GST (Goods and Services Tax) is a comprehensive indirect tax levied on the supply of goods and services in India. GSTIN (Goods and Services Tax Identification Number) is a unique 15-digit alphanumeric code assigned to registered taxpayers under the GST regime, serving as their identification for compliance and tax-related transactions.

Key Takeaways

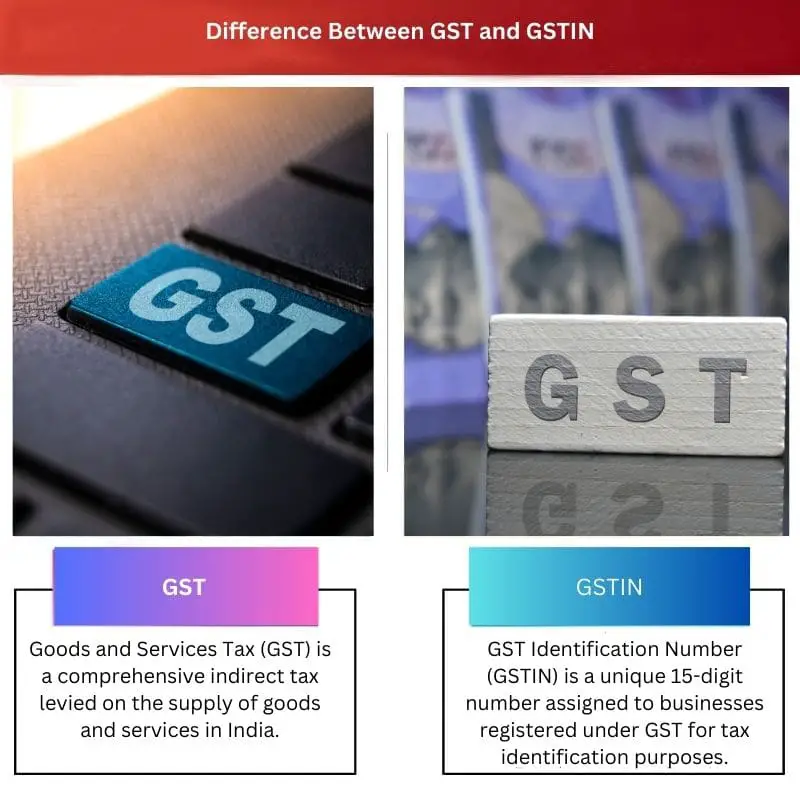

- Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services in India.

- GST Identification Number (GSTIN) is a unique 15-digit number assigned to businesses registered under GST for tax identification purposes.

- GST streamlines the taxation system, while GSTIN enables efficient tracking of tax transactions and compliance.

GST vs GSTIN

The difference between GST and GSTIN is that the former refers to India’s overall indirect tax structure. At the same time, the latter is a unique identification code provided under the former.

Goods and Service Tax or GST refers to the indirect tax regime introduced in July 2017, replacing India’s massive and complex consumption tax regime with a simple, manageable, uniform and centralized one.

Strictly speaking, it is a consumption tax charged on goods and services availed by 1.3 billion Indian consumers.

Although GST is charged to consumers, it reaches the government through the providers of goods and services, i.e. businesses and companies. Therefore, businesses are required to register for GST.

Comparison Table

| Feature | GST | GSTIN |

|---|---|---|

| Nature | Indirect Tax | Unique Identification Number |

| Purpose | – A value-added tax levied on most goods and services supplied in India. – Aims to create a unified indirect tax system across the country. | – Assigned to businesses registered under the GST regime. – Enables identification of taxpayers and facilitates administration of GST. |

| Applicability | Applies to a broad range of goods and services | Not applicable; it’s an identifier |

| Rates | Varies depending on the product or service category (multiple rates exist) | Not applicable |

| Payment | Businesses registered under GST collect GST from customers and deposit it with the government | Not applicable |

| Filing | Businesses registered under GST need to file regular returns with tax authorities | Not applicable |

| Format | Not applicable | 15-digit alphanumeric number |

What is GST?

Introduction to GST

GST, which stands for Goods and Services Tax, is an indirect tax levied on the supply of goods and services in India. It was introduced on July 1, 2017, replacing multiple indirect taxes like VAT, service tax, and excise duty, simplifying the tax structure and unifying the Indian market.

Key Components of GST

GST comprises three major components:

- CGST (Central Goods and Services Tax): Collected by the Central Government on intra-state transactions of goods and services.

- SGST (State Goods and Services Tax): Collected by the State Government on intra-state transactions of goods and services.

- IGST (Integrated Goods and Services Tax): Collected by the Central Government on inter-state transactions of goods and services, ensuring seamless movement of goods and services across state borders.

Benefits of GST

- Simplified Tax Structure: GST has simplified the tax structure by eliminating the cascading effect of taxes and streamlining compliance procedures, making it easier for businesses to understand and adhere to tax regulations.

- Uniform Taxation: GST has replaced a complex web of indirect taxes with a single tax regime, promoting uniformity in taxation across the country and fostering a common market.

- Boost to Economic Growth: By reducing tax barriers, promoting ease of doing business, and enhancing tax compliance, GST has contributed to the growth of the Indian economy and facilitated greater integration into the global market.

What is GSTIN?

Introduction to GSTIN

GSTIN, which stands for Goods and Services Tax Identification Number, is a unique identification number assigned to every registered taxpayer under the Goods and Services Tax (GST) regime in India. It is a 15-digit alphanumeric code that serves as a primary identifier for businesses and individuals registered under GST.

Structure of GSTIN

The GSTIN is structured as follows:

- State Code (First Two Digits): The first two digits represent the state code where the taxpayer is registered under GST. Each state in India has a unique code assigned to it.

- PAN or TIN (Next Ten Digits): The next ten digits are either the PAN (Permanent Account Number) issued by the Income Tax Department or the TIN (Taxpayer Identification Number) assigned by the State VAT authorities before the introduction of GST.

- Entity Code (Thirteenth Digit): The thirteenth digit of the GSTIN is assigned based on the number of registrations a taxpayer has within a state under the same PAN.

- Check Digit (Fifteenth Digit): The fifteenth digit of the GSTIN is a check code used for verification purposes. It is calculated using a mathematical formula based on the other digits of the GSTIN.

Significance of GSTIN

- Legal Compliance: GSTIN is essential for legal compliance under the GST regime. It is mandatory for businesses and individuals engaged in the supply of goods and services to register for GST and obtain a GSTIN.

- Filing Returns: GSTIN facilitates the filing of GST returns by providing a unique identifier for each taxpayer. It is used to file monthly, quarterly, and annual returns, including GSTR-1, GSTR-3B, and GSTR-9.

- Claiming Input Tax Credit (ITC): Businesses use GSTIN to claim input tax credit on taxes paid on inputs and services used in the course of business. It helps in offsetting tax liabilities and reducing the overall tax burden.

Main Differences Between GST and GSTIN

- Here are the main differences between GST and GSTIN in a bullet point list:

- GST (Goods and Services Tax):

- GST is an indirect tax levied on the supply of goods and services in India.

- It replaces multiple indirect taxes like VAT, service tax, and excise duty, simplifying the tax structure.

- GST is the tax itself, applied to transactions of goods and services.

- GSTIN (Goods and Services Tax Identification Number):

- GSTIN is a unique 15-digit alphanumeric code assigned to registered taxpayers under the GST regime.

- It serves as an identification number for compliance and tax-related transactions.

- GSTIN is used for filing returns, claiming input tax credits, and conducting business under the GST framework.

Similarities Between GST vs GSTIN

GST (Goods and Services Tax) and GSTIN (Goods and Services Tax Identification Number) are intricately connected components within the taxation framework of India, sharing certain similarities in their overarching objectives and roles. Both are integral parts of the government’s initiative to modernize and streamline the taxation system, promoting transparency, and reducing complexities.

At their core, both GST and GSTIN aim to simplify the taxation process. GST, as a comprehensive indirect tax, seeks to replace multiple pre-existing taxes, unifying the tax structure and eliminating cascading effects. Similarly, GSTIN, a 15-digit alphanumeric code, contributes to simplification by providing a standardized and unique identifier for businesses registered under the GST regime.

Both entities play pivotal roles in the identification and tracking of businesses. GST serves as the overarching tax applicable to the supply of goods and services, while GSTIN specifically identifies and distinguishes individual businesses within this broader tax framework. The structured nature of the GSTIN, with its state code, PAN, and registration-specific digits, aids in precise tracking and management of tax-related activities for each registered entity.

Furthermore, both GST and GSTIN are designed to enhance transparency in the taxation system. GST aims to create a more transparent and efficient tax structure for goods and services, while GSTIN contributes by providing a distinct identity that facilitates easy recognition and monitoring of individual businesses.