In business, you need to understand all the details of the market—the supply and demand with all the connections. In the commercial sector, you will learn many things about business management.

And this includes acquisition and asset management. Commerce can help you in a lot of manners; it can also increase your marketing knowledge. The way the economy works, the way business works. Everything is explained well in commerce.

Key Takeaways

- Acquisition focuses on purchasing assets or businesses, whereas asset management involves overseeing and optimizing the performance of owned assets.

- Acquisition involves a single transaction, while asset management is ongoing.

- Asset management can cover various types of assets, including physical, financial, and intellectual property.

Acquisition vs Asset Management

Acquisition refers to the process of acquiring assets for a business. This can include purchasing physical assets. Asset management refers to the ongoing management of assets within a company. It helps ensure that assets are used, maintained, and managed efficiently and effectively.

An acquisition is a business transaction in which one firm buys all or part of a stock or property of some other firm. Purchases are commonly conducted to gain control of a target business’s distinctive and exploit benefits.

Acquisitions, both businesses survive, mergers only one business stays, and mergers are the three forms of corporate pairings neither company stays.

The importance of creating, running, maintaining, and sales of assets in an expensive manner is referred to as asset management.

People or businesses that handle resources on behalf of an individual or even other entities are called investment firms in economics. Every business should identify its assets.

As a result, its stakeholders will be aware of which assets are accessible to be used to generate the best possible profits.

Comparison Table

| Parameters of Comparison | Acquisition | Asset Management |

|---|---|---|

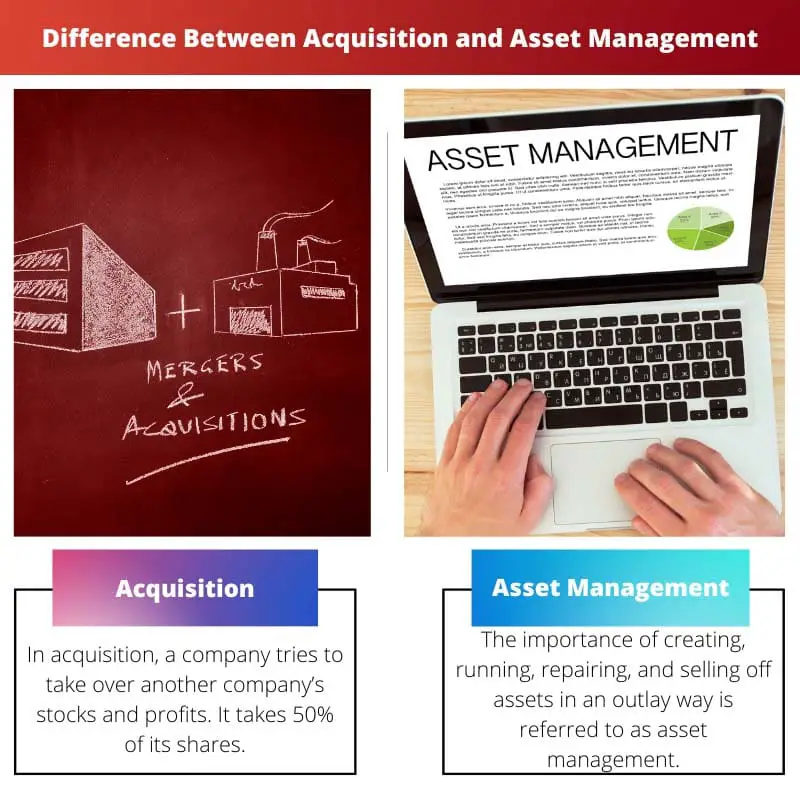

| Definition | In acquisition, a company tries to take over another company’s stocks and profits. It takes 50% of its shares. | The importance of creating, running, repairing, and selling off assets in an outlay way is referred to as asset management. |

| Purpose | In acquisition, a company tries to take over another company’s stocks and profits. It takes 50% of its shares. | The acquisition is where two companies are involved, and one of them takes control of the other company. |

| Parties Involved | Acquisitions entail purchasing a company’s assets or shares seizing control of it and taking charge of the company. | If the purchasing business obtains more than 50% of the assets. |

| Decision Making | Regarding asset management, only one company is present, and choices are made within that company. | In acquisition, there is no need to track the business management or the stocks. |

| Tracking Tool | In asset management, the assets need to be tracked as there are many assets and marketing materials. | In asset management, the assets need to track as there are a lot of assets and marketing materials. |

What is Acquisition?

When one corporation buys or takes control of another, this is known as an acquisition. An acquisition happens when a more prominent firm buys a weaker one. However, this isn’t always the situation.

Small businesses can also buy larger enterprises. While mergers and acquisitions have technical differences, they are closely related and frequently addressed as “M&A,” The two terms are commonly used interchangeably.

We’ll look at how an acquisition is, the many kinds of assets, and how they’re done in this post. The acquiring firm is the one that buys another, and the obtained, or target, company is the one that is purchased.

However, in what has been known as a “power grab,” acquisitions can occur against the will of the acquired firm’s management. In a power grab, an outside firm purchases over 50 percent of the target company’s equity to gain control.

This is accomplished by paying existing shareholders a better price for their stock than they might get on the marketplace, enticing them to sell.

A cash payment, a security deposit such as a share price transfer, a public offering, or a mix of these approaches can be used to fund an acquisition.

A firm can buy another by paying cash to the target company’s current owners in exchange for their stock. This is the most basic form of payment.

What is Asset Management?

The importance of creating, running, preserving, and cost-effectively selling shares is referred to as asset management. Individuals or businesses that handle assets the behalf of people or other entities are referred to as asset managers in finance.

The method makes it simple for businesses to maintain track of their holdings, whether liquid or fixed. Firm owners can see where assets are situated, why they’re being used, and whether they have been modified.

As a result, asset recovery can be made more efficient, resulting in higher profits. Because assets are examined regularly, the asset management process guarantees that the income accounts accurately reflect them.

Asset management is the process of identifying and managing risks associated with the use and control of specific assets. It implies that a company will always be prepared to deal with any trouble.

There have been instances where assets that have been lost, destroyed, or stolen have been incorrectly documented on the books.

The company’s owners will be informed of any assets lost because of a strategic action plan, and they will be removed from the books.

Property ownership is indeed a part of any public or private business. A firm owner must design a strategic plan for managing the assets.

Main Differences Between Acquisition and Asset Management

- The main difference we can look at in both terms is that acquisition means taking over a company to control it and seize all its shares. At the same time, asset management means selling an individual’s company’s assets to maintain the cost balance.

- There is no tracking quality for acquisitions as it is directly connected to the company of another firm. It takes over and controls the business from thereon. But in asset management, all the assets and transactions should be tracked properly.

- In acquisitions, all the assets, shares, and marketing details are involved. It doesn’t exclude anything from the company. But asset management only involves the assets and it only deals with the assets which are to be managed.

- In acquisitions, the company can make its decisions regarding the shares and profits without contacting the shareholders, as it has already purchased 52% of the shares. In asset management, the company must contact individuals to track the asset.

- There is no tracking tool for acquisitions as the company takes the whole shares and in asset management, there is software management that is installed to track the assets and to look after them.

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=8164

- https://onlinelibrary.wiley.com/doi/abs/10.1111/jofi.12696

The article effectively elucidates the nuances of acquisition and asset management, catering to the needs of individuals seeking to expand their knowledge in the fields of commerce and business management.

The detailed comparisons and explanations of the key differences between acquisition and asset management make this article a valuable resource for individuals involved in business and commerce.

The article effectively highlights the significance of asset management and acquisition in the commercial sector, providing valuable insights for those interested in business operations and management.

The article provides a comprehensive overview of the differences between asset acquisition and asset management, offering a clear understanding of the critical aspects of commerce.

The explanation of the differences between acquisition and asset management is clearly presented. It is a good summary for people who are interested in commerce and business management.

The in-depth information provided about acquisitions and the asset management process is valuable for individuals seeking to improve their knowledge in this area.

I agree with you. This article is definitely helpful for those who want to understand these business concepts better.

This article provides a comprehensive comparison between acquisition and asset management which is beneficial for individuals planning to venture into the business world.

The detailed explanation regarding acquisitions and the role of asset management in businesses is indeed enlightening and informative.

The detailed comparison table and the emphasis on the importance of asset management makes this article an excellent resource for business professionals.