Banking services have different functionalities all around the world. Keeping your everyday cash requires a bank account too. As the banking business requires to charge a fee on an everyday transaction or even on minimum balance, it is time to explore other banking options to save money.

On that front, there are two types of banking services that might help you in this regard. One is the Chime Bank, and the other is Credit Union. The latter is very prominent as it has been functional for a long time, while the former is relatively new in this context of business.

Key Takeaways

- Chime Bank is an online-only bank that offers fee-free banking services, including checking and savings accounts. At the same time, Credit Unions are non-profit financial institutions that provide banking services to members who share a common bond, such as employment or location.

- Chime Bank offers higher interest rates and more flexible banking options than Credit Unions, which have stricter membership requirements and may charge higher fees.

- Chime Bank is FDIC-insured, while Credit Unions are insured by the National Credit Union Administration (NCUA), and both offer mobile banking and other digital services for added convenience.

Chime Bank vs Credit Union

The difference Between Chime Bank and Credit Union is the criteria to join them. Chime Bank is open to all and any citizen of 50 states of the United States of America, while Credit Union is open to the cooperative society of an organization. The size of credit unions ranges from small to big, while Chime Bank is just a single entity, and a Financial Technology Company owns that.

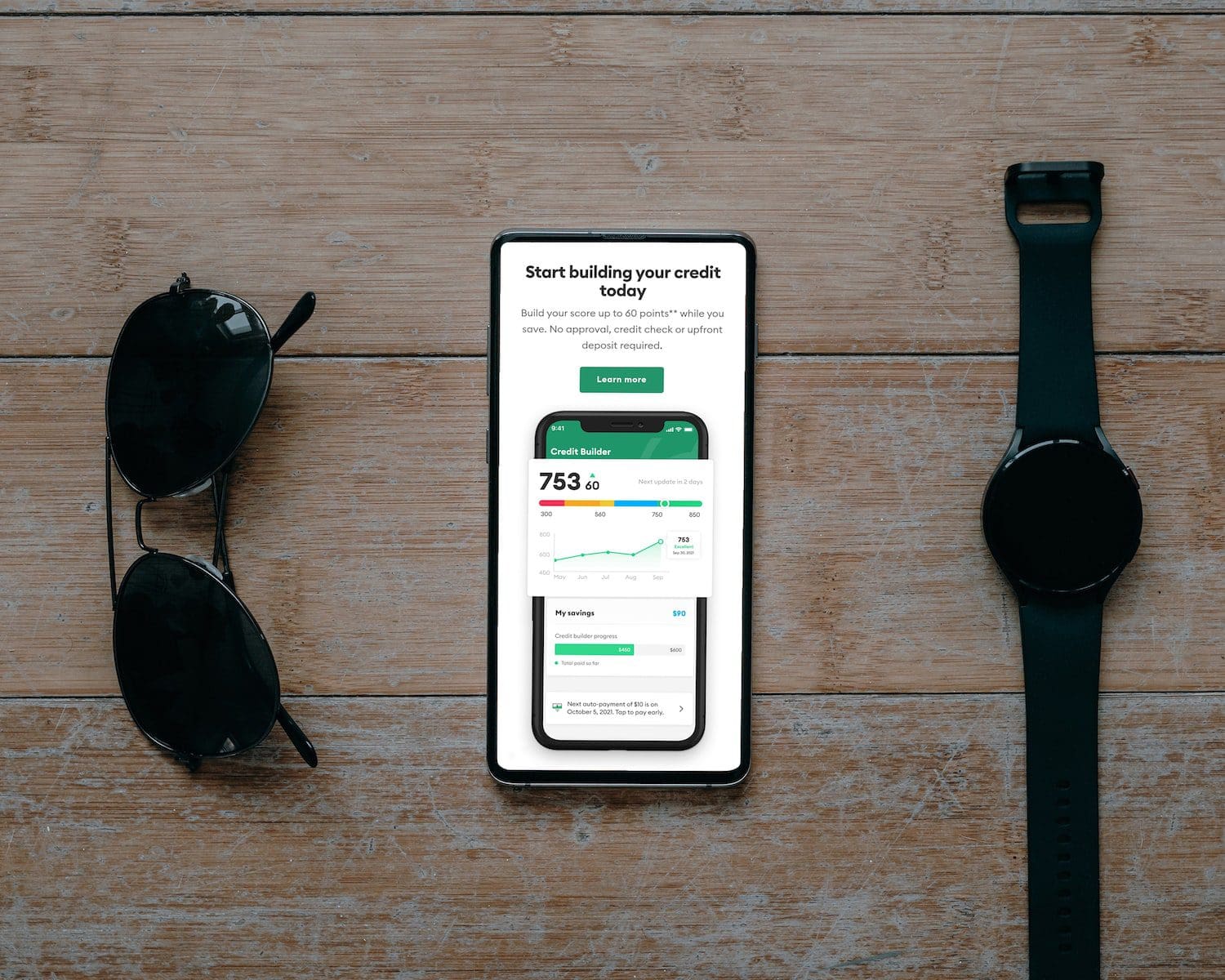

Chime Bank is a banking services entity developed and operated by Fintech in the US. Chime Bank operates over the mobile application and offers zero charges for opening accounts and transactions.

You need not have any minimum balance to open an account too. Chime Bank is renowned for its accelerated direct deposit that can reach your account at least 48 hours early compared to other banks.

Credit Union is a financial cooperative that offers banking services to its members. It has fewer features than traditional banks but has access to a wide range of ATMs worldwide.

Credit Unions are not publicly traded hence, higher interest rates. The best news is the member of the credit union need not pay corporate tax for his earnings.

Comparison Table

| Parameters of Comparison | Chime Bank | Credit Union |

|---|---|---|

| Operations | Chime Bank is operated by Bankcorp or Stride Bank, US. | Credit Union is operated by its members. |

| Interest Rates on Savings | You can earn interest on every single penny you save in the account. | Interest rates are comparatively high than the traditional banks but must maintain a minimum balance. |

| Minimum Balance | No requirement as such | You must have a minimum balance in the account. |

| Physical Branch | No Physical Bank branch | Credit Unions have physical branches. |

| Overdraw facility | Available | Not Available |

What is Chime Bank?

Chime is a banking service offered by a Fintech firm. The banking services of Chime Bank are provided by Bankcorp Bank or Stride Bank. As it is said, banking services it does not have many complicated account options as traditional banks do. It does not have checking or savings account opening criteria as well.

The products offered by Chime Bank are

- Spending Account

- Savings Account

The best part about these accounts is that you don’t need an opening balance or qualification criteria to open an account. You can open the account with the help of them. And yes, mobile application and online banking is the only mode you can do banking with Chime.

Chime Bank has unique offers, unlike the banks. It has an overdraw facility if you regularly receive funds in your spending account. The bank can regulate the overdrawn amount can also reach up to $200. At the same time, a few features help you save money too.

The Savings account is automatically created, and you can save money in this account. As such, there is no fee as a monthly fee, nor you need any minimum balance to maintain. Save as you spend is one of the saving modes.

As you spend on purchasing online, and the amount comes up to $20.70, the app rounds it off to $21, and the $0.30 is fed to the saving account. Save as you get paid is another way to save your money.

If you get paid $500 or more, 10% of the funds are redirected to the savings account, and you can save it alternatively. Chime Bank offers higher APY and a secured credit card service.

What is Credit Union?

Credit Union is also a type of banking service provider but is operated by a cooperative union. Traditionally, the credit union was maintained and developed by people of the same industry or a company or the same locality.

It indeed provides traditional banking services with higher interest towards the deposit. Credit Unions were formed by bigger corporations and organisations for the benefit of the employees.

The participants involved in the credit union, that is, the deposit holders, are the ones who maintain and operate the credit union. Credit Union gives tax-exempt earnings and is thus considered worthy by people.

These days credit union has become public too. At the same time, you can become a member only by opening an account. Of course, opening an account requires a minimum balance and a small amount is also charged on transactions.

Credit unions are formed to invite deposits for higher interest rates and offer loans to employees with lower interest rates. There are charges that the credit unions charge and the business shall run smoothly.

Credit Unions have very few physical bank locations. And a few lower-budget credit unions do not have them too. This might be seen as a drawback. The two main advantages of being a member of a Credit Union is

- Corporate Tax is exempted from the earned money.

- Earnings of every quarter are an increased and thus higher percentage of interest in savings.

Main Differences Between Chime Bank and Credit Union

- The main difference between Chime Bank and Credit Union is the operational aspects. A financial technology company operates the Chime Bank, and any citizen of the US can join as an account holder, while Credit Union is a cooperative developed by the corporations or a group of people and maintained by the members.

- Chime Bank has an excellent online presence, and the mobile application is the mode through which one can transact. However, Credit Unions have physical branches and also possess few online banking facilities.

- Chime Bank does not require any minimum balance for opening an account, while Credit Union requires the member to have a minimum balance.

- Chime Bank offers secured credit card facilities, and Credit Union offers low-interest loans for its members.

- Chime Bank helps customers with overdraw facilities, and Credit Unions do not offer such services.

References

- https://www.sciencedirect.com/science/article/abs/pii/0378426693900318

- https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1468-0416.2011.00166.x

Your delineation of Chime Bank and Credit Union provides a comprehensive overview of their distinct attributes and offerings. By emphasizing key factors such as physical branch access and overdraw facilities, you’ve enlightened readers on the unique features provided by each banking service.

Your informative comparison of Chime Bank and Credit Union offers valuable insights into their unique features and benefits. By addressing key elements such as physical branch access and operational facilities, you’ve provided readers with a clear understanding of each banking service’s offerings.

Chime Bank and Credit Union each offer distinct features and benefits to prospective customers. Chime Bank provides fee-free banking, higher interest rates, and an overdraw facility, while Credit Unions offer access to a wide range of ATMs worldwide and do not require members to pay corporate tax. Understanding the operations and unique offerings of each can help consumers choose the banking service that aligns with their financial goals and preferences.

Your detailed comparison of Chime Bank and Credit Union helps clarify the differences between these two banking options. It’s essential for consumers to weigh the benefits and limitations of each service to make an informed decision based on their individual financial needs.

I appreciate the insightful breakdown of Chime Bank and Credit Union. Your emphasis on the distinct features and benefits of each banking option provides valuable information for individuals seeking to optimize their banking experience and financial outcomes.

The informative breakdown of Chime Bank and Credit Union offers valuable insights into their distinct features and offerings. By highlighting essential elements such as physical branch access and minimum balance requirements, you’ve provided readers with an informative comparison of the unique attributes provided by each banking service.

The breakdown of Chime Bank and Credit Union’s unique attributes offers a valuable comparison of the distinct features and benefits provided by each banking service. Your analysis of essential factors such as interest rates and operational operations provides readers with a clear understanding of the offerings of each banking option.

Your comprehensive comparison of Chime Bank and Credit Union provides readers with valuable insight into their distinct features and benefits. By addressing key factors such as operational facilities and interest rates, you’ve illuminated the essential considerations for individuals evaluating their banking options.

The comparison table you’ve provided offers a comprehensive overview of the key differences between Chime Bank and Credit Union, specifically in their operations, interest rates on savings, minimum balance requirements and physical branch access. This detailed analysis can guide individuals in assessing which banking service suits their specific financial needs and preferences.

Your evaluation of Chime Bank and Credit Union highlights the essential factors for individuals to consider when choosing a banking service. By addressing key elements such as interest rates, operations, and key features, you’ve provided valuable insights for readers seeking to make an informed banking decision.

The breakdown of Chime Bank and Credit Union’s distinct features and criteria for joining offers valuable insights into the unique attributes of each banking service. By emphasizing key factors such as interest rates and operational operations, you’ve illuminated essential considerations for individuals evaluating their banking options.

Your in-depth analysis of Chime Bank and Credit Union provides valuable clarity on their distinct features and benefits. Understanding the differences in interest rates and minimum balance requirements can help individuals make informed decisions about their banking preferences.

Your detailed comparison of Chime Bank and Credit Union provides readers with a comprehensive understanding of the unique offerings and benefits of each banking service. By addressing essential elements such as minimum balance requirements and interest rates, you’ve highlighted the important considerations for individuals evaluating their banking options.

The breakdown of Chime Bank and Credit Union’s unique attributes and offerings is valuable for individuals exploring their banking options. Understanding the differences in criteria for joining, interest rates, and account operations can assist consumers in selecting a banking service that meets their financial objectives.

Your detailed insights into Chime Bank and Credit Union showcase the unique benefits and limitations of each banking service. By outlining key factors such as interest rates and account operations, you’ve provided readers with a valuable framework for evaluating their banking needs.

Your comprehensive comparison of Chime Bank and Credit Union emphasizes important aspects such as interest rates, minimum balance requirements, and overdraw facilities. This comprehensive analysis can help individuals navigate through the distinct features and benefits offered by each banking option.

Your comparison of Chime Bank and Credit Union offers valuable insights into the distinct features and benefits provided by each banking service. The delineation of key differences, such as interest rates and operational facilities, can assist individuals in making an informed choice regarding their preferred banking service.

The detailed comparison of Chime Bank and Credit Union underscores key differentiators such as operations and interest rates. By elucidating the unique benefits and limitations of each banking service, you’ve offered valuable clarity for readers evaluating their banking options.

Your detailed analysis of Chime Bank and Credit Union sheds light on essential aspects such as interest rates and operational operations. By offering a comprehensive comparison, you’ve provided informative guidance for individuals seeking to understand the unique offerings of each banking service.

Your delineation of the features and benefits of Chime Bank and Credit Union enables readers to discern the unique offerings provided by each banking service. Highlighting important factors such as minimum balance requirements and overdraw facilities can guide individuals in selecting a banking option aligned with their financial goals.

The comprehensive overview of Chime Bank and Credit Union’s distinct offerings provides valuable insights into the unique features of each banking service. By addressing key factors such as minimum balance requirements and overdraw facilities, you’ve illuminated important considerations for individuals evaluating their banking options.

Your informative comparison of Chime Bank and Credit Union emphasizes essential elements such as minimum balance requirements and operational features. This insightful analysis can help consumers make an informed decision when choosing a banking service suited to their specific financial needs.

Chime Bank and Credit Union are two different options for banking services. Chime Bank is open to all citizens of the United States, while Credit Union is open to a cooperative society of an organization. Chime Bank offers fee-free banking, provides higher interest rates and access to mobile banking. On the other hand, Credit Unions provide banking services to members and have fewer features than traditional banks but access to a wide range of ATMs worldwide. Understanding the differences between these two options can help individuals make an informed decision about their banking needs and find the best fit for their financial goals.

Your explanation of the criteria to join Chime Bank and Credit Union is very informative. It’s helpful to know that Chime Bank is open to all citizens of the United States, while Credit Union is open to the cooperative society of an organization. This insight can guide individuals in choosing the right banking option for their specific needs.

You have provided a clear and concise comparison of Chime Bank and Credit Union. It’s important for individuals looking to open a new bank account to be aware of these differences and consider the unique features and benefits offered by each option.