Study, languages, and subjects have always played an integral part in our lives and helped us grow to think analytically, politically, and critically and raise questions to show our society’s positions.

From the study of rocks called geology, every subject exists today, a sub-division of geography, which is a division of social studies, to the analysis of space, dark matter, string theory, and even time travel is a part of physics.

English which determines whether the person is qualified as a proficient intermediate or an introductory speaker, is the universally accepted language.

Accounting or accounting is the soul of every business in the world. No business can survive without bookkeeping as it helps to assert profits, losses, expenditures, and flow of income.

Moreover, it helps to keep accurate information on the assets and liabilities that the firm holds. The depreciation caused by the assets is the salary that must be paid to the employees.

Moreover, bookkeeping results in investors’ final balance sheet as an instrument of whether the company is reliable and a place to invest, all of which are accounts or bookkeeping.

Key Takeaways

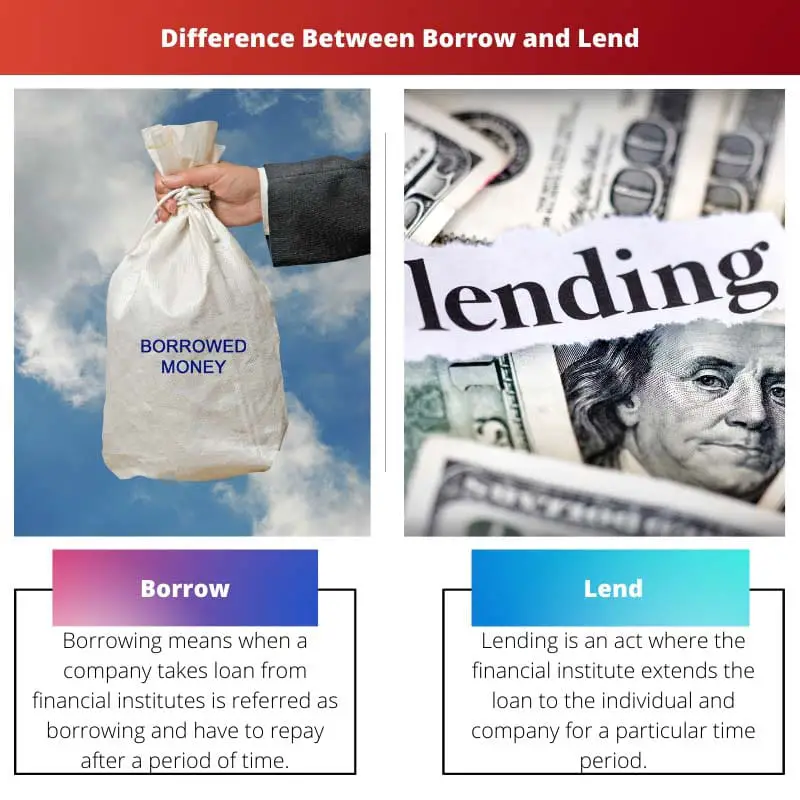

- Borrow means to take something from someone to return it, while lending means to give something to someone with the expectation of it being returned.

- The person who receives something is the borrower, while the person who gives something is the lender.

- Borrowing involves an agreement between the borrower and lender, including the terms of repayment and any interest that may be charged.

Borrow vs Lend

The difference between borrow and lending is that lending is an act of giving. For example, when the bank extends a loan towards us, the bank gives us money under some security that has to be repaid later.

Borrowing is an act of taking something.

For example, a company brought stationery stock on credit here; the company is borrowing goods where they will provide security like a bill of exchange which can be later discounted from the bank.

Borrow is when we take something; lend is when we give or extend something.

Comparison Table

| Parameters of Comparison | Borrow | Lend |

|---|---|---|

| Meaning | Borrowing means when a company takes a loan from financial institutes, which is referred to as borrowing and has to repay after some time. | Lending is an act where the financial institution extends a loan to the individual and company for a particular period. |

| Objectives | Borrowing is not in terms of money. It may be in terms of goods and commodity | Borrowing is a noun in the English language |

| Grammar Usage | Borrowing is a noun is the English language | Lending is termed a verb in English grammar, as verbs are used to indicate or happen. |

| Motto | The motto behind this is that the person does not possess that particular and borrows by paying some premium. | The motto behind lending is to extend something you have in surplus and is ready to extend for some extra income. |

| Purpose | Borrowing’s purpose is to use money and get an asset that can be used by the borrower and even generate income and repay. | The lending purpose is to extend money to a person that is re-payed with extra interest that becomes the lender’s income. |

What is Lending?

Lending is giving or extending a particular or monetary term like money; lending is also termed as a verb as it specifies that an action is taking place.

Lending is, many times, meaning extending loans that are given to a third party. The party is supposed to repay the loan with a rate of interest that is considered an income for the lender.

Moreover, the lender is always considered supreme or has the upper hand in lending as the third party still has to pay or keep some collateral that is an assurance for the money and can be sold if the payee fails to deliver.

Lending has different terminologies and definitions. Lending is also known as a reverse repo in many accounting terms, where many big business houses borrow money for just a single day with specified collateral.

The amount is enormous, and that can be used for significant dealings and investments.

What is Borrowing?

Borrowing means getting something like a commodity like gold or money at credit, and assurance like collateral or a bill of exchange is provided.

Borrowing generates income for the lender, as they will get the principal sum with the decided interest rate and security rate.

The borrower always has the lower hand as the lender has the security and can be sold if the borrower fails to repay the lender’s money.

Borrowing is also considered a noun in English grammar, as the word represents a name, place, or thing.

The borrowing is also termed as short selling or is an example of where one borrows shares of one company not purchased by the investor and is returned the borrower makes the same day and profits.

Short selling also requires some collateral.

Main Differences Between Borrowing and Lending

- Borrowing is an act of getting something. For example, extending a bank loan is an act of lending that must be repaid, whereas lending is an act of giving. For example, when a bank extends a loan, it is termed lending.

- The purpose behind lending is to generate income, as the lender will be interested in the books’ revenue. In contrast, borrowing is also used for fruitful purposes like medical expenses, home loans, or car loans repaid with interest.

- The fundamental purpose behind lending is to give money in exchange for security, called collateral. In contrast, borrowing’s vital goal is getting cash and exchanging it again to buy the required assets or cover expenditures.

- The lender always has the upper hand, as the lender can sell the collateral if the borrower fails to repay the loan. In contrast, the borrower has no say in marketing the collateral as it is the security.

- Lending is to extend money often; the lender can extend goods like a stock on credit for security like a bill of exchange. The borrower can also borrow commodities like gold or a lease asset to fulfil the purpose.

The post provides a witty yet informative look at borrowing and lending, adding sophistication and wit to the discussion.

I agree, the witty and comical tone makes the subject matter all the more engaging.

The juxtaposition of humor and intellect in this post is indeed commendable.

The post divulges crucial and intricate details about accounting and the functioning of businesses.

Absolutely, it sheds light on how essential accounting is for the survival and reliability of businesses.

It makes a compelling argument for the value of sound bookkeeping practices.

This article offers a fascinating perspective on various disciplines and the interconnectedness of knowledge.

It certainly provides an intellectual exploration of important concepts that shape our society.

The post presents an enlightening and well-structured comparison of borrowing and lending, offering a deep understanding of these concepts.

I appreciate the sarcastic undertones in depicting the differences between borrowing and lending, quite clever!

The post does an excellent job of balancing humor and intellect while discussing these financial aspects.

The article ingeniously explores the complexities of borrowing and lending in the context of various financial and linguistic parameters.

Absolutely, the use of irony and precise language adds an intriguing layer to the piece.

An insightful exploration of the differences between borrowing and lending, and how these concepts apply in various situations.

Indeed, it’s a fascinating and thought-provoking analysis of these financial principles.

The post creates an interesting and intellectual discussion on the subject.

Absolutely, it raises essential questions about society’s positions and the importance of knowledge.

Yes, I agree. It offers a comprehensive and well-informed view of the topic.

The post provides a comprehensive look at the significance of borrowing and lending in the business world.

It’s an informative and detailed explanation of the processes of borrowing and lending.

The post is quite enlightening and thought-provoking.

I appreciate how it delves into the intricacies of economics and linguistics with such clarity.

Indeed, it presents very valuable insights into different subjects and languages.

The linguistic and economic perspectives in this post are fascinating and intellectually enriching.

Indeed, the post masterfully intertwines various knowledge domains to offer a profound understanding of borrowing and lending.