When it comes to business, the terms cash flow, as well as net income are frequently misunderstood.

Financial statements, net income total, cash flow statistics, and balance sheet declarations are regarded to be highly significant when glancing at an income statement.

Hence, getting clear with these two vital terms is the main objective of this article on the difference between ‘cash flow’ and ‘net income.

Key Takeaways

- Cash flow measures the cash movement in and out of business over time.

- Net income represents a company’s profit after subtracting expenses from revenue.

- Cash flow focuses on liquidity, while net income emphasizes profitability.

Cash Flow vs Net Income

The difference between cash flow and net income is that cash flow is considered as the influx of liquid assets as well as cash held by an organization in the form of revenues, investment money markets, or outflow in the form of fees associated, and debt servicing transfers throughout an accounting period. On the other hand, net income, also referred to as net earnings, is the quantity of net earnings generated by an organization, measured as the total of all income produced less the price of goods sold.

Cash inflow and outflow or its cognates in a company or organization are referred to as cash flow. It calculates the amount of money spent or generated during a specified period.

Its examination also determines the current sources of cash flow as well as the potential scope of inputs.

The current cash flow for just a given time is determined by subtracting the starting balance first from the closing amount for that quarter.

Net income can be dispersed as a payout to ordinary stockholders or kept by the company as a supplement to increase profit.

Net earnings and net profit are widely used as substitutes for net income since profit and income are used interchangeably for revenue.

The phrase income is frequently used in place of net income, however, this is not advised owing to the potential for misunderstanding.

Comparison Table

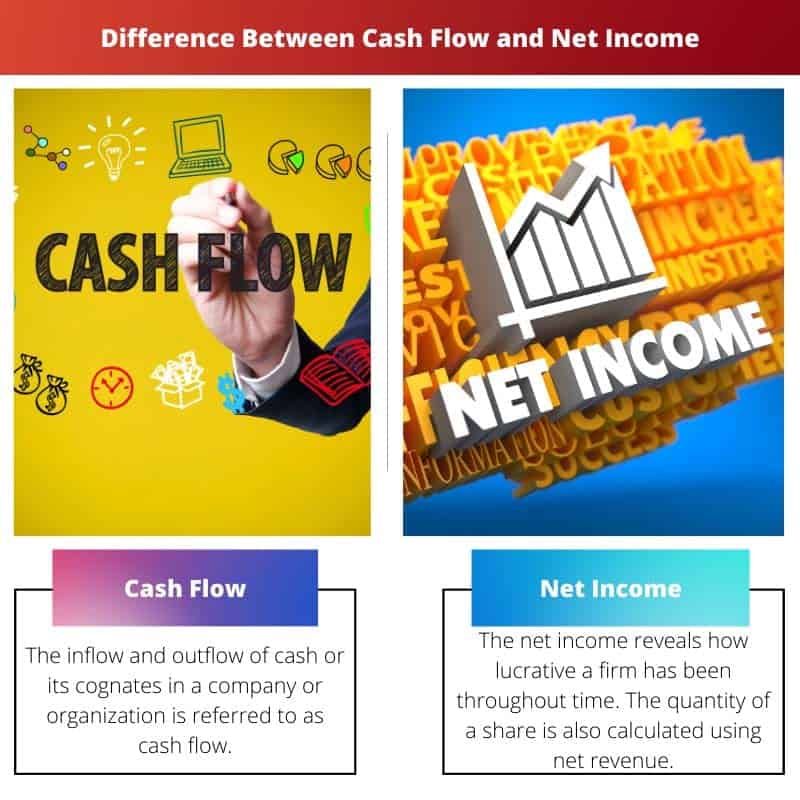

| Parameters of Comparison | Cash Flow | Net Income |

|---|---|---|

| Definition | The inflow and outflow of cash or its cognates in a company or organization is referred to as cash flow. | The net income reveals how lucrative a firm has been throughout time. The quantity of a share is also calculated using net revenue. We must refer to the net earnings in order to compute the cash inflow. |

| Components | Constitutes of cash only. | Constitutes of cash, inflows and outflows as well as revenues and assets too. |

| Types | Operating activities, investing activities and financing activities. | Categories under operating and non-operating activities. |

| Preparation | Balance sheet and income statements are collected to calculate a cash flow statement. | Trial balances and account statements with profit/loss ratios. |

| Method of accounting | Cash only. | Cash, accruals and assets. |

What is Cash Flow?

The total sum of liquid assets being moved in and out of a corporation is referred to as cash flow. Inflows are represented by cash, whereas outflows are represented by money being spent.

The capacity of a corporation to generate sufficient cash flow or, better precisely, to optimize lengthy free cash flow determines its potential to create profits for investors (FCF).

After removing any money spent on capital expenditures, FCF is the cash earned by a firm through its normal business activities.

The quantity of money that rolls in, functions, and leaves any organisation’s business is referred to as cash flow. Businesses generate income from sales and spend that money on costs.

They may also earn money via interest, dividends, copyrights, licensing deals, and selling things on credit, expecting to receive the money owed later.

A company’s chequebook is the statement of cash flow, which unifies the net income statement with the financial statement assertion.

The cash flow statement keeps track of all in- and out-flows. The working capital statement is a financial statement that indicates where cash comes from and where it goes.

Net income is shown at the start of the statement of cash flows. The net income report represents the real income for a certain period, whether that be a loss or a profit.

Cash flows might result in a bad or favourable balance after they’ve been computed.

A budget surplus shows that the organization has enough cash to meet its urgent liquidity needs, whereas a negative level suggests that liquidity is restricted.

What is Net Income?

Each shareholder must collect and comprehend the amount of net profit made by the organization. Net income may be used to calculate net earnings per share.

Because this is the last line item on the financial statements, it is also known as the bottom line.

A company’s balance sheet’s “bottom line” is profit or net earnings. A corporation must create an income statement and determine the net balance of income and costs in order to determine profit or net income.

These earnings and costs are reported since the operations were completed regardless of whether or not cash was exchanged.

After capturing off all additional costs during an income statement, net revenue is the money of surplus money earned by an organization.

This estimate is determined by calculating in the firm’s profitability A/c as the fraction of total figures confirmed (cash or non-cash) and expenditure incurred (cost of goods sold, operational costs, quasi-operational expenses, interest charges, tax expenses, or any other expenses), whether paid directly or not.

The net income reveals how lucrative a firm has been throughout time. The quantity of a share is also calculated using net revenue.

We must refer to the net earnings in order to compute the cash inflow (profit).

After accounting for net income, we may start adding or subtracting the appropriate modifications to arrive at net income inflow using the alternate approach of cash flow.

Main Differences Between Cash Flow and Net Income

- Cash flow refers to the funds that enter and exit a firm for its different operations, whereas net income and otherwise profit refers to the cash that stays after all costs have been deducted.

- Cash flow helps determine the value of a company, whereas net income helps in the calculation of profits and losses.

- Cash flow considers cash only, whereas net income counts resources, assets, and profitable cash.

- A cash flow statement plays a crucial role in a balance sheet, whereas the employer and management calculate the net income for self-calculative purposes only.

- Cash flow helps in enriching inter-market relations, whereas net income boasts a company’s dignity and market value.

- https://www.investor.gov/introduction-investing/investing-basics/glossary/net-income

- https://corporatefinanceinstitute.com/resources/knowledge/finance/cash-flow/

The article gives a comprehensive explanation of cash flow and net income, emphasizing their importance and relevance for businesses. I found the section on what constitutes net income particularly insightful.

I agree, the article’s detailed breakdown of net income and its calculation provides a clear understanding of this important financial metric.

The detailed explanations on cash flow and net income provide valuable insights into these fundamental financial concepts. The article effectively outlines the importance of both parameters in assessing a company’s financial position.

The comparison of cash flow and net income in this article is quite informative, providing a holistic view of their role in financial reporting and analysis.

Absolutely, the article’s breakdown of cash flow and net income helps in understanding their respective contributions to a company’s financial analysis.

Understanding the comparison between cash flow and net income is crucial for investors and business owners to make informed financial decisions. The article explains this comparison in an insightful manner.

The comparison table provides a succinct summary of the parameters of comparison between cash flow and net income, making it easier to understand the key differences between these financial measures.

The article effectively explains the significance of both cash flow and net income, providing a clear and detailed comparison of their definitions, preparation, and accounting methods.

This article provides a comprehensive overview of the difference between cash flow and net income, highlighting their definitions, components, and types.

The analysis of what constitutes cash flow and net income is very well-presented. The article does a great job of breaking down the components and categories of these two important financial concepts.

This article offers a thorough analysis of cash flow and net income, shedding light on their significance in evaluating a company’s financial health and performance over time.