Chime Bank and Wells Fargo are both magnificent online banks that offer essential administrations for nothing. However, which is the most ideal decision for you, speaking? We are expecting to furnish you with what you need to realize which is best for you – we have accounts with two Wells Fargo and Chime actually as they are two major banks, and we feel they are both reliable and more secure/better banks contrasted with regular old fashioned banks.

Eventually, we would infer that Chime is, to some degree, unrivalled since all Wells Fargo highlights are advertised. With an enlistment reward that is not difficult to procure, in addition to Chime doesn’t have an FX cost for unfamiliar buys, which’s convenient on the off chance that you haven’t got an FX expense Visa.

Key Takeaways

- Chime Bank is a digital-only bank, whereas Wells Fargo has brick-and-mortar branches.

- Chime Bank offers fee-free overdrafts and early direct deposits, while Wells Fargo charges overdraft fees and has no early direct deposit option.

- Chime Bank has no monthly fees or minimum balance requirements, whereas Wells Fargo charges monthly maintenance fees unless certain criteria are met.

Chime Bank vs Wells Fargo

Chime is an online-only financial technology company that gives fee-free mobile banking services, customized banking administrations, checks and investment accounts exclusively. Wells Fargo is America’s public business bank that gives an impressively more extensive scope of bank items and records.

Chime Bank is a bank that is claimed by Central National Bank or The Bankcorp Bank. It’s anything but a private bank that was begun in the year 2013.

It’s anything but a genuine bank as it gives just free versatile financial administrations. Clients who open a record in Chime Bank get a Visa-Debit card to get to Internet banking frameworks.

All work of Chime Bank is done through online mode. There is no actual part of Chime Bank.

It has its central command in San Francisco, California.

Wells Fargo is the most established bank, which was begun in the year 1799. It is America’s public bank which has its base camp in Manhattan, New York City.

It’s anything but a business and shopper bank, and it’s anything but an auxiliary of a worldwide U.S. bank. Wells Fargo has in excess of 5,100 branches and 16,000 ATMs in 100 nations around the world.

It is probably the greatest bank in America.

Comparison Table

| Parameters of Comparison | Chime Bank | Wells Fargo |

|---|---|---|

| Products | Chime gives checks and investment accounts exclusively instead of Wells Fargo. | Wells Fargo gives an impressively more extensive scope of bank items and records. |

| Customer service | Chime business hours are the lone client assistance. | Whenever, anytime, contact client care. |

| Interest bearing account | Chime’s bank account is the solitary record you get revenue. | All Wells Fargo accounts are advantageous while including their record checking. |

| Mobile app | Chime is a versatile record that has underlying notification, prompt exchange cautions, and that’s just the beginning. | Partner gives a versatile, sound-based application dependent on Wells Fargo, making its portable application the best. |

| Fees | You’re almost allowed to open a Chime and use it. | On the store records of Wells Fargo, you will pay extra expenses. |

What is Chime Bank?

In 2013, California locals Chris Britt and Ryan King set up Chime as a minuscule beginning up. In 2014, Dr Phil had a chance to acquire 1,000,000 customers in 2018.

This would develop to 4,000,000 only one year after the fact. Chime was consistently an online monetary innovation firm, focusing on working with and getting banking experience for anybody.

Chime’s motivation is to give its customers more monetary control, as indicated by the organization’s statement of purpose. However, some other traditional banks are known to benefit individuals with high overdraw charges and other secret costs.

These fines address 40% of the organization’s pay for some monetary foundations. Chime, then again, is pleased to have no expenses.

The firm advantages from you, not from you. The makers feel that they are likewise just about as straightforward as conceivable to their purchasers.

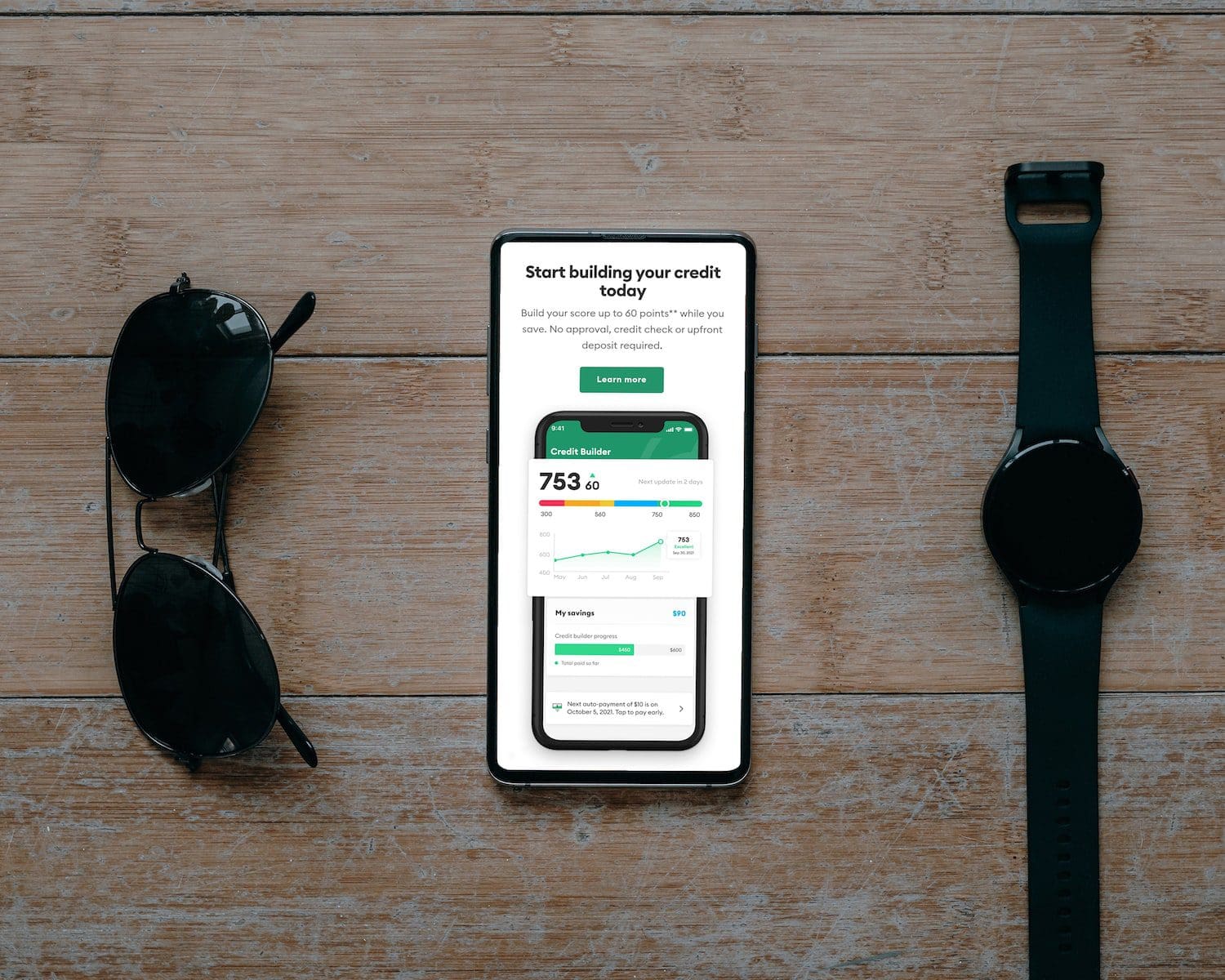

With the Chime application, you can get all you need to deal with your cash at the tips of your fingertips. Chime offers a straightforward financial encounter utilizing the Chime application to help you oversee, save, and go through your cash.

You will track down the monetary administrations’ application Chime to deal with your records and support easily in one area. Also, no secret charges are paid.

For Chime banking, disregard overdraw expenses, least equilibrium costs, month-to-month expenses, or worldwide expenses. What’s more, 38,000 free in-network ATMs might be utilized for cash withdrawals for nothing.

What is Wells Fargo?

Wells Fargo is one of the biggest car finance firms in the USA, furnishing 4.5 million customers with financing and renting and creating 1.4 million vehicle credits yearly. It is on the rundown with 2.0 million investors among the top banks in the United States by resources.

His web-based business network contains more than 350,000 financed accounts.

The firm sold right around 5 million autos, incorporating 270,000 vehicles sold in 2019 through its Smart Auction Online Marketplace for Automotive Auctions established in 2000. The Company has been known until 2010, like GMAC, an overall motor adequacy organization’s shortened form.

General Motors set up the partnership to give money to vehicle purchasers in 1919 as General Motors Acceptance Corporation.

In 1939, Motors Insurance Corporation was set up, and the protection market for vehicles got functional. GMAC created GMAC Mortgage and purchased Colonial Mortgage in 1985 and furthermore served the Northwestern Mortgage administration arm, including a home loan portfolio, while GM was driven by Roger Smith, who intended to extend the business.

Main Differences Between Chime Bank and Wells Fargo

- Wells Fargo has not many alternatives for saving, though Chime accompanies a number that may help you bring in the most out of your cash.

- Chime business hours are the lone client support, while Wells Fargo’s business hours are whenever, anytime, contact the client care.

- Chime’s investment account is the solitary record you get revenue, while Wells Fargo accounts are beneficial, including their record checking.

- Chime Bank is free, though Wells Fargo is extra expensive.

- Chime is a portable record that has underlying notification and quick exchange alarms, while Wells Fargo gives a versatile, sound-put-together application based with respect to Chime, making its versatile application the best.

- https://www.cambridge.org/core/journals/proceedings-of-the-international-astronomical-union/article/pulsar-science-with-the-chime-telescope/33778456D73F1C86F5356330BB93E9A0

- https://en-academic.com/dic.nsf/enwiki/9406938

The comparison between Chime Bank and Wells Fargo underscores the significance of considering individual financial needs. While Chime’s fee-free structure and online nature are advantageous for some, Wells Fargo’s extensive range of services and physical branches offer a different appeal. Each person must weigh these factors carefully to make an informed decision.

Absolutely. It’s vital to assess personal banking preferences and habits when choosing between Chime Bank and Wells Fargo for the best fit.

You’re right. A thorough evaluation of the specific offerings and features of Chime Bank and Wells Fargo is crucial to determine the best fit based on individual banking requirements.

The comparison between Chime Bank and Wells Fargo emphasizes the importance of aligning individual financial needs with the features offered by each bank. While Chime’s digital-only model is innovative, Wells Fargo’s physical branches provide a sense of reliability for some individuals. Each person should evaluate these unique aspects to make the best choice.

That’s an excellent point. It’s crucial for individuals to carefully consider their personal banking needs and preferences to make an informed decision.

Absolutely. A careful evaluation of the unique offerings of Chime Bank and Wells Fargo is necessary to determine the best fit based on individual banking requirements.

Chime Bank’s digital-only model and Wells Fargo’s brick-and-mortar presence cater to different banking needs. While Chime’s fee-free structure is appealing to many, Wells Fargo’s broader range of bank products may be more suitable for others. It’s crucial to understand the nuances of each bank’s services for an informed choice.

I couldn’t agree more. The individual advantages and limitations of each bank must be considered thoroughly before making a decision.

I think it’s essential to carefully evaluate and compare the unique offerings of Chime Bank and Wells Fargo to determine the best fit based on individual banking requirements.

The discussion between Chime Bank and Wells Fargo showcases the significance of evaluating the specific offerings of each bank in relation to individual financial requirements. Chime’s fee-free overdrafts and online-only presence are appealing, while Wells Fargo’s broader suite of services and physical branches cater to different needs. It’s important to align these with personal preferences.

Indeed, it’s essential for individuals to thoroughly evaluate and compare the offerings of Chime Bank and Wells Fargo before making a decision based on their unique banking needs.

You’re absolutely right. A careful assessment of personal financial needs and habits is crucial for selecting the bank that best aligns with individual requirements.

Both Chime and Wells Fargo have their advantages and unique features. Chime’s online-only model provides a fresh approach to banking, while Wells Fargo’s physical branches offer a sense of security. It’s important to weigh the benefits and determine which aligns best with individual banking needs.

I couldn’t agree more. It’s essential to consider which aspects of the banks align with our specific financial habits and requirements.

The comparison between Chime Bank and Wells Fargo highlights the importance of examining the specific features of each bank that are relevant to individual banking needs. While Chime offers fee-free overdrafts and early direct deposits, Wells Fargo provides a vast range of bank products. It’s a matter of weighing the benefits against personal requirements.

You’re absolutely right. It’s essential for individuals to thoroughly assess their banking needs and habits to determine which bank will best suit their requirements.

Absolutely, making an informed decision involves carefully considering the unique advantages and disadvantages of each bank according to personal financial situations.

The discussion between Chime Bank and Wells Fargo stresses the importance of aligning individual financial needs with the unique offerings of each bank. Chime’s digital-only model and fee-free structure are attractive to some, whereas Wells Fargo’s extensive suite of services and physical presence may be appealing to others. It’s essential to conduct a thorough evaluation based on personal financial habits and preferences.

I couldn’t agree more. Carefully evaluating individual financial requirements is fundamental for selecting the bank that best meets their unique banking needs.

The comparison and contrast between Chime Bank and Wells Fargo highlight the importance of understanding and evaluating individual financial needs. Chime’s digital-only approach and fee-free structure appeal to certain individuals, while Wells Fargo’s long-established history and wider range of services cater to differing needs. It’s crucial to carefully assess these factors for an informed decision.

Absolutely. Each person’s unique banking habits and requirements should be thoroughly evaluated to determine which bank aligns best with their individual financial needs.

Chime Bank and Wells Fargo each have their own unique offerings, and the decision between the two largely depends on individual preferences, such as whether face-to-face banking is required or not. Chime’s fee-free overdrafts and mobile banking are appealing, while some may prefer the established reputation that Wells Fargo offers.

I agree with your analysis. It’s important to carefully evaluate our own financial needs and compare them to what these banks provide to make an informed choice.

That’s a good point. It’s crucial for each individual to consider their personal preferences and financial habits when choosing between the two banks.

Chime Bank’s proposition of fee-free banking services is quite compelling, especially for those who prioritize digital banking. However, for individuals seeking a more traditional banking experience, Wells Fargo’s physical branches and long history may be more attractive. It’s crucial to assess personal preferences and needs when selecting a bank.