The term asset refers to any resource or economic entity that is owned or controlled by a business. It is anything that can generate positive economic value.

On a balance sheet of a business, the assets owned by the company are listed in monetary terms. An individual’s or a business’s money and other valuables can be covered while calculating assets.

Having assets is critical, since they help a company generate revenue. Furthermore, assets increase the value of a business. They make a business run more smoothly. A business’s assets can be classified into tangible and intangible.

Key Takeaways

- Tangible assets are physical resources such as buildings, equipment, and inventory, which can be seen, touched, and have a quantifiable value.

- Intangible assets include non-physical resources like intellectual property, brand value, and goodwill, which hold significant value but are not tangible.

- Tangible assets depreciate over time, whereas intangible assets can appreciate or depreciate depending on market conditions and management decisions.

Tangible Assets vs Intangible Assets

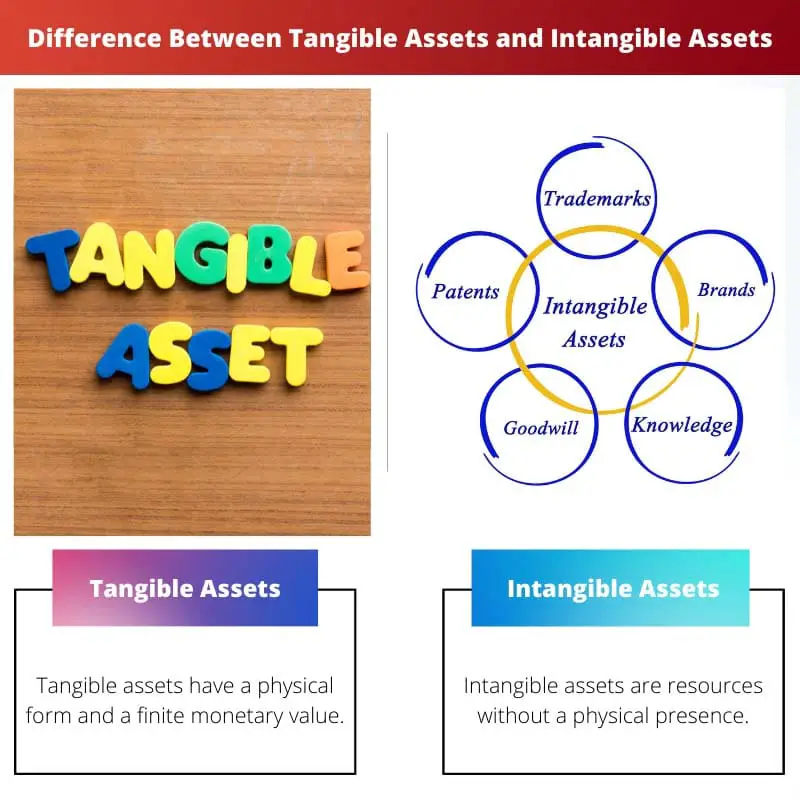

Tangible assets are physical assets that can be touched and have a physical form, such as property, equipment, and inventories. Intangible assets are non-physical assets that cannot be handled but nevertheless have value and can create income, examples include patents, trademarks, copyrights, and goodwill.

Assets that have a physical form and a finite monetary value are known as tangible assets. Although different markets will vary in liquidity, tangible assets can always be transacted for some monetary value.

Tangible assets are of utmost importance as they help determine the value of a company.

Intangible assets are resources that do not have a physical presence but have long-term value to a business. Companies reputation and copyright are considered intangible assets.

Businesses can use them to buy back destroyed tangible assets, such as equipment, and they have value since they own sole legal or intellectual rights.

Comparison Table

| Parameters of Comparison | Tangible Assets | Intangible Assets |

|---|---|---|

| Definition | Tangible assets have a physical form and a finite monetary value. | Intangible assets are resources without a physical presence. |

| Ease of calculation | Their limited lifespan makes them easy to calculate. | Due to their subjective nature, they are difficult to calculate. |

| Indestructibility | As physical assets, they can be damaged by natural disasters. | Since they are non-physical assets, they are unaffected by natural disasters. |

| Worth | Tangible assets determine the firm’s current value. | Intangible assets increase the firm’s long-term value. |

| Examples | Land, vehicles, equipment, machinery, furniture, inventory, stocks, bonds, and cash. | Recognition, company reputation, copyrights, trademarks, patents, franchises, intellectual property, domain, licensing agreement, lease agreements, client relationships. |

What is a Tangible Asset?

Tangible assets are assets with a finite monetary value and for which a physical form can be found. Generally, tangible assets can always be traded for some monetary value. Tangible assets have a transactional value rather than a theorized value.

Tangible assets make up a majority of the balance sheet. Most industries tend to rely heavily on these assets. Additionally, the value of these assets is easy to determine.

Tangible assets refer to assets with a finite or discrete value and, in most cases, a physical component. An examination of a balance sheet will provide a breakdown of tangible assets by liquidity.

There are two categories of assets on the balance sheet: current assets and long-term assets. Assets that can be converted into cash within one year are regarded as current assets.

Assets that cannot be converted to cash within a year are considered long-term. Regardless of the type of asset, it is crucial for a company to have it in order to achieve its main goal, generating revenue.

What is an Intangible Asset?

As the name implies, intangible assets don’t have a physical existence. Intangible assets include goodwill, brand recognition, patents, trademarks, copyrights and other intellectual properties. Intangible assets can be created as well as acquired by businesses.

A company’s intangible assets are not recorded on the balance sheet and have no book value. Therefore, when a company is purchased, the purchase price is higher than the book value of its assets.

The premium paid is recorded as an intangible asset in the company’s balance sheet that purchased it.

Intangible assets can be categorized into two categories: definite and indefinite. Intangible assets, such as brand names, are considered indefinite because they stay with the company for as long as it is operational.

A definite intangible asset would be a contract for the use of another company’s patent without any plans to extend the agreement. As a result, the contract has a limited life and is classified as a definite asset.

It may not have the same obvious physical value as a factory or piece of equipment, but an intangible asset may nonetheless be an important part of a company’s long-term success.

Main Differences Between Tangible Assets and Intangible Assets

- Tangible assets have a physical form (such as cash, factories, etc.), whereas intangible assets are non-physical (such as patents, copyrights, etc.)

- Since tangible assets have a definitive value, they are easy to calculate, while intangible assets are challenging to calculate since their value is subjective.

- On balance sheets, tangible assets are reported, while intangible assets are not.

- The tangible assets of a company will be lost during a natural disaster, but not the intangible assets.

- A company’s tangible assets determine its current value, while a company’s intangible assets determine its future value.