A specific country is governed harmoniously when the government of that country puts in efforts to strengthen the country in every aspect, right from its economy, educational programs, natural resources, human resources and human rights etc.

To boost a country’s economy government levy a certain amount of money on citizens. That set amount is called tax. In this article, we will see more about (1) Taxes and (2) one of the subtypes of taxes, i.e. Duty.

Key Takeaways

- Taxes refer to the number of money individuals or companies pay the government for public services and facilities.

- Duties refer to the taxes imposed by the government on imported or exported goods, which are a percentage of the value of the goods.

- Taxes are mandatory payments based on income, while duties are levied on the goods during import or export.

Taxes vs Duties

Taxes are a mandatory financial obligation that must be made to the government. Individuals, wealth, services, and sales are all subject to tax. They are of two types. Duty is a charge made to the government on the creation, importation, and exportation of products. A duty is imposed on goods.

There exist several definitions of taxes. According to Professor Seligman, “A tax is a compulsory contribution from the person to the government without reference to special benefits conferred”.

Taxes have several characteristics. The primary motive of the government to collect taxes from citizens is to fulfil society’s interests and strengthen the country’s economy.

Taxes are a charitable contribution from a citizen to their country as a citizen doesn’t get any benefits or services in return.

Duties are one of the many subtypes of taxes. Duties are charged on wares that are imported or exported by the government. Duties are mainly of two types, namely excise duties and customs duties.

Custom Duties are of several types, such as Basic customs duties, Countervailing duties etc. Different countries have different rules and regulations regarding customs duties.

Comparison Table

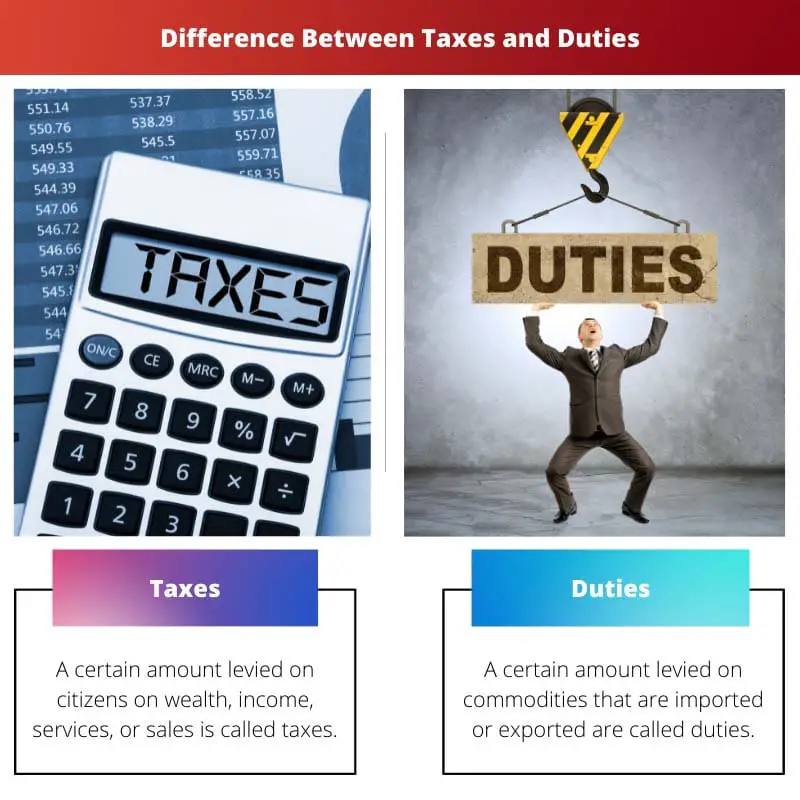

| Parameters of Comparison | Taxes | Duties |

|---|---|---|

| Definition | Tax is a certain amount levied on citizens on wealth, income, services, or sales. | A certain amount levied on imported or exported commodities is called duties. |

| Introduced by | Sir James Wilson | Constitution of India (in India) |

| Introduced in | 1860 | 1962 (in India) |

| The objective of the Government | To increase remuneration to meet society’s expenses. | Safeguard domestic industry |

| Sub-categories | Direct tax, Indirect tax, Progressive tax, Regressive tax, Proportionate tax | Excuse Duties and Custom Duties Essential customs duties, Countervailing duty, Additional customs or Special duty, Safeguard duty, National Calamity Contingent duty, Anti-dumping duty, Education cess on customs duty, and Protective duties. |

What are Taxes?

Tax is a certain amount levied on citizens on wealth, income, services or sales. In 1860, Sir James Wilson introduced the term tax in the financial world and the world as a whole in general.

The fundamental motive of taxes is to strengthen a country’s economy and meet society’s expenses.

Taxes are of several types and are levied on several things. There exist several modes by which tax is collected. The tax has several kinds of, and two main types are direct and Indirect tax.

Indirect taxes include GST (Goods and Service Tax) and Custom duty. Direct taxes are further segmented into (1) Progressive tax, (2) Regressive tax (3) Proportionate tax.

Different countries levy taxes on citizens by other methods. For instance, India follows the Progressive tax technique, wherein taxes increase with income.

It is claimed that the first taxation system was put forth back in 3000-28000 BC in ancient Egypt. There were two forms of taxation, namely corvée and tithe, wherein corvée was a system where people who couldn’t afford to pay taxes were made to work forcefully for the state.

The inclusion of taxes is made in one of the chapters of the Bible as well. The Hittite Empire and The Roman Empire also used a taxation system. In the Hittite Empire, grains from people were collected as a form of tax to display the ruling king’s wealth.

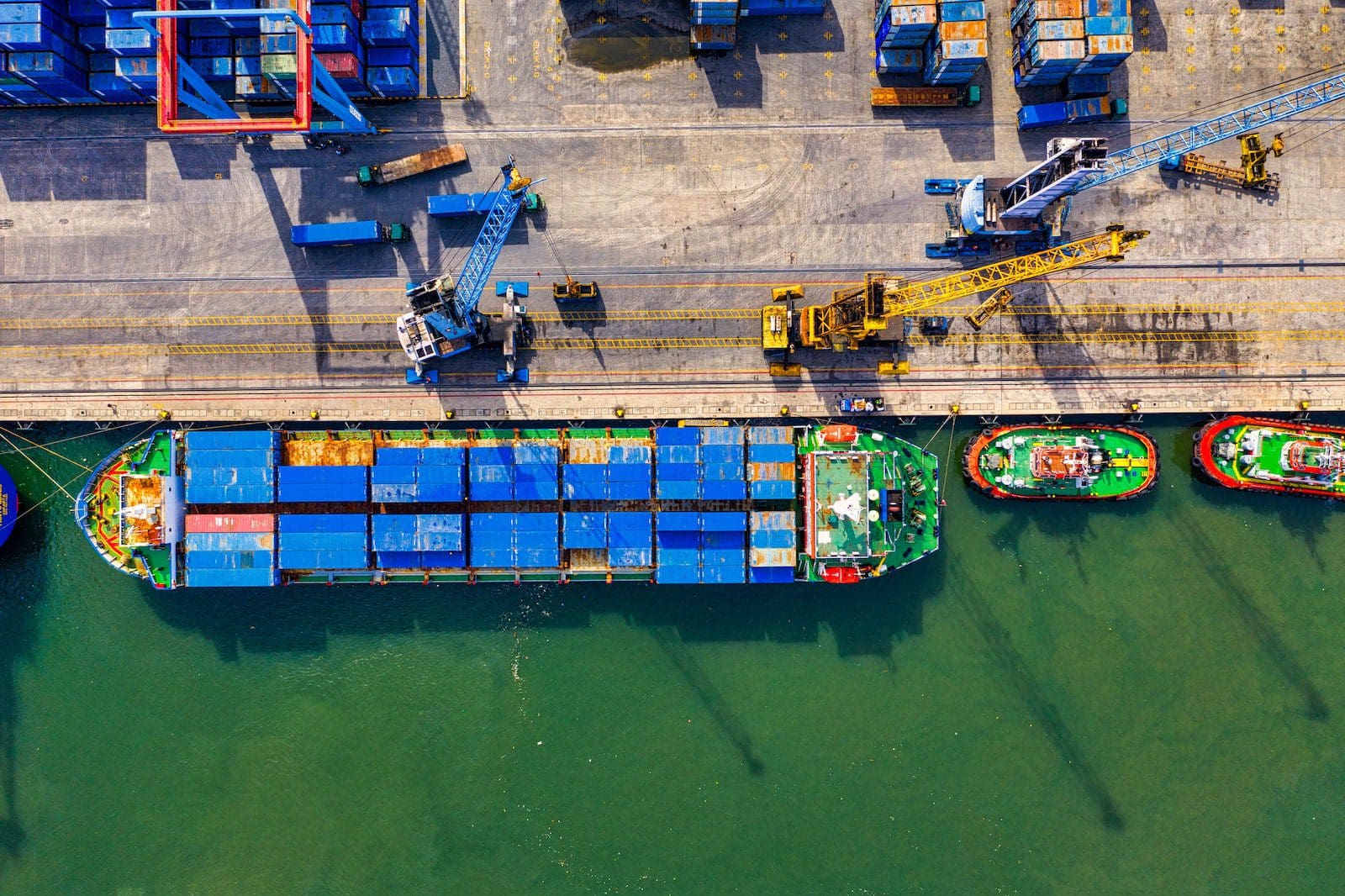

What are Duties?

A certain amount levied on imported or exported commodities is called duties. The Constitution of India put forth the taxation form as a customs duty in 1962. Two main types of duties are customs duties and customs duties.

There are several sub-categories of Customs Duty, such as Basic custom duties, Countervailing duty, Additional customs duty or Special duty, Safeguard duty, National Calamity Contingent duty, Anti-dumping duty, Education cess on customs duty, and Protective duties.

Regulation of goods moving in and out of the country is made well because of Customs Duties. The value of customs duties is directly proportional to the value of goods.

Several methods are used to calculate customs duties which, involve the comparative value method, deductive value method, computed value method, the fallback method etc.

Customs duties can be paid these days, even online, through e-payment portals. Custom duties in different countries vary from each other. For example, 7.5% of customs duties are levied on several commodities in Nigeria.

On the other hand, in India, 10% of customs duties are levied on various commodities.

Different sub-categories of Custom duties have different meanings. For example, Basic Customs Duty is the duty in which the tax is levied at a fixed and special rate on the goods.

On the other hand, Safeguard Duty is the duty used to protect against the surge in exports and is charged whenever there is a probability that the rise in exports can harm the prevailing domestic industry.

Good harmony is created in the exportation and importation of commodities because of customs duties. Annual customs duty rates show variations in various countries depending on the amount of charge levied in multiple countries.

Main Differences Between Taxes and Duties

- Taxes are charged on services, sales, income etc.; on the other hand, customs duties are charges on commodities that are exported and imported globally.

- Taxes have sub-categories such as direct tax, indirect tax, progressive tax, regressive tax, and proportionate tax. On the other hand, duties have sub-categories, such as Excise Duties and Customs Duties and customs duties, which are further classified into various types.

- Either State Government or Central Government charges taxes. On the contrary, duties are set by only the Central Government.

- The tax itself is an independent term. On the contrary, customs duty is a type of tax.

- The term “tax” was derived from the Latin word “taxare” on the contrary. The term “duties” was derived from the Anglo-French word “deueté”.

The detailed breakdown of custom duties and their sub-categories provides a comprehensive understanding of their role in regulating the movement of goods across national borders.

This article adeptly explores the multifaceted nature of custom duties and their subtypes, enriching the reader’s knowledge of trade regulations across different countries.

Precisely, the article aptly captures the complexities of custom duties and their varied forms, shedding light on their importance in a country’s regulatory framework.

The article presents a thorough analysis of the tax system and its role in strengthening a country’s economy. The historical background on the first taxation system is intriguing.

This article has done an excellent job of clarifying the distinctions between taxes and duties, shedding light on their significance in a country’s governance.

Absolutely, the article effectively outlines the different types of taxes and their implications on society and the economy.

This article provides an elaborate depiction of taxes and duties, presenting a comprehensive analysis that contributes to a deeper understanding of their implications on a country’s governance.

An informative and insightful piece that effectively communicates the crucial role of taxes and duties in governing a country, substantiated by a comprehensive comparison of their various parameters.

This article serves as a reservoir of knowledge on taxes and duties, presenting a rich tapestry of historical insights and contemporary relevance, thereby enriching the discourse on governance.

Absolutely, the article skilfully navigates through the intricate facets of taxes and duties, furnishing readers with a nuanced understanding of their implications on a country’s governance.

The article provides a comprehensive overview of taxes and duties and their role in the governance of a country. The historical context is enlightening, and the comparison table is very informative.

Agreed, this article offers a clear and in-depth understanding of taxes and duties in a country’s governance.

The article offers a comprehensive examination of the taxation system and the relevance of taxes and duties in strengthening a country’s economy, while also highlighting their historical significance.

I couldn’t agree more. The historical background on taxation and the breakdown of taxes and duties are informative and engrossing.

This article effectively communicates the essential role of taxes and duties in governance and their impact on a country’s economic structure, fostering a deeper understanding of these concepts.

The historical context on the origins of taxation and its practice in ancient civilizations adds an enriching dimension to the article, offering a holistic perspective on taxes and duties.

An illuminating article that succinctly delineates the scope and significance of taxes and duties in governing a country, especially through the historical context provided.

The article eloquently describes the various subtypes of taxes and duties, offering a compelling comparison table for easy reference.

I appreciate the comprehensive breakdown of taxes and duties, which serves to enhance the reader’s understanding of their essential role in a country’s governance.

This article emphasizes the importance of taxes and duties in bolstering a country’s economy, providing detailed insights into their historical origins and sub-categories.

I concur, the article serves as an invaluable resource for individuals seeking a detailed understanding of taxes and duties within the governance framework of a country.