Taxes are financial charges imposed by the government to fund the public sector and meet other expenses. Countries and economic systems have independent tax systems.

Failing to pay taxes is a punishable offence.

Key Takeaways

- Tax planning involves devising strategies to minimize tax liabilities and maximize after-tax income, while tax management focuses on the proper administration and compliance with tax laws and regulations.

- Tax planning is proactive, as it involves anticipating future tax implications, while tax management is reactive, as it deals with current tax obligations and reporting.

- Tax planning can help individuals and businesses save money by using deductions, credits, and tax-efficient investment strategies. In contrast, tax management ensures the timely and accurate filing of tax returns to avoid penalties.

Tax Planning vs Tax Management

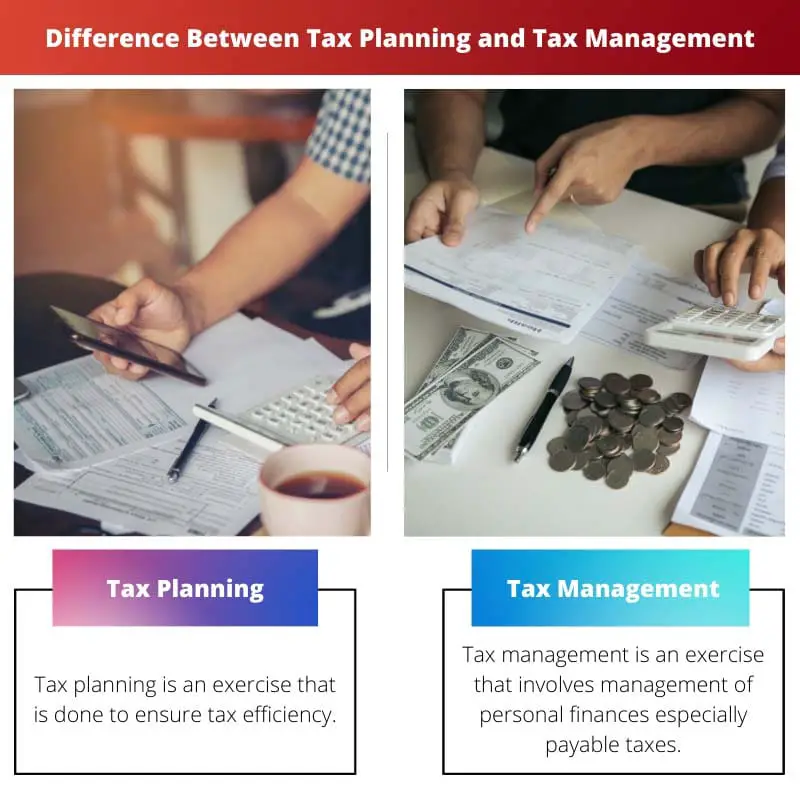

The difference between tax planning and tax management is that tax planning is an optional exercise for tax aversion. In contrast, tax management is a general term that describes the timely payment of taxes per the allied norms.

Individuals and businesses must pay the taxes imposed per the country’s laws. The extra expenses incurred by individuals and organizations in the form of taxes can be significantly controlled by simple practices.

Tax management refers to the practice of maintaining and paying taxes as per the laws and requirements.

Tax Management involves effective financial management for taxation. Tax planning, on the other hand, is a systematic method of tax aversion.

Tax planning enables the saving of taxes by redirecting taxable amounts towards investments.

Comparison Table

| Parameter of Comparison | Tax Planning | Tax Management |

|---|---|---|

| Objective | Tax planning is done to minimize liability. | Tax management is done to function in ordinances with Income-tax Law and Allied rules. |

| Relationship | Tax Planning includes tax management. | Includes auditing accounts, filing tax returns etc. |

| Time | it is done for the future. | It can be done for the past, present and future. |

| Usage | It enables minimizing tax liability for both the short and long term. | If done well, one can avoid penalties and interests. |

| Relevance | It is an optional exercise. | It is essential. |

What is Tax Planning?

Tax planning is an exercise that is done to ensure tax efficiency. Investors develop a tax plan to optimize their financial situation tax-efficiently.

It is done so that the available resources are utilised appropriately and efficiently. Proper tax planning helps investors in availing tax benefits and exemptions.

Tax planning majorly involves redirecting taxable money into places such as retirement plans or other investments, relieving tax liability. If well done, it can help individuals and organisations save a lot of money.

This method helps in locking in the amount that would have otherwise been deducted as tax. The locked-in amount can be used later under retirement plans.

Tax planning enables streamlined returns adding to individuals’ overall financial planning. Tax planning is legal and done in ordinance with the existing tax norms.

Tax planning has different benefits. Different types of tax planning have other pers.

The four major types of tax Planning are;

- Short-Term Planning- Planning executed at the year’s end to reap tax benefits.

- Long-Term Planning- Planning is done at the beginning of the year and followed throughout the year.

- Purposive Tax Planning- Purposive tax planning is done with a specific objective. This includes the selection of the perfect programme to maximise benefits and earnings.

- Permissive Tax Planning- Planning that focuses on using permissive laws for maximum exemptions and savings.

What is Tax Management?

Tax management is an exercise that involves the management of personal finances, mainly payable taxes. It is a routine procedure that people follow to ensure the timely payment of taxes.

Payment of taxes must be made instead of the economy’s tax norms and law.

The procedure includes filing returns and getting accounts audited. The process is holistic as it entails the transactions of the past, management of current taxes and planning for the future.

Unlike tax planning, it is not a voluntary exercise and is essential for everyone. Not managing taxes or failing to file returns can lead to penalties.

The elements of tax management are;

- Reduce Adjusted Gross income- Adjusted Gross income is the amount one is liable to pay income tax. A legally reduced amount would automatically reduce payable taxes.

- Increase Number of Tax Deductions- Deductions are claims of expenses that can help reduce tax liability. Knowing the type of deductions that apply to your annual plan is essential.

- Tax Crediting- Tax crediting helps reduce the payable tax amount by introducing certain activities that entail such credits.

- Retirement Plans- The easiest way to stock income is to plan an individual’s retirement. Experienced investors suggest investing 5-6 years before the scheduled retirement date.

The tax filing system becomes particularly complex because of the various slabs, rates and conditions. Each slab has different types of exemptions and conditions associated with it.

Tax planning, if done, becomes a part of task management. However, not all people engage in tax planning. Tax management enables reducing the net amount paid as taxes by filing timely returns, paying advance taxes, and avoiding penalties by reporting to concerned authorities.

Main Differences Between Tax Planning and Tax Management

- Tax planning refers to the practice of planning finances for optimal tax savings, while tax management is the practice of avoiding penalties by making timely tax payments. Tax Planning uses existing provisions to evade unnecessary taxes.

- Tax planning is about planning and filing tax returns, while management is about maintaining financial records and taxes.

- The primary purpose of tax planning is to reduce payable taxes to evade the burden on the taxpayer, while tax management is about following income tax rules and making timely payments.

- Tax planning is about reducing tax liability, while tax management reduces taxes by filing returns and avoiding penalty payments.

- Tax planning is optional, while tax management is compulsory for all.

- https://staff.blog.ui.ac.id/martani/files/2019/11/2010-corporate-governance-and-tax-management-minick-noga.pdf

- https://www.sciencedirect.com/science/article/pii/S0020706311000264

The article elucidates the nuances of tax planning and management with an intellectual rigor that is truly commendable. The systematic exposition of the subject matter enhances the educational value of the content.

Absolutely. The systematic and intellectually rigorous exposition of tax planning and management greatly enhances the educational value of the content. It’s a remarkable achievement in presenting a complex subject with such clarity.

Indeed. The intellectual rigor and systematic elucidation of tax planning and management have greatly enriched the educational experience for readers. It’s an exemplary piece of work on such a complex subject.

The article provides a rigorous and detailed analysis of tax planning and management, shedding light on the strategic and administrative aspects of these practices.

I completely agree. The article has effectively elucidated the strategic and administrative considerations involved in tax planning and management, making it a valuable resource for readers.

Indeed. The exhaustive coverage of the strategic and administrative dimensions of tax planning and management is truly commendable. It has broadened my perspective on the subject.

The comprehensive comparison table provided in the article succinctly encapsulates the disparities between tax planning and tax management. It’s a valuable reference for understanding the nuanced differences between these practices.

I couldn’t have expressed it better. The comparison table is a noteworthy highlight of the article, enhancing the clarity and comprehensiveness of the content.

Absolutely. The adept use of a comparison table to delineate the disparities between tax planning and tax management is truly commendable. It has significantly augmented the educational value of the article.

What an exhaustive and informative analysis of tax planning and management! This article is a must-read for anyone who is interested in understanding the intricacies of taxes.

Absolutely! The clarity provided in the article is commendable. I particularly appreciate the comparison table that succinctly illustrates the differences between tax planning and tax management.

The incisive delineation of the elements of tax management in the article offers a robust understanding of the practical dimensions involved in managing taxes. The informative exposition is highly beneficial for readers seeking clarity on the subject.

Indeed. The incisive treatment of the elements of tax management is an invaluable asset for readers aiming to comprehend the pragmatic aspects of handling taxes, thereby enhancing the educational quality of the content.

The comprehensive presentation of the different types of tax planning provides a nuanced understanding of the subject matter, making it beneficial for readers aiming to delve deeper into the complexities of taxation.

I couldn’t agree more. The comprehensive delineation of the different types of tax planning caters to the needs of readers aspiring to gain a detailed understanding of this intricate field.

Absolutely. The comprehensive presentation of the various types of tax planning is a praiseworthy contribution to the discourse on tax-related matters, providing valuable insights to readers.

The article provides an insightful and comprehensive analysis of tax planning and management, enhancing the readers’ understanding of the intricate aspects related to taxation.

Absolutely. The comprehensive nature of the analysis and its impact on enriching readers’ understanding is truly noteworthy. This article is an invaluable resource for individuals and businesses alike.

The article provides an enlightening perspective on the importance of tax planning and management. I found the definition and key takeaways to be very helpful for understanding the nuances of this complex subject.

I couldn’t agree more. The delineation of tax planning and tax management in such a lucid manner is truly beneficial for readers.

I concur. The thoroughness of the analysis provided in the article has certainly enriched my understanding of tax planning and management.

The pragmatic approach adopted in the delineation of tax planning and management underscores the significance of these practices in the realm of taxation. The informative content presented in the article adds substantial value for readers.

Absolutely. The informative and pragmatic approach adopted in presenting the content has significantly enriched the discourse on tax planning and management, offering valuable insights to readers.

I concur. The pragmatic treatment of tax planning and management in the article effectively highlights the practical and theoretical considerations associated with these practices, making it an edifying read for all.

This article presents a comprehensive and systematic approach to tax planning and management. The differentiation between tax planning and tax management is crystal clear, elucidating the proactive and reactive nature of these practices.

Absolutely. The article’s emphasis on the proactive and reactive aspects of tax planning and management is both enlightening and thought-provoking.

I couldn’t agree more. The descriptive nature of the content has significantly enhanced my understanding of tax planning and management.