There are different meanings of a Journal, the journal can be a diary to write about your day, or it can be used as a subsidiary journal in which transactions are recorded.

A ledger is a permanent book of financial transactions. A ledger is a book in which account transactions are recorded and classified. Both journals and ledgers are a part of financial accounting.

Key Takeaways

- Journals record financial transactions chronologically, providing a detailed account of a company’s financial activities.

- Ledgers organize transactions by account type, offering a summarized view of a business’s financial situation.

- Both journals and ledgers are essential for accurate bookkeeping and generating financial statements.

Journal vs Ledger

A journal is a chronological record of all financial transactions that occur in a business. It records each transaction in the order in which it occurred. A ledger is a collection of all accounts used by a business, organized by account type (such as assets, liabilities, and equity). Each account in the ledger contains a running balance of all transactions related to that account.

In a journal, the financial transactions have been recorded. It is the first step in accounting. They can be multiple credit and debit entries.

However, the sum of debits should be equal to the sum of debits. A journal includes the date of a transaction, the amount, and the accounts which are affected.

A ledger is a permanent book for recording transactions. The transactions are analyzed and then shifted to a ledger. The ledger will give the financial statement as the transactions are classified.

A ledger is prepared according to the nature of the account. Calculating the financial statement per head is possible via the entries of the ledger.

Comparison Table

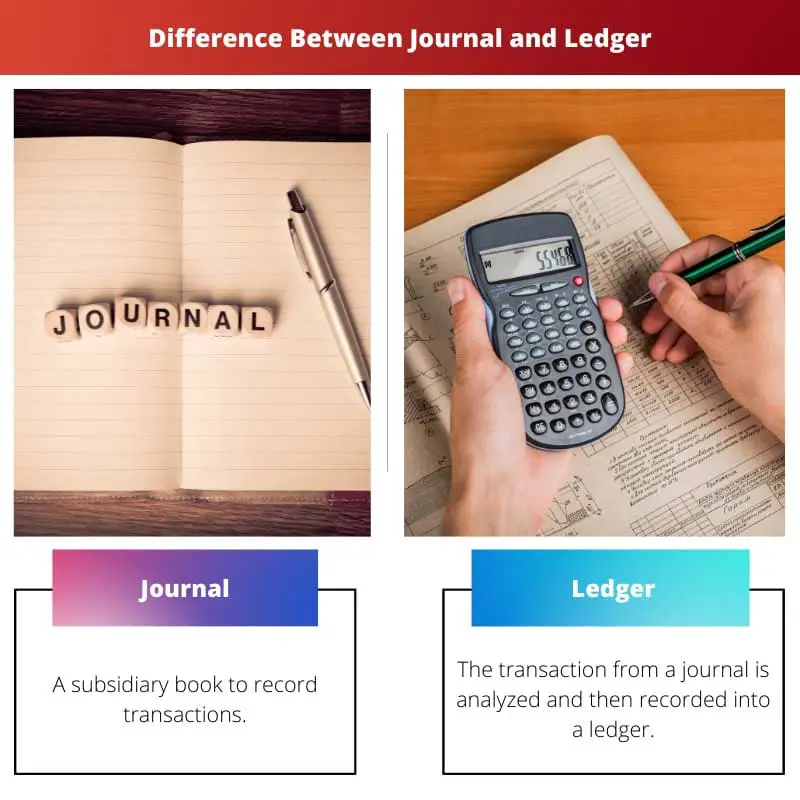

| Parameters of Comparison | Journal | Ledger |

|---|---|---|

| Definition | A subsidiary book to record transactions. | The transaction from a journal is analyzed and then recorded into a ledger. A ledger is a permanent book to record financial transactions. |

| Name | Recording transactions in a journal is known as journalizing. | Recording transactions in a journal is known as posting. |

| Income Statement | An income statement cannot be prepared from a journal. | Income statements are prepared from ledgers to know the profits and losses. |

| Balance Sheet | You cannot prepare a balance sheet from a journal. | Balance sheets are prepared from a ledger. |

| Opening Balance | Journals don’t have an opening balance. They are prepared from current transactions. | Ledgers have the option of the opening balance. |

What is Journal?

A journal is a journal in which accounting transactions are recorded. The transactions are about adjustment entries, opening stock, accounting errors, depreciation, etc.

Journals are the first step in accounting. It is also known as Books of original entries. The entries are then forward posted into a ledger.

A journal records all the financial transactions of a business. It is used so that there will be a temporary record of every transaction. The future reconciling of accounts can be done through a journal.

Mostly, it is used for double-entry bookkeeping entries, which means the crediting and debiting of one or more accounts, making the amount the same in total.

The journal is used in specific records such as sales journals, purchase journals, etc., and a general journal s used where the record doesn’t specify one specific journal.

The transactions are recorded by date. Mainly an accountant keeps the journal updated. A summary explanation of the transaction, known as narration, is also included in the journal.

Another meaning of a journal that is not related to accounting is a daybook, a personal diary. A diary in which a person writes about his/her daily life, emotions, and feelings is also called a journal.

What is Ledger?

A ledger is a permanent book of financial transactions. The transactions are recorded into a ledger by date from a journal. Every transaction is first recorded in a journal, and then the transactions are analyzed and checked and then recorded into a ledger.

A ledger is prepared from the journal so that the transactions can be recorded in separate columns properly with all the details. A ledger has about six to eight columns.

The transactions are recorded in the classified form and under respective heads. The recording of transactions in a ledger is known as posting. The income statement is prepared by a ledger to know the profits and losses.

Each account in the ledger has two sides, separate columns for credit and debit. The left side is called debit, while the right side is called credit. There are three types of ledgers: general, debtors, and creditors.

Each account has an opening or carry-forward balance. Indeed, a ledger can have the opening balance as well as the closing balance.

The trial balance can also be prepared from ledgers. A ledger is prepared by the nature of the accounts. And it is possible to know the income and expenditures of different heads through the record of a ledger.

Main Differences Between Journal And Ledger

- A journal is a temporary book, a supporting book of transactions, while a ledger is a permanent summary of all amounts and transactions.

- The transactions are first entered into a journal and, after analysis, are recorded in a ledger.

- In a journal, the transactions are recorded with a summary, while in a ledger, an explanation or summary is not needed.

- The format of a journal contains five columns, while a ledger has six to eight columns.

- The balance sheet cannot be prepared from a journal, while it can be prepared from a ledger.

- A trial balance cannot be prepared from a journal, while it can be prepared from a ledger.

- https://jamanetwork.com/journals/jama/article-abstract/202114

- https://www.jstor.org/stable/1735096

- https://search.proquest.com/openview/f5e0781683d9fae761542ed1a316d5fd/1?pq-origsite=gscholar&cbl=48426

Thank you for the detailed explanation of the difference between journals and ledgers. It’s crucial for accurate financial bookkeeping.

Absolutely, the distinction between journals and ledgers is fundamental in accounting.

The detailed comparison between journals and ledgers is very insightful.

Absolutely, a clear understanding of the differences is essential for accurate accounting.

The detailed outline of the journal and ledger functions adds valuable depth to this explanation.

Agreed, the information presented here offers a comprehensive understanding of accounting practices.

The section that explains the distinction between journals and ledgers in terms of income statements and balance sheets adds valuable insight.

The clarity provided about preparing balance sheets and income statements is highly informative.

Absolutely, understanding how journals and ledgers contribute to these financial statements is key.

The detailed explanation of what a journal entails is vital for those new to accounting principles.

Indeed, a comprehensive understanding of journal entries is the foundation of accurate accounting.

The explanation of how transactions are recorded from the journal into the ledger is very useful.

Agreed, understanding the process of recording transactions is crucial in accounting.

The description of how the journal and ledger are linked in the bookkeeping process is enlightening.

Absolutely, a full understanding of the interplay between journals and ledgers is crucial in accounting.

A very informative and comprehensive explanation of the purposes of journals and ledgers.

The overview provided here about the purpose and function of ledgers is quite informative.

The detailed insights into ledger preparation are very informative.

Absolutely, understanding the role of ledgers is indispensable for sound accounting practices.

The comparison table provided here is quite helpful in understanding the different aspects of journals and ledgers.

Yes, it certainly is. It makes it easier to grasp the differences between journals and ledgers.

Agreed, the clarity offered by the comparison table is impressive.