The receipt and invoice play the crucial role of representing proof of financial transactions. They are essential accounting documents used to keep records of business transactions.

These documents provide information about the amount owed and paid in return for goods and services.

Key Takeaways

- Receipts are given after a payment, while Invoices are given before a payment is made.

- Receipts act as proof of payment, while Invoices act as a request for payment.

- Receipts include the date, amount, and description of the transaction, while Invoices include additional details such as the due date, terms, and itemized breakdown of charges.

Receipt vs Invoice

Receipts are important for both the buyer and the seller as they provide a record of the transaction and can be used for tax purposes, accounting, and as proof of payment in case of disputes or returns. An invoice is a document that is issued by a seller to a buyer requesting payment for goods or services.

Receipt can be considered a legal record or a piece of documentary evidence for purchased or sold goods. They are also pieces of evidence in services like legal consultation and medical prescription.

Based on accounting, there are two types of receipts: Revenue Receipt and Capital Receipt. They are further divided into tax and non-tax, savings, and loans, respectively.

An invoice can also be considered as a proof or legal record that states the identity of the buyer and the seller, as well as the quantity and price of the goods and services.

Invoices first began in 5000 BC in Mesopotamia, where details of transactions were carved on stones and leaves. Later, animal skin and parchment became popular, and they used seals as signatures.

Comparison Table

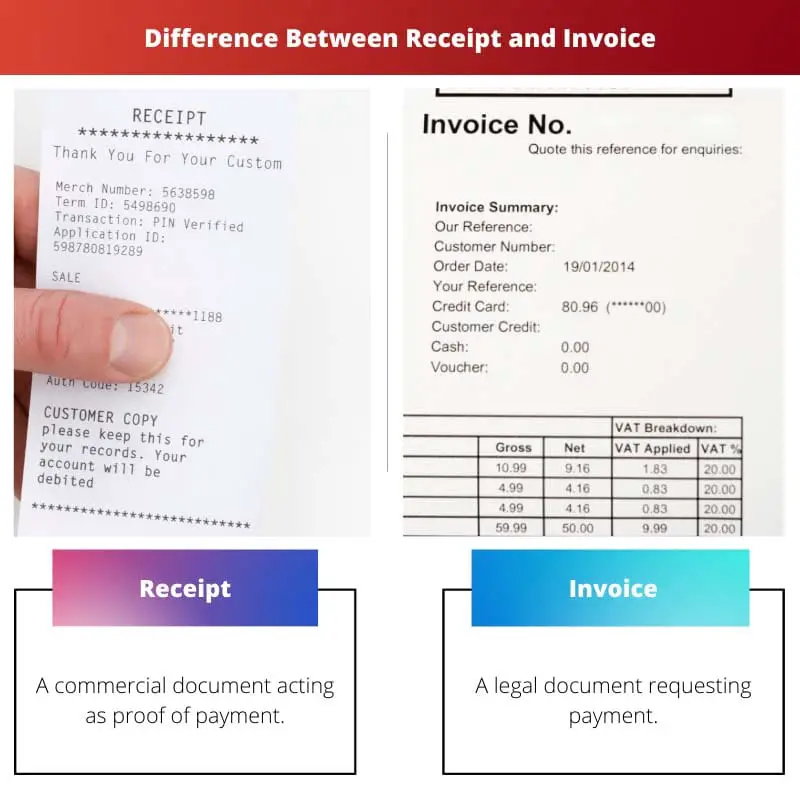

| Parameters of Comparison | Receipt | Invoice |

|---|---|---|

| Meaning | A commercial document acting as proof of payment | A legal document requesting payment. |

| Purpose | Serve as proof of the amount paid by the buyer for goods and services | Track the sale of goods and services |

| Period | Given after payment is made by the buyer | Given after service is done and before payment is made |

| Details | lists the product quantity, amount of service, the amount due, etc. | lists the payment due on goods and services. |

| Further Clarifications | Divided into Revenue and Capital Receipts | Pro-forma, Interim, Final Invoice, etc |

What is a Receipt?

As the word suggests, a receipt is an incoming flow of cash or payment. During it’s origin in Jericho in 7500 BC, the word meant “act of receiving” in the Latin language.

In this procedure, a receipt is proof of payment received from the buyer to the seller for the goods and services. The receipt is an essential need for the consumer as well.

With its “Jaago Ghrahak Jaago” or the “Wake up consumer, be aware” consumer awareness scheme, the government encourages consumers to take receipts from the buyer on purchase on anything.

The program was started by the Department of Consumer Affairs to create consumer awareness through advertisements and slogans. It was enacted to spread awareness that receipt acts as evidence of the payment made by the buyer.

The government also launched the new Consumer Protection Act, 2019, and widened the definition of Unfair Trade Practices as compared to the 1986 Act.

The act newly introduced the practice of issuing bills/memos for goods and services and returning goods that are proven to be defective or faulty.

Receipts also help in accounting procedures and keeping records of the inflow and outflow of cash. They are proof of accounting activity done by the buyer and seller.

They help determine profits or losses and the company’s net worth. The world’s longest receipt was generated in New York City, which was 57.5 feet long.

What is an Invoice?

A commercial document delivered by a seller to a buyer about a sale transaction and stating the items, quantities, and agreed pricing for products or services the seller has provided the customer is known as an invoice, bill, or Tab Invoices.

It was first published in the double-entry book system by Italian Luca Pacioli.

Invoices can be used to bill for one-time tasks or recurring work, although they are most commonly used to seek payment when work is finished and if the customer is usual and repetitive.

In the past, invoices were printed on paper, either handwritten or typed, and then mailed.

There are three major types of invoices: Pro forma, interim, and final. A Pro forma invoice, as the name suggests, is a “pre” invoice that doesn’t demand payment but informs the customer how much will the estimated amount be after the work is complete and the goods are delivered.

The interim invoice is a breakdown of the final invoice, that is, the bigger payment is broken down into smaller payments as the work progresses.

The final invoice is exactly how it states. It is an official request made for payment after the work is done. This is the standard procedure in most firms.

Invoices can be used to bill for one-time tasks or recurring work, although they are most commonly used to seek payment when work is finished and if the customer is usual and repetitive.

Invoices have their own set of benefits and drawbacks.

Though invoices are a chance to deliver a good message about your brand and its products, customer satisfaction can also be improved through efficient invoice creation and payment collection.

Without this, a badly managed system might harm the company’s reputation.

Main Differences Between Receipt and Invoice

- A receipt is a document verifying that the seller has received the payment, whereas an invoice is a request made by a seller to the buyer to pay for the goods and services.

- A receipt is made for the purpose of serving as proof that the payment is made by the buyer. On the other hand, an invoice is made to track the sale of goods.

- A receipt is made after payment, and an invoice is made before payment.

- A Receipt lists the quantity and amount of service of goods and services. While the Invoice lists the amount due on goods and services.

- A receipt is further divided into Revenue and Capital Receipts. The invoice is further divided into 9 parts, including Pro-forma, interim, final invoice, etc.

- https://link.springer.com/chapter/10.1007/978-3-030-20890-5_35

- https://digitalcommons.salve.edu/cgi/viewcontent.cgi?article=1234&context=goelet-personal-expenses

Last Updated : 13 July, 2023

Chara Yadav holds MBA in Finance. Her goal is to simplify finance-related topics. She has worked in finance for about 25 years. She has held multiple finance and banking classes for business schools and communities. Read more at her bio page.

This article is truly enlightening. It provides comprehensive information on the key differences between a receipt and an invoice, something that many people confuse. The historical context presented in the article is fascinating as well.

I totally agree with you, Lilly34. The article presented the information in a clear and concise manner, making it easy for readers to understand the nuances of receipts and invoices.

Absolutely, Lilly34. The extensive comparison and historical insights make this post highly informative and engaging.

The meticulous analysis of receipts and invoices in this article is truly commendable. The in-depth comparison and historical exploration offer a comprehensive understanding of these essential financial documents.

I concur, Matthew64. The attention to detail and historical context make this article a valuable resource for unraveling the complexities of receipts and invoices.

This article offers a comprehensive breakdown of the differences between receipts and invoices, backed by historical and commercial insights. The global context provided adds further depth to the discussion.

You made a valid point, Oliver69. The historical context indeed provides a unique perspective on the evolution of receipts and invoices in different cultures.

I agree with you, Oliver69. The global context and thorough analysis in this article make it an excellent resource for understanding the complexities of receipts and invoices.

While reading this article, I discovered numerous intriguing facts about the ancient origins of receipts and invoices. The information presented here is undeniably valuable in understanding the roles of these documents in commercial transactions.

Indeed, Jackson Harris. The historical narrative combined with the functional distinctions of receipts and invoices adds depth and rigor to this article.

I absolutely agree with you, Jackson Harris. The captivating historical context gives this article an edge in exploring the intricacies of receipts and invoices.

I found this article to be incredibly helpful. The detailed explanations and historical background provided a thorough understanding of the significance and functions of receipts and invoices.

Couldn’t agree more, Qthompson. The comparison table and the in-depth analysis of receipts and invoices were quite enlightening.

I share your sentiments, Qthompson. This article is a testament to the importance of receipts and invoices in the world of financial transactions.

This article is a treasure trove of information. It provides a detailed comparison of receipts and invoices while delving into their historical origins. The insightful content makes this article a valuable resource for anyone seeking to understand these financial documents.

I couldn’t agree more, Kirsten Jones. The depth and clarity of information in this article elevate the understanding of receipts and invoices to a new level.

Absolutely, Kirsten Jones. The extensive analysis and historical insights make this article an indispensable guide to comprehending receipts and invoices.

This article is quite interesting. The detailed insights into the historical origins of receipts and invoices provided a fresh perspective on their significance in economic transactions.

This article provides a rich and detailed exploration of receipts and invoices, presenting invaluable historical insights alongside comprehensive comparisons. It’s a well-crafted piece that contributes significantly to enhancing knowledge about financial documents.