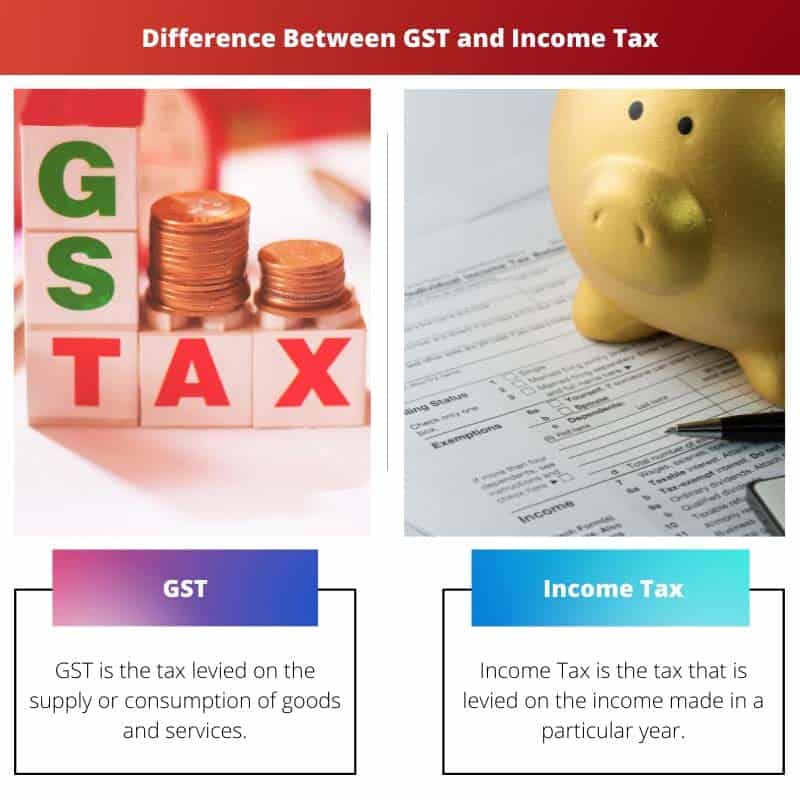

GST (Goods and Services Tax) is a consumption-based indirect tax levied on goods and services, aiming to replace multiple taxes. Income tax is a direct tax imposed on individuals and businesses based on their income, providing revenue to the government. Both contribute to government funds, but GST focuses on consumption, while income tax targets earnings.

Key Takeaways

- GST (Goods and Services Tax) is an indirect tax levied on the supply of goods and services, while income tax is a direct tax imposed on an individual’s or a company’s income.

- GST is a consumption-based tax, meaning it is charged at the point of sale and is ultimately borne by the end consumer, while income tax is charged based on the income of individuals or businesses and is paid by the income earner.

- GST aims to eliminate the cascading effect of multiple taxes on goods and services, simplifying the tax system. In contrast, income tax generates revenue for the government from the earnings of individuals and businesses.

GST vs Income Tax

GST and Income Tax differ in that GST is levied on the consumption of goods and services, while Income Tax is levied on income or profit earned. In a way, GST is the indirect tax, while Income tax is the direct tax.

Comparison Table

| Feature | GST | Income Tax |

|---|---|---|

| Type of Tax | Indirect Tax | Direct Tax |

| Levied on | Value of goods and services consumed | Individual’s income |

| Taxpayer | Businesses and individuals (registered under GST) | Individuals and certain entities (companies, partnership firms etc.) |

| Rates | Multiple rates (5%, 12%, 18%, 28%) | Progressive rates (5% – 30%) |

| Filing Frequency | Monthly or quarterly | Monthly, quarterly, or annually depending on turnover |

| Payment | Input Tax Credit (ITC) system allows claiming credit for taxes paid on purchases | No such system |

| Purpose | Raise revenue for the government and promote exports | Raise revenue for the government and promote economic growth |

| Administration | Central and State governments (dual GST) | Central government |

| Impact on Consumers | Ultimately borne by consumers | Borne directly by the taxpayer |

| Compliance Burden | Can be complex for businesses | Can be complex depending on income sources and deductions |

| Applicability | Most goods and services | Not applicable on agricultural income, capital gains, etc. |

What is GST?

GST, or Goods and Services Tax, is a comprehensive indirect tax implemented to streamline and simplify the taxation system. It replaces a multitude of indirect taxes such as Value Added Tax (VAT), Central Excise Duty, and Service Tax, creating a unified tax structure.

Structure

GST operates on a dual model, involving both the Central and State governments. It is divided into Central GST (CGST) levied by the Central government and State GST (SGST) imposed by individual state governments. Additionally, there is an Integrated GST (IGST) for transactions involving inter-state movement of goods and services.

Mechanism

GST is a destination-based tax, meaning it is levied at the point of consumption. It is applicable at each stage of the supply chain, ensuring that taxes are paid only on the value added at each stage, thus eliminating cascading effects. Input Tax Credit (ITC) allows businesses to claim credit for taxes paid on inputs, promoting a more efficient and transparent tax system.

Advantages

- Simplified Tax Structure: GST simplifies the tax structure by replacing multiple indirect taxes, reducing compliance burdens for businesses.

- Promotes Transparency: The transparent nature of GST fosters accountability and discourages tax evasion.

- Boosts Economic Growth: By promoting a common market and eliminating barriers to trade, GST contributes to economic growth and development.

Challenges

- Initial Implementation Challenges: The transition to GST initially faced challenges such as technological issues and resistance from various stakeholders.

- Complex Rate Structure: The multiple GST rates for different goods and services can lead to complexity and confusion.

What is Income Tax?

Income tax is a direct tax imposed by the government on individuals and entities based on their earnings. It is a key source of revenue for governments worldwide, used to fund public services and infrastructure.

Purpose of Income Tax

- Revenue Generation: Income tax serves as a primary means for governments to generate funds required for public expenditures, such as education, healthcare, defense, and infrastructure development.

- Wealth Redistribution: Progressive income tax systems aim to redistribute wealth by imposing higher tax rates on higher income levels, promoting a more equitable distribution of resources.

Components of Income Tax

- Taxable Income: The amount of income subject to taxation, derived from various sources such as salaries, business profits, capital gains, and rental income.

- Tax Rates: Governments establish progressive tax rates, where higher income levels face higher tax percentages. Tax rates may vary based on income brackets.

- Deductions and Exemptions: Taxpayers can benefit from deductions and exemptions, reducing their taxable income. These may include expenses related to education, healthcare, and charitable contributions.

Types of Income Tax

- Individual Income Tax: Levied on the income of individuals, including wages, salaries, bonuses, and investment gains.

- Corporate Income Tax: Imposed on the profits of businesses and corporations, influencing their net earnings.

- Capital Gains Tax: Applied to the profits generated from the sale of assets such as stocks, real estate, and valuable personal property.

Tax Filing and Compliance

- Tax Returns: Individuals and entities are required to file annual tax returns, providing details of their income, deductions, and exemptions.

- Compliance and Enforcement: Tax authorities enforce compliance through audits and penalties for non-compliance, ensuring that taxpayers fulfill their legal obligations.

Global Variations

- International Taxation: Cross-border income is subject to international tax laws, with treaties and agreements governing the taxation of income earned in different jurisdictions.

- Tax Planning: Individuals and businesses engage in tax planning to optimize their tax liability legally, taking advantage of available deductions and credits.

Main Differences Between GST and Income Tax

- Nature of Tax:

- GST (Goods and Services Tax): Indirect tax levied on the consumption of goods and services.

- Income Tax: Direct tax imposed on the income earned by individuals and entities.

- Base of Taxation:

- GST: Applied on the sale of goods and services, focusing on consumption.

- Income Tax: Applied on the earnings of individuals and businesses, covering various sources of income.

- Collection Point:

- GST: Collected at each stage of the supply chain, from production to final consumption.

- Income Tax: Collected directly from individuals and businesses through periodic filings.

- Objective:

- GST: Aims to streamline and replace multiple indirect taxes, fostering simplicity and efficiency in the taxation system.

- Income Tax: Aims to generate revenue for government expenditures and influence wealth distribution through progressive tax rates.

- Scope:

- GST: Applies uniformly to all goods and services, regardless of the income level of the consumer.

- Income Tax: Varies based on the income levels of individuals and businesses, with higher earners facing higher tax rates.

- Compliance:

- GST: Involves compliance by businesses in the supply chain, ensuring proper reporting and payment of taxes.

- Income Tax: Requires individuals and businesses to file annual tax returns, providing details of their income, deductions, and exemptions.

- International Considerations:

- GST: Generally does not have direct international implications; each country implements its own GST system.

- Income Tax: International taxation agreements and treaties govern the taxation of cross-border income.

- Taxpayer Impact:

- GST: Directly affects consumers through the prices of goods and services, influencing purchasing decisions.

- Income Tax: Directly impacts individuals and businesses, influencing investment decisions and overall financial planning.

- https://www.rse.anu.edu.au/researchpapers/CEPR/DP684.pdf

- https://pdfs.semanticscholar.org/2aae/2a3ea27c1c6b1063a27b35b02c8f947e503c.pdf

Last Updated : 11 February, 2024

Chara Yadav holds MBA in Finance. Her goal is to simplify finance-related topics. She has worked in finance for about 25 years. She has held multiple finance and banking classes for business schools and communities. Read more at her bio page.

The post effectively outlines the purpose and mechanism of GST and income tax.

The purpose and wealth redistribution aspect of income tax is articulated convincingly, providing valuable insights.

This article provides insightful information about GST and income tax. It’s helpful for understanding the tax systems in a comprehensive manner.

I found the detailed analysis of GST and income tax to be very enlightening.

I agree, the comparison table and explanations make it easier to grasp the concept.

The comparison table provided clear distinctions between GST and income tax, making it easy to distinguish their key features.

Yes, the information is presented in an organized manner, aiding in better understanding.

The purpose and components of income tax are expounded coherently, shedding light on its significance and functioning.

The article effectively addresses the relevance and types of income tax.

It’s evident that the post provides a comprehensive view of income tax and its implications.

This post is very educational and informative. It provides a clear understanding of the differences between GST and income tax.

The clarity in distinguishing between indirect taxes like GST and direct taxes such as income tax makes the post highly informative and relevant.

I concur, the post effectively clarifies the contrasting nature of these tax systems.

The post adeptly highlights the advantages and challenges of GST, facilitating a deeper understanding of its impact on the economy.

I found the information regarding the challenges faced during the implementation of GST to be particularly insightful.

The post logically explains the structure and mechanisms of GST and income tax.

The challenges and advantages of GST and income tax are presented with clarity and depth.

The detailed explanations help to comprehend the complexities of the tax systems.

The article offers an insightful view of GST and income tax and how they impact individuals and businesses.