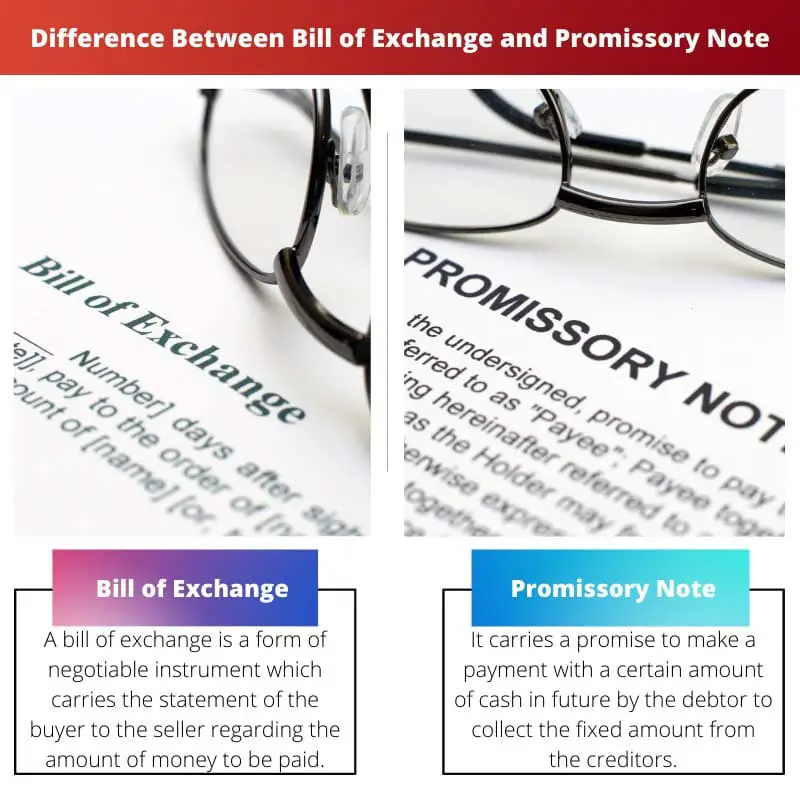

A bill of exchange is a negotiable instrument used in trade transactions that orders one party to pay a specified sum of money to another party at a predetermined future date. In comparison, a promissory note is a written promise from one party to pay a specific amount of money to another party on a specified date or on demand.

Key Takeaways

- A Bill of exchange is a written order from one person (drawer) to another (drawee) to pay a specified sum of money to a third party (payee) on a selected date or demand.

- A promissory note is a written promise from one person (maker) to pay a specified sum of money to another person (payee) on a selected date or demand.

- A Bill of exchange involves three parties (drawer, drawee, and payee), while a promissory note involves two parties (maker and payee).

Bill of Exchange vs Promissory Note

A bill of exchange is issued by the creditor and a Promissory Note is issued by the Debtor. In the former, 3 parties are involved i.e., drawer, drawee and payee, in the latter 2 parties are involved i.e., a drawer and the payee. In the former, liability of the drawer is primary unlike the latter.

Comparison Table

| Feature | Bill of Exchange | Promissory Note |

|---|---|---|

| Definition | An order to pay a certain sum of money to a specific person or their order by a specific date. | A written promise to pay a certain sum of money to a specific person or their order by a specific date. |

| Parties involved | Drawer (the person issuing the bill), drawee (the person ordered to pay), and payee (the person who is to receive the payment). | Maker (the person issuing the note) and payee (the person who is to receive the payment). |

| Nature of obligation | An unconditional order to pay. | A conditional promise to pay, depending on the fulfillment of certain conditions. |

| Negotiability | Highly negotiable and can be transferred to other parties through endorsement. | Less negotiable than a bill of exchange and may not be easily transferable. |

| Typical use | International trade, financing transactions, and obtaining loans. | Short-term loans, credit purchases, and personal debts. |

| Acceptance | The drawee must accept the bill of exchange before it becomes a legally binding obligation. | The maker is automatically bound by the terms of the promissory note. |

| Format | More formal and standardized format with specific legal requirements. | More flexible format and can be customized according to the specific needs of the parties involved. |

What is Bill of Exchange?

A Bill of Exchange (BoE) is a formal written document used in financial transactions to promise or order the payment of a specific sum of money at a specific date. It is considered a highly negotiable instrument and is crucial in facilitating international trade and financing activities.

Key features of a Bill of Exchange:

- Three parties involved:

- Drawer: The person who creates and issues the BoE, instructing the payment.

- Drawee: The person who is ordered to pay the specified sum.

- Payee: The person who is entitled to receive the payment.

- Unconditional order to pay: The drawee must pay the specified sum to the payee on the due date.

- Negotiability: The BoE can be transferred to other parties through endorsement, allowing for flexibility in payment arrangements.

- Formal format: The BoE needs to adhere to specific legal requirements and include essential details like the parties involved, amount due, due date, and drawer’s signature.

Types of Bills of Exchange:

- Trade draft: Used in international trade to secure payment for goods shipped.

- Bank draft: Issued by a bank on behalf of a customer to guarantee payment to another party.

- Sight draft: Requires immediate payment upon presentation.

- Time draft: Specifies a future date for payment.

- Domiciled bill: Specifies a specific location for payment.

Benefits of using Bills of Exchange:

- Security and reliability: Guarantees payment by creating a legally binding obligation for the drawee.

- Flexibility: Can be customized to meet the specific needs of the transaction.

- Negotiability: Facilitates easy transfer of payment rights to other parties.

- Cost-effective: Provides a relatively low-cost method of securing payment compared to other options like letters of credit.

What is Promissory Note?

A Promissory Note (PN) is a written promise by one party (the maker) to pay a certain sum of money to another party (the payee) at a specified date or on demand. It is a legal document that defines a debt obligation and serves various purposes in financial transactions.

Key features of a Promissory Note:

- Two parties involved:

- Maker: The borrower who signs the note and promises to repay the loan.

- Payee: The lender who receives the note and is entitled to the payment.

- Conditional promise to pay: Unlike a Bill of Exchange, the maker may be subject to certain conditions before fulfilling the payment obligation.

- Less negotiable than Bills of Exchange: Transferring ownership of a PN might require specific procedures and may not be as readily accepted by third parties.

- Flexible format: The format of a PN can be customized to suit the specific needs of the parties involved and may not require strict adherence to legal formalities like BoE.

Types of Promissory Notes:

- Demand note: Payable on the demand of the payee.

- Term note: Specifies a future date for payment.

- Secured note: Backed by collateral, such as property or assets.

- Unsecured note: Not backed by collateral and relies solely on the maker’s promise to repay.

Benefits of using Promissory Notes:

- Simple and straightforward: Easy to understand and implement for both parties involved.

- Flexible and adaptable: Can be customized to different loan terms and repayment schedules.

- Cost-effective: Less expensive to prepare and manage compared to formal loan agreements.

- Personal touch: Provides a personalized approach to loan agreements between individuals or small businesses.

Overall, Promissory Notes play a crucial

Main Differences Between Bill of Exchange and Promissory Note

- Parties Involved:

- Bill of Exchange: In a bill of exchange, there are three parties involved: the drawer (who orders the payment), the drawee (who is directed to make the payment), and the payee (who receives the payment).

- Promissory Note: In a promissory note, only two parties are involved: the maker (who promises to pay) and the payee (who receives the payment).

- Nature of Instrument:

- Bill of Exchange: A bill of exchange is primarily an order for payment and is used in trade and business transactions to request the drawee to pay the payee.

- Promissory Note: A promissory note is a direct promise by the maker to pay a specified sum of money to the payee and is used for various types of loans, debt arrangements, or personal agreements.

- Payment Direction:

- Bill of Exchange: The bill of exchange contains an order from the drawer to the drawee to pay the payee on a specified future date or upon presentation.

- Promissory Note: The promissory note includes a direct promise by the maker to pay the specified amount to the payee on a specified future date or upon demand.

- Acceptance Requirement:

- Bill of Exchange: Bills of exchange may require acceptance by the drawee, indicating their willingness to make the payment as instructed.

- Promissory Note: Promissory notes do not require acceptance since they are already a direct promise to pay by the maker.

- Usage and Context:

- Bill of Exchange: Bills of exchange are commonly used in commercial and international trade transactions to facilitate payments and financing arrangements.

- Promissory Note: Promissory notes are used for personal loans, financial transactions, or for individuals and businesses to formalize debt obligations.

- Negotiability:

- Bill of Exchange: Bills of exchange are negotiable instruments, meaning they can be transferred to third parties, who then become entitled to the payment.

- Promissory Note: Promissory notes can also be negotiable, but their negotiability depends on specific legal requirements and the terms specified in the note.

- https://albertalawreview.com/index.php/ALR/article/download/1893/1882/

- https://heinonline.org/hol-cgi-bin/get_pdf.cgi?handle=hein.journals/ibl4§ion=26

While the article provides an insightful comparison, I think it would be helpful to include specific examples of scenarios where each instrument is commonly used to further illustrate their respective applications.

I second that, Baker. Real-world examples would certainly enhance the practical understanding of these financial instruments.

The benefits of using bills of exchange mentioned in the article highlight their practical advantages. The security, flexibility, and negotiability make them a valuable financial instrument.

I fail to see the supposed ‘benefits’ as convincingly superior. The comparison to other options like letters of credit leaves room for skepticism.

Indeed, Alexandra. The comprehensive coverage of bill of exchange benefits underscores their practical utility in diverse financial scenarios.

The distinction between the maker and payee in a promissory note is clearly outlined. This clarity helps in understanding the roles and obligations of each party involved.

I find the emphasis on the two-party nature of promissory notes somewhat oversimplified. There could be scenarios with more complexity.

Absolutely, Isla62. The precise definition of the involved parties in promissory notes ensures transparent roles and responsibilities in financial transactions.

The structured explanation of the types of bills of exchange is exceptional. It makes it easier to comprehend the various forms and their specific applications.

Agreed, Jrobertson. The detailed breakdown of trade drafts, bank drafts, and other types offers a comprehensive view of the versatility of bills of exchange.

I find the categorization of bill types somewhat arbitrary and overly complicated. It seems like unnecessary complexity.

The detailed features of a bill of exchange highlight its contractual nature and role in international financial activities. Such comprehensive information is highly valuable.

Indeed, Oliver52. A thorough understanding of bill of exchange features provides a solid foundation for engaging in international commercial transactions.

The article’s coverage of the benefits of promissory notes presents a compelling case for their use in managing personal debts and short-term loans.

I remain skeptical of the practicality claimed for promissory notes in managing personal debts, especially considering the evolving financial landscape.

Absolutely, Jackson Ruby. Understanding the practical application of promissory notes is crucial for individuals navigating short-term financial transactions.

This is a very informative article! I appreciate the clear comparison between a bill of exchange and a promissory note, making it easier to understand the differences and use cases for each.

I agree, Maria. The clear distinction between the two financial instruments is valuable for anyone involved in trade or financial transactions.

The direct comparison of the negotiation aspects between bills of exchange and promissory notes adds a layer of practical understanding to the differences between the two financial instruments.

The negotiation aspects seem exaggerated, almost trivializing the significance of promissory notes in financial dealings.

Well put, Zking. The clarity on the negotiability factor offers a distinct perspective on the operational differences between these financial instruments.

While the comparison between bills of exchange and promissory notes is informative, the article’s presentation could benefit from a lighter tone to engage a wider audience.

I couldn’t agree more, Bpalmer. Injecting some humor and relatable references could make the complex topic more accessible to broader readership.

I find the complexity of bills of exchange intriguing. The involvement of three parties and the formal legal requirements make it a powerful tool in international trade and financing.

Absolutely, Craig. The nuances of bills of exchange reveal their significance in facilitating complex international financial transactions.

I respectfully disagree. I find the requirements and strict formalities associated with bills of exchange burdensome and a potential barrier to more streamlined financial operations.