral: Bank always ignores your credit score (how good it may be) and need to form some collateral. This is how they protect themselves in case you fail to return the sum of money.

Complicated: Applying for a loan is complex as it requires a lot of physical paperwork. It may take up to months to process your request and approve it.

What is Debt?

Debt is the amount of money the recipient borrows from a particular individual, party, or nonprofit organization.

You can return the principal amount any time you wish, with little or no interest that the individual verbally mentioned before giving you the money.

Debts are taken when you are under a heap of bank loans.

There are different types of debts –

- Credit card debt

- Corporate Debt

- Personal Debt

- Medical Debt

- Consumer debt and others.

Advantages of Debt:

No qualification required: Unlike banks, you can obtain a debt irrespective of your social status and tax information.

Long-term: Debts can be a long-term relationship with the lender. You can share a bit of your profit and retake money to enrich your business.

Disadvantages of Debt:

Affect Credit rating: A critical disadvantage of Debt is significantly reducing your credit score, which puts a wrong impression of you in the market.

This might lead you to pay a higher rate of interest. Unsafe: Most debt lenders can be a fraud, and you can involve yourself in a debt trap. It was finally leading you to threats and even jail!

Main Differences Between Loan and Debt

The key differences between them are listed below:

- The sum of money you borrow from a bank/financial organization is a loan, and that you borrow from a person or debenture is a debt.

- The loan does not affect your credit score, but Debt affects your credit score.

- The loan includes signing collateral (an asset), but Debt does not require collateral.

- All Loans are Debt, but all Debts are not loans.