During the institution of a business group, the first decision is to choose between different business models. The two most common models are Ltd and Inc.

Key Takeaways

- “Inc.” is an abbreviation for “Incorporated,” used in the United States and some other countries, while “Ltd.” stands for “Limited” and is commonly used in the United Kingdom, Canada, and other Commonwealth countries.

- Both Inc. and Ltd. provide limited liability protection to shareholders, but their legal structures and regulations differ according to the country they are formed in.

- Companies with Inc. or Ltd. designations must adhere to specific reporting requirements and corporate governance rules to maintain their legal status and benefits.

Inc vs. Ltd

Inc (Incorporation) is a business company where owners are separated from the board of directors. It has a single tax system, thus affecting members of the company. Ltd (Limited company) is where a group starts a business. It has a corporation tax system.

In a limited company, powers lie in the hands of the owners, who are either the company’s investors or guarantors.

Comparison Table

| Parameter of Comparison | Inc | Ltd |

|---|---|---|

| Basic definition | Inc is an entity that is kept separate from its owners. | Ltd is a company in which the powers or the liability of the company are vested with the people investing in it or with the people who have taken a guarantee of it. |

| Management | Inc company is regulated or run by the board of directors and the companies are required to appoint officers as per the laws established by the government. | Ltd company has to appoint officers at various levels and is run by at least one director. |

| Taxation system | The company pays the corporation tax while its profit and loss are transferred to the company and do not reach its members. | The Ltd company has a single taxation system. Therefore, the profit and loss are passed to its members. |

| Ownership of the company | The stockholders hold an Inc company. | Members of the company can either be public or from a defined group. |

| Suitable for | Inc designation is more suited to large businesses. | Ltd designation is more suited for small business organizations. |

What is Inc

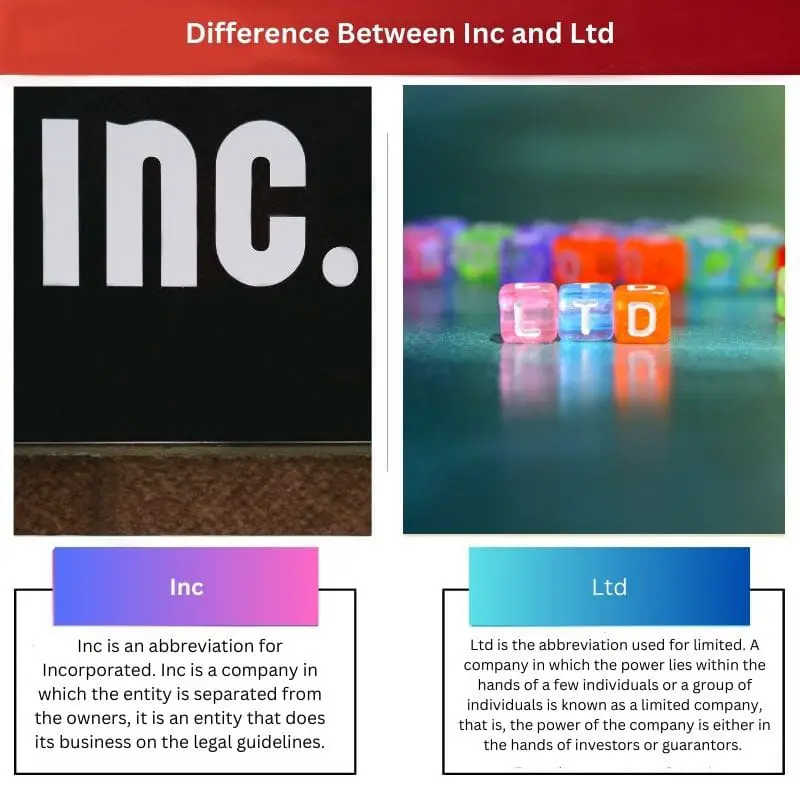

Inc is an abbreviation for Incorporated. Inc is a company in which the entity is separated from the owners; it is an entity that does its business on the legal guidelines.

The company pays the corporation tax. All its profits and losses remain within the company and are not transferred to its members.

In its shares, an Inc company does not pose any restrictions on its members; however, in an Inc company, there are some limits on the liabilities of an individual.

What is Ltd?

Ltd is the abbreviation used for limited. A company in which the power lies within the hands of a few individuals or a group of individuals is known as a limited company; that is, the power of the company is either in the hands of investors or guarantors.

A limited company has a single taxation system. The profits and losses of the company are directly transferred to its members.

When it comes to shares, a limited company poses some restrictions on its shareholders. It has a separate legal body for its shareholders. Officers and directors are answerable in case of debts.

An Ltd company can either be a public limited company or a private limited company depending on the type of its members.

Main Differences Between Inc and Ltd

- The incorporated designation is better for large businesses, while the limited designation is more suited to small business groups.

- The legal entity is separated from shareholders in both the Inc and Ltd company.

The article presents a stark comparison between Inc. and Ltd. – it leaves little room for ambiguity. I appreciate the clarity.

Agreed, the straightforward comparison is very useful for business-minded individuals.

Absolutely, Wayne White. The clarity makes it an invaluable reference.

It’s a well-structured and informative piece. The business comparisons are very enlightening.

The differentiation between Inc. and Ltd. is quite intriguing. It’s interesting to see the variations in governance rules and taxation systems.

Absolutely, George Wood. The complexities of governance rules and taxation nuances are intriguing.

Good point, George. These differences certainly add depth to the discussion.

While it’s informative, I would have appreciated a more critical analysis of the business models. This would add depth to the content.

That would certainly elevate the discussion, Patricia.

You have a valid point, Patricia Hunt. An analysis of potential drawbacks or challenges would be informative.

The article is informative, but the tone is overly formal. It could benefit from a more light-hearted approach.

I see your point, Adrian57, an informal tone could make the content more engaging.

This article provides a comprehensive and clear comparison between Inc. and Ltd. business models. It’s very enlightening.

I agree with you, Owen56, it’s very helpful in understanding the differences.

While it’s very informative, I sense a hint of bias towards the Inc. model. A more balanced approach would have been appreciated.

I see what you mean, Mark36. A balance between the models would add value.

The article lays out the differences very clearly – an excellent resource for those needing a quick comparison.

I found it very helpful too. It’s well-structured and easy to follow.

Indeed, Nharrison. The clarity and depth of the comparisons are commendable.

This is a very useful resource for anyone looking to start a business. The comparisons outlined make it easier to understand which model would suit different types of businesses.

It’s laid out well and contains valuable information, indeed.

Absolutely agree, Helen07. This should be required reading for aspiring entrepreneurs.

The content is quite engaging and easy to comprehend. It serves as a valuable learning resource for business enthusiasts.

I couldn’t agree more, Megan45. It’s a valuable resource indeed.

Absolutely, Megan45. The engaging content makes concepts more accessible.