Management is a very crucial part of the field of banking. But when one talks about Investment banking and Asset management as similar terms, they are on the wrong side.

Both these terms are used in banking and its management but are still very different. Investment banking and Asset Management are the strongholds of the finance sector.

Key Takeaways

- Investment banking is a service that helps companies and governments raise capital by underwriting securities, while asset management is a service that manages investment portfolios on behalf of clients.

- Investment banks provide services such as mergers and acquisitions, underwriting, and corporate finance, while asset managers provide portfolio management, risk management, and financial planning services.

- Investment banking focuses more on transactional work and deals with corporations and governments, while asset management focuses on managing investment portfolios for individuals and institutions.

Investment Banking vs Asset Management

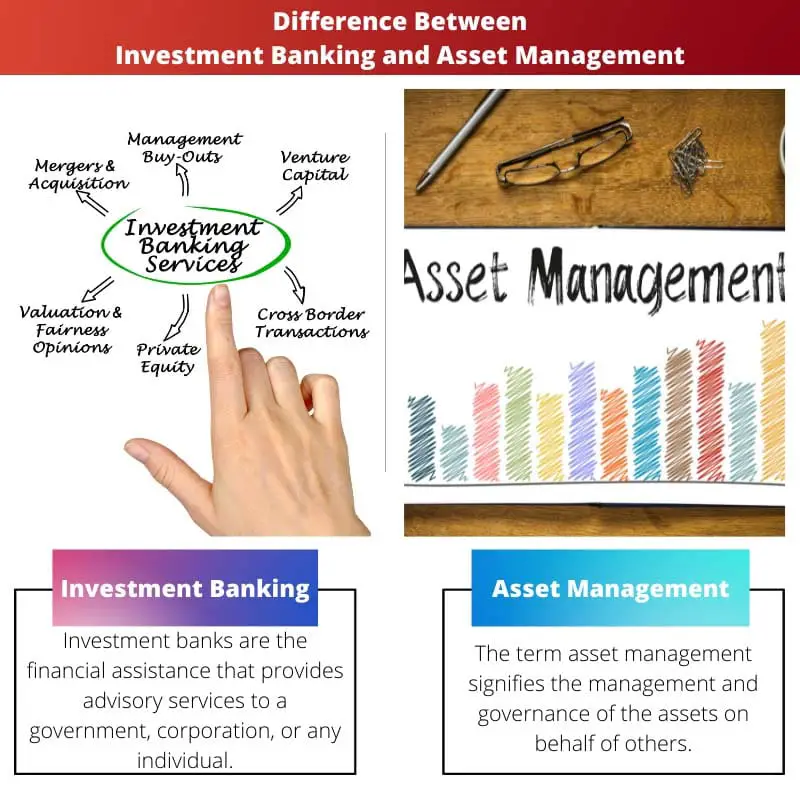

The difference between investment banking and asset management is that the former works on the selling side, whereas asset management works on the buying side. While investment banking sells finance-related products and services, asset management buys the same. It shows that both these sectors are opposite to each other.

Investment Banking is a bank sector that sells services like capital raising, mergers, and acquisitions to the government and corporate institutions as an advisory. In short, these banks are intermediates between a corporation and an investor.

Corporations require an investment to grow in the market, whereas investors are the ones who invest in them.

Asset management is considered subordinate to investment management. It reflects as the backbone of business markets and other public support infrastructure.

Asset management includes all the parts of physical as well as financial and human capital assets.

Comparison Table

| Parameters of Comparison | Investment Banking | Asset Management |

|---|---|---|

| Significance | It works on the selling part of different services. | Asset management works on the buying and management part of goods and services. |

| Professionalism | They sell financial products and services if an investment banker does a job. | On the other hand, buying and managing those products is an asset manager’s work. |

| Skills | Good-to-go skills in the sales part are required for an investment banker. | Asset managers need to have a good grip on quantitative aptitude and analytics. |

| Capital | The main job done by an investment banker is to raise money regularly. | Asset managers work in the field of managing money and assets. |

| Skills and work culture | An Investment banker should have good selling skills. Also, they are required to work 80-90 hours a week. | They work more towards technical support rather than working on the selling part. |

What is Investment Banking?

Investment banks and their banking methods are the financial assistance that provides advisory services to a government, corporation, or any individual. Investment banking comprises transactions based on financial capital.

Investment banking is a lot different from commercial and retail banking. Unlike others, investment banks don’t consider taking deposits from their consumers.

The history of investment banking lies with the East India Company of Dutch. Being officially the first traded company, it was also a part of the stock exchange.

Investment banking created a special appearance in the finance sector of this company. It now includes mergers, advisory assistance, underwriting, and other benefits.

It is divided into three core divisions: front office, middle office, and back office. The front office generates revenue in investment banking and the market.

Talking the middle office handles the area of treasury supervision and risk controls and designs strategies for corporations. The Back-office checks upon the conducted trades and works on the required transaction changes.

What is Asset Management?

Asset management signifies the management and governance of assets on behalf of others. This term includes physical assets and other financial and human capital assets.

Physical asset management includes financial, economic, and management of practices.

Public asset management is a bigger version of enterprise asset management and incorporates the handling of municipalities and citizens.

Financial asset management is related to investment management. It signifies the finance industry sector that operates client accounts and funds for investment.

Also, it covers all the aspects of client accounts and fund management. The finance companies assign asset managers to look after management work.

An asset manager manages client assets according to investment aims and goals.

Similarly, Enterprise asset management(EAM) is the information system for an asset that manages an organization’s accounts and physical support. When one talks about non-physical asset management, intellectual assets are also incorporated into it.

Assets like software, books, and applications are used widely by users, and businesses are looked over by asset managers and are restrained by a license contract.

Main Differences Between Investment Banking and Asset Management

- The former works on the selling side, whereas asset management is more inclined towards buying and managing money and other assets.

- An investment banker does the job of selling products and services. On the other hand, an asset manager is known for buying and managing the same on behalf of others.

- Good sales skills are mandatory in investment banking, whereas asset management focuses on quantitative aptitude and analytics.

- Raising capital is the job of an investment banker. On the other hand, managing financial and physical assets is done by an asset manager.

- An investment banker works for the sales department of a bank, but an asset manager is bound to work as technical support.

This post simplifies the differences between investment banking and asset management. It’s very useful for someone trying to understand the nuances of the finance sector.

Agreed. The comparison table is particularly helpful.

Absolutely, the clarity of explanation is commendable.

This article provides an excellent comparison between investment banking and asset management. It’s a great guide for people interested in the finance industry.

I couldn’t agree more. It’s a valuable resource.

Absolutely, this is a very well-researched article.

This is a well-structured article. The comparison table definitely adds value to the content.

I couldn’t agree more. The format is very helpful.

Absolutely. The structure makes it easy to comprehend.

I’m not sure if I agree that asset management is subordinate to investment management. Both are essential in their own ways.

That’s a valid point. They both play crucial roles.

I understand your perspective. It’s a matter of how they complement each other.

This article makes it easy to understand the crucial differences between investment banking and asset management. A very enlightening read.

Indeed, it’s a very informative piece. Great insight into the finance industry.

I appreciate the thorough explanation. It’s always beneficial to know the distinctions in the finance sector.

Absolutely. It’s crucial information for anyone in the finance field.

Well said. The depth of coverage is impressive.

Finally, an article that explains the disparity between these two with such clarity. It’s refreshing to read such well-detailed content.

I absolutely agree. The author has done a great job in simplifying complex concepts.

Couldn’t have said it better. A much-needed elucidation.

While this is informative, are there differing perspectives on this topic? It seems quite one-sided.

Good point. It would be interesting to explore differing opinions.

Great explanation. This article is very informative and detailed. Very interesting to see the distinctions so clearly explained.

I absolutely agree. The article has addressed all aspects thoroughly.

Yes, this is one of the best explanations I’ve read. Well done!

A much-needed distinction between investment banking and asset management. It’s a refreshingly detailed piece.

Absolutely. A commendable effort in explaining complex finance concepts.