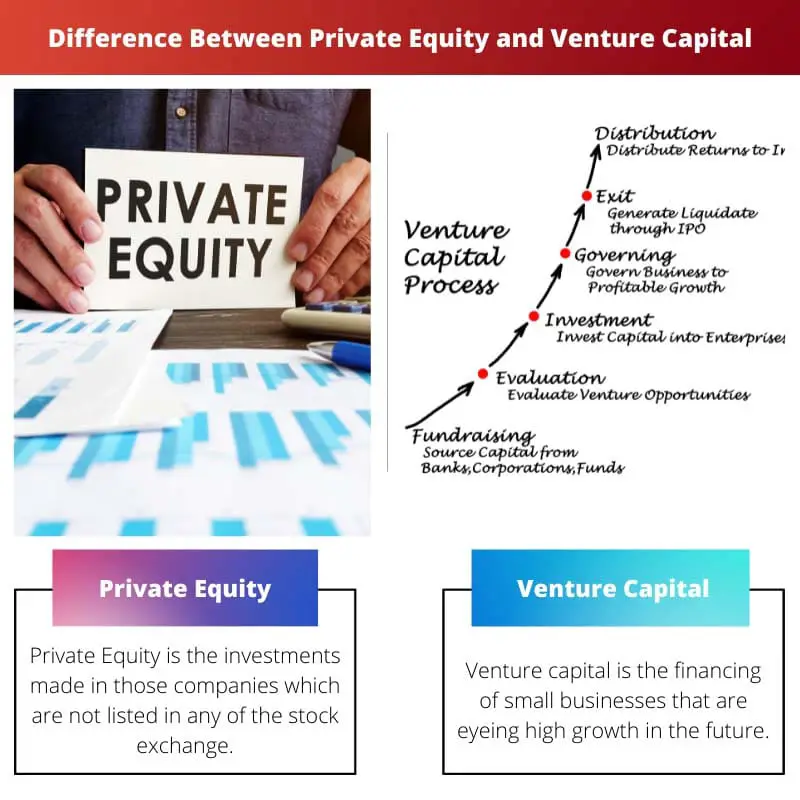

El capital privado implica invertir en empresas establecidas, con un enfoque en la reestructuración o el crecimiento, mientras que el capital de riesgo financia empresas emergentes en etapa inicial con un alto potencial de crecimiento. El capital privado trata con empresas maduras, con el objetivo de mejorar operativas, mientras que el capital de riesgo busca apoyar ideas innovadoras y tecnologías disruptivas en sus primeras etapas. Ambos implican que los inversores proporcionen capital a cambio de participaciones en la propiedad.

Puntos clave

- Las firmas de capital privado invierten en empresas establecidas y maduras para mejorar su rendimiento y rentabilidad, mientras que las firmas de capital de riesgo invierten en empresas en etapa inicial con alto potencial de crecimiento.

- Las inversiones de capital privado implican la compra de participaciones de control en empresas y pueden implicar adquisiciones apalancadas, mientras que las inversiones de capital de riesgo se centran en la adquisición de participaciones minoritarias en nuevas empresas.

- El perfil de riesgo de las inversiones de capital privado es menor que el de las inversiones de capital de riesgo, ya que el capital privado apunta a negocios más estables y probados.

Capital Privado vs Capital de Riesgo

La diferencia entre Private Equity y Venture Capital es que en el caso de Private Equity las inversiones se realizan en la etapa de expansión. En cambio, en el caso del Venture capital, los activos se realizan en la propia etapa seed.

Tabla de comparación

| Feature | Private Equity | Capitales de Riesgo |

|---|---|---|

| Etapa de inversión | Empresas maduras, consolidadas y rentables | Startups en etapa temprana, alto potencial de crecimiento pero no probado |

| Tipo de inversión | Compra (control mayoritario) o capital de crecimiento | Participaciones minoritarias |

| Perfil Riesgo-Retorno | Menor riesgo, rentabilidad moderada | Mayor riesgo, rendimientos potencialmente mayores |

| Periodo de inversión | 3-5 años | 5-7 años |

| Industrias objetivo | Amplia gama (bienes de consumo, sanidad, industria, etc.) | Sectores específicos (tecnología, biotecnología, tecnologías limpias) |

| Financiación | Compras de apalancamiento (deuda + capital) | Principalmente basado en acciones |

| Creación de valor | Mejoras operativas, ingeniería financiera. | Desarrollo de modelos de negocio, expansión del mercado. |

| Estrategia de salida | IPO, venta a otra empresa de capital privado, oferta secundaria | IPO, adquisición por parte de una empresa más grande |

| Tamaño típico del fondo | Billones de dolares | Cientos de millones de dólares |

| Focus | Retorno financiero a través de la eficiencia operativa | Apreciación del capital a través de startups de alto crecimiento |

| Ejemplos | Blackstone, KKR, Grupo Carlyle | Sequoia Capital, Andreessen Horowitz, Kleiner Perkins |

¿Qué es el Capital Privado?

El capital privado (PE) es una forma alternativa de inversión que implica la adquisición de participaciones en empresas privadas, con el objetivo de lograr rendimientos significativos. Las empresas de capital privado reúnen fondos de inversores institucionales, como fondos de pensiones y dotaciones, para formar un fondo dedicado a invertir en empresas privadas.

Proceso de inversión

- Recaudación de fondos: Las empresas de capital privado obtienen capital de los inversores, formando un fondo que se utiliza para realizar inversiones.

- Búsqueda de acuerdos: Los profesionales de PE identifican posibles oportunidades de inversión a través de varios canales, incluidos networking, relaciones industriales e investigación de mercado.

- Debida diligencia: Se realiza un análisis exhaustivo de las finanzas, las operaciones y la posición de mercado de la empresa objetivo para evaluar la viabilidad y los riesgos potenciales de la inversión.

- Estructuración del trato: Negociación de términos, valoración y estructura de la inversión, que implica la compra de una participación significativa.

- Gestión de la cartera: Una vez invertidas, las empresas de capital privado gestionan activamente y trabajan en estrecha colaboración con las empresas de la cartera para mejorar la eficiencia operativa, implementar cambios estratégicos e impulsar el crecimiento.

- Estrategia de escape: Las empresas de capital privado pretenden salir de sus inversiones de manera rentable, mediante métodos como vender la empresa, fusionarla con otra o hacerla pública mediante una oferta pública inicial (IPO).

Tipos de Capital Privado

- Compras: Implica adquirir una participación mayoritaria en una empresa madura para implementar cambios y mejorar la rentabilidad. Los tipos incluyen:

- Compras apalancadas (LBO): Implica financiar la adquisición con un importe importante de deuda.

- Compras de gestión (MBO): La dirección de la empresa participa en la adquisición.

- Capital de riesgo: Se centra en invertir en empresas en etapa inicial con alto potencial de crecimiento, especialmente en los sectores de tecnología e innovación.

- La financiación de entresuelo: Implica proporcionar una combinación de deuda y capital a una empresa, en una etapa posterior de desarrollo.

Caracteristicas claves

- Iliquidez: Las inversiones en PE tienen un horizonte de inversión más largo, con fondos bloqueados durante varios años antes de lograr rendimientos.

- Participación activa: Las empresas de capital privado participan activamente en la gestión y las decisiones estratégicas de las empresas de su cartera para mejorar el valor.

- Riesgo y retorno: Si bien las inversiones de capital privado pueden ofrecer altos rendimientos, también conllevan un mayor riesgo debido a su naturaleza ilíquida y al potencial de fluctuaciones del mercado.

¿Qué es el capital riesgo?

El capital de riesgo (VC) es una forma de financiación de capital privado que se centra en proporcionar financiación a empresas emergentes de alto potencial y en etapa inicial con perspectivas de crecimiento prometedoras. Los capitalistas de riesgo invierten en empresas innovadoras en sectores como la tecnología, la biotecnología y otras industrias emergentes.

Proceso de inversión

- Formación de fondos:

- Las empresas de capital de riesgo obtienen capital de inversores institucionales, corporaciones e individuos de alto patrimonio para crear un fondo dedicado a invertir en nuevas empresas.

- Búsqueda de acuerdos:

- Los profesionales de capital de riesgo buscan activamente oportunidades de inversión estableciendo contactos, asistiendo a eventos de la industria y colaborando con empresarios y otros inversores.

- Debida diligencia:

- Se lleva a cabo un análisis exhaustivo del modelo de negocio, la tecnología, el potencial de mercado y el equipo de gestión de la startup para evaluar la viabilidad y los riesgos de la inversión.

- Negociación de la hoja de términos:

- Si la diligencia debida tiene éxito, la empresa de capital de riesgo presenta una hoja de términos que describe los términos propuestos para la inversión, incluida la valoración, la participación en la propiedad y otros términos clave.

- Inversión:

- Después de negociar y finalizar los términos, la empresa de capital de riesgo proporciona financiación a la startup a cambio de una participación accionaria en la empresa.

- Apoyo posterior a la inversión:

- Los capitalistas de riesgo desempeñan un papel activo en el apoyo al crecimiento de las empresas de su cartera brindando orientación estratégica, oportunidades de establecimiento de contactos y tutoría.

- Estrategia de escape:

- Las empresas de capital de riesgo pretenden salir de sus inversiones para obtener rentabilidad, normalmente a través de una oferta pública inicial, una adquisición por parte de una empresa más grande o una fusión.

Tipos de capital de riesgo

- Capital de riesgo en etapa inicial:

- Financiamiento proporcionado a nuevas empresas en sus etapas iniciales de desarrollo, antes de que tengan un producto probado o ingresos significativos.

- Capital de riesgo en etapa tardía:

- Inversiones realizadas en startups más maduras que han demostrado tracción en el mercado y están ampliando sus operaciones.

- Capital Riesgo Corporativo (CVC):

- Fondos de inversión establecidos por grandes corporaciones para invertir y colaborar con nuevas empresas, obteniendo conocimientos estratégicos y potencial de innovación.

Caracteristicas claves

- Alto riesgo, alta recompensa:

- Las inversiones de capital de riesgo son inherentemente riesgosas debido a la incertidumbre asociada con las empresas en etapa inicial, pero las inversiones exitosas pueden generar retornos sustanciales.

- Participación activa:

- Los capitalistas de riesgo aportan no sólo capital sino también experiencia, conexiones industriales y tutoría para ayudar a las nuevas empresas a superar los desafíos y alcanzar el éxito.

- Horizonte a largo plazo:

- Las inversiones de capital de riesgo pueden tardar varios años en madurar y los eventos de liquidez ocurren cuando la startup sale a bolsa o es adquirida.

- Focus en innovación:

- El capital riesgo está especialmente interesado en empresas con tecnologías o modelos de negocio innovadores y disruptivos.

Principales diferencias entre Private Equity y Venture Capital

- Etapa de inversión:

- Capital Privado (PE): Se centra en invertir en empresas maduras y establecidas.

- Capital de riesgo (VC): Está dirigido a startups en etapa inicial con alto potencial de crecimiento.

- Madurez de la empresa:

- EDUCACIÓN FÍSICA: Normalmente se trata de empresas que tienen una trayectoria comprobada y buscan crecimiento o reestructuración.

- VC: Invierte en empresas en sus primeras etapas, antes de que se obtengan ingresos significativos o la validación del mercado.

- Perfil de Riesgo y Retorno:

- EDUCACIÓN FÍSICA: Riesgo generalmente menor en comparación con el capital de riesgo, con un enfoque en un flujo de caja estable y mejoras operativas.

- VC: Implica un mayor riesgo debido a la incertidumbre de las empresas en etapa inicial, pero ofrece el potencial de obtener retornos sustanciales.

- Horizonte de inversión:

- EDUCACIÓN FÍSICA: Por lo general, tiene un horizonte de inversión de mediano a largo plazo y mantiene inversiones durante varios años.

- VC: Implica un horizonte a más largo plazo, con salidas que se producen a través de OPI o adquisiciones después de que la startup alcance la escalabilidad.

- Tipo de empresas a las que se dirige:

- EDUCACIÓN FÍSICA: Se dirige a una amplia gama de industrias y sectores, incluidas las empresas tradicionales.

- VC: Se centra principalmente en empresas innovadoras e impulsadas por la tecnología, especialmente en sectores como TI, biotecnología y otras industrias emergentes.

- Tamaño de la inversión:

- EDUCACIÓN FÍSICA: Implica inversiones de mayor tamaño, que requieren un capital significativo para adquisiciones o reestructuraciones.

- VC: Por lo general, implica montos de inversión más pequeños, especialmente en las primeras etapas de una startup.

- Propiedad y control:

- EDUCACIÓN FÍSICA: A menudo adquiere una participación mayoritaria o significativa en las empresas en las que invierte.

- VC: Adquiere participaciones minoritarias, lo que permite a los fundadores conservar el control y el poder de toma de decisiones.

- Base de inversores:

- EDUCACIÓN FÍSICA: Obtiene capital de inversores institucionales, como fondos de pensiones, dotaciones e inversores privados.

- VC: Atrae financiación de inversores institucionales, corporaciones e individuos de alto patrimonio.

- Estructura del trato:

- EDUCACIÓN FÍSICA: A menudo implica compras apalancadas, financiación mezzanine u otros acuerdos estructurados para mejorar la rentabilidad.

- VC: Por lo general, implica inversiones de capital con un enfoque en apoyar el crecimiento de la startup.

- Estrategias de salida:

- EDUCACIÓN FÍSICA: Las salidas se producen mediante la venta de la empresa, fusión o recapitalización.

- VC: Las salidas suelen implicar salidas a bolsa, adquisiciones de empresas más grandes o fusiones.

- https://www.hbs.edu/faculty/Pages/item.aspx?num=35877

- https://www.econstor.eu/bitstream/10419/48428/1/577823078.pdf

Última actualización: 11 de febrero de 2024

Chara Yadav tiene un MBA en Finanzas. Su objetivo es simplificar los temas relacionados con las finanzas. Ha trabajado en finanzas durante unos 25 años. Ha impartido múltiples clases de finanzas y banca para escuelas de negocios y comunidades. Leer más en ella página de biografía.

La tabla comparativa es una característica excelente de este artículo, que facilita discernir las principales divergencias entre el capital privado y el capital de riesgo. Es una guía bien estructurada para cualquiera que busque claridad sobre estos tipos de inversiones.

Aprecié la naturaleza concisa pero informativa de la tabla. Complementa perfectamente las explicaciones textuales detalladas.

Tienes razón, Tiffany12. La tabla resume eficazmente las diferencias clave y proporciona una descripción general rápida y accesible.

El desglose que se hace en el artículo del proceso de inversión de capital privado y capital de riesgo es encomiable. Ofrece una visión holística que permite a los lectores apreciar las complejidades de estas formas de inversión.

No podría estar más de acuerdo, Erin Wilkinson. El artículo analiza cuidadosamente el proceso de inversión y arroja luz sobre las complejidades involucradas en las transacciones de capital privado y capital de riesgo.

Este artículo proporciona un desglose completo del capital privado y el capital de riesgo, lo que lo convierte en un excelente punto de referencia para profesionales y recién llegados a la industria financiera. Las distinciones están claramente articuladas y las conclusiones clave son especialmente valiosas.

El enfoque del artículo en el proceso de inversión tanto para capital privado como para capital de riesgo es lo que lo distingue. Los conocimientos proporcionados sin duda beneficiarán a quienes busquen una comprensión más profunda de estos vehículos de inversión.

Absolutamente Lucas. Los ejemplos de empresas de capital privado y de capital de riesgo me parecieron particularmente útiles para fundamentar los conceptos teóricos en aplicaciones del mundo real.

La exploración que se hace en el artículo de los perfiles riesgo-retorno del capital privado y el capital de riesgo aclara las consideraciones financieras asociadas con estas inversiones. Este enfoque analítico mejora la credibilidad del artículo.

El contenido está lleno de información valiosa sobre capital privado y capital de riesgo. Este análisis en profundidad es precisamente lo que los lectores necesitan para captar los matices de estos vehículos de inversión.

Si bien el artículo es indudablemente informativo, un toque de ironía o sarcasmo podría aportar algo de humor y hacer que el contenido sea más atractivo. El tema se presta bien a tales recursos estilísticos.

Puedo entender tu punto, Parker Lola. Inyectar algo de humor podría aumentar el atractivo del artículo, especialmente dada la naturaleza técnica del tema.

Este artículo es un recurso valioso para cualquiera que busque obtener una comprensión sólida del capital privado y el capital de riesgo. Es una guía bien elaborada que está dirigida tanto a profesionales novatos como experimentados.

Me hago eco de sus sentimientos, Marshall Leah. La profundidad del análisis y la claridad lograda en este artículo es un testimonio de su calidad como herramienta educativa.

Un aspecto que mejoraría el artículo es incorporar estudios de casos o escenarios de la vida real para ilustrar la aplicación del capital privado y el capital riesgo. Los ejemplos prácticos sirven como poderosas herramientas para la comprensión.

Este artículo proporciona una excelente comparación entre capital privado y capital de riesgo. Es muy informativo y está bien estructurado. Agradezco la explicación detallada del proceso de inversión tanto de capital privado como de capital riesgo. Realmente ayuda a comprender las diferencias entre los dos.

Me alegra que el artículo haya aclarado parte de la confusión en torno a estos dos tipos de inversión. Es un gran recurso para cualquiera que busque aprender más sobre capital privado y capital de riesgo.

Estoy de acuerdo contigo, Beth80. La tabla comparativa es particularmente útil para resaltar las distinciones entre capital privado y capital de riesgo. ¡Bien hecho!

Si bien la comparación es exhaustiva, creo que se podría hacer más énfasis en los desafíos y posibles desventajas asociadas con el capital privado y el capital de riesgo. Una visión más equilibrada haría que el artículo fuera aún más esclarecedor.

Entiendo tu punto, Alee. Es esencial comprender los riesgos y desventajas de estos tipos de inversión. Hacer hincapié en esos aspectos añadiría profundidad al debate.