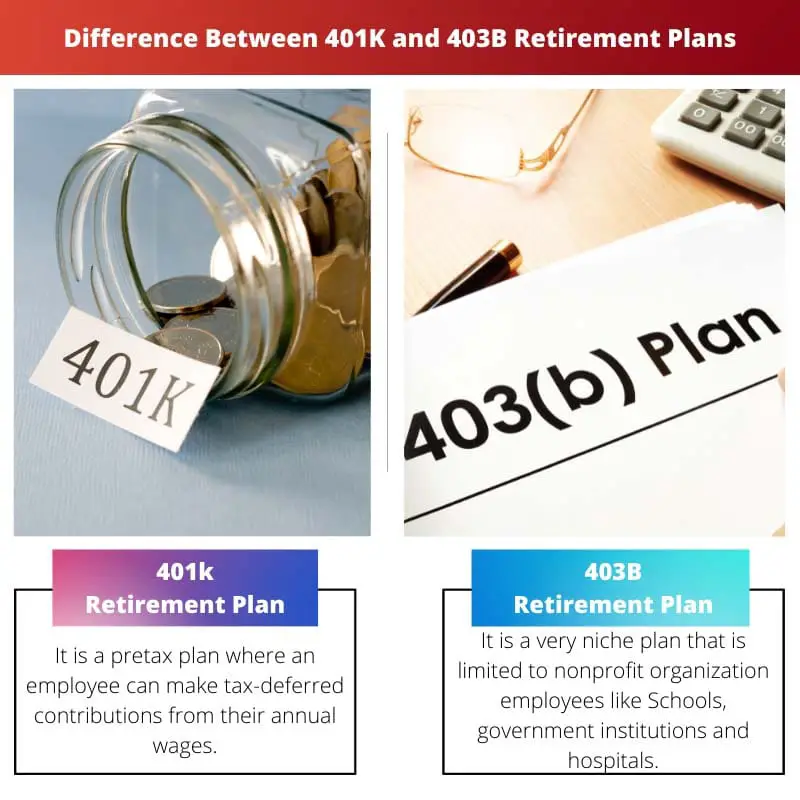

401(k) and 403(b) retirement plans are similar in that they both allow employees to save for retirement on a tax-advantaged basis, but 401(k) plans are typically offered by for-profit companies while 403(b) plans are offered by certain non-profit organizations, schools, and government entities.

Key Takeaways

- 401k and 403b are retirement savings plans that allow employees to save for retirement on a tax-deferred basis.

- 401k is offered by for-profit companies, while non-profit organizations, schools, and hospitals provide 403b.

- 401k may offer more investment options than 403b.

401K vs 403B Retirement Plans

The difference between 401K and 403B retirement plans is that 403b is executable only if you are a part of any non-profitable organization like a hospital or an educational institute. However, a 401k retirement plan applies to all employees whose organization is profitable and has its advantages.

Comparison Table

| Feature | 401(k) | 403(b) |

|---|---|---|

| Eligibility | Employees of for-profit companies | Employees of non-profit organizations and public schools |

| Contribution Limits | $23,000 per year in 2024, $7,500 catch-up for 50+ | Same as 401(k) |

| Employer Contributions | Optional, employer may match employee contributions | Optional, employer may contribute directly or through a Roth option |

| Tax Treatment | Pre-tax or Roth contributions, both options grow tax-free and are taxed on withdrawal | Same as 401(k) |

| Investment Options | Wide range, may include mutual funds, individual stocks, bonds, and annuities | Generally narrower, often limited to mutual funds and annuities |

| Loan Options | May be available, subject to plan rules and limitations | Generally not available |

| RMD Age | 72 | Same as 401(k) |

What is 401K?

401(k) retirement plans are popular employer-sponsored retirement savings accounts offered by for-profit companies to their employees. These plans are named after the section of the U.S. Internal Revenue Code that governs them.

How 401(k) Plans Work

- Employee Contributions: Employees contribute a portion of their pre-tax income to their 401(k) accounts, typically through automatic deductions from their paychecks. These contributions lower the employee’s taxable income for the year, effectively reducing their current tax burden.

- Employer Matching Contributions: Many employers offer a matching contribution to their employees’ 401(k) plans, up to a certain percentage of the employee’s salary. This matching contribution serves as an incentive for employees to save for retirement and can significantly boost retirement savings over time.

- Tax-Deferred Growth: One of the key advantages of 401(k) plans is the ability for contributions and investment earnings to grow on a tax-deferred basis. This means that participants don’t pay taxes on their contributions or investment gains until they withdraw funds from the account, typically during retirement when they may be in a lower tax bracket.

- Investment Options: Participants in 401(k) plans typically have a range of investment options to choose from, including mutual funds, exchange-traded funds (ETFs), stocks, and bonds. The specific investment options available depend on the plan offered by the employer.

Contribution Limits and Withdrawals

- Contribution Limits: The IRS sets annual contribution limits for 401(k) plans, which may change from year to year. As of 2022, the annual contribution limit for individuals under 50 years old is $20,500, while those aged 50 and older can make catch-up contributions of an additional $6,500, for a total of $27,000.

- Withdrawal Rules: Withdrawals from 401(k) plans are typically subject to income tax and, if taken before age 59½, may be subject to an additional 10% early withdrawal penalty, with some exceptions such as for certain hardships or qualifying distributions. Additionally, participants are generally required to start taking required minimum distributions (RMDs) from their 401(k) accounts once they reach age 72 (or 70½ if they reached that age before January 1, 2020), to ensure that the IRS collects taxes on the funds.

What is 403B?

403(b) retirement plans, also known as tax-sheltered annuity (TSA) plans, are employer-sponsored retirement savings accounts offered by certain non-profit organizations, schools, and government entities. These plans are similar to 401(k) plans but have some key differences.

How 403(b) Plans Work

- Employee Contributions: Like 401(k) plans, employees contribute a portion of their pre-tax income to their 403(b) accounts, often through payroll deductions. These contributions reduce the employee’s taxable income, providing immediate tax benefits similar to 401(k) plans.

- Employer Contributions: While not as common as in 401(k) plans, some employers offer matching contributions to employees’ 403(b) accounts. However, employer contributions in 403(b) plans are typically in the form of non-elective contributions rather than matching contributions.

- Investment Options: 403(b) plans often offer a range of investment options, including annuities and mutual funds. Annuities are a distinctive feature of 403(b) plans and can provide a stream of income during retirement, making them particularly appealing to employees in the education and non-profit sectors.

- Tax-Deferred Growth: Similar to 401(k) plans, contributions and investment earnings in 403(b) plans grow on a tax-deferred basis. Participants do not pay taxes on their contributions or investment gains until they withdraw funds from the account, typically during retirement.

Contribution Limits and Withdrawals

- Contribution Limits: The IRS sets annual contribution limits for 403(b) plans, which may change from year to year. As of 2022, the annual contribution limit for individuals under 50 years old is $20,500, while those aged 50 and older can make catch-up contributions of an additional $6,500, for a total of $27,000.

- Withdrawal Rules: Withdrawals from 403(b) plans are subject to income tax and, similar to 401(k) plans, may be subject to an additional 10% early withdrawal penalty if taken before age 59½, with some exceptions for certain hardships or qualifying distributions. Additionally, participants are generally required to start taking required minimum distributions (RMDs) from their 403(b) accounts once they reach age 72 (or 70½ if they reached that age before January 1, 2020), to ensure tax obligations are met.

Main Differences Between 401K and 403B

- Employer Eligibility:

- 401(k) plans are typically offered by for-profit companies.

- 403(b) plans are offered by certain non-profit organizations, schools, and government entities.

- Investment Options:

- 401(k) plans typically offer a range of investment options such as mutual funds, ETFs, stocks, and bonds.

- 403(b) plans may offer additional investment options like annuities, which are often favored by employees in the education and non-profit sectors.

- Employer Contributions:

- While both plans may offer employer contributions, 401(k) plans often have matching contributions, whereas 403(b) plans may have non-elective contributions.

- Contribution Limits:

- Contribution limits for both plans are set by the IRS and may vary annually. As of 2022, the limits are the same for both plans, but historically, 403(b) plans have had slightly different contribution limits.

- Regulatory Oversight:

- While both plans are governed by the IRS, 401(k) plans are subject to the Employee Retirement Income Security Act (ERISA), while 403(b) plans may be exempt from certain ERISA requirements.

- Participant Eligibility:

- Employees eligible for 401(k) plans typically include full-time and part-time employees.

- 403(b) plans may have additional eligibility requirements specific to non-profit organizations, schools, or government entities.

- https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-403b-tax-sheltered-annuity-plans

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1937795

While 401(k) and 403(b) plans have similarities, the article effectively highlights the crucial differences that individuals need to consider when evaluating their retirement savings strategies.

I share your sentiment, Aclark. The detailed analysis of employer eligibility, contribution limits, and investment options provides readers with a comprehensive understanding of these retirement plans.

This article offers a balanced viewpoint on 401(k) and 403(b) plans, presenting both the advantages and limitations of each plan. It’s a well-rounded resource for informed decision-making.

Absolutely, Amorris. The objective assessment of 401(k) and 403(b) plans equips readers with the necessary knowledge to evaluate the suitability of these retirement savings options based on individual circumstances.

This article effectively demystifies the complexities of 401(k) and 403(b) plans, providing readers with a well-structured guide for navigating retirement savings options.

The detailed breakdown of 401(k) and 403(b) plans, including employer matching programs and taxes, offers readers valuable insights for maximizing their retirement savings opportunities.

I share your perspective, Ava54. The emphasis on employer matches and tax implications equips individuals with the knowledge to optimize their retirement planning and financial security.

This is a very informative article that provides details about 401(k) and 403(b) retirement plans. The key takeaways make it easy to understand the differences between these plans and the comparison table is quite useful for decision-making.

I completely agree with you, Adele14. This article has effectively highlighted the distinguishing features of 401(k) and 403(b) retirement plans. The comparison table is particularly helpful for employees evaluating their retirement savings options.

Absolutely, Adele14. The comprehensive overview of 401(k) and 403(b) plans, along with their features, makes it an excellent resource for anyone seeking to make informed decisions about retirement savings.

The article offers a comprehensive examination of 401(k) and 403(b) plans, shedding light on the critical nuances that can impact retirement savings strategies.

The distinction between 401(k) and 403(b) retirement plans is very clear from this article. It’s great to have such detailed information available to help individuals make sound financial choices.

I couldn’t agree more, Roberts Lisa. This article offers valuable insights into the differences between 401(k) and 403(b) plans, enabling readers to assess their suitability based on their employment status and financial goals.

The comprehensive overview of 401(k) and 403(b) plans, along with their respective tax benefits and investment options, makes this article a valuable resource for individuals planning for retirement.

I completely agree, Bmartin. The detailed insights into employee contributions, tax benefits, and vesting offer readers an in-depth understanding of these retirement savings plans.

The article’s coverage of 401(k) and 403(b) plans, including early withdrawal penalties and investment options, provides readers with a holistic view of retirement planning considerations.

Absolutely, Robinson Jasmine. The article’s focus on withdrawal penalties and investment flexibility empowers individuals to make well-informed decisions about their retirement savings strategies.

The comparison table effectively outlines the key differences between 401(k) and 403(b) retirement plans in a concise manner. It’s a great resource for those seeking clarity on their retirement savings options.

Absolutely, Suzanne Turner. The breakdown of features and eligibility criteria in the comparison table is beneficial for employees navigating the complexities of retirement planning.