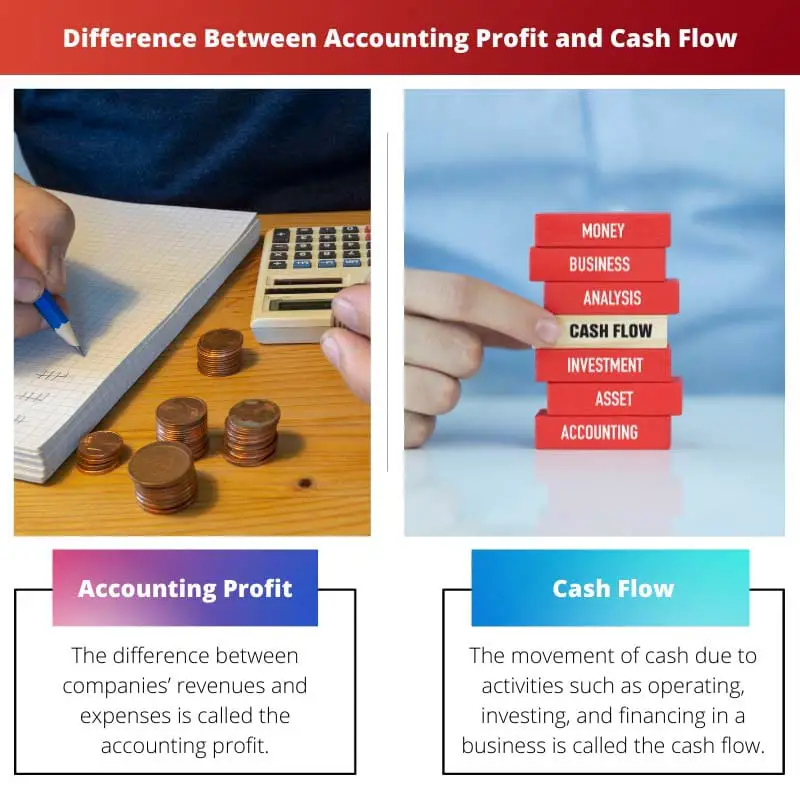

Accounting profit represents the net income calculated by subtracting expenses from revenue according to accrual accounting principles, which may include non-cash items. Cash flow, however, reflects the actual movement of money in and out of a business, providing a clearer picture of liquidity and operational health by focusing solely on cash transactions.

Key Takeaways

- Accounting profit is the difference between revenue and expenses calculated Generally using Accepted Accounting Principles (GAAP).

- Cash flow is the movement of cash in and out of business.

- Accounting profit is based on accrual accounting, while cash flow is based on actual cash transactions.

Accounting Profit vs Cash Flow

Accounting profit is the difference between a company’s total revenue and total expenses. Cash flow is the movement of cash in and out of a business, and is a more accurate measure of a company’s liquidity, as it shows the actual cash available for operations, investments, and financing.

Comparison Table

| Feature | Accounting Profit | Cash Flow |

|---|---|---|

| Definition | The net income remaining after a company deducts all its expenses from its revenue during a specific period. | The movement of cash in and out of a company during a specific period. |

| Focuses on | Profitability and financial performance based on accounting principles. | Liquidity and the company’s ability to meet its short-term financial obligations. |

| Measurement | Based on accrual accounting, which considers income earned and expenses incurred, regardless of whether cash is received or paid. | Based on cash accounting, which only considers actual cash receipts and disbursements. |

| Timeframe | Represents a snapshot of the company’s financial performance over a specific period (e.g., quarter, year). | Can be broken down into different types (operating, investing, financing) to understand the sources and uses of cash over time. |

| Impact | Important for understanding a company’s long-term profitability and potential for growth. | Crucial for assessing a company’s short-term financial health and ability to pay its bills. |

| Limitations | Can be misleading if a company has high profit but poor cash flow. | Does not directly reflect profitability, as cash flow can be positive even if the company is not profitable. |

What is Accounting Profit?

Definition of Accounting Profit:

Accounting profit refers to the financial metric used to assess a company’s profitability by deducting expenses from revenue using accepted accounting principles (GAAP) or international financial reporting standards (IFRS).

Calculation of Accounting Profit:

Accounting profit is calculated by subtracting all expenses incurred during a specific period from total revenue generated within the same timeframe. The formula for calculating accounting profit is as follows:

Accounting Profit=Total Revenue−Total ExpensesAccounting Profit=Total Revenue−Total Expenses

Revenue includes income generated from the sale of goods or services, interest, dividends, and other sources. Expenses cover the costs incurred in the production, operation, and administration of the business, including salaries, utilities, rent, depreciation, and taxes.

Importance of Accounting Profit:

- Performance Evaluation: Accounting profit serves as a key indicator of a company’s financial performance. It allows stakeholders, such as investors, creditors, and management, to evaluate the profitability of the business over a specific period.

- Decision Making: Businesses utilize accounting profit to make strategic decisions regarding resource allocation, pricing strategies, expansion plans, and investment opportunities. It provides insights into the financial health and viability of different projects or ventures.

- Financial Reporting: Accounting profit forms the basis for financial reporting, including income statements, which summarize a company’s financial performance during a given period. It is a crucial component of financial statements that comply with regulatory requirements and provide transparency to stakeholders.

Limitations of Accounting Profit:

- Non-Cash Items: Accounting profit may include non-cash items such as depreciation, amortization, and unrealized gains or losses, which can distort the true cash-generating ability of the business.

- Accrual Basis: Accounting profit is calculated on an accrual basis, which recognizes revenue and expenses when they are incurred, regardless of when cash actually exchanges hands. This can lead to discrepancies between reported profit and actual cash flows.

- Subjectivity: The determination of certain accounting measures, such as depreciation methods or allowance for doubtful accounts, involves subjective judgments, potentially impacting the accuracy and comparability of accounting profit across different entities.

What is Cash Flow?

Definition of Cash Flow:

Cash flow refers to the movement of money in and out of a business over a specific period, reflecting the liquidity and financial health of the company. It represents the net amount of cash and cash equivalents generated or consumed by a business’s operating, investing, and financing activities.

Components of Cash Flow:

- Operating Activities: Cash flow from operating activities includes cash transactions related to the core operations of the business, such as sales revenue, payment to suppliers, salaries to employees, and operating expenses. It indicates the ability of the company to generate cash from its primary business activities.

- Investing Activities: Cash flow from investing activities involves cash transactions related to the purchase and sale of long-term assets, such as property, plant, equipment, and investments in securities. It includes cash inflows from asset sales and cash outflows for asset acquisitions or capital expenditures.

- Financing Activities: Cash flow from financing activities reflects cash transactions related to the company’s capital structure, such as borrowing or repayment of loans, issuance or repurchase of equity shares, payment of dividends, and other financing activities. It indicates how the company raises capital and distributes it to shareholders or creditors.

Importance of Cash Flow:

- Liquidity Management: Cash flow analysis helps businesses manage their liquidity by ensuring they have sufficient cash to meet short-term obligations, such as paying suppliers, salaries, and other operating expenses. It enables proactive cash management to avoid liquidity crises.

- Financial Health Assessment: Cash flow provides a more accurate assessment of a company’s financial health compared to accounting profit, as it focuses solely on cash transactions. Positive cash flow indicates that the company is generating more cash than it is spending, while negative cash flow may signify financial distress or inefficiencies.

- Investment and Financing Decisions: Investors and creditors use cash flow information to evaluate the financial viability and stability of a company before making investment or lending decisions. Positive cash flow signals the company’s ability to generate cash internally, reducing reliance on external financing.

Limitations of Cash Flow:

- Timing Differences: Cash flow may not always align with revenue recognition or expense accruals, leading to timing differences between when cash is received or paid and when transactions are recorded in the financial statements.

- Non-Cash Items: Cash flow does not account for non-cash items such as depreciation, amortization, and changes in working capital, which can affect a company’s cash position without directly impacting cash flow from operating activities.

- Quality of Earnings: In some cases, companies may manipulate cash flow figures through aggressive cash management techniques or financial engineering, which can distort the true financial performance and health of the business.

Main Differences Between Accounting Profit and Cash Flow

- 1. Basis of Calculation:

- Accounting Profit:

- Calculated by subtracting expenses from revenue according to accrual accounting principles.

- Includes non-cash items like depreciation and amortization.

- Cash Flow:

- Represents the actual movement of money in and out of a business.

- Focuses solely on cash transactions, excluding non-cash items.

- 2. Timing of Recognition:

- Accounting Profit:

- Recognizes revenue and expenses when they are incurred, regardless of cash inflows or outflows.

- May not reflect the actual timing of cash receipts or payments.

- Cash Flow:

- Reflects the timing of actual cash receipts and payments.

- Provides a more immediate and accurate depiction of liquidity and financial health.

- 3. Importance for Decision Making:

- Accounting Profit:

- Used for performance evaluation, financial reporting, and strategic decision-making.

- Indicates long-term viability and profitability.

- Cash Flow:

- Critical for short-term financial management, ensuring operational liquidity and meeting immediate obligations.

- Helps assess the ability to cover expenses, debt obligations, and investment opportunities with available cash.

- 4. Stability vs. Liquidity Focus:

- Accounting Profit:

- Emphasizes long-term stability and profitability.

- May not provide insights into short-term liquidity challenges.

- Cash Flow:

- Focuses on short-term liquidity and operational stability.

- Indicates the ability to meet immediate financial obligations and sustain day-to-day operations.

- 5. Transparency and Comparability:

- Accounting Profit:

- Reported in financial statements according to established accounting standards (GAAP or IFRS).

- Subject to interpretation and manipulation due to accounting policies and estimates.

- Cash Flow:

- Provides a more transparent and objective view of a company’s financial position.

- Less susceptible to accounting adjustments and offers better comparability across entities.

- http://www.joams.com/uploadfile/2015/0602/20150602115256681.pdf

- https://www.hbs.edu/faculty/Pages/item.aspx?num=7567

The comparison table provided here is especially helpful in clarifying the distinctions between accounting profit and cash flow.

Agreed, having a clear understanding of these concepts is essential for making sound financial decisions.

Definitely, the insights shared here are beneficial for anyone involved in financial management.

This article provides a clear and concise overview of the crucial differences between accounting profit and cash flow, highlighting their significance in financial management.

The analysis of accounting profit and cash flow provided here is comprehensive and insightful, offering valuable knowledge for individuals interested in financial management.

Absolutely, the depth and clarity of the explanations enhance the understanding of these critical concepts.

Indeed, the article provides a well-rounded understanding of these financial metrics, contributing to informed decision-making.

The explanations of accounting profit and cash flow are thorough, offering valuable insights into these fundamental financial concepts.

Absolutely, the clarity of the content makes it an essential read for individuals involved in financial analysis.

I agree, the depth of information in this article is commendable and highly informative.

The article effectively outlines the distinctions between accounting profit and cash flow, offering valuable knowledge for financial practitioners and business owners.

Indeed, the insights provided here are beneficial for understanding the financial health of a business.

Absolutely, the detailed comparison serves as a useful reference for financial analysis.

This article presents a detailed comparison between accounting profit and cash flow, shedding light on their importance and relevance to business operations and decision-making.

Indeed, the information provided here is highly relevant and valuable for financial analysis.

This article provides a comprehensive overview of the difference between accounting profit and cash flow, a very useful resource for any entrepreneur or business owner.

Absolutely, understanding the nuances of cash flow and profit calculation is crucial for financial management.

I agree, this article is a valuable resource for understanding the importance of accounting profit and cash flow in business.

The article delivers an in-depth analysis of accounting profit and cash flow, providing valuable insights into the financial dynamics of businesses.

Absolutely, the detailed explanations enhance the understanding of these essential financial concepts.

Indeed, the comprehensive nature of the content makes it an essential read for professionals in the field of finance.

The comprehensive explanations of accounting profit and cash flow provided here are enlightening and offer a balanced perspective on both concepts.

I couldn’t agree more. The detailed insights make this article a valuable resource for professionals and entrepreneurs alike.

Absolutely, the in-depth analysis in this article enhances understanding of these critical financial metrics.

The detailed explanation of accounting profit and cash flow is highly informative, providing a comprehensive understanding of these vital financial metrics.

Agreed, the clarity and depth of information in this article make it an invaluable resource for financial professionals.

Absolutely, the clarity and thoroughness of the content make it an indispensable read for individuals involved in financial management.