The system of tax is considered to be mandatory in an economically sound state, but for the taxpayers, it seems like a painful deal.

However, there are certain methods that can help a person to get relief in this process. Exemption and Deduction are two such methods by which the overall tax liability of a person gets reduced.

But both of these are very different from one another, and it is important to recognize these differences.

Key Takeaways

- Exemptions reduce taxable income based on the taxpayer’s filing status and dependents.

- Deductions lower taxable income by accounting for specific expenses or losses.

- Both exemptions and deductions aim to decrease the tax burden on individuals and businesses.

Exemption vs Deduction

An exemption is an amount of money that is excluded from taxable income based on a person’s status or circumstances. A deduction is an amount of money that can be subtracted from taxable income based on certain expenses or contributions, such as contributions to retirement accounts or charitable organizations.

In terms of tax liability, exemption refers to a system where some part of the income or the salary of a person is not calculated when he is asked to pay tax on the total income.

This meaning is very simple as it is clearly seen from the term exemption itself that it indicates that something has been exempted, and in the context of Texas, it represents that part of the income that attracts no tax at all.

But on the other hand, the term deduction represents a system of tax whereby the complete income of a person attracts tax liability.

But due to certain reasons, some of the total amounts get reduced to a particular extent.

This can either be a one-time deduction or a regular deduction scheme, but it totally depends upon the nature of tax liability and the amount of income as well.

Comparison Table

| Parameters of Comparison | Exemption | Deduction |

|---|---|---|

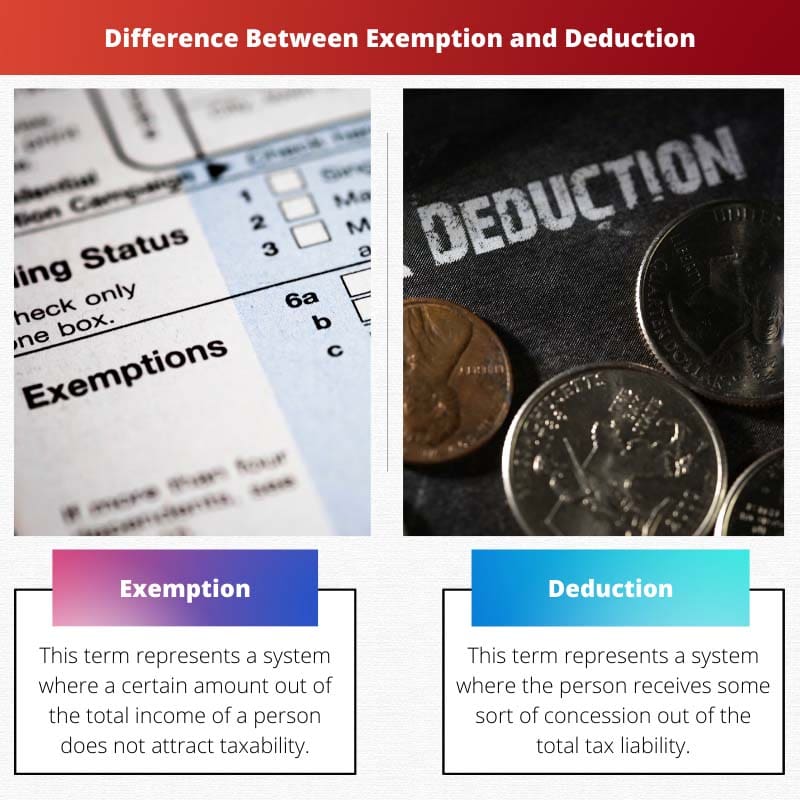

| Meaning | This term represents a system where a certain amount out of the total income of a person does not attract taxability | This term represents a system where the person receives some sort of concession out of the total tax liability |

| Nature | This system has a nature of relaxation | This system has a nature of the concession |

| Purpose | The hidden objective behind this particular system is to make sure that certain people receive relaxation because of their weaker economic condition | The objective behind this system is to make sure that people save a certain amount of their total income. |

| Applied on | It is applied to almost all the persons | It is only applied to the persons who happened to meet certain criteria prescribed by the competent authority |

| Procedure | Only a specific part out of the total income is counted for tax liability | All of the income is counted for tax liability but afterward certain concession is granted |

What is Exemption?

In the system of tax, the exemption is a process that grants the person who is liable to pay tax some sort of relief upon the total tax liability.

In simple words, a person is said to be exempted in his tax liability when a specific part of his total income is ignored while taking into account his total income that is subjected to tax liability.

The system works in two manners, basically.

In a first manner, the income of a person that he has gained through a particular way becomes totally exempted from the tax liability.

Income arising out of agricultural activities is one of the main examples of this particular system.

But the system works in another manner also that is known as half exemption. In this process, not the total amount is exempted, but only a particular part of the total amount receives some relief.

The hidden objective behind this particular system is to make sure that certain people receive relaxation because of their weaker economic conditions.

What is Deduction?

In order to grant some relief to a taxpayer, the system of deduction is also prevalent in some areas all across the world.

The concept of deduction can easily be understood by looking at the name itself.

It simply denotes that when a person has to file tax upon his income, he is granted some sort of concession on the total amount.

In other words, a deduction is when a person need not pay 100% of the total tax liability and receives a particular extent of discount or concession.

The reason why this concept works in society is that the authorities want people to maximize their savings, and for the same reason, they allow people some sort of concession upon their tax liability.

Although this system is very famous in many states, it still brings certain downsides along with certain benefits.

For example, it carries along with a particular eligibility criterion because it is only applied to the persons who happened to meet certain criteria prescribed by the competent authority.

Main Differences Between Exemption and Deduction

- Exemption represents a process where a person is not needed to pay tax on a certain amount of his income, while on the other hand, Deduction is a process where a person receives some concession or discount upon the total tax liability.

- The exemption applies to almost all persons, while the deduction applies to certain individuals only.

- The nature of exemption is to provide relaxation while, on the other hand, deduction provides concession.

- The reason why the exemption is provided is that the government wants the weaker section to feel lightly weighted in terms of tax liability, but on the other hand, the reason why deduction is provided is that the authorities want people to maximize their savings.

- To provide exemption certain part of the income is not at all calculated while making tax liability, but to provide deduction, the whole amount receives some concession.

- https://heinonline.org/hol-cgi-bin/get_pdf.cgi?handle=hein.journals/ohslj52§ion=54

- https://link.springer.com/article/10.1007/BF00874087

Last Updated : 13 July, 2023

Emma Smith holds an MA degree in English from Irvine Valley College. She has been a Journalist since 2002, writing articles on the English language, Sports, and Law. Read more about me on her bio page.

This article is as fun as doing taxes! (aka, not fun at all)

The tax system is convoluted by design. It’s neither fair nor easy to understand, but this article helps demystify it.

The post needs some humor injected into it. Tax talk is too boring without it!

A very thorough analysis of a complex concept that most people don’t fully understand. Good job explaining this in depth.

I agree, the post really clarifies the differences between the two terms. It’s very informative.

This is an important topic, but it’s a bit too wordy. The essence could be conveyed in a much more concise way.

I agree with Aaron, thoroughness is valuable in a tax-related topic.

I think the details are what make this article important. A topic like this needs detailed explanations.

The dry subject of taxes can’t really be made much more interesting than this. Kudos to the writer for trying!