GST and CGST are both two separate Tax terms. GST is a Goods and Services Tax that commenced on 1st July 2017, whereas CGST is a Central Goods and Services Tax, a part of GST.

Key Takeaways

- Tax structure: GST (Goods and Services Tax) is an indirect tax levied on goods and services in India, while CGST (Central Goods and Services Tax) is a component of GST collected by the central government.

- Revenue distribution: GST comprises CGST, SGST (State Goods and Services Tax), and IGST (Integrated Goods and Services Tax), while CGST revenue solely goes to the central government.

- Applicability: GST is levied on intrastate and interstate transactions, while CGST is specifically applied to intrastate transactions along with SGST.

GST vs CGST

The difference between GST and CGST is that GST has four components: CGST, SGST, IGST, and UTGST, whereas CGST is only the part of GST for which the central government collects tax Intra State Supplies. GST has subsumed many taxes that are divided into CGST and SGST.

Comparison Table

| Parameter of Comparison | GST | CGST |

|---|---|---|

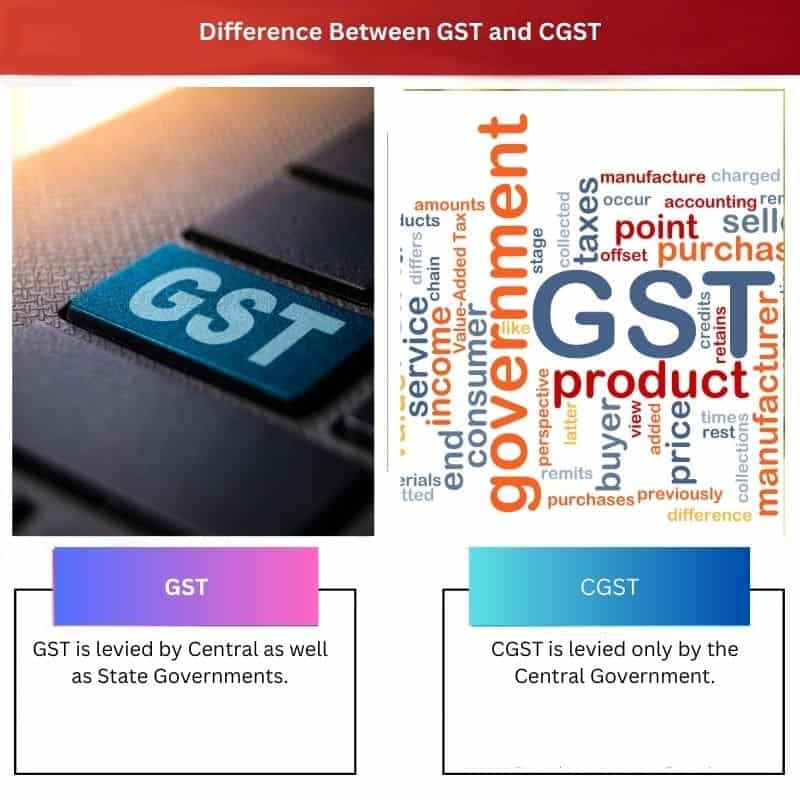

| Levy of Tax | GST is levied by Central as well as State Governments. | CGST is levied only by the Central Government. |

| Rate of Tax | GST has a rate on goods and services such as 5%, 18%,28%, etc. | CGST is half of the GST rate, so that it will be 2.5%,9%,14%.etc. |

| Collection of Taxes | Both central and state Governments do the group of GST. | Collection of CGST is only for Central Government |

| Components | GST comprises four parts: CGST, SGST, IGST and UTGST. | CGST has no components. It is a part of GST. |

| Subsumed Taxes | GST have subsumed all the state as well as central taxes. | CGST has only subsumed the mid-level of taxes. |

What is GST?

GST is a Goods and Services Tax introduced on 1st July 2017.GST is the value-added tax levied on manufacturing, selling, and consuming goods and services.

As the consumer pays GST on purchasing goods and services, he is the final consumer who bears the GST charged by the supplier. He can also avail of credit on the purchase items.

GST is levied on all goods and services except alcoholic consumption and petroleum crude, diesel, petrol, ATF, and Natural Gas.

Benefits of GST:

- Now in India, there is only one tax for all, i.e. GST.

- ITC benefits can be taken from another state in which taxes are paid to purchase goods or services.

- Removing the effect of Double taxation.

- Provided a higher threshold for GST Registration.

Transfer of goods from one state to another became easier by having an e-way

What is CGST?

CGST is referred to as Central Goods and Services Tax. It is a tax levied and collected by the Central Government on intra-state supplies of goods and services. CGST extends to the whole of India except Jammu and Kashmir.

CGST Input Tax can be set off against CGST, and IGST can never be set off against SGST. The Manner to utilize CGST is that CGST can be set off first against CGST, and if some balance remains, it will be used in IGST.

Main Differences Between GST and CGST

- The rate of GST on goods and services is directly charged as 5%, 12%, 14%, and 18%, but for CGST, it is half of the rate of GST as 2.5%, 6%, 7%, and 9%.

- The collection of GST Amount is divided into state and central. The Central government collects the collection of CGST and IGST amounts.

- http://www.indianjournals.com/ijor.aspx?target=ijor:jcmt&volume=8&issue=2&article=004

- https://www.osapublishing.org/abstract.cfm?uri=ome-8-6-1551

Last Updated : 13 July, 2023

Emma Smith holds an MA degree in English from Irvine Valley College. She has been a Journalist since 2002, writing articles on the English language, Sports, and Law. Read more about me on her bio page.

I’m not completely convinced there aren’t potential drawbacks to GST and CGST. Do you know of any?

I agree, there are always challenges in the implementation of new tax systems.

There might be some, perhaps in the transition period to this new tax system.

Well, I didn’t have to read a complicated legal text to understand the difference between GST and CGST. This was really helpful.

Indeed, and it’s not an easy feat to make a complex topic this approachable.

That’s the beauty of this post, the explanations are simple and clear.

I’m not sure I’m convinced that GST is beneficial. Can you elaborate on that?

Sure, I can share some additional resources that detail the benefits of GST.

This article is very thorough, it really helps clarify a complex topic.

I fully agree, it’s impressively comprehensive.

Yes, and it avoids ambiguous language. It’s very clear and straightforward.

I must admit that I was not clear on the differences, and this article really helped to explain them.

Indeed, it brought clarity to a complex subject.

The main differences between GST and CGST are clearly outlined in this post. It’s very helpful.

Yes, I find it very comprehensive and clear as a reader.

Great article. I’ve been researching this and you did a great job summarizing the differences between the taxes.

I agree, this is very informative.

The comparison table made it easy to understand the distinctions between GST and CGST.

Absolutely, the visual presentation was very beneficial.

The distinction between GST and CGST is crystal clear in this post.

Yes, this content is very well-organized and informational.

The e-way for transfer of goods is a real game-changer, and this post brought that to light.

I also think that was an important element highlighted.