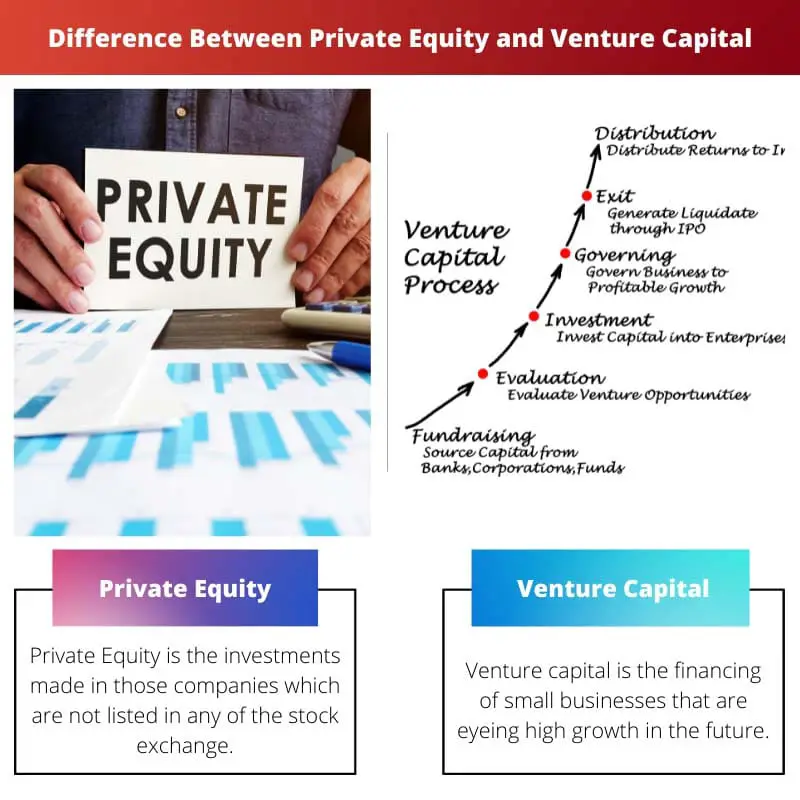

Private equity involves investing in established companies, with a focus on restructuring or growth, while venture capital funds early-stage startups with high growth potential. Private equity deals with mature businesses, aiming for operational improvements, while venture capital seeks to support innovative ideas and disruptive technologies in their early stages. Both involve investors providing capital in exchange for ownership stakes.

Key Takeaways

- Private equity firms invest in established, mature companies to improve their performance and profitability, whereas venture capital firms invest in early-stage companies with high growth potential.

- Private equity investments involve purchasing controlling stakes in companies and can involve leveraged buyouts, whereas venture capital investments focus on acquiring minority stakes in startups.

- The risk profile of private equity investments is lower than that of venture capital investments, as private equity targets more stable, proven businesses.

Private Equity vs Venture Capital

The difference between Private Equity and Venture Capital is that in the case of Private Equity, the investments are made at the expansion stage. In contrast, in the case of Venture capital, the assets are made at the seed stage itself.

Comparison Table

| Feature | Private Equity | Venture Capital |

|---|---|---|

| Investment Stage | Mature companies, established and profitable | Early-stage startups, high growth potential but unproven |

| Investment Type | Buyout (majority control) or growth capital | Minority equity stakes |

| Risk-Return Profile | Lower risk, moderate returns | Higher risk, potentially higher returns |

| Investment Period | 3-5 years | 5-7 years |

| Target Industries | Broad range (consumer goods, healthcare, industrials, etc.) | Specific sectors (technology, biotech, cleantech) |

| Financing | Leverage buyouts (debt + equity) | Primarily equity-based |

| Value Creation | Operational improvements, financial engineering | Business model development, market expansion |

| Exit Strategy | IPO, sale to another PE firm, secondary offering | IPO, acquisition by larger company |

| Typical Fund Size | Billions of dollars | Hundreds of millions of dollars |

| Focus | Financial returns through operational efficiency | Capital appreciation through high-growth startups |

| Examples | Blackstone, KKR, Carlyle Group | Sequoia Capital, Andreessen Horowitz, Kleiner Perkins |

What is Private Equity?

Private equity (PE) is an alternative form of investment that involves the acquisition of ownership stakes in private companies, with the goal of achieving significant returns. PE firms pool funds from institutional investors, such as pension funds and endowments, to form a fund dedicated to investing in private businesses.

Investment Process

- Fundraising: PE firms raise capital from investors, forming a fund that is used to make investments.

- Deal Sourcing: PE professionals identify potential investment opportunities through various channels, including networking, industry relationships, and market research.

- Due Diligence: Thorough analysis of the target company’s financials, operations, and market position is conducted to assess the viability and potential risks of the investment.

- Deal Structuring: Negotiation of terms, valuation, and the structure of the investment, involving the purchase of a significant ownership stake.

- Portfolio Management: Once invested, PE firms actively manage and work closely with portfolio companies to enhance operational efficiency, implement strategic changes, and drive growth.

- Exit Strategy: PE firms aim to exit their investments profitably, through methods like selling the company, merging it with another, or taking it public through an initial public offering (IPO).

Types of Private Equity

- Buyouts: Involves acquiring a controlling stake in a mature company to implement changes and improve profitability. Types include:

- Leveraged Buyouts (LBOs): Involves financing the acquisition with a significant amount of debt.

- Management Buyouts (MBOs): Company management participates in the acquisition.

- Venture Capital: Focuses on investing in early-stage companies with high growth potential, especially in the technology and innovation sectors.

- Mezzanine Financing: Involves providing a mix of debt and equity to a company, at a later stage of development.

Key Characteristics

- Illiquidity: PE investments have a longer investment horizon, with funds locked in for several years before achieving returns.

- Active Involvement: PE firms actively engage in the management and strategic decisions of their portfolio companies to enhance value.

- Risk and Return: While PE investments can offer high returns, they also come with higher risk due to the illiquid nature and the potential for market fluctuations.

What is Venture Capital?

Venture capital (VC) is a form of private equity financing that focuses on providing funding to early-stage, high-potential startups with promising growth prospects. Venture capitalists invest in innovative companies in sectors like technology, biotechnology, and other emerging industries.

Investment Process

- Fund Formation:

- Venture capital firms raise capital from institutional investors, corporations, and high-net-worth individuals to create a fund dedicated to investing in startups.

- Deal Sourcing:

- VC professionals actively seek out investment opportunities by networking, attending industry events, and collaborating with entrepreneurs and other investors.

- Due Diligence:

- Thorough analysis of the startup’s business model, technology, market potential, and management team is conducted to assess the investment’s viability and risks.

- Term Sheet Negotiation:

- If the due diligence is successful, the VC firm presents a term sheet outlining the proposed terms of the investment, including valuation, ownership stake, and other key terms.

- Investment:

- After negotiating and finalizing the terms, the VC firm provides funding to the startup in exchange for an equity stake in the company.

- Post-Investment Support:

- Venture capitalists play an active role in supporting the growth of their portfolio companies by providing strategic guidance, networking opportunities, and mentorship.

- Exit Strategy:

- VC firms aim to exit their investments to realize returns, commonly through an IPO, acquisition by a larger company, or a merger.

Types of Venture Capital

- Early-Stage Venture Capital:

- Funding provided to startups in their initial stages of development, before they have a proven product or significant revenue.

- Late-Stage Venture Capital:

- Investments made in more mature startups that have demonstrated market traction and are scaling their operations.

- Corporate Venture Capital (CVC):

- Investment funds established by large corporations to invest in and collaborate with startups, gaining strategic insights and potential innovation.

Key Characteristics

- High Risk, High Reward:

- VC investments are inherently risky due to the uncertainty associated with early-stage companies, but successful investments can yield substantial returns.

- Active Involvement:

- Venture capitalists contribute not only capital but also expertise, industry connections, and mentorship to help startups navigate challenges and achieve success.

- Long-Term Horizon:

- VC investments may take several years to mature, and liquidity events occur when the startup goes public or is acquired.

- Innovation Focus:

- Venture capital is particularly interested in companies with innovative and disruptive technologies or business models.

Main Differences Between Private Equity and Venture Capital

- Investment Stage:

- Private Equity (PE): Focuses on investing in established, mature companies.

- Venture Capital (VC): Targets early-stage startups with high growth potential.

- Company Maturity:

- PE: Typically deals with companies that have a proven track record and are looking for growth or restructuring.

- VC: Invests in companies in their early stages, before significant revenue or market validation.

- Risk and Return Profile:

- PE: Generally lower risk compared to VC, with a focus on stable cash flow and operational improvements.

- VC: Involves higher risk due to the uncertainty of early-stage ventures but offers the potential for substantial returns.

- Investment Horizon:

- PE: Typically has a medium to long-term investment horizon, holding investments for several years.

- VC: Involves a longer-term horizon, with exits occurring through IPOs or acquisitions after the startup achieves scalability.

- Type of Companies Targeted:

- PE: Targets a broad range of industries and sectors, including traditional businesses.

- VC: Primarily focuses on innovative and technology-driven companies, especially in sectors like IT, biotech, and other emerging industries.

- Investment Size:

- PE: Involves larger investment sizes, requiring significant capital for buyouts or restructuring.

- VC: Typically involves smaller investment amounts, especially in the early stages of a startup.

- Ownership and Control:

- PE: Often acquires a controlling or significant ownership stake in the companies it invests in.

- VC: Takes minority ownership stakes, allowing founders to retain control and decision-making power.

- Investor Base:

- PE: Draws capital from institutional investors, such as pension funds, endowments, and private investors.

- VC: Attracts funding from institutional investors, corporations, and high-net-worth individuals.

- Deal Structure:

- PE: Often involves leveraged buyouts, mezzanine financing, or other structured deals to enhance returns.

- VC: Typically involves equity investments with a focus on supporting the startup’s growth.

- Exit Strategies:

- PE: Exits occur through the sale of the company, merger, or recapitalization.

- VC: Exits commonly involve IPOs, acquisitions by larger companies, or mergers.

The comparison table is an excellent feature of this article, making it easy to discern the core divergences between private equity and venture capital. It’s a well-structured guide for anyone seeking clarity on these investment types.

I appreciated the concise yet informative nature of the table. It complements the detailed textual explanations perfectly.

You’re right, Tiffany12. The table effectively summarizes the key differences, providing a quick and accessible overview.

The article’s breakdown of the investment process for private equity and venture capital is commendable. It offers a holistic view, allowing readers to appreciate the intricacies of these investment forms.

I couldn’t agree more, Erin Wilkinson. The article carefully dissects the investment process, shedding light on the complexities involved in private equity and venture capital transactions.

This article provides a comprehensive breakdown of private equity and venture capital, making it an excellent reference point for professionals and newcomers to the finance industry. The distinctions are clearly articulated, and the key takeaways are especially valuable.

The article’s focus on the investment process for both private equity and venture capital is what sets it apart. The insights provided will undoubtedly benefit those seeking a deeper understanding of these investment vehicles.

Absolutely, Lucas. I found the examples of private equity and venture capital firms particularly helpful in grounding the theoretical concepts in real-world applications.

The article’s exploration of the risk-return profiles for private equity and venture capital clarifies the financial considerations associated with these investments. This analytical approach enhances the article’s credibility.

The content is rich with valuable insights on private equity and venture capital. This in-depth analysis is precisely what readers need to grasp the nuances of these investment vehicles.

While the article is undoubtedly informative, a touch of irony or sarcasm could infuse some humor, making the content more engaging. The subject matter lends itself well to such stylistic devices.

I can see your point, Parker Lola. Injecting some humor could elevate the article’s appeal, especially given the technical nature of the topic.

This article is a valuable resource for anyone looking to gain a solid understanding of private equity and venture capital. It’s a well-constructed guide that caters to both novice and seasoned professionals.

I echo your sentiments, Marshall Leah. The depth of analysis and clarity achieved in this article is a testament to its quality as an educational tool.

One aspect that would enhance the article is incorporating case studies or real-life scenarios to illustrate the application of private equity and venture capital. Practical examples serve as powerful tools for comprehension.

This article provides an excellent comparison between private equity and venture capital. It’s very informative and well-structured. I appreciate the detailed explanation of the investment process for both private equity and venture capital. It really helps in understanding the differences between the two.

I’m glad the article cleared up some of the confusion around these two investment types. It’s a great resource for anyone looking to learn more about private equity and venture capital.

I agree with you, Beth80. The comparison table is particularly helpful in highlighting the distinctions between private equity and venture capital. Well done!

While the comparison is thorough, I feel that there could be more emphasis on the challenges and potential downsides associated with private equity and venture capital. A more balanced view would make the article even more insightful.

I see your point, Alee. It’s essential to understand the risks and drawbacks of these investment types. Emphasizing those aspects would add depth to the discussion.