A certificate of Deposit (CD) and a Savings account are both money market instruments that represent some amount of money deposited in the bank for which the bank is giving interest to the depositor.

Key Takeaways

- CDs have a fixed term and interest rate, whereas savings accounts offer variable interest rates and no term limits.

- CDs offer higher interest rates than savings accounts but penalize early withdrawals.

- Savings accounts provide easier access to funds, while CDs lock in the deposited money for a specific time.

Certificate of Deposit vs Saving Account

The difference between the two is that a savings account provides liquidity to the money deposited in the account. In other words, we can say that the amount which is deposited in the saving account can be withdrawn at any time but it is not the case with a certificate of deposit. In the case of a certificate of deposit, the funds can’t be withdrawn before a fixed time interval without taking a penalty of 2 years.

A savings account is an account which can be opened in any bank or financial institution on which it has to pay interest, and also, this account works as a protector of money that different people deposit in it.

A Certificate of Deposit (CD) is a deposited paper which is issued to the depositor after the deposit of some amount of money in the bank or any other financial institution for a fixed time interval.

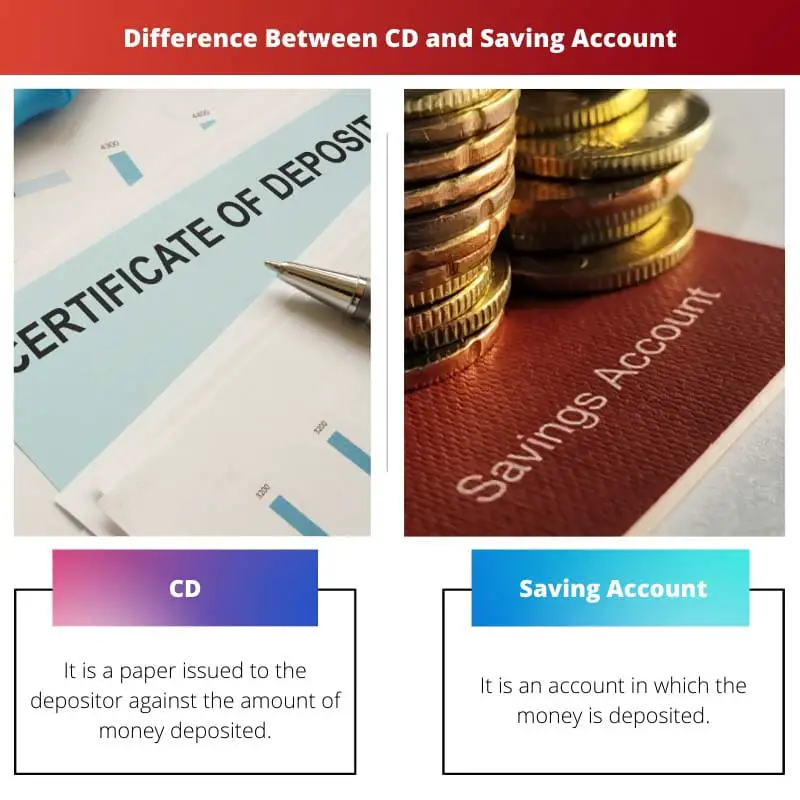

Comparison Table

| Parameter | Certificate of Deposit | Saving Account |

|---|---|---|

| Meaning | It is a paper issued to the depositor against the amount of money deposited. | It is an account in which the money is deposited. |

| Interest rate | The interest rate is higher than that in saving account. | The interest rate is lower than that of the certificate of deposit. |

| Liquidity | No liquidity of money. | The liquidity of money is present. |

| Time interval | It is fixed before depositing the amount. | It is variable as per the customer’s choice. |

| Penalty | The penalty is imposed on withdrawal before a fixed time interval. | No penalty is imposed on any withdrawal at any time. |

What is a Certificate of Deposit (CD)?

A certificate of deposit is a kind of account that is issued to the depositor in the dematerialized form against the amount of money deposited in any financial institution for a fixed interval of time which is a minimum of 6 months and can go up to a maximum of 5 years.

The customer can’t withdraw the funds from the account before completing the time which is decided earlier. Otherwise, he has to pay the imposed penalty by the bank.

The interest rates on which it is issued are higher than normal interest rates, and they are fixed in nature, they remain unchanged even if the rates are variable at that time in the market.

There are twelve types of certificate of deposit which are listed below:

- Traditional CD

- Bump-up CD

- Step-up CD

- Liquid CD

- Zero-coupon CD

- Callable CD

- Brokered CD

- High-yield CD

- Jumbo CD

- IRA CD

- Add-on CD

- Foreign currency CD

These are all the different types of the CD having different types of features which can be used for different purposes and choices accordingly.

What is Saving Account?

It is an account that is used for providing protection to our earned money under the security of the bank by depositing it. By this, some amount of interest can also be earned from the bank at the rate which is available in the market.

It acts as a wallet which also helps to hold the money in it. They are used to fulfil our short-term needs, such as paying bills, making recharges, transferring money, making investments, and many more.

This account also provides a lot of facilities such as debit cards, cheques, internet banking, and many more.

The main drawbacks of saving accounts are a limited no of withdrawals, a limited no of transactions, and a monthly withdrawal limit, due to which the UPI payments are rising at a fast rate.

Main Differences Between Certificate of Deposit (CD) and Saving Account

- Both are money market instruments representing some amount deposited in the financial institution, but CD is in dematerialized form.

- Certificate of deposit is issued at a higher rate of interest than that of a Savings account for a fixed time interval. On the other hand, the time interval is not fixed in the case of a savings account.

- We can’t withdraw any amount of money in CD, whereas it is possible in a saving account.

- The penalty is imposed if money is withdrawn from CD whereas it is not the rule in the saving account.

- Amount in CD can’t be used for routine transactions, whereas the amount present in a saving account can be used anytime.

- No extra facilities are given in case of CD-like debit cards, cheques and other facilities which are provided in case of saving account.

- The amount in savings can also be used for investment purposes, but it is not the case with a certificate of deposit.

- https://www.proquest.com/openview/cdc24cd403fed3d5910cbe7fe12ee5dd/1?pq-origsite=gscholar&cbl=2032143

- https://www.aeaweb.org/articles?id=10.1257/app.20160547

The breakdown of different types of CDs and their features is quite informative. It adds depth to the discussion and assists in understanding the options available.

I appreciate the detailed explanation of the different types of CDs, it broadens one’s understanding of their functionality.

Indeed, the differentiation between various CDs is enlightening and expands the reader’s knowledge.

This is a very insightful and informative article, explaining the key differences between Certificate of Deposit and a Savings account very well.

I couldn’t agree more. The information provided is clear and easy to understand.

The detailed explanation of the nuances between the various types of Certificate of Deposit is enlightening and enriches the reader’s understanding of their diverse functionalities.

I couldn’t agree more. The comprehensive coverage of different CD types attests to the article’s educational depth.

The article succeeds in providing a valuable exploration of the varied CD types, offering comprehensive insights into their unique features and utility.

The detailed description of what a savings account entails is very educational, providing clarity on its functions and limitations.

I couldn’t agree more. The article offers comprehensive insight into the workings of a savings account.

The detailed explanation of the technical aspects of Certificate of Deposit and Savings accounts is exceptionally beneficial, providing a deep understanding of their mechanics.

The technical breakdown of the Certificate of Deposit and Savings account contributes to a comprehensive grasp of their operational distinctions, adding substance to the article.

I agree, the article’s focus on the technicalities of both types of accounts is illuminating and enhances the reader’s financial knowledge.

The emphasis on the main differences between Certificate of Deposit and Savings accounts is exceptionally clear and aids in comprehending the distinct features of each.

The article succeeds in creating a clear delineation between the primary characteristics of Certificate of Deposit and Savings accounts, facilitating informed financial choices.

Absolutely, the comparison of their respective qualities offers a comprehensive understanding of their core distinctions.

The clarification that both types of accounts are money market instruments but differ in their form is a valuable insight, shedding light on their unique nature and usage.

Indeed, the detailed explanation of their different forms is a noteworthy aspect that enriches the article’s content.

The emphasis on liquidity and penalties for both types of accounts offers essential insights into the considerations that need to be made when choosing between them.

The article effectively highlights the repercussions of withdrawals and their impact on the different accounts, underscoring their importance in decision-making.

The discussion on liquidity and penalties contributes significantly to the article’s educational value, providing valuable guidance in making informed financial decisions.

The article effectively highlights the disparities between a Certificate of Deposit and a Savings account, clarifying the key distinguishing factors to consider.

I concur, the article effectively distinguishes the nuances between the two types of accounts, enabling informed decision-making.

The comparison table provided is very helpful in understanding the differences between the two types of accounts. It offers a clear and concise summary.

Absolutely, the comparison table provides an excellent visual aid to complement the detailed explanation.